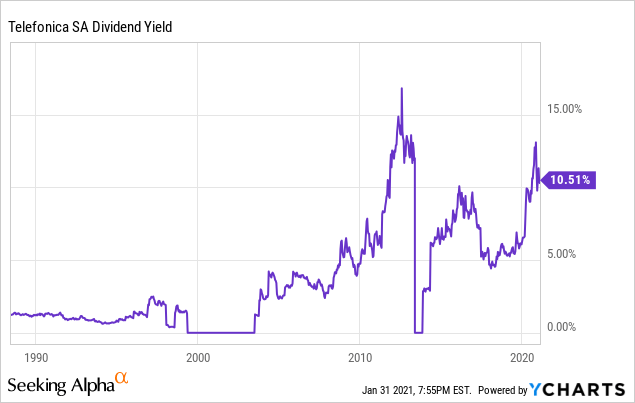

Telefonica (NYSE:TEF) is a diversified European and South American telecom giant. The valuation appears to be dirt cheap as the free cash flow yield is in excess of 20%, EV/EBITDA is well below historical and recent norms, and the dividend yield is sky-high:

Data by YCharts

Data by YCharts

However, there are three big risks that currently weigh on the stock:

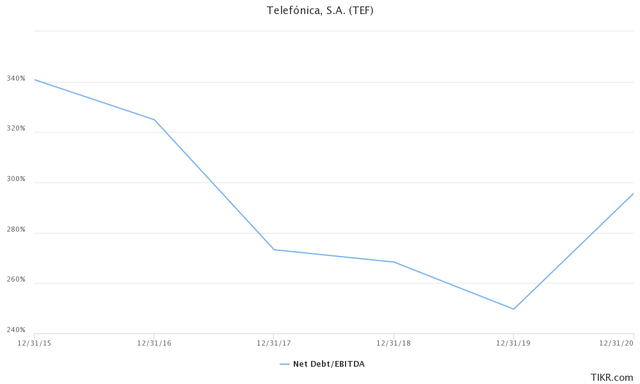

#1 Stubbornly High Leverage Ratio

First and foremost - and similar to Energy Transfer (ET) and AT&T (T) as we discussed earlier - the balance sheet has been plagued with stubbornly high leverage that threatens the investment grade credit rating.

While paying down debt should seem simple and straightforward given the massive free cash flow yield (projected at ~25% in 2020) that TEF has, it isn't so simple. In fact, since the current CEO took over in 2016, management has been using free cash flow to aggressively pay down net financial debt, reducing it by €15.5 billion in 51 months.

Yet, its Net Debt-to-EBITDA hasn't quite followed suit, still hovering around 3x:

Including hybrids and other commitments, it actually stands around 3.8x, putting heavy pressure on the investment grade credit rating. Why is this?

Including hybrids and other commitments, it actually stands around 3.8x, putting heavy pressure on the investment grade credit rating. Why is this?

Because net debt is only the numerator. The denominator has been getting hammered this year due to a perfect storm of headwinds, leading us to our next reason why the market doesn't like TEF stock right now.

#2 Perfect Storm Of Current Headwinds

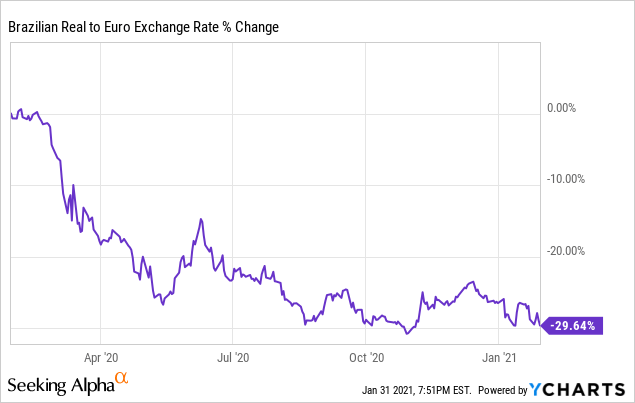

Between COVID-19, forex headwinds, and poor performance in its Latin American business (including a massive one-off impairment in Argentina of €785 million), TEF has faced a perfect storm in 2020.

COVID-19 has led to less travel, less economic activity, and lower overall demand for its products and services this year, combining with dreadful currency performance in its Latin American and Brazilian markets:

Data by YCharts

Data by YCharts

When ~40% of your revenues come from markets that see their currencies decline by such precipitous numbers and combine it with COVID-19 quarantine headwinds, you are doomed to a rough year. Furthermore, several of its Latin American markets currently suffer from political instability and significant economic challenges, further denting results in organic terms.

Through the first three quarters of 2020 revenue has fallen by a whopping 10.7% (5.9% due to foreign exchange, 3.9% due to COVID-19 impacts, and 0.9% due to organic declines) and EBITDA has declined by an astonishing 14.9% (7% due to foreign exchange, 5.2% due to COVID-19 impacts, and 2.7% due to organic declines).

With headline numbers like these and lingering uncertainty from COVID-19 and foreign exchange performance, you can begin to see why the markets are so bearish on TEF.

#3 Very Competitive Business Sector

Finally, it is important to remember that in addition to the aforementioned headwinds, the telecommunications business is highly competitive and only getting worse. Consumers constantly demand higher data caps and speeds at cheaper prices and with the upgrading of networks to 5G, competition is only intensifying while capital investment requirements are continuing to mount on companies.

Given the capital-intensive and increasingly competitive nature of the telecom business, the STOXX Europe 600 Telecommunications Index has returned an annualized -2.6% for the last 5 years:

TEF has been a leading contributor to this underperformance and even its strongest and largest business market in Spain is battling increasing competition from MasMovil and Euskaltel. This competition leads to low ROICs which makes it hard for the business to be a long-term wealth compounder.

Something else hurting TEF is that its two largest segments are in Spain and Brazil, which are underperforming economies whereas its two smaller segments are in the U.K. and Germany, which are much stronger economies.

Investor Takeaway

TEF is not a low risk investment and is clearly in "show me" mode. The business is currently facing severe headwinds from COVID-19 and will likely see further revenue and EBITDA declines before it sees growth again.

They are also besieged by forex headwinds in Brazil and the rest of Latin America and growing competition in their core European markets that require massive capital investments to contend with.

Their leverage is also staying stubbornly high and threatening their investment grade credit rating.

That said, they are priced like they are battling financial distress, given their 25% free cash flow yield. In reality, they are quite safe financially for the foreseeable future given their enormous liquidity, average cost of debt, and weighted average length of maturity.

Furthermore, they recently announced the sale of their Telxius tower portfolio to American Tower (AMT).

The deal sends:

- ~31,000 existing communications sites in Germany, Spain, Brazil, Chile, Peru and Argentina to AMT.

- 3,300 committed sites in Germany and Brazil to AMT to spend ~$500M through 2025 on constructing a built-to-suit pipeline.

- In exchange for the Euro equivalent of $9.4 billion.

The financials of the deal implies an EV/Adjusted EBITDA multiple of under 26x, and increases to 30.5x if the full impacts of the German portfolio acquired by AMT are included. This valuation is very attractive for TEF given that AMT currently trades at an EV/EBITDA of ~25x.

Even better, TEF trades at an EV/EBITDA of ~5.5x. Granted, TEF isn't even close to being a pure-play tower investment, but the fact that it sold these assets at such a massive premium to its overall business EBITDA multiple means that it will be very useful towards accomplishing its goal of deleveraging the balance sheet and also very likely did unlock some shareholder value that was not being previously recognized by the market.

Once closed, the deal should reduce TEF's net financial debt by ~$5.6 billion and reduce the leverage ratio by ~0.3x. When combined with the ~$6.7 billion in net proceeds expected from the expected closing of a merger between TEF's subsidiary O2 and Virgin Media by the middle of this year, their net financial debt should decline to ~$25 billion.

Throw in the several billion dollars in retained free cash flow they are expected to generate this year, and they will be making major headway against their debt pile and reaching their target leverage ratio.

If the economy can pick up, forex headwinds decline, and/or they can score another major sale or two in Latin America or elsewhere at attractive multiples, they should be able to reach their targets fairly quickly.

Additional benefits from the deal include:

- Divesting ~7k Latin American sites, which is in line with their goal of spinning off/disposing the Latin American exposure outside of Brazil.

- Deepens an existing mutually beneficial partnership with AMT in three of TEF's core markets.

- Last, but not least, this deal is a massive bet on/endorsement of TEF's business by AMT since 88% of the property revenue by tenant is coming from TEF.

In their overall global portfolio, TEF will now make up 9% of their total property revenue by tenant.

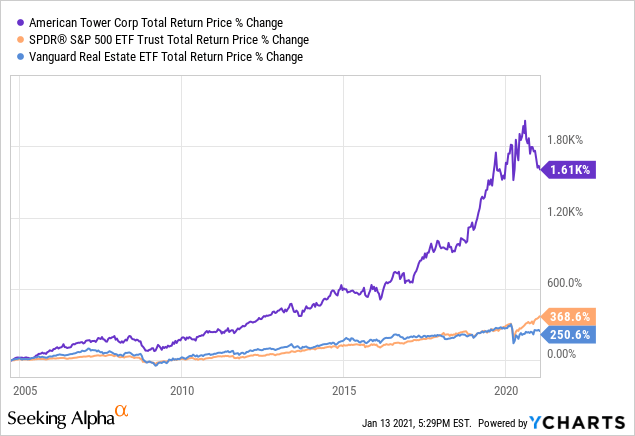

As one of the premier tower infrastructure investors in the world, with a strong record of crushing the REIT (VNQ) and broader stock market (SPY),

AMT's decision to pour significant resources into assets anchored by TEF and pursue growth in TEF's markets is a ringing endorsement of TEF's current strength and future outlook.

It also shows that there is a strong market for TEF's assets, even in Latin America, where it is trying to sell off businesses to deleverage and reduce risks.

In describing the deal, AMT called Germany, Spain, and Latin America

attractive markets from economic, regulatory, and financial strength perspectives.

It went on to describe the deal as a

Compelling opportunity to enhance LatAm presence.

and described the assets as

well-located, well-constructed sites with a strong, committed, investment-grade anchor tenant (i.e., TEF).

Coming from a pure-play tower company that has generated nearly 4.5x the total return of the S&P 500 over the past 16 years, that is an extremely strong endorsement of TEF, especially since Mr. Market is practically leaving the company for dead with a 20%+ free cash flow yield, double-digit dividend yield, and extremely low EV/EBITDA multiple.

We believe that brighter days are ahead for TEF with tremendous upside potential as the COVID-19 crisis subsides over the course of 2021 and their relentless application of free cash flow to their debt burden combines with a rebound in EBITDA to bring their leverage ratio under control.

What Are We Buying?

We are sharing all our Top Ideas with the members of High Yield Investor. And you can get access to all of them for free with our 2-week free trial! We are the the fastest-growing high yield-seeking investment service on Seeking Alpha with over 600 members on board and a perfect 5-star rating!

You will get instant access to all our Top Picks, 2 Model Portfolios, Course to High Yield investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!