REIT Rankings: Cell Towers

(Hoya Capital Real Estate, Co-Produced with Colorado Wealth Management)

Cell Tower REIT Sector Overview

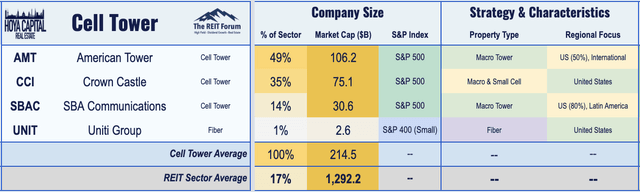

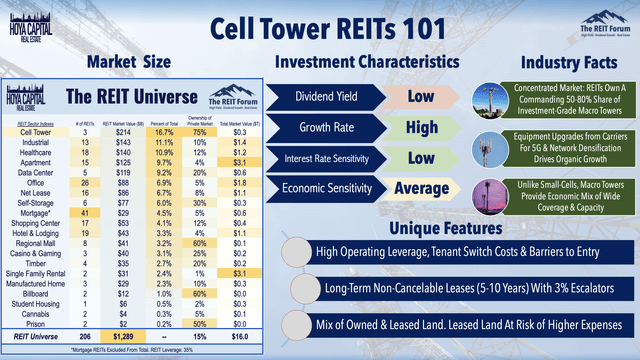

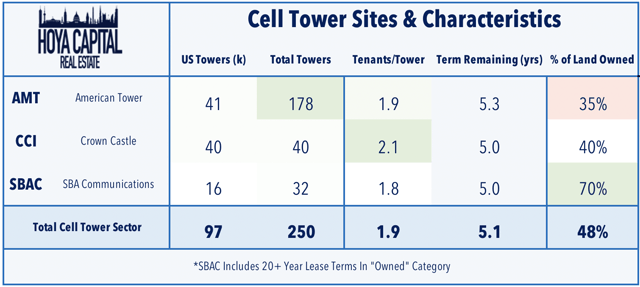

Emerging from relative obscurity early last decade, Cell Tower REITs have developed into dominant players of both the telecommunications and real estate sectors through relentless growth. Within the Hoya Capital Cell Tower REIT Index, we track the three Cell Tower REITs which account for over $200 billion in market value: American Tower (AMT), Crown Castle (CCI), SBA Communications (SBAC), along with small-cap Uniti Group (UNIT) which owns a large fiber optic cable network along with a smaller cell tower portfolio.

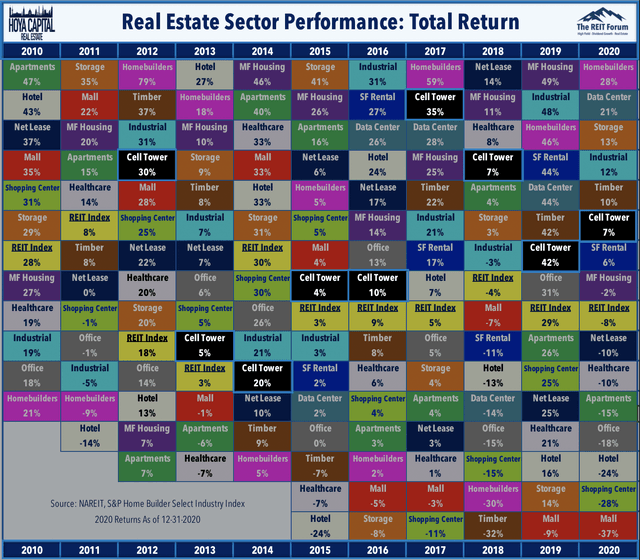

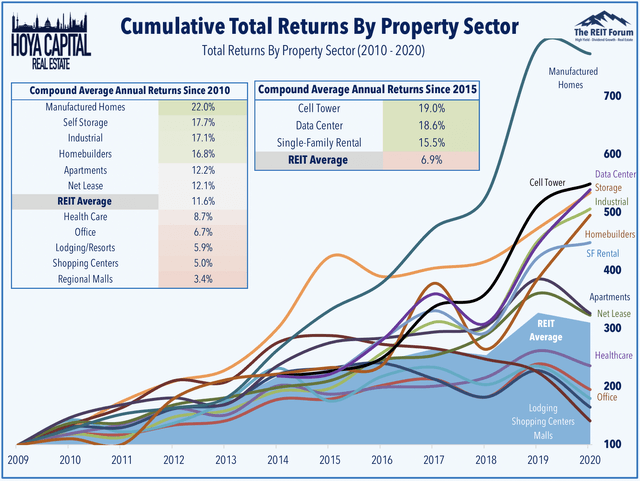

Cell Tower REITs outperformed the broad-based Equity REIT Index for the sixth consecutive year in 2020 and, after uncharacteristically lagging early this year, these REITs have posted strong gains over the last month. The single largest property sector by market capitalization, three Cell Tower REITs now account for almost a fifth of the total REIT market value. Cell Tower REITs continue to be one of the few remaining "growth engines" of the REIT sector, and the coronavirus pandemic has done little to slow this trajectory.

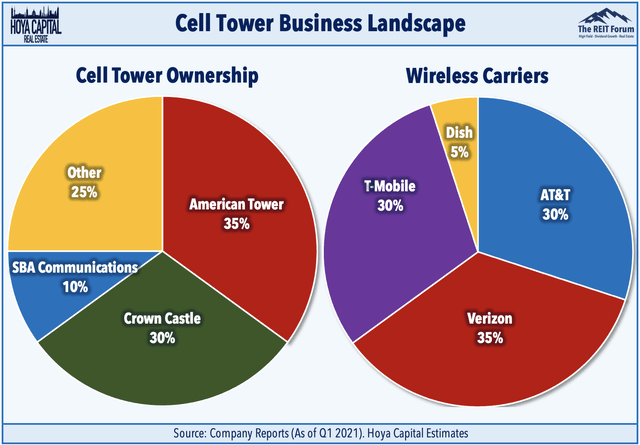

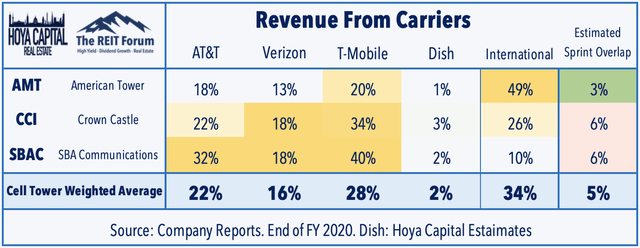

Cell Tower REITs' relative dominance over the real estate sector is dwarfed by its dominance over the telecommunications sector, as these REITs control nearly 75% of wireless communication infrastructure in the U.S. These REITs are the landlords to the four nationwide cellular network operators in the U.S.: AT&T (T), Verizon (VZ), T-Mobile (TMUS), and DISH Network (DISH). While this tenant base is highly concentrated, the tower ownership business is even more concentrated. These Cell Tower REITs own 50-80% of the 100-150k investment-grade macro cell towers in the United States.

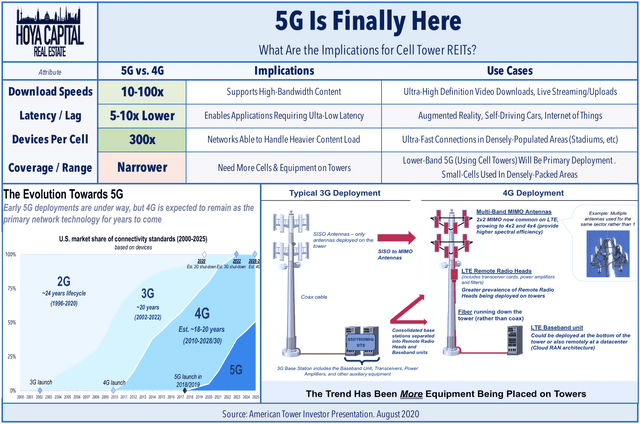

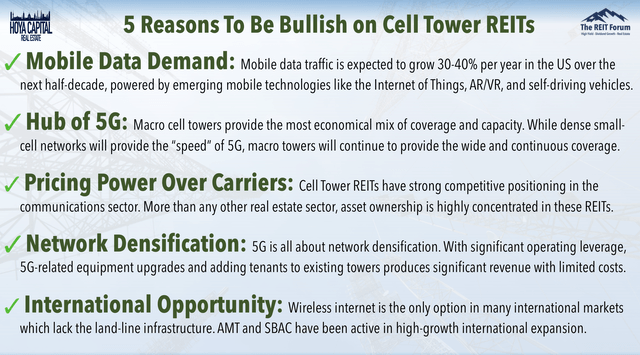

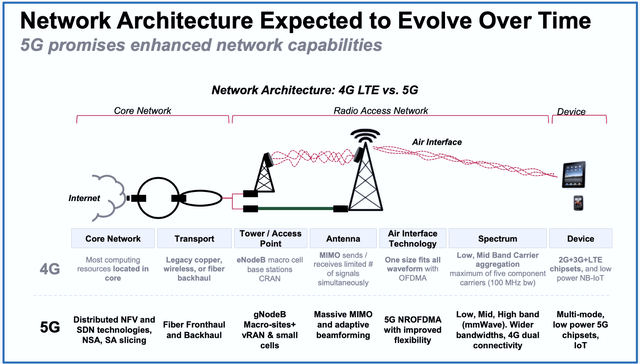

This favorable competitive positioning has given these REITs substantial pricing power amid the roll-out of 3G, 4G, and 5G wireless networks, which has translated into enviable shareholder returns. While 4G networks gave us the "streaming" and "e-commerce" age, pioneered by Amazon (AMZN) and apps like Uber (UBER) and Spotify (SPOT), 5G networks are expected to spur a new wave of technological innovation fueled by "fiber-like" speeds and latency over wireless nodes including fixed wireless broadband and autonomous cars with Tesla (TSLA) and Alphabet (GOOGL) leading the way.

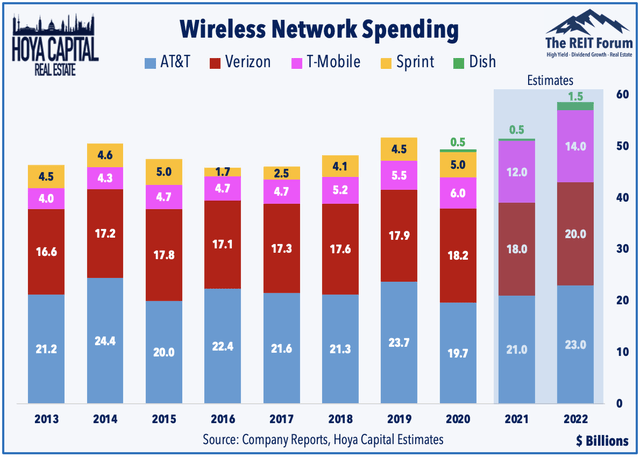

5G networks require up to 10 times more physical antennas per tower, and Cell Tower REITs typically negotiate higher revenue per tower after each incremental equipment upgrade. Thanks largely to the success of Apple's (AAPL) iPhone 12 launch, Gartner estimates that 213 million 5G-enabled smartphones were sold globally in 2020 and expects sales to double to over 530 million in 2021, accounting for 35% of global sales and the majority of unit sales in the United States. With more 5G devices in consumers' hands, network spending is expected to rise considerably over the next five years as carriers race to claim 5G network supremacy.

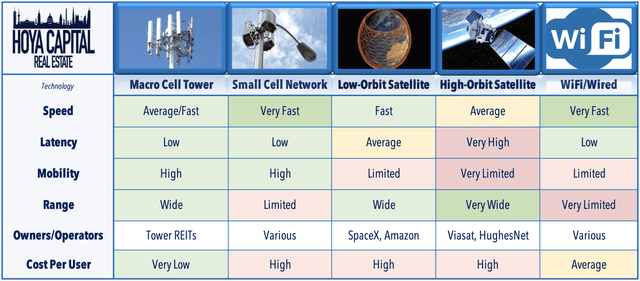

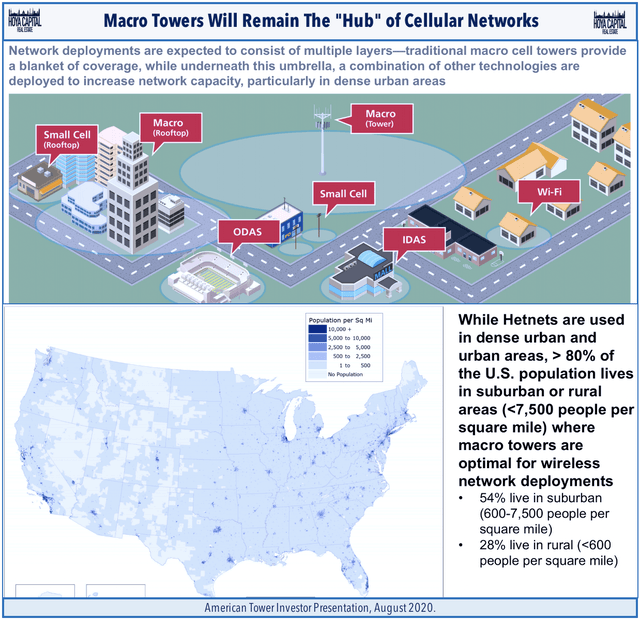

The three major U.S. carriers now boast "nationwide" 5G networks, built primarily by upgrading equipment on existing macro towers, an upgrade cycle that is expected to continue for the next half-decade, at least. Amid concerns about small-cell networks or low-orbit satellite networks making cell towers obsolete, we've continued to discuss how high-power macro cell towers provide the most economical mix of network coverage and capacity given regulatory, logistical, and economic challenges of competing technologies. Citing the favorable supply/demand dynamics, we've remained bullish on Cell Tower REITs, and we continue to believe that these towers will be the essential "hub" of next-generation wireless networks.

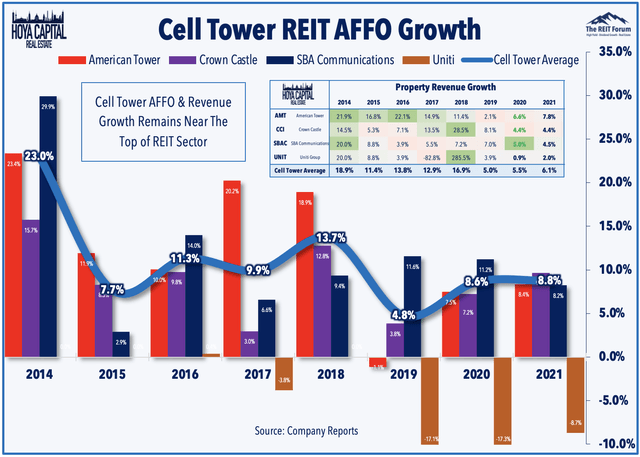

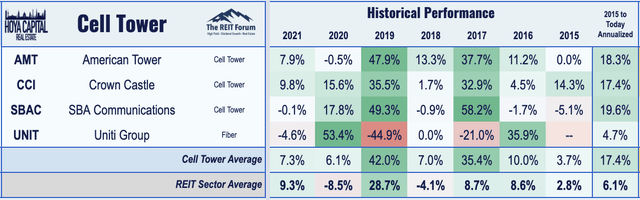

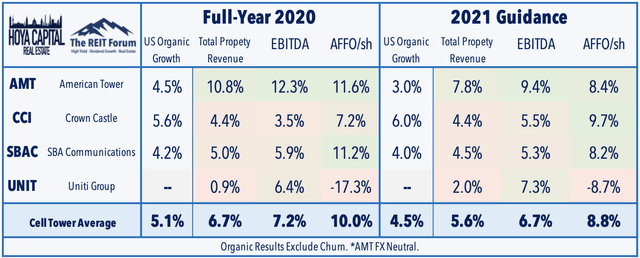

With these tailwinds at its back, Cell Tower REITs delivered another stellar year in 2020 with AFFO (Adjusted Funds From Operations) growth of nearly 9% with no signs of slowing. While tower REITs expect to see an uptick in churn related to the T-Mobile/Sprint merger to weigh on same-store results over the next three years, earnings call commentary suggests that incremental revenues from Dish should more than offset the drag. Guidance for 2021 calls for an acceleration in revenue, EBITDA, and AFFO/share growth, but the highlight of earnings season was American Tower's stated "aspirational" guidance target of double-digit annual AFFO growth through 2027.

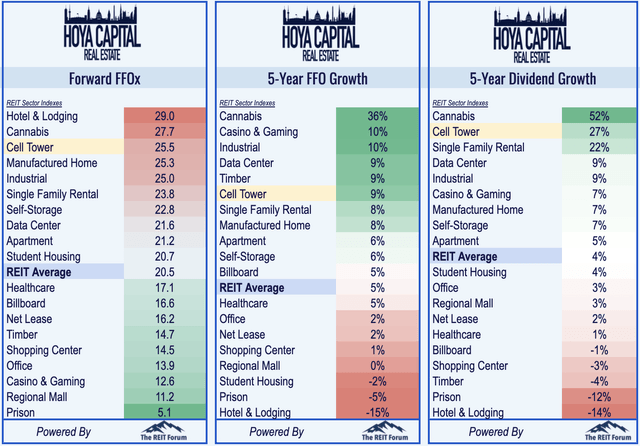

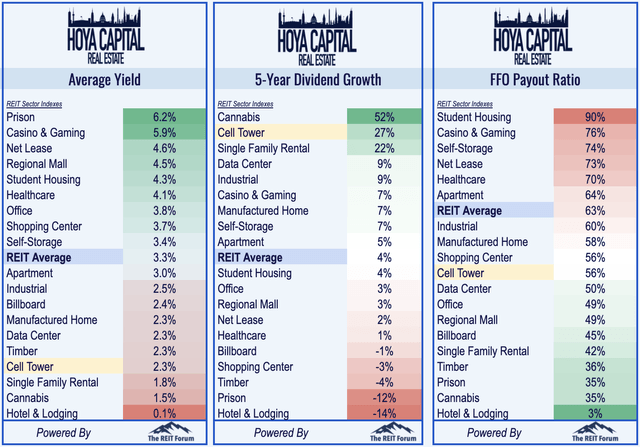

Last quarter, we discussed how the recent pull-back appeared to be a long-awaited buying opportunity. While the "flash sale" may be over, tower REITs have continually provided support to our theory that growth-oriented REITs are persistently undervalued, a theme that applies to other "essential" REITs across the housing, e-commerce, and technology sectors. Similar to Manufactured Housing REITs which we discussed in Great REITs Are Never Cheap, Cell Tower REITs have appeared "expensive" based on static earnings metrics throughout the past half-decade, but have recorded annual average FFO growth of 9% and dividend growth averaging 27% over the past years.

Cell Tower REIT Performance

Under pressure amid the vaccine-driven "REIT Reopening Rotation" that has sent shares of troubled REIT sectors soaring and has pressured "essential" sectors, Cell Tower REITs endured a five-month stretch of uncharacteristically weak performance in which the sector dipped roughly 25% from late September of last year through early March. Despite the weak performance in late 2020, Cell Tower REITs still finished the year with total returns of 7.25% compared to the -8.00% total returns from the Equity REIT Index.

Riding a nearly 20% rally since March 8th, Cell Tower REITs are now higher by 7.3% this year. AMT has led the rebound in 2020 after lagging last year due to its international exposure as the European and Indian markets remain laggards compared to the stronger U.S. market. AMT continues to plow ahead with external growth, announcing a pair of acquisitions in early 2021 - a $3.5B acquisition of InSite Wireless Group, which owns 1,400 towers in North America, and a $9.4B acquisition of Telxius Tower, which owns 31,000 towers in Germany, Spain, Brazil, Chile, Peru, and Argentina.

Deeper Dive Into Cell Tower Industry

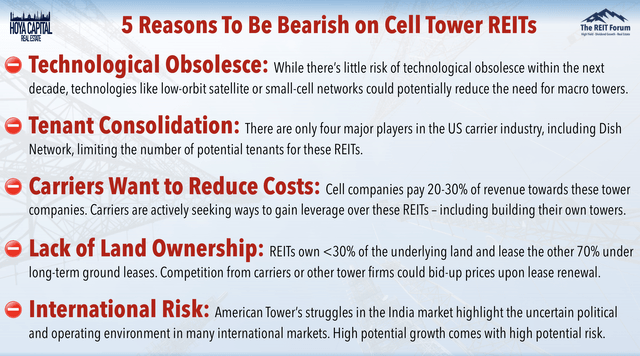

The cellular industry has seen plenty of fireworks over the last two years, underscored by T-Mobile's now-completed acquisition of Sprint, a merger that is expected to amplify competition - and network spending - within the industry. The emergence of a fourth competitor - DISH Network - as a precondition to approval was a coup for Cell Tower REITs, even as questions remain about DISH's viability as a national competitor. Four competitors are better than three, and three definitely beats two. Even if DISH's ambitious plans fail to materialize, the long-awaited merger gives the combined T-Mobile the ammunition and capital to compete in the 5G arms race.

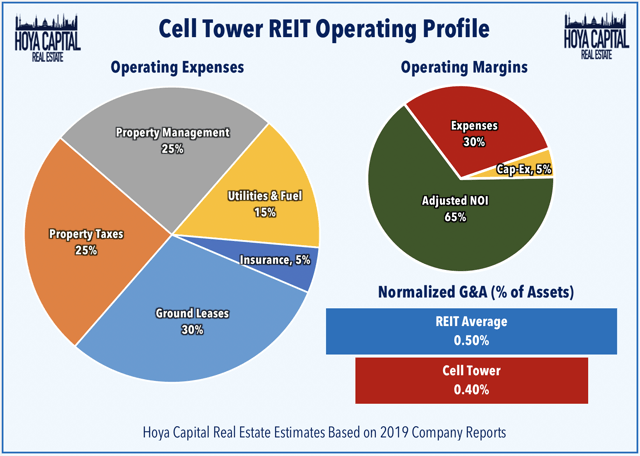

The relative scarcity of cell towers - combined with the absolute necessity of these towers for networks - has given REITs substantial pricing power even as the number of potential tenants has dwindled down to just four national carriers over the last two decades. Supply growth is very limited in the US, as there are significant barriers to entry through the local permitting process and due to the economics of colocation versus building single-tenant towers. Relative to other real estate sectors and their cellular carrier tenants, cell tower ownership is a high-margin business with significant operating leverage driven by adding additional multiple tenants to existing towers.

The typical cell tower operates equipment from multiple carriers and rental rates based on property location and the amount of equipment on the tower or on the ground site below. Cell tower leases are typically 5-10 years with annual fixed-rate escalators with multiple renewal options. Cell Tower REITs, however, only own about one-third of the land under the towers and control the rest through long-term ground leases, a source of potential long-term risk. EBITDA margins typically average around 60-65% for the Cell Tower REIT sector, towards the higher end of the real estate universe, with minimal ongoing cap-ex required relative to other REIT sectors.

We continue to see fixed wireless broadband - using a cell network for home or business broadband - as 5G's true "killer app." Sensing the competitive threat on their core wireline business from wireless broadband, Comcast (CMCSA) and Charter (CHTR) have made a push in recent years to compete in the cell business, primarily through "renting" capacity from the existing carriers as so-called "mobile virtual network operators" (MVNO) to supplement their public WiFi networks. Cell Tower REITs also stand to benefit from the adoption of "Edge" network architecture whereby data centers are located in close physical proximity to end-users or wireless networking hubs.

Meanwhile, Elon Musk's SpaceX has made headway on its ambitious low-orbit satellite ("LEO") network called Starlink that could eventually offer fixed broadband services. While some investors have raised concern that LEO networks could "replace" cell towers, telecom analysts - and Elon Musk himself - see these networks as more likely to be tenants to tower REITs than competitors. Noting that no firm has ever succeeded in making a viable LEO network, Elon Musk commented to reporters, "it is far from a sure thing." Amazon, Apple, Google (GOOG), and Microsoft (MSFT), are also indirect players and natural partners for emerging carriers.

Cell Tower REIT Dividend Yields

Cell Tower REIT Dividend Yields

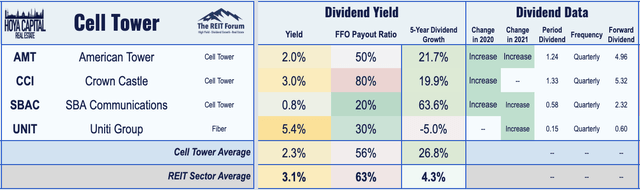

Cell Tower REITs pay an average dividend yield of 2.3%, well below the market-cap-weighted REIT sector average of 3.3%. That said, cell towers were one of the few property sectors that were untouched by the wave of dividend cuts and suspensions that hit the REIT sector in 2020 and have delivered robust annual dividend growth averaging 27% over the past five years. Cell Tower REITs retain roughly half of their free cash flow leaving ample free cash flow for external growth and additional dividend growth.

Within the sector, we note that only Crown Castle acts like a "typical REIT" when it comes to distributions, paying a healthy 3.0% dividend yield, roughly 80% of its available cash flow. American Tower, meanwhile, pays a relatively low 2.0% yield, while SBA Communications pays a yield of 0.8%. Three REITs - AMT, CCI, and SBAC - raised their dividend in 2020 and we've seen another three dividend boosts this year from AMT, SBAC, and UNIT. Through twelve weeks of 2021, 51 equity REITs have raised their distributions.

Bull and Bear Thesis for Cell Tower REITs

Below, we outline five reasons why investors are bullish on Cell Tower REITs.

Below, we outline five reasons why investors are bearish on Cell Tower REITs.

Key Takeaways: 5G Dominance - For Now

Emerging from relative obscurity early last decade, Cell Tower REITs have developed into dominant players of both the telecommunications and real estate sectors. Keep in mind, however, that some level of valuation discount is warranted for property sectors with limited "alternative uses" - as is the case with communications towers. Strong competitive positioning has historically been a fleeting privilege in the telecommunications sector, but the simple physics and economics of wireless networking suggest that high-power macro communication towers will continue to be the "hub" of mobile networks.

Similar to our favorable fundamental outlook on the residential and industrial real estate sectors, we see the trends of limited supply and robust demand continuing well into the next decade for the Cell Tower REIT sector. Cell Tower REITs delivered another stellar year in 2020 with FFO growth of nearly 9% with no signs of slowing. Last quarter, we discussed how the recent pull-back appeared to be a long-awaited buying opportunity. While the "flash sale" may be over, Cell Tower REITs have continually provided support to our theory that growth-oriented REITs are persistently undervalued.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, Cannabis, Real Estate Crowdfunding, High-Yield ETFs & CEFs, REIT Preferreds.

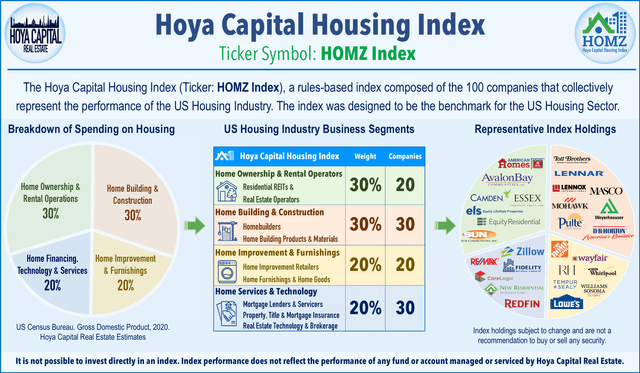

Disclosure: Hoya Capital Real Estate advises an Exchange-Traded Fund listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. Index definitions and a complete list of holdings are available on our website.

Join The REIT Forum for the Full Analysis

Hoya Capital is excited to announce that we've teamed up with The REIT Forum to bring the premier research service on Seeking Alpha to the next level. Exclusive articles contain 2-3x more research content including access to The REIT Forum's exclusive ratings and live trackers and valuation tools. Sign up for the 2-week free trial today! The REIT Forum offers unmatched coverage and top-quality model portfolios for Equity and Mortgage REITs, Real Estate ETFs and CEFs, High-Yield BDCs, and REIT Preferred Stocks & Bonds.