These are very interesting times that we live in - especially from a stock market point of view.

We recently crossed above the 100% recovery threshold from the lows of the recent COVID-19 recession, which represented the fastest double from a recession bottom ever. And, I suppose this shouldn't have come as a surprise, being that the sell-off and ensuing recovery during the March 2020 crisis were unique in their depth and steepness.

Markets continue to hover at all-time highs. Just today, we hit the 52nd record high since the start of 2021. In short, the markets have moved up in a fairly straight line, without much of a dip to be seen anywhere (from a macro perspective anyway).

Of course, there are various industries and even entire sectors that have lagged the broader markets. The stock market is a market of stocks and even in this day and age, where algorithmic trading of ETFs tends to lower and lift all boats as one, we see divergence on an individual equity level. Yet, for the most part, investors appear to have become complacent, with forward-looking multiples on the major indexes well above historical norms. What's more, due to the short-term nature of the collective memory of the markets, investors have become used to this relatively low volatility/upward trajectory trade.

The Fed remains dovish, governments across the world have offered record levels of stimulus to spur economies out of the COVID-19 crisis, and thus far, throughout Q1 and Q2 of 2021, we've seen companies beat (already high) analyst expectations by leaps and bounds.

In short, there is a lot of reason to be bullish on stocks right now.

However, that changed a bit early last week, when the combination of geopolitical, Delta variant, and U.S. budgetary concerns inspired a ~1.5% sell-off on the S&P 500 (the Dow Jones Industrial average fell even further, some nearly 2.5%).

Now, to be clear, a 1.5% sell-off should not be overly concerning to bulls. During typical years, markets experience dips like this on a fairly regular basis. But, after so many records, I think a lot of individuals had bought into the Dave Portnoy idea that "stocks only go up" and were taken by surprise when we saw a couple of big red days, back-to-back.

As a strategist for Wide Moat Research, I participate in many investor forums and chat rooms. I interact with retail investors/traders on a daily basis and their response to the very short-term weakness that we saw last week inspired me to write this piece.

One area of the market, in particular, that appears to have caught the attention of investors recently is the healthcare space. Healthcare stocks have finally perked up, after a couple of years of lagging performance, in recent months and now, I'm starting to hear a louder and louder chorus that many of the blue chips in this sector are ripe to sell.

It's true that we're looking at 52-week highs on many of these names. And, I'll be the first to say that if you're going to sell something, you might as well sell it high. Right?

But, just because a stock is hitting new 52-week/all-time highs does not mean that it is no longer a bargain. Truth be told, there are quite a few overvalued stocks in today's market. However, when I look across the biopharma space, I don't see exuberant greed driving prices to unsustainable highs. Actually, on the contrary, I see a space of the market that has been unjustifiably unloved for several years now and the rally that we've witnessed in recent months is just the coiled spring unloading.

When I look at the blue chip biopharma names, I actually think there is quite a bit of upside left, in certain cases. And, in others, where the rise of share price has moved stock valuation up to levels that I consider to be fair, I'm still not interested in taking profits because forward-looking growth prospects remain strong and therefore, not only do I see improving fundamentals in the coming years but also rising dividends.

In short: I don't see compelling reason, valuation or otherwise, to sell blue chip biopharma names.

At the end of the day, if there's one thing I know about the stock market it's this: investors are best off buying and holding blue chip stocks.

Best-in-breed companies aren't meant to be traded; they're meant to be owned.

Attempting to time the market is a fool's errand and therefore, investors who're feeling the itch to lock in profits should strongly consider the opportunity cost of doing so. As you'll see in a moment, I wouldn't be surprised if many of the blue chip biopharma names that I've seen recent bearish commentary on continue to generate wealth for their shareholders and therefore, I'm very content to maintain my heavy exposure to this defensive area of the market.

Now, before I get into the individual company breakdowns here, I will say that biopharma names always come with patent cliff concerns, which is a risk that investors in this space must accept. However, being that I'm focused on the blue chips here, I'm talking about companies with long, proven histories of success when it comes to recycling cash flows from current blockbusters into further R&D and M&A which leads to future revenue growth.

In short, when owning biopharma stocks, investors are putting their faith in the ability of management to execute on both short-term and long-term operations, with particular regard to the cultivation of a strong pipeline. But, in my view, the leadership of each and every single one of the companies that I'm going to discuss below have proven themselves capable of managing this risk and therefore, I'm not going to spend too much time talking about various blockbusters that facing loss of exclusivity in the near-term and the pipeline assets which can replace those sales.

Instead, I want to focus on the fundamentals, which should be the starting point of anyone's due diligence process in this space - from there, I believe that intrigued parties should begin a deeper dive into LOE and pipeline assets.

With that being said, let's take a look at some of my favorite healthcare companies - contrary to recent commentary that I've seen elsewhere, all stocks that I'm happy to hold (or even buy more of) in today's market environment.

Johnson & Johnson (JNJ)

JNJ certainly isn't the cheapest biopharma stock, but I believe it is the best-in-breed player in this space and therefore, I'm totally surprised anytime I see dividend growth investors talking about selling/trimming shares.

JNJ is arguably the strongest stock on Earth. This company has been generating tremendous long-term wealth for its shareholders for decades. The company has increased its annual dividend for 59 consecutive years. JNJ is one of just 2 companies in the world with a AAA credit rating (which, to put this into perspective, is higher than the U.S. government's). JNJ operates a well-diversified business, with strong assets in the pharmaceutical space, the medical devices space, and the consumer goods space. These three divisions smooth out some of the revenue/cash flow volatility that is usually associated with biopharma names. 2020 was the first year in decades that JNJ produced negative y/y EPS growth (yes, decades).

That sort of consistency is absolutely amazing and goes to show the immense quality that this company offers. And yes, during COVID-19, when the company's pharmaceutical and medical device segments were disrupted in a major way, the company's EPS fell by 7% on a y/y basis. Yet, during 2021, the company has bounced back in a major way, with the consensus analyst estimate for full-year EPS coming in at $9.67 right now, which represents 20% y/y growth relative to the 2020 figure and 11.4% growth relative to 2019's pre-pandemic bottom-line figure.

In other words, JNJ's long-term growth story is intact. And, analysts expect this trend to continue into the coming years as well, with mid-to-high single digit EPS growth expected in 2022, 2023, and 2024 as well (which is impressive considering that these comparisons are coming on top of 2021's strong double digit growth).

With all of this growth in mind, I'm surprised to see that not more analysts are bullish here. 6 of the last 10 articles written on Seeking Alpha offer a "neutral" rating on shares. JNJ shares are down nearly 3% this week and I've seen subscribers talking about selling/trimming their positions. I've seen a handful of individuals claim that JNJ is overvalued. To me, none of this makes sense.

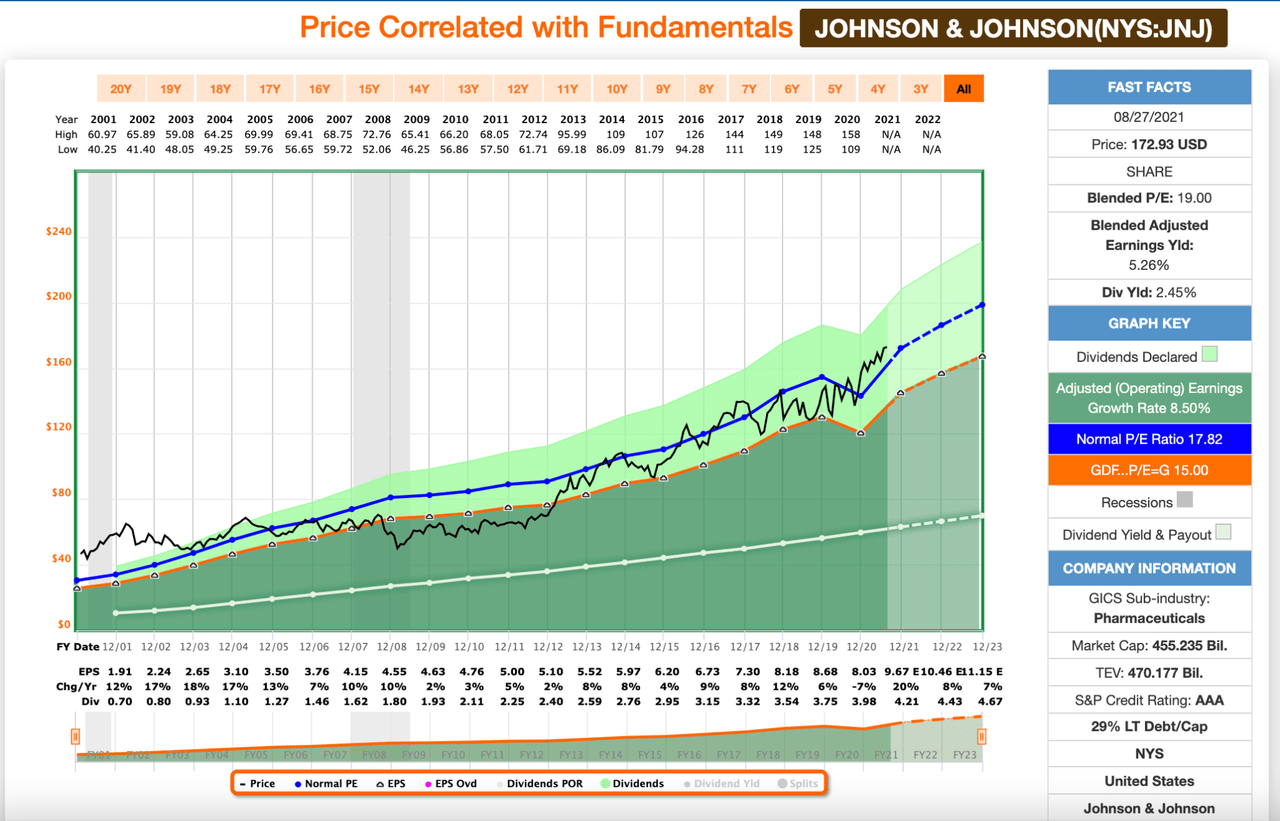

Source: F.A.S.T. Graphs

Right now, JNJ is trading for 19x blended earnings, which makes the stock's valuation seem a bit elevated (JNJ's long-term average P/E ratio is 17.8x). However, it's important to understand that any earnings multiple which factors in trailing twelve-month earnings here is going to point towards an abnormally high multiple because of the one-time issues that JNJ experienced in 2020. On a forward-looking basis, JNJ is for 17.9x 2021 EPS estimates, which means that the stock is trading within a historically normal range. And, looking further ahead, to 2022 (which I am factoring heavily into my current valuation at this point in time) we see that JNJ's current share price equates to a forward 2022 P/E ratio of just 16.5x.

Sure, the shares aren't discounted like they were a year ago (during the depths of the COVID-19 sell-off, JNJ's P/E multiple fell down to the 13x range. But, that was a unique period for the shares (and the entire market) and expecting to pay less than 15x for JNJ is unrealistic. Historically speaking, this is a stock that has traded with a market multiple (or higher). Today, shares are trading with sub-market multiples and frankly put, I'm pleased to pay 16.5x forward earnings for JNJ.

With that in mind, I rate JNJ a "Buy" not a "Hold" or worse, a "Sell". This isn't a stock that is likely to make investors rich in the short term, but over the long term, I have to believe that JNJ will continue to generate a lot of wealth for shareholders.

My fair value for JNJ shares is $178.50 and due to the high quality of this company, even above fair value, this is not an asset that I'm looking to sell/trim. JNJ shares should be held. This is a quintessential S.W.A.N. stock. Buy, hold, re-invest. It's a simple solution to wealth generation over time.

AbbVie (ABBV)

Like JNJ, which is only up about 10.5% on a year-to-date basis, ABBV shares have also underperformed the S&P 500, up just 12.5% compared to the SPY's 19.36% gains.

It's true, that to those who bought ABBV during either of its relatively recent pullback to the $60 range (when its Allergan acquisition was announced in 2019 and then again during March of 2020 during the COVID-19 lows) ABBV's $120 share price may look expensive…

But, let me assure you, that when you look at the company's fundamentals, ABBV remains one of the cheapest blue chips that I'm aware of in the entire market.

Right now, ABBV shares trade for less than 9.5x this year's expected earnings. If you look a year ahead, to the consensus 2022 EPS estimates that the analyst community has placed upon ABBV shares, we're talking about an 8.6x forward multiple.

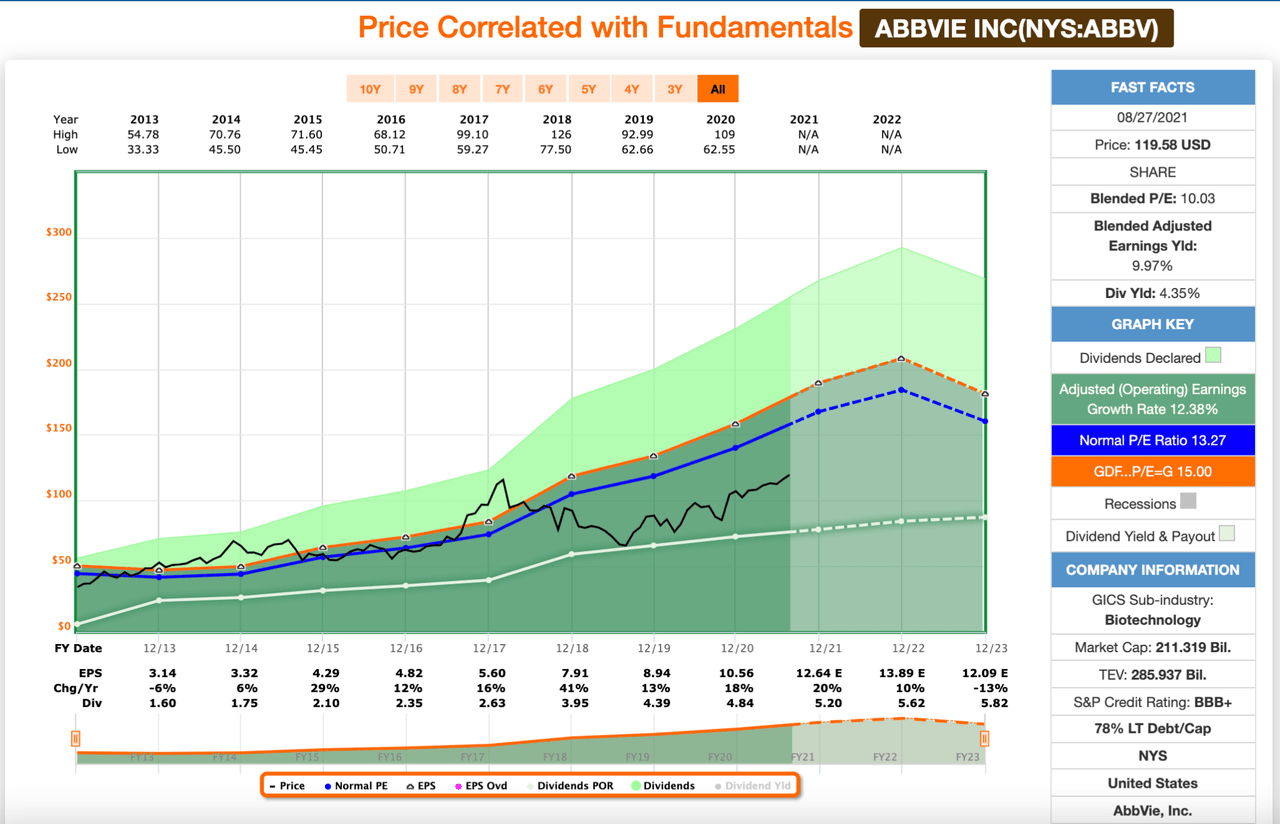

Source: F.A.S.T. Graphs

Granted, some of this weakness can be justified by the Humira (the world's largest drug in terms of sales) LOE overhang and the revenue/cash flow uncertainty surrounding ABBV shares in a post-2022 world.

However, it's not as if Humira sales are going to zero after the patent cliff hits. That drug will likely take a huge hit, but right now, analysts are calling for negative 13% growth during 2023, followed by a relatively flat EPS growth year in 2024.

In short, Humira's LOE is not expected to represent catastrophic losses, from a fundamental perspective. The Allergan acquisition went a long way towards diversifying ABBV's revenue stream away from its heavyweight Humira exposure. And, the continued strong growth that Skyrizi and Rinvoq offer the company are expected to help to replace the lion's share of Humira losses.

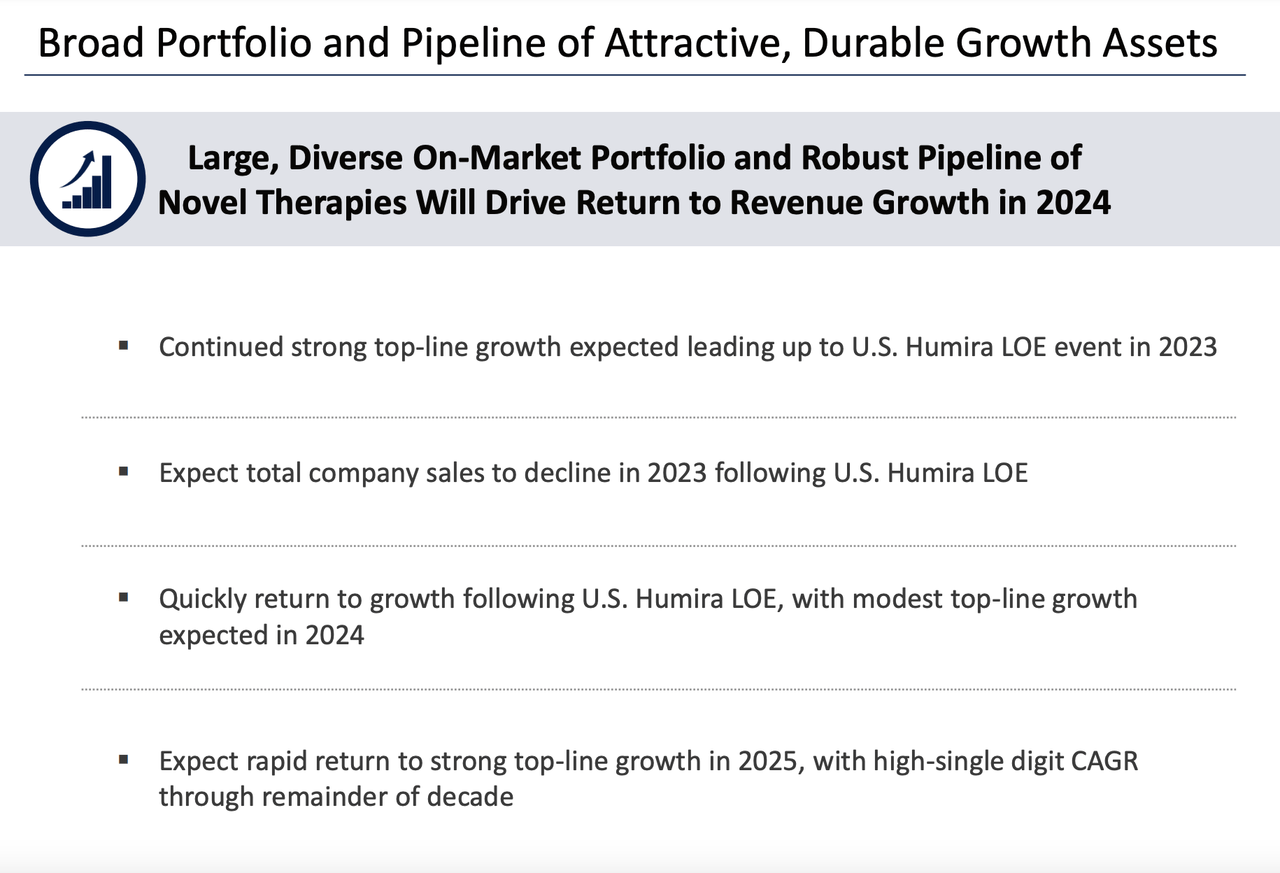

Earlier in the year, ABBV management offered post-2022 guidance:

Source: ABBV JPM Healthcare Conference presentation page 4

The company's management team has spoken about this guidance, reaffirming its long-term outlook, several times since the JPM conference as well.

In short, even after the -13% EPS growth that is expected to occur once Humira falls over the patent cliff, ABBV will still be trading for less than 10x expected earnings. And, assuming management is correct and the company will return to "strong" top and bottom-line growth throughout the second half of the decade, then without a doubt, ABBV shares represent an intriguing long-term value here, with known risks and the stock's recent rally in mind.

Bristol-Myers Squibb (BMY)

If there's a cheaper biopharma name in the market than AbbVie, it's Bristol-Myers Squibb.

BMY shares sold off a couple of years ago because of similar reasons to AbbVie's more recent decline: M&A risk.

Bristol-Myers made a big move acquiring Celgene and while that deal has proven to be very accretive to earnings, it appears that the analyst community is worried about the potential impact of Revlimid's upcoming patent cliff on the company's earnings outlook - as well as continued concerns about BMY's immuno-oncology suite of drugs lining up well against the competitions in what has proven to be a very competitive space.

BMY shares peaked in the mid-$70s back in 2016 and haven't reached their prior highs yet. I hear investors complain all the time about the stock's stagnant share price performance, especially relative to its peers, and more so, the broader market, which has performed enormously well throughout the last 5 years.

However, the fact is, just like all investments, entry prices matter, as do the valuations that investors pay.

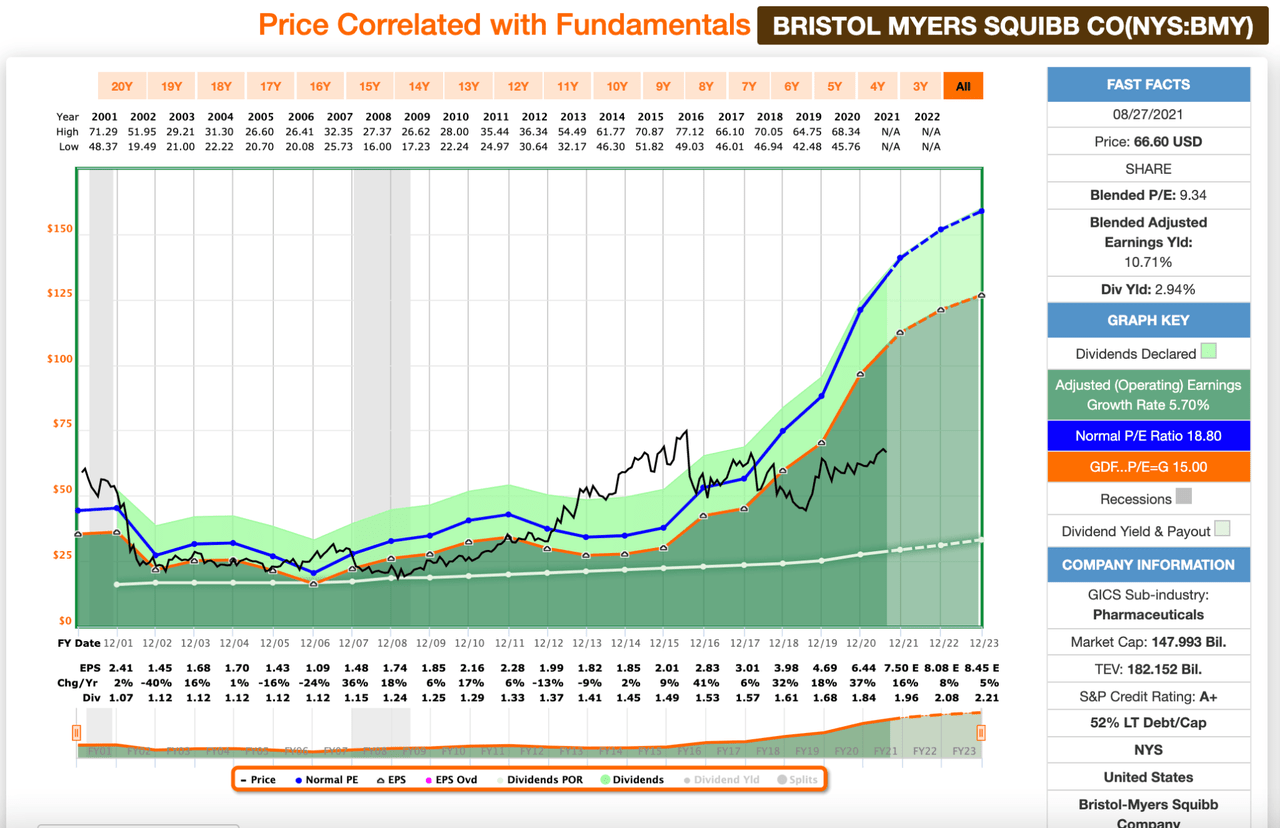

What's so interesting about BMY's sell-off is that the share price's movement has not been correlated to the stock's fundamentals in the least. Looking at the chart below, you'll see that throughout BMY's multi-year sell-off, the stock's bottom-line has continued to grow at a strong pace. And, looking ahead at analyst consensus estimates, we see that this upward trajectory is expected to continue into the foreseeable future.

Source: F.A.S.T. Graphs

In short, this irrational divergence between BMY's share price and the stock's underlying fundamentals has created a unique buying opportunity.

BMY is trading for just 8.88x 2021 expected EPS. BMY is trading for just 8.2x 2022 EPS estimates. Having the opportunity to buy a blue chip company, with a near 3% dividend yield (which is more than twice as high as the S&P 500's dividend and the yield on the U.S. 10-year) is pretty amazing. Sure, BMY's growth is slowing, but at this point in time, the stock's bottom-line could flatline for an extended period of time and multiple expansion would likely be strong enough to generate satisfactory returns.

The way I see it, there is no reason for BMY to trade so cheaply. The market has been dead wrong about this one for years. And, I'm grateful to have taken advantage of this weakness, acquiring an overweight stake in the company at such low valuation premiums.

Merck (MRK)

Merck is another name that I've seen brought up as a potential sell candidate in recent days/weeks/months, due to MRK's relative underperformance.

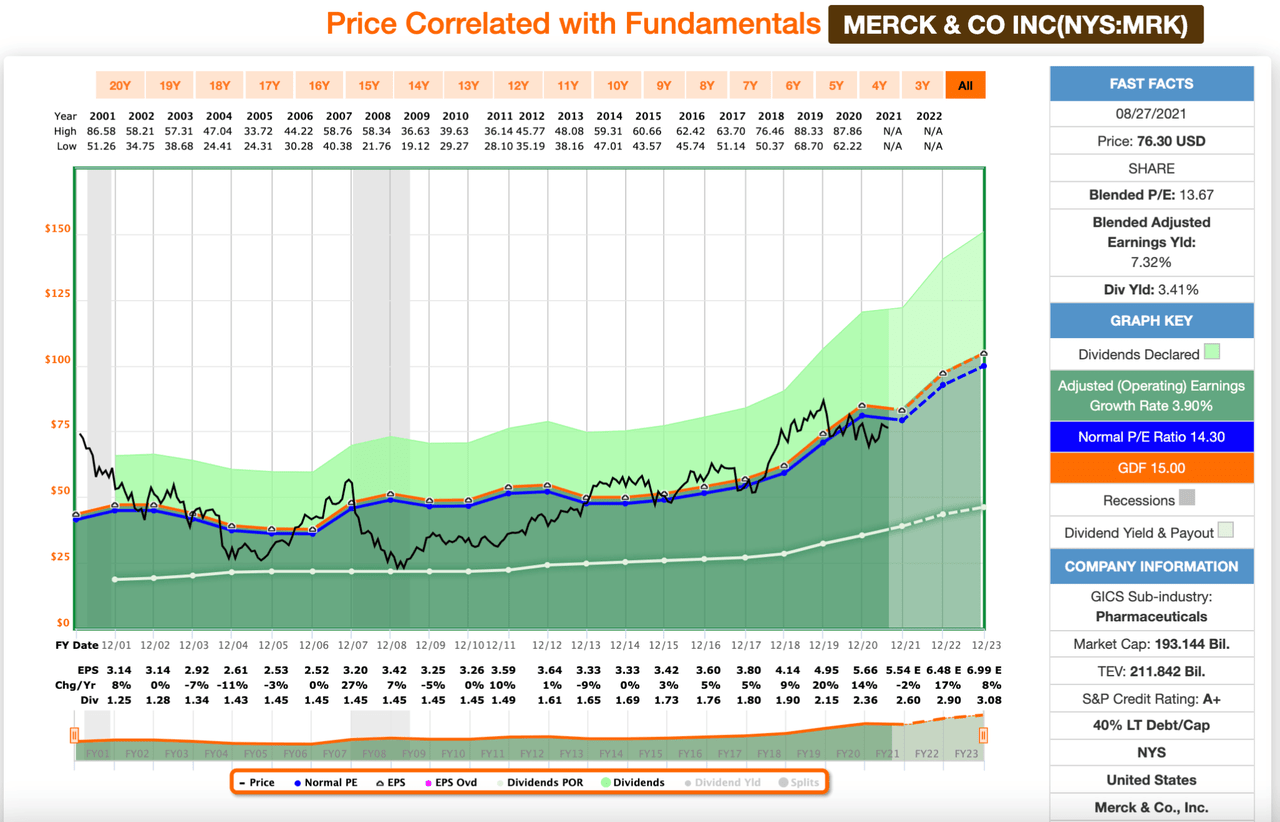

However, like ABBV and BMY, MRK's valuation is well below its historical norm, while its growth prospects remain above long-term historical averages in terms of top and bottom-line growth, implying another irrational event in the market.

Right now, MRK shares are trading 13.8x 2021 EPS estimates and just 11.7x 2022 estimates. MRK's 5, 10, and 20-year average P/E ratios are 15.75, 14.63x, and 14.3x, respectively. In short, no matter how you slice it, this stock looks cheap.

Looking at the chart below you'll see that earnings are expected to accelerate nicely into 2022 and 2023, which to me, not only implies that MRK's share price is due for a bounce, but also that the company's dividend is likely to continue to grow nicely as well.

Source: F.A.S.T. Graphs

I've seen talk of MRK's dividend being unsustainable recently (certain analysts like to focus on operational income payout ratios) but to me, looking at adjusted earnings-per-share (and the recent influx of cash that MRK is receiving from its Organon (OGN) spin-off), I think MRK's dividend looks quite safe.

Right now, the analyst consensus EPS figure for 2023 is nearly $7/share. The company's current dividend is $2.60/share, representing a forward payout ratio of just 37%.

Looking at shares, I think it's reasonable to assume that they're worth conservative a 13-14x multiple on that forward-looking figure and you're talking about a share price of $91-98/share in a couple of years.

2023 is a way down the road, but I'm happy to collect MRK's nearly 3.4% yield as I wait for the fundamental growth to kick in.

Medtronic (MDT) and Novo Nordisk (NVO)

Now, let's move away from what I consider to be attractive buying opportunities in the biopharma space and take a look at two of the other blue chip healthcare names that I've owned for years and discuss why it is that I have absolutely zero plans to take profits on my positions enough though they've experienced really nice rallies as of late.

If you follow my investing style at all, you know that I've arrived at the conclusion that it's likely not in the best long-term interest of investors to sell/trim positions just because of short-term valuation concerns.

Why is this? Because over the long term, blue chip companies tend to compete well, they adapt, they evolve, and ultimately, they tend to prosper, resulting in fundamental growth. And, generally speaking, when their valuations rise well above historical averages, it's due to the market's widely held belief that their growth prospects are strong. It usually doesn't take all that long for the growth that inspired investors to pay a high premium for shares in the first place to come to fruition, eventually justifying present share prices (and more).

Therefore, I see no reason to attempt to time the market with regard to guessing near-term tops and hoping to see a dip to buy. In my experience, doing so is a fool's errand and due to the strength of blue chips over time, those dips are relatively unlikely to occur, especially when compared to the prospect of the share price simply staying high (or even moving higher).

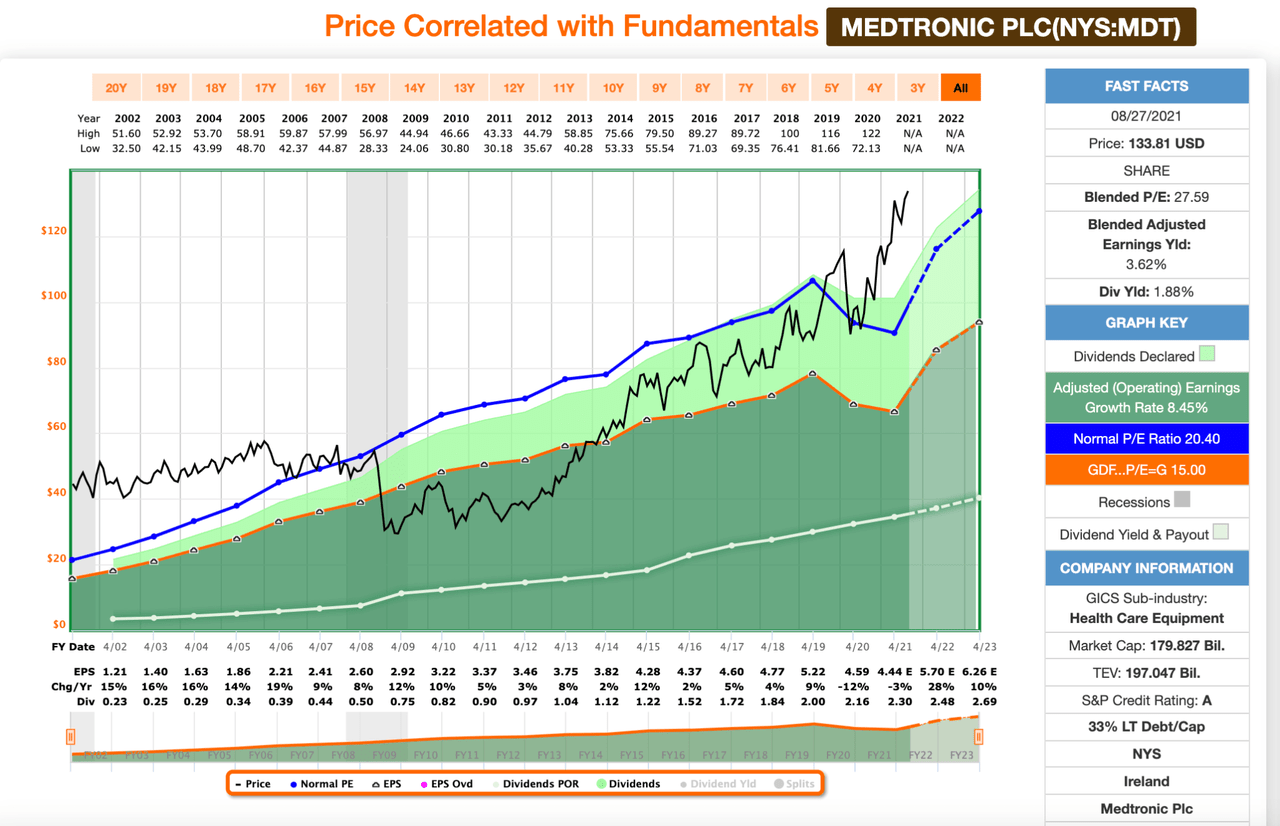

With that being said, I want to take a look at MDT and NVO, two companies that appear to have irrationally high valuations in the short term, but also the potential to grow into them in the relatively near term.

MDT is trading for 30.1x its recent fiscal 2021 EPS total. This is well above its long-term average P/E ratio of 20.4x. However, analysts expect to see MDT post EPS growth of 28% this year and another 10% next year, and assuming that these estimates are close to being accurate, MDT's current share price would represent a 21.3x multiple on earnings estimates 18 months from now. This implies that any EPS growth past that would result in rational share price appreciation.

And, due to the high quality of MDT's operations, I see no reason to attempt to trade out of and back into the stock during the next 18 months. Why not just hold, be patient, collect the dividend, and maintain my position which points towards long-term wealth generation? Even if this means relative underperformance in the short term, this seems like the most prudent path to take for a conservative, long-term, income-oriented investor.

Source: F.A.S.T. Graphs

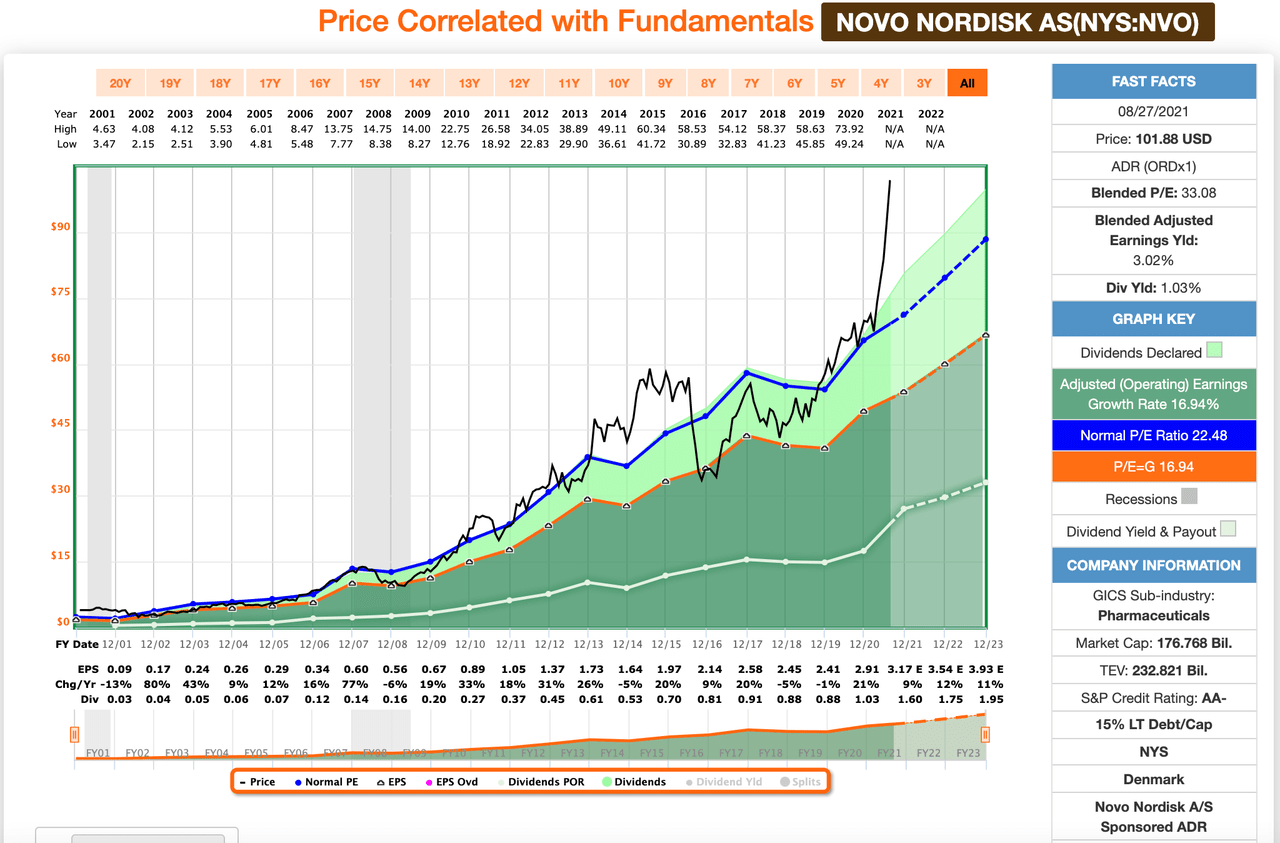

NVO appears to be a bit more expensive than MDT.

Forex plays a role here (when looking at NVO's fundamentals presented in USD terms), so please keep that in mind.

Right now, NVO is trading with a 32.1x forward P/E multiple when compared to 2021 earnings estimates. NVO is trading with a 28.7x multiple when looking at the 2022 consensus and a 25.9x multiple when looking at 2023 estimates.

NVO's long-term average P/E multiple is 22.5x. During the last 10-years, the stock's average P/E is 22.5x. And, during the last 5 years, NVO's average P/E ratio is 21.2x.

Source: F.A.S.T. Graphs

Looking ahead at future growth estimates, NVO's prospects aren't stellar, when compared to the company's history. The low double digit growth expected to play out during the next 3-5 years is in-line with historical averages. This implies that the current premium is irrationally high. However, the strong secular growth prospects at play here (the global diabetes issue isn't going anywhere, anytime soon) led me to believe that given enough time, NVO's fundamental growth will eventually justify the stock's valuation.

Time is an investor's best friend and we see that made clear when looking at NVO's past performance. In mid-2015, NVO's valuation premium was just as elevated as it is today. Looking at the F.A.S.T. Graph above, you'll see that this high premium played a role in the significant sell-off that NVO had over the next 18 months.

From mid-2015 to late 2016, NVO's stock fell from approximately $58/share in 2015 to $33/share. However, investors who held patiently through this weakness have since made up their losses (and then some). Today, NVO shares are 75% higher than they were at their 2015 peak.

Obviously the past can't predict the future, but if I had to guess, NVO shares will be much higher in 5-6 years (when it comes to blue chips, due to their reliable cash flows, history has a way of repeating itself).

And, while I have no idea what NVO's share price will look like in the late 2020s, I do have a high degree of certainty when I say that the company's dividend will be much higher than it is today.

This is the true benefit of owning blue chip dividend growth stocks (regardless of which sector/industry they hail from) - regardless of which direction stocks head in the near term, up, down, or sideways... investors get paid generously while they wait and see.

This article was previously published for subscribers to The Dividend Kings.

Come Join Safe High Yield

Safe High Yield offers one actively managed portfolio, a weekly portfolio review, and real-time trade alerts/stock analysis of the companies included in the portfolio.

The portfolio yields roughly 6% right now (our yield on cost is even higher!) and has never experienced a dividend cut.

We're sticking with the K.I.S.S. (keep it simple, Stupid) mantra for this service, which allows us to offer it to subscribers at the lowest possible cost.

Click here to come join us and begin your free 2-week trial!