da-kuk/E+ via Getty Images

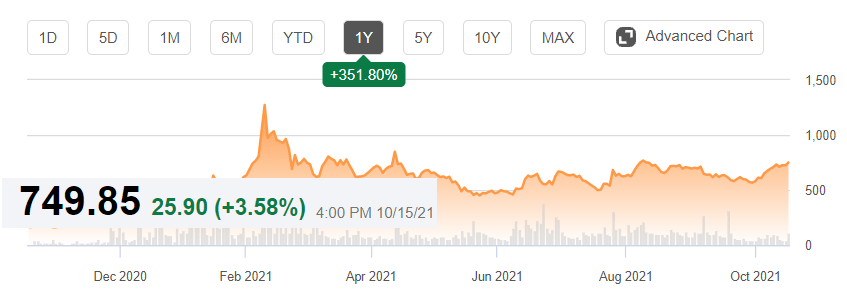

MicroStrategy (NASDAQ:MSTR) has sufficient liquidity to finance new versions of the HyperIntelligence tool and perhaps new REST APIs. Besides, if the management can develop new software by using blockchain technologies, I would expect significant free cash flow growth. In my base case scenario, I believe that the implied share price is equal to $995 per share, which is way above the current valuation of $700-$750.

MicroStrategy: Actionable Enterprise Data Analytics And Bitcoin

Founded in 1989, MicroStrategy offers enterprise analytics software and services:

Source: Company’s Website

The company’s core offering includes MicroStrategy2021 and HyperIntelligence. These are enterprise platforms that offer actionable enterprise data analytics to make smarter actions and informed decisions.

With that, the company’s most interesting business is the management of bitcoin and blockchain software. The company is not only investing a significant amount of money in Bitcoin (BTC-USD). The management also believes that the programmers inside the organization could implement blockchain analytics. In this case scenario, I would expect significant sales growth and free cash flow generation. I designed several financial models to learn about the upside potential.

Expectations From Other Analysts And My Base Case Scenario

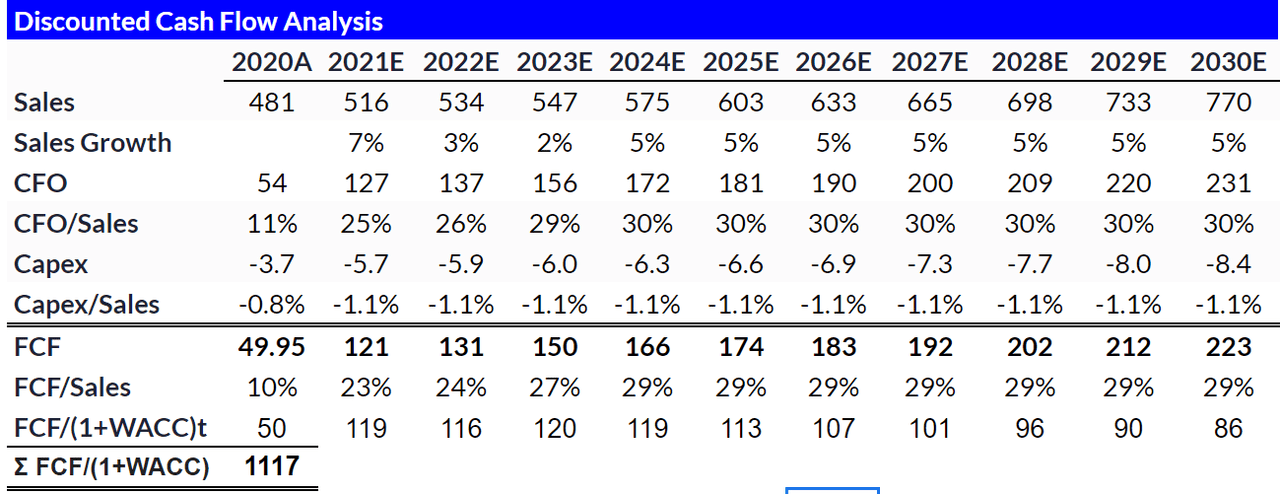

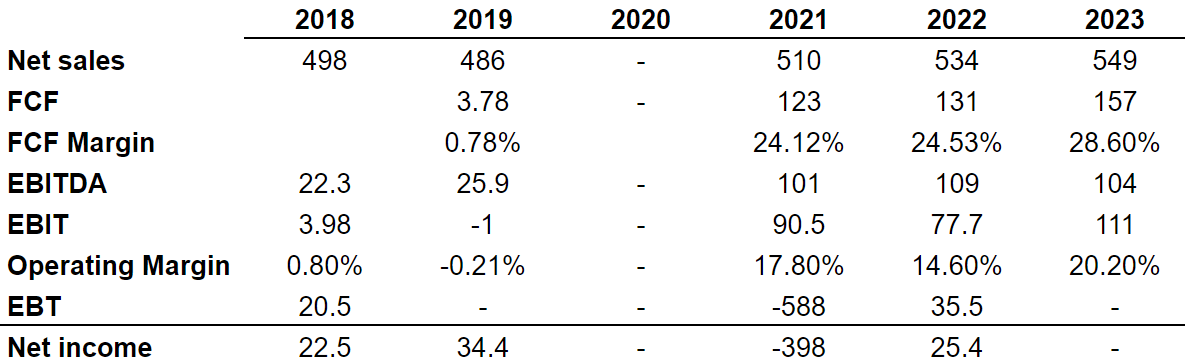

The investment community appears to be very optimistic about the future of MicroStrategy. Market analysts expect net sales to grow from $510 million in 2021 to close to $550 million in 2023. The FCF margin would also be impressive, close to 24%-28%. The 2023 FCF would be close to $157 million. Take a look at the figures below because I used them for my base case scenario:

Source: Market Screener

In my opinion, MicroStrategy could grow at close to 5% of the sales growth if the management continues to build a comprehensive open enterprise analytics and mobility platform. Besides, if MicroStrategy delivers new versions of the company’s HyperIntelligence tool, and injects additional contextual analytics into the online workflows, the free cash flow would trend north.

I would also be expecting new versions of the REST APIs, which, in my view, will make the life of coders a lot easier. Note that clients can use the API to generate their own automatic tools, and improve their own applications and integrations with other devices.

With regards to the company’s marketing strategies, I will be even more optimistic about the future if the management signs new alliances with third-party vendors. Take into account that these consulting firms, resellers, original equipment manufacturers, and tech companies offer MicroStrategy’s materials to other clients. As a result, the company may in the future benefit from network effects, which will most likely lead to sales increase.

My financial model includes sales growth of 5%, CFO/Sales of 30%, and FCF/Sales of 23%-30%. Under these assumptions, the free cash flow would increase from close to $120 million in 2021 to $212 million in 2029. The cumulative FCF is equal to $1.117 billion:

Source: My DCF Model

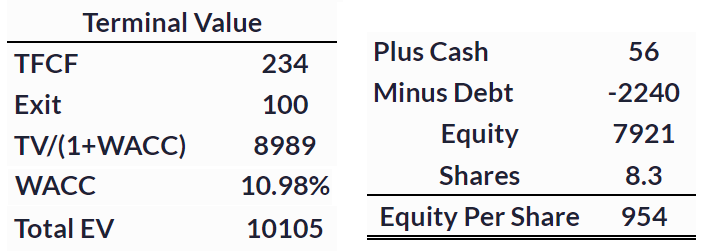

I used a WACC of 10%, which is approximately what other investors are using. With an exit multiple of 100x and close to 8.2 million shares, the enterprise value would look close to $10 billion, and the implied share price would be close to $955. With the shares currently trading at $700-$750, MicroStrategy looks like a buy:

Source: My DCF Model

Source: Seeking Alpha

The Company’s Bitcoin Acquisition Strategy Would Imply A Valuation Of $995 Per Share

In September 2020, Bitcoin was established as the primary treasury reserve asset. It means that the company will use a combination of cash and cryptocurrency to manage its liquidity. In my opinion, in the coming years, the company’s new strategy may bring significant cash. Notice that the management is using the net process from convertible senior notes to invest in Bitcoin. Investors will make money not only because of the company’s HyperIntelligence tool. If the price of Bitcoin increases, MicroStrategy will make quite a bit of money too:

As part of these treasury management and capital allocation strategies, we purchased a total of approximately 70,469 bitcoin at an aggregate purchase price of approximately $1.125 billion in 2020 for an average purchase price of approximately $15,964 per bitcoin, inclusive of fees and expenses. These purchases included purchases of bitcoin using the net proceeds of our issuance of $650.0 million aggregate principal amount of 0.750% Convertible Senior Notes due 2025 in the fourth quarter of 2020. Source: 10-k

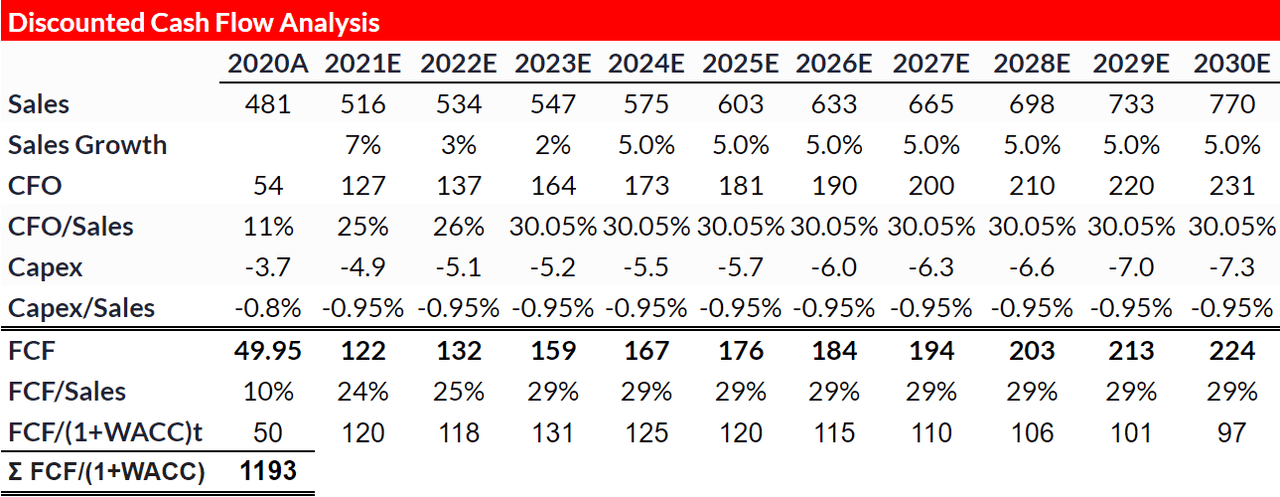

That’s not all. The management appears to be exploring software developments using blockchain analytics. In my view, if MicroStrategy finally launches anything related to the blockchain industry, the sales growth potential could be quite impressive. With this in mind, under these assumptions, I used a large FCF exit multiple, significant sales growth, and a decent FCF margin:

We are also exploring opportunities to apply bitcoin-related technologies such as blockchain analytics into our software offerings. Source: Source: 10-k

Under these extremely beneficial assumptions, MicroStrategy would report sales growth of 5%, CFO/Sales of 30.05%, and a capital/sales ratio of around 0.95%. MicroStrategy could report a massive increase in FCF, from close to $50 million in 2020 to close to $225 million in 2030:

Source: DCF Model

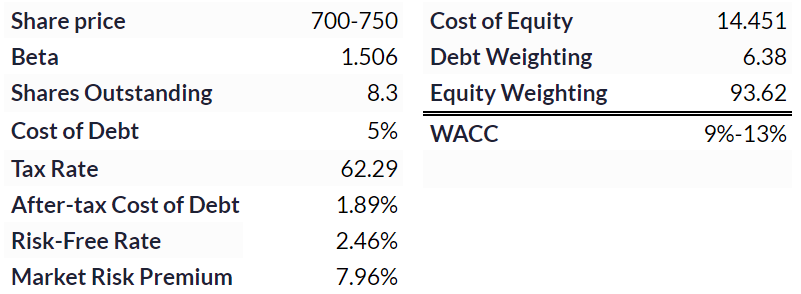

My CAPM numbers are shown below. I used a beta of 1.5, 8.3 million shares outstanding, and cost of debt of 5%, which implied a WACC close to 13.5%. With that, I would be expecting a significant decline in the cost of equity if MicroStrategy delivers the sales growth noted above. In my view, traders would most likely buy shares of MicroStrategy, which would increase the demand for the stock, and decrease the beta as well as WACC. With this in mind, under this case scenario, I would be using a WACC of 9.55%:

Source: Author

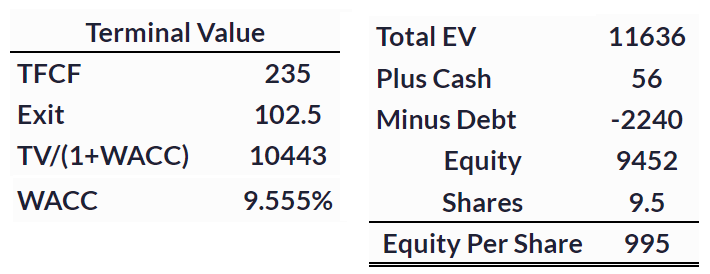

Putting everything together, with an exit multiple of 102.5x and the mentioned WACC, the enterprise value obtained is close to $11.635 billion. I also believe that the company could raise capital, so the total share count would increase. I used 9.5 million shares outstanding. In sum, the equity per share would be equal to $995.

Source: Author

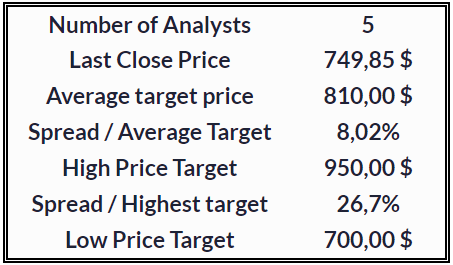

My figures are actually not that far from the expectations of other analysts. The results from 5 analysts included an average target price of $810 and a high price target of $950. Clearly, for everyone, MicroStrategy appears to be a buy at its current price mark:

Source: Results of other analysts

Downside Risks

The management of Bitcoin involves significant risks. Bitcoin exists entirely in electronic form, which means that data corruption or security breaches could destroy some part of the company’s total assets. In that case scenario, I would expect not only a decline because of the loss of assets. In my opinion, many investors would sell shares as they would not believe anymore in the company’s business model. Read the following lines for more details on some of the risks:

Consequently, bitcoin holdings are susceptible to all of the risks inherent in holding any electronic data, such as power failure, data corruption, security breach, communication failure, and user error, among others. These risks, in turn, make bitcoin subject to theft, destruction, or loss of value from hackers, corruption, or technology-specific factors such as viruses that do not affect conventional fiat currency. Source: 10-k

Notice that channel partners represent close to 23.3% of the company’s license revenue. If MicroStrategy loses some of its channel partners because they prefer to operate with other software, the revenue line would most likely decline. As a result, I would expect a significant decline in the expectations for free cash flow, which would make the market valuation decline:

Our channel partners may offer customers the products and services of several different companies, including competing offerings, and we cannot be certain that they will prioritize or devote adequate resources to selling our offerings. If we are unable to maintain our relationships with our channel partners, or if we experience a reduction in sales by our channel partners, our business, operating results, and financial condition could be materially adversely affected. Source: 10-k

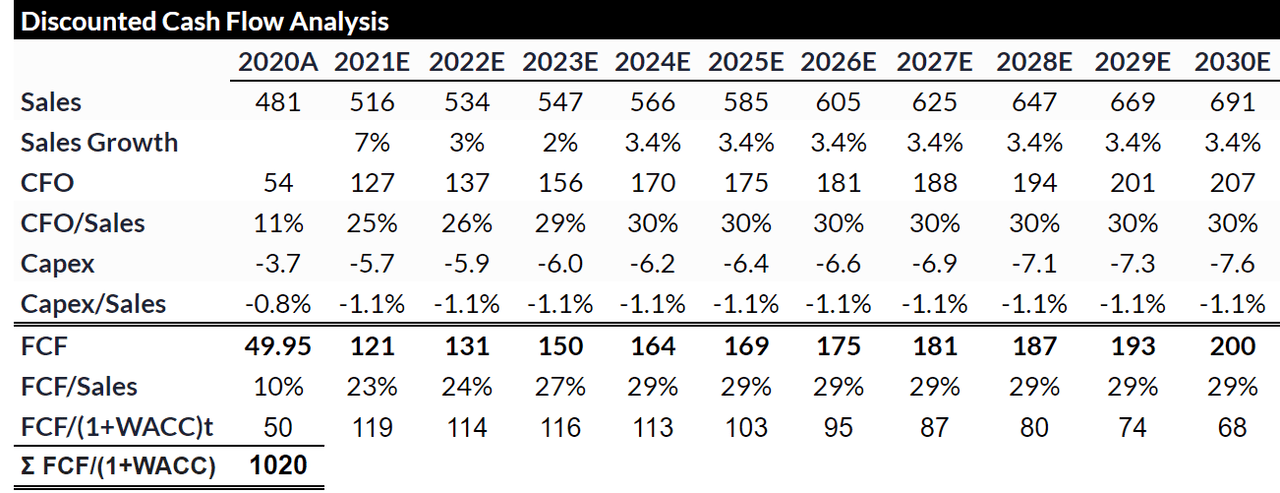

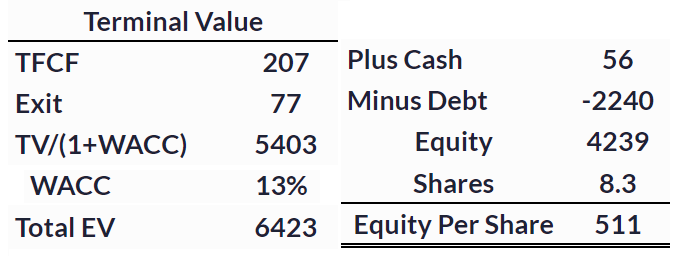

In the worst-case scenario, I would envisage sales growth of 3.4%, CFO/Sales around 30%, and a capital expenditures/sales ratio of 1.1%. The free cash flow would increase from $121 million in 2021 to close to $199 million in 2030. Note that the resulting free cash flow is significantly lower than that in previous case scenarios:

Source: DCF Model

If we use a WACC of 13% and an exit multiple of 77x, the implied equity per share would be equal to $511. MicroStrategy currently trades at close to $743-$757, which means that under this particular case scenario, MicroStrategy’s stock price may decline significantly:

Source: DCF Model

Solid Financial Situation

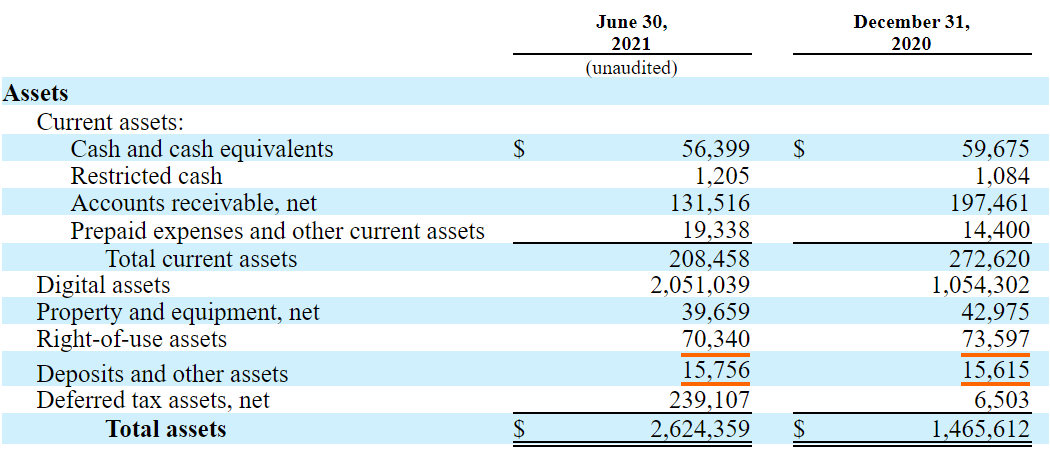

With $56 million in cash and $2 billion in digital assets, I believe that MicroStrategy has sufficient liquidity to design new solutions, and launch new marketing campaigns:

Source: 10-Q

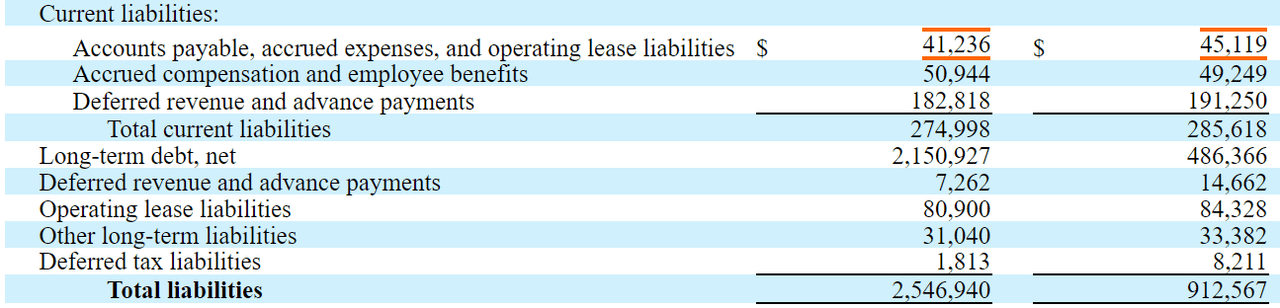

The company’s long-term debt is equal to $2.15 billion. If we assume 2025 FCF equal to $175 million, the company’s net Debt/FCF is close to 12x FCF:

Source: 10-Q

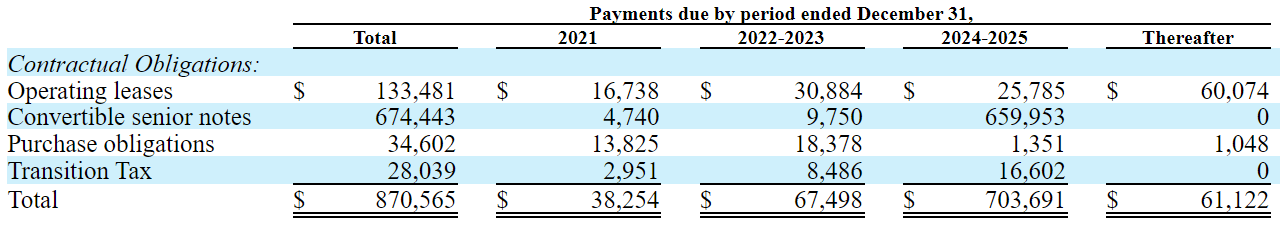

I wouldn’t be worried about the company’s financial obligation for now. Note that the company may have to pay a significant part of its obligations in 2024-2025. The table below offers more information on the matter:

Source: 10-k

My Takeaway

With a significant amount of cash in the balance sheet, MicroStrategy has the liquidity to develop new versions of HyperIntelligence, and perhaps new REST APIs. That’s not all. If the company develops new software implementing blockchain technology, I would be expecting significant FCF generation and sales growth. In my most optimistic case scenario, the fair price is close to $995 per share. Given the current market price, in my opinion, the company looks like a buy. I envisage more than 35% upside potential in the share price.