DNY59/E+ via Getty Images

There is extensive froth in the stock market right now, and you don't have to go far or dig deep to see what I mean.

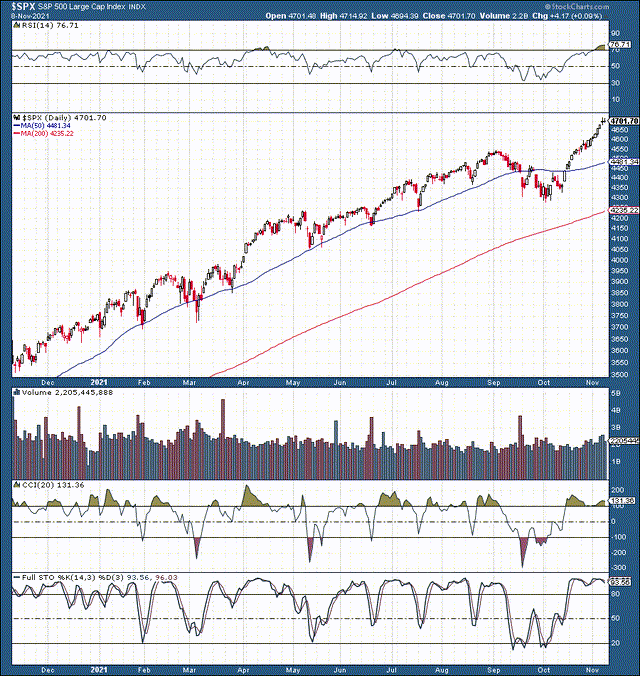

The S&P 500/SPX (SP500)

Source: StockCharts.com

The S&P 500 has

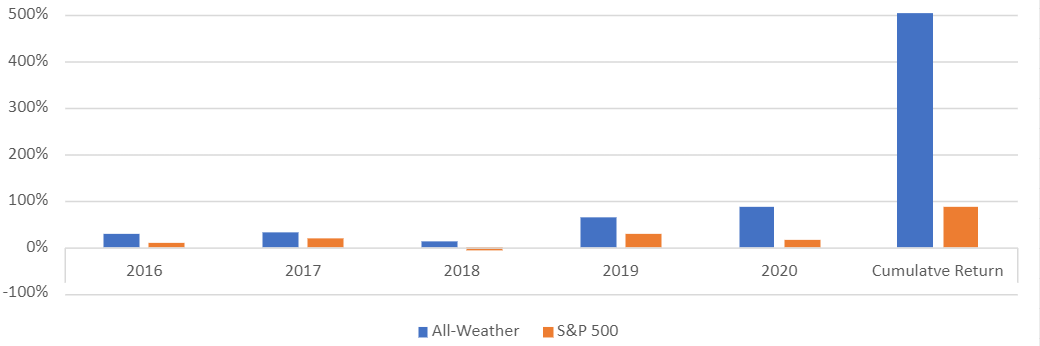

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet's All-Weather Portfolio (2020 return 87%), and achieve optimal results in any market.

- Our Daily Prophet Report provides the crucial information you need before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don't Wait, Unlock Your Own Financial Prophet!

Don't Wait, Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!