ViewApart/iStock via Getty Images

Investment Thesis

Constellation Brands (NYSE:STZ) is well suited for the environment we’re in. It’s set to see reopening demand and already has favorable demographics behind it. It’s positioned to better manage the rising cost environment than peers. It can eat the cost pressures with its sector-leading margins to spur better unit growth. Despite all of these well-above-average characteristics, its stock trades at below-average current and forward multiples. In my opinion, Constellation offers one of the best risk-reward dynamics in the consumer staples space and is a medium-term buy.

Constellation Will Grow Faster than Most Peers

Constellation has several competitive advantages over its peers for the current macro-environment which should enable above-average growth. It benefits from favorable demographics. The company’s beer segment, which is its largest business unit, caters to the fast-growing Hispanic demography. Continued Hispanic population growth should bode well for Constellation.

The company is an overlooked pandemic loser. It managed to grow through the pandemic thanks to its product differentiation and smart management but Constellation took a demand hit. It has heavy exposure to eating out; distancing measures harmed Constellation’s on-premise demand. This was evident in shrinking YoY sales last year. The reopening and the return to normal should boost company results.

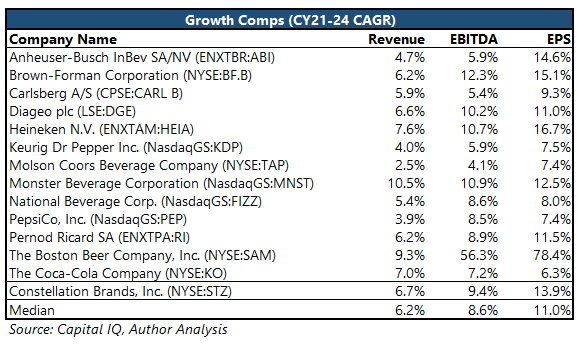

The combination of these factors is evident in Wall Street's expectations of the company. I’ve compared CY21-24 consensus revenue, EBITDA, and EPS growth expectations of large beer, wine, spirits, and beverage companies below. Constellation is expected to grow all of these line items faster than the peer-median.

Constellation is one of the Most Profitable Beverage Companies

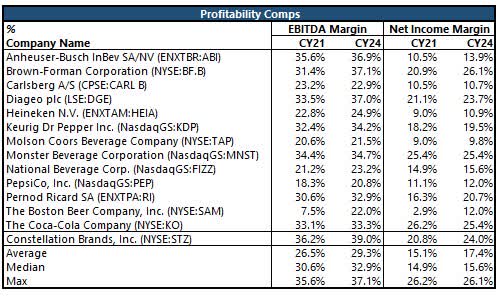

The company’s expected relative growth performance increases as we move down the income statement. It’s expected to outgrow the median by 50 bps in revenue, 80 bps in EBITDA, and 290 bps in EPS. This shows the company’s relative strength in the environment hints at its superior margin profile. I’ve compared the peer group's EBITDA and net income margins in the table below. Constellation has best in class EBITDA margins today and it’s expected to hold its leadership for the foreseeable future. It also has well above peer average net income margins and is expected to close into the top in three years.

Margins will be important in the coming years with increasing cost pressures. Constellation is perhaps the best consumer goods company for the environment combining a good strategic position, rapid growth, and a strong margin profile.

The Company has a Below-Average Price Despite Above Average Operations

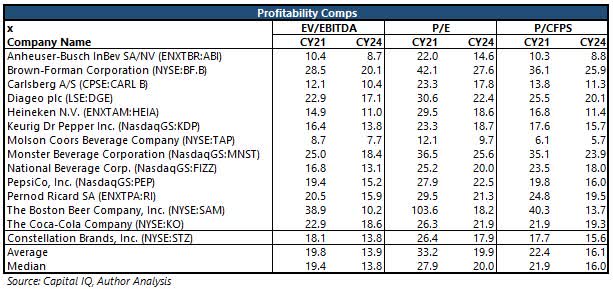

I would expect Constellation to be worth more than its peers given its favorable dynamics and above-peer growth and margins. This is not the case. In the table below, I’ve compared peers’ current and forward EV/EBITDA, P/E, and P/CFPS multiples. Constellation is cheaper than the median and the average in almost all cases.

I think that buying above-average companies at below-average prices is a great alpha generation strategy and I see Constellation as a simple GARP (growth at a reasonable price) buy as, in my opinion, this valuation discrepancy is unjustified.

Share Gains Likely Over the Coming Months

I think that Constellation will have a key catalyst over the coming months. Constellation is facing cost pressures along with its sector as I’ve noted above. Times like these will favor companies with stronger demand as those companies will have the unit growth and/or the pricing pressure to protect margins. Constellation is both. It’s set to see increasing demand as evident in its growth rates and has premium brands as evident in its margins. Constellation could match its peers in raising prices mid-single-digits to further grow its margins but it’s strategically choosing not to. The company is more cautious on elastic demand than peers and will likely raise prices by less. I expect this cautiousness to have a second-order effect of increased unit sales and should bode well for the stock and think that it will catalyze a well-deserved multiple expansion.

Constellation is a Buy Today

Overall, I see constellation as a nice consumer staple bet for the medium term. It should be able to grow throughout the reopening and do so better than peers. Its sector-leading margin profile should give it the needed durability at a time of rising cost pressures. The stock offers these two key advantages at a discount.