franckreporter/E+ via Getty Images

Facing stiff long-term headwinds from the Work-From-Home (WFH) trend, and with recovery delayed by the Omicron mutation, the Office REIT sector underperformed in 2021, returning 23%, compared to 41% for the average REIT. In fact, from 2010-2021, Office REITs delivered average compound annual total returns of just 8.2%, badly trailing the 14.4%.

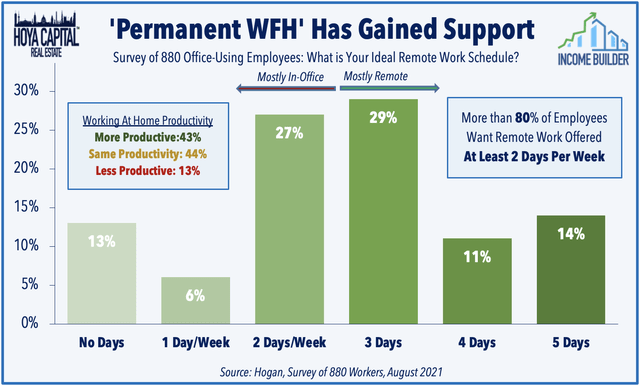

The WFH trend is not going away. Depending on the city, remote work can save an average of 6 hours a week in commuting time, not to mention fuel and other transportation costs. That represents huge savings for the worker, and better work-life balance. Small wonder that the vast majority of employees look for employers to offer remote work at least two days per week, even if it means a pay cut.

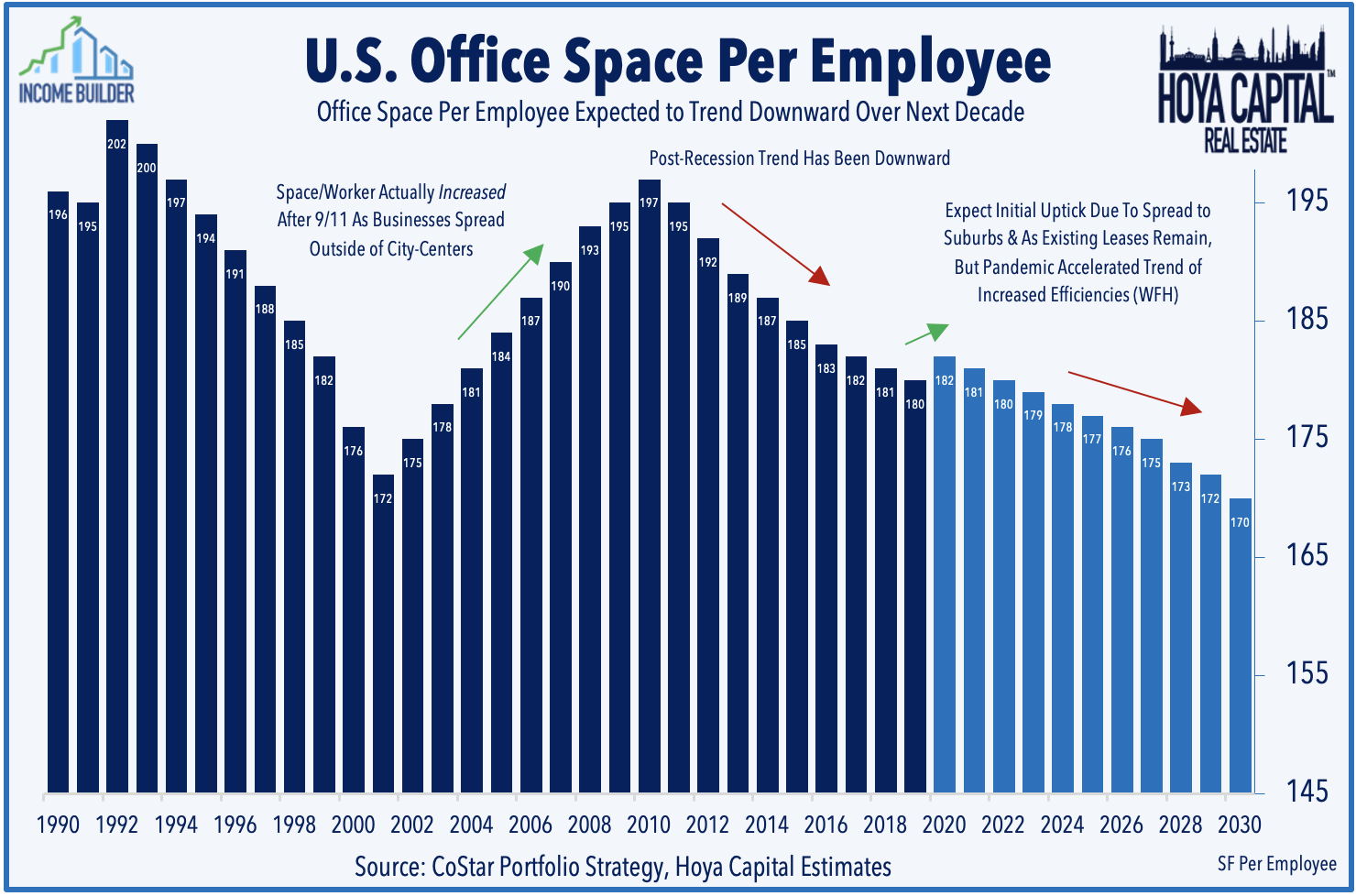

Hoya Capital expects a gradual 15-20% decline in office space per employee to last the remainder of this decade.

According to a December article by Seeking Alpha contributor Austin Rogers:

A fall survey shows that 54% of large employers have recently modified their "return to the office" plans, while 20% don't expect to return until sometime in 2022 and 32% expect not to return at any point. [bold print added].

Hoya Capital

Making matters worse, office space is in oversupply. According to Hoya, spending on office development increased after the 2016 elections, thanks to corporate tax reform and strong growth in demand. After a brief pullback during the pandemic, the office REIT pipeline has ramped back up to new record highs.

Fallout from the pandemic lingers too:

... office utilization rates have recovered only a fraction of pre-COVID levels, particularly in dense coastal markets with longer and more transit-heavy commutes... but have shown notable improvement above 50% in major Sunbelt markets. "

However, the news is not all bad.

While WFH headwinds will persist, the office REIT outlook has brightened in recent months - particularly for REITs focused on more business-friendly Sunbelt regions... Office REITs are some of the most pro-cyclical sectors and as a result, provide some of the better inflation-hedging properties of any REIT sector despite their rather healthy dividend yields.

As Seeking Alpha contributor Austin Rogers noted in December:

... Texas office markets of Dallas, Houston, and Austin have shown the fastest recovery in employee occupancy

That's where Cousins Properties Incorporated comes in.

Cousins Properties Incorporated

Meet the company

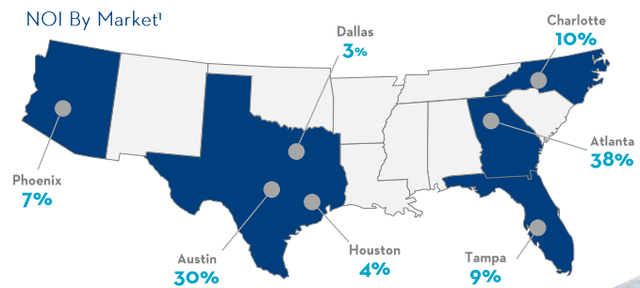

Founded in 1958 and headquartered in Atlanta, Cousins Properties (NYSE:CUZ) owns and leases trophy-quality office space in high-dollar areas of 6 growing Sunbelt markets: Atlanta, Austin, Charlotte, Tampa, Phoenix, and Dallas.

Cousins Properties portfolio footprint (Cousins Properties February 2022 investor presentation)

The portfolio adds up to 18.9 msf (million square feet), which is currently 92% leased, with a development pipeline of 1.9 msf, and a land bank that will support an additional 5.1 msf.

As President and CEO Colin Connolly summed it up on the Q4 earnings call:

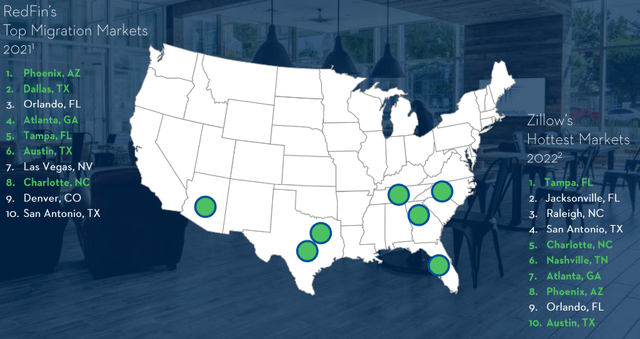

We strive to be the preeminent Sunbelt office company ... We have been executing on our Sunbelt strategy for over 10 years. We were ahead of the curve... The U.S. population continues to migrate to the Sunbelt in search of that lower cost and pro-business environment.

According to management, Cousins operates on 4 core principles:

- Own premier trophy-quality properties in leading urban markets across the Sunbelt.

- Seek new investments where the company can generate attractive returns.

- Maintain a best-in-class balance sheet to provide financial flexibility.

- Use local operating platforms for customer service, local market relationships, and deep community involvement.

The 6 markets in which Cousins has 96% of its assets all ranked in the top 10 nationally for in-migration in 2021, according to both RedFin and Zillow:

Cousins Properties February 2022 investor presentation

As a result, a larger share of office demand is now focused on an even smaller share of the overall inventory. The white collar workforce has grown nearly 13% since the onset of the pandemic.

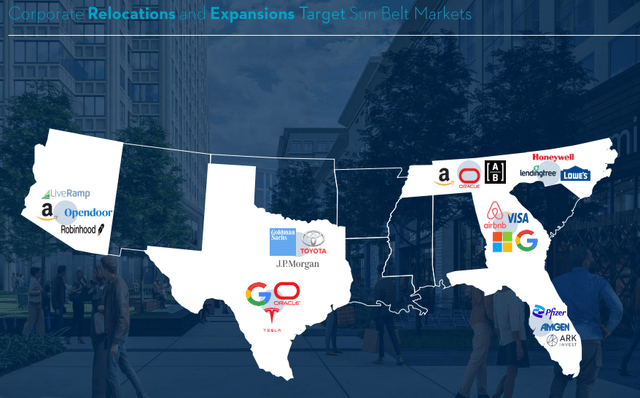

In 2021 there was an uptick in corporate relocation activity into Sunbelt markets, as shown below.

Cousins Properties February 2022 investor presentation

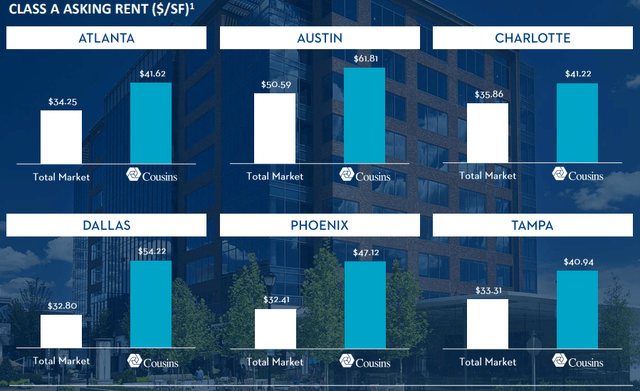

Asking rents are considerably higher than average in the markets where Cousins is concentrated, compared to the country as a whole.

Cousins Properties February 2022 investor presentation

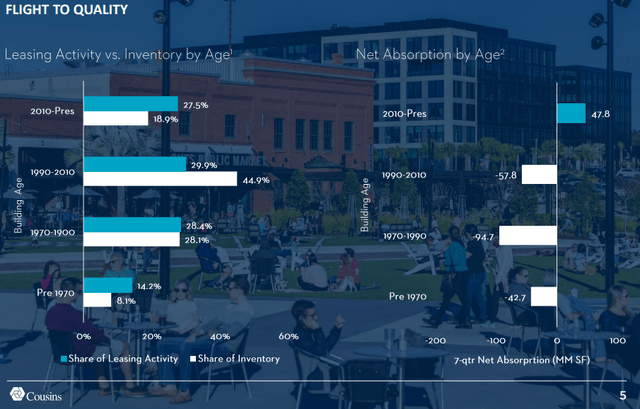

In addition, companies are learning that culture, collaboration, and innovation are best fostered in person. Those companies want to create an invigorating office environment where employees want to spend their days. This has led to a "flight to quality," with companies seeking highly-amenitized office space, and willing to pay for it.

Net absorption has been positive for office buildings erected since 2010, while negative for buildings older than that. According to CBRE research, more companies are expanding their footprint than they are contracting. Cousins' average building is 18 years old, while 25% of the portfolio is less than 5 years old.

Cousins Properties February 2022 investor presentation

In Q4 2021, CUZ delivered $0.69 per share in FFO. Same-property NOI on a cash basis increased 2.1%.

In addition, the company leased 743,000 square feet, their second best quarterly leasing volume in the past 5 years, with a 6% spread on new leases. Austin alone accounted for almost 50% of Q4 leasing activity

Downtown Austin (Cousins Properties February 2022 investor presentation)

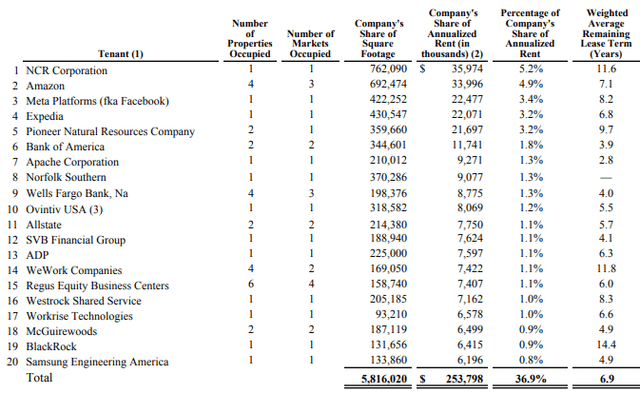

Cousins Properties' tenant roster includes some of the best know companies in the world, with top 10 tenants accounting for 25% of ABR (annual base rent), and the top company (NCR Corp) accounting for just 5%.

Cousins Properties 10-K for Dec. 31, 2021

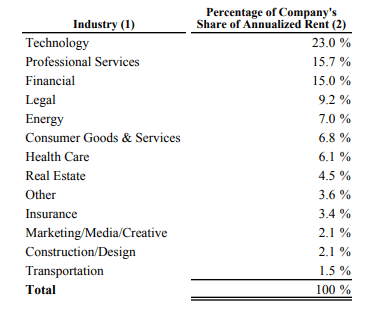

Industry diversification of the tenant base is good, with technology, professional services, and financial firms leading the way, together accounting for just over 50%.

Cousins Properties 10-K for Dec. 31, 2021

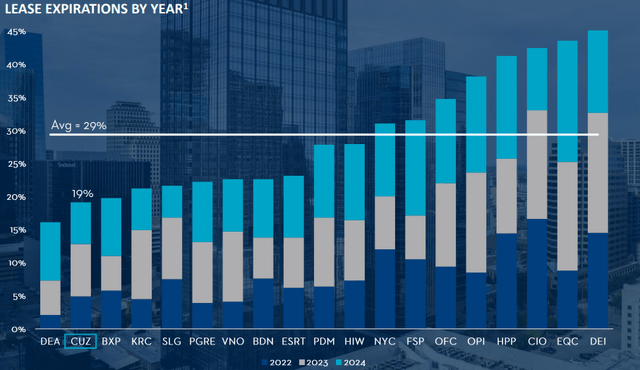

Only 4.9% of Cousins' leases will expire during 2022, with the largest a space of 73,000 square feet at Colorado Tower in Austin, which is already completely backfilled. Cousins' lease expirations over the next 3 years amount to only 19% of ABR, which is second lowest among all Office REITs. Only Easterly Government Properties (DEA) faces lower lease expiration.

Cousins Properties February 2022 investor presentation

For the full year 2021, Cousins signed almost 2.1 million square feet of leases, a 48% increase over 2020. Rents on expiring leases rolled up 15.1% on a cash basis during calendar year 2021, following a 13.1% increase in 2020. Weighted average occupancy in Q4 came in at 89%, representing a 110 basis point decline from Q3. However, net effective rents in the fourth quarter were 18.9% higher than the company's trailing four-quarter average.

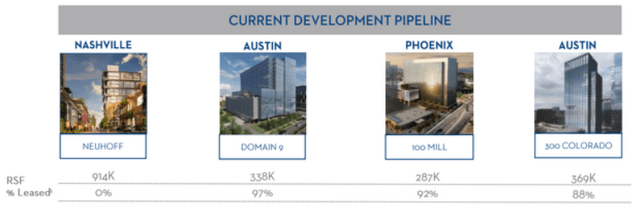

Since the onset of the COVID pandemic in early 2020, Cousins has started $600 million in new developments, acquired $900 million for new properties, and sold $1.2 billion of non-core assets. Management is committed to doing new development on a leverage-neutral basis.

Cousins has a $759 million development pipeline, accounting for approximately 5% of the company's total enterprise value, and the office space in the pipeline is 78% pre-leased.

Cousins Properties February 2022 investor presentation

Parking revenues comprise between 5% and 6% of the company's total. During Q4 2021, parking revenues increased 8% over Q3, and were up 14% from their trough in Q4 2020. They're still about 20% below pre-COVID levels.

FAD (Funds Available for Distribution, similar to AFFO) has grown significantly faster than FFO. In 2021 alone, the company's FAD grew per share 11.3% over the previous year.

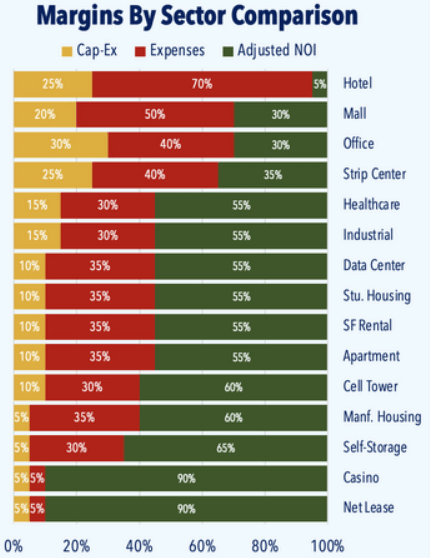

Second generation CapEx represented 17% of total NOI in 2021, versus 20% in 2020. That 17% is in line with the company's historical capex over the past decade. Relatively high capex is characteristic of Office REITs in general.

Hoya Capital

Cousins Properties issued 2.6 million shares using their ATM program, for gross proceeds of $105 million, to fund development and acquisition. This represents a dilution of 1.7% of the total share count.

Growth metrics

Here are the key growth metrics for Cousins Properties:

| Metric | 2018 | 2021 | CAGR |

| FFO (millions) | $268 | $409 | 16.30% |

| FFO/ Share | $2.51 | $2.75 | 3.09% |

| TCFO (millions) | $229 | $389 | 22.43% |

Source: TD Ameritrade and Hoya Capital Income Builder

These are very healthy numbers, considering the headwinds the company has been battling.

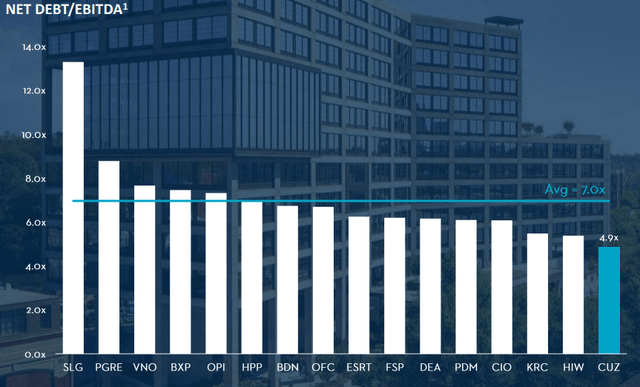

Balance sheet metrics

Cousins' market cap sits right in the sweet spot at $5.8B. Here is how the company stacks up, on the key balance sheet measures:

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| CUZ | 2.66 | 27% | 4.7 | -- |

Source: Hoya Capital Income Builder and TD Ameritrade

These are outstanding figures, particularly when compared to their peers in the Office sector. Management is committed to keeping Debt/EBITDA between 4.5 and 5.0, and new investments are paid for on a leverage-neutral basis.

Cousins Properties February 2022 investor presentation

The company has $781 million in liquidity, including a revolving line of credit with $772 million unused, and 78% of its portfolio assets are unencumbered.

Dividend metrics

Cousins pays an above-average dividend Yield that is growing at a healthy clip.

| Company | Div. Yield | Div. Growth | Div. Score | Payout Ratio | Div. Safety |

| CUZ | 3.19% | 6.0% | 3.62% | 46% | A+ |

Source: Hoya Capital Income Builder, Seeking Alpha Premium, and author's calculations. Dividend Score projects the Yield 3 years from now, assuming the dividend growth rate remains unchanged.

If anything, Cousins' dividend is too safe, as their Yield lags their Office sector peers.

Valuation metrics

Office REITs are value plays currently, and CUZ trades at a tempting P/FFO multiple of just 13.9, far below the REIT average, and even below the average Office REIT.

| Company | Share Price | Div. Score | Price/FFO | Premium to NAV |

| CUZ | $38.62 | 3.62% | 13.9 | (-11.5)% |

Source: Hoya Capital Income Builder and author's calculations

What could go wrong?

Because CUZ operates in fewer than 10 markets, local changes in supply, demand, laws, or demographics can make a big difference. This is particularly true in Atlanta and Austin, which together comprise more than 67% of the company's assets. In its 10-K, the company lists political instability, social unrest, and climate change as risk factors. Another COVID variant, if any, (God forbid) could keep rent collection and leasing below historic averages. The company also owns 2.2 msf of rentable space in buildings that sit on land they don't own, and are obligated to pay ground leases. That is 11.6% of their total portfolio.

Investor's bottom line

Quoting from Hoya Capital's research:

office REITs have a relatively small roster of tenants, and given the ongoing supply overhang from the combination of weak demand and continued supply growth, we project that most landlords will have soft pricing power for the foreseeable future.

Austin Rogers says this in his December article:

... even CUZ's strong performance this year (especially leasing spreads on unoccupied space) is not enough to buy into office real estate, which I view as fundamentally weakened by the hybrid and work-from-home trends that COVID-19 greatly accelerated... I see CUZ as the best house in a bad neighborhood.

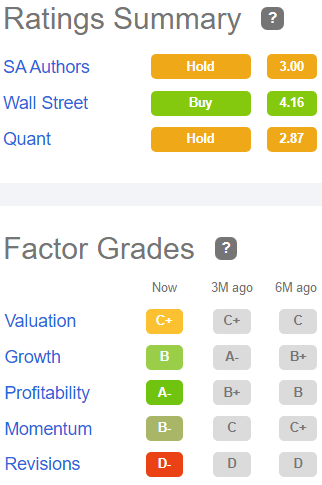

The Seeking Alpha Quant Ratings and Authors rate CUZ a Hold, but the Wall Street analysts covered by Seeking Alpha rate it a Buy, with an average price target of $44.83, implying 16% upside.

Seeking Alpha Premium

Ford Equity Research and Zacks rate CUZ a Hold, but The Street says Buy. Wells Fargo has it as Overweight, with a price target of $44.

As for me, the company's impressive growth in FFO and TCFO despite the headwinds, and its strong balance sheet and robust dividend growth have put Cousins Properties on my radar, but I am not inclined to pull the trigger right now.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!