Sundry Photography/iStock Editorial via Getty Images

From a quantitative and data-driven perspective, CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is a very clear case. The company's fundamental performance is truly outstanding, with vigorous sales growth, elevated profitability, and earnings exceeding expectations by a large margin. CrowdStrike is

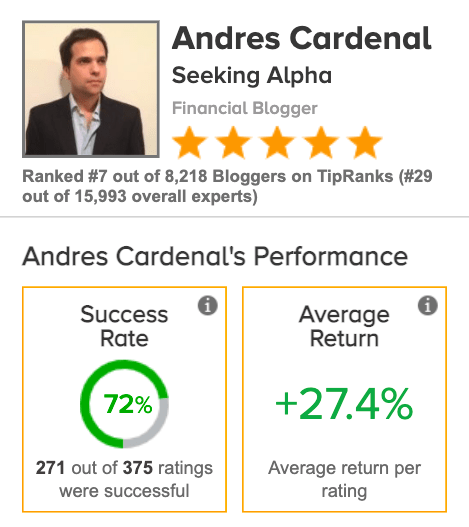

A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on hard data. Our portfolios have outperformed the market by a considerable margin over time, and The Data Driven Investor has an average rating of 4.9 stars out of 5. Click here to get your free trial now, you have nothing to lose and a lot to win!