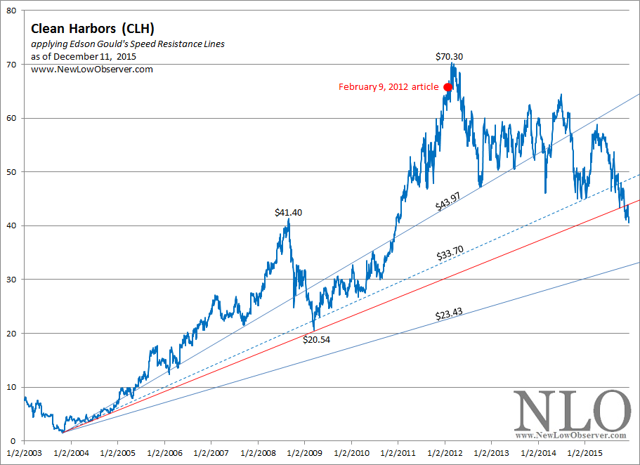

On January 28, 2015 we said the following:

"So far, CLH has adhered to the SRL that was initially outlined in 2012. If we consider the period of 2007 to 2009, when the stock fell as low as $20.54 and extend that same decline to the current period, then CLH could decline as low as $41.40. This assumption is predicated on the stock market not experiencing a precipitous decline from the current level. A broad market decline would easily bring CLH to the ascending $23.43 level in the SRL."

The assessment was based on our February 2012 review of Clean Harbors when the stock was trading at $64.28. Since Clean Harbors has reached our technical target, it is now time to assess the fundamentals through a source like Value Line Investment Survey and Morningstar. Morningstar typically gives a bearish case on a stock so if Clean Harbors has full coverage it be helpful to carefully read the negative assessment to contrast the upside review.