Wall Street is dipping back in to the junk bond market after the rout in high-yield corporates resulted in record outflows just a week ago.

Citigroup on Monday and Bank of America Merrill Lynch last week both said it's time to add exposure to high yield, now that prices are cheaper. For the week ended Aug. 6, investors worldwide pulled a record $7.07 billion out of high-yield junk bond funds and ETFs, according to Lipper.

A JPMorgan strategist, in fact, likes junk bond ETFs so much he says they look more attractive than stocks in the near term, based on flows.

Most of last week's outflows were from mutual funds, with the $1.3 billion balance from ETFs. The strategist, Nikolaos Panigirtzoglou noted in an afternoon report that the ETF outflows of 0.6 percent assets under management improved from the withdraw of 4.3 percent the previous week. At the same time, U.S. equity ETF outflows accelerated, but outflows are just 0.5 percent since July 24, about a quarter of the outflows of previous stock market corrections, he noted.

Normally, when you see a spread backup, in theory, it should be related to fundamentals, but fundamentals have been good, not bad, since the selloff that started in June," said Citigroup's Stephen Antczak, head of U.S. credit strategy. He pointed out that since June, the credit default rate for a single-B issuer actually dropped by 5 basis points, to 50 basis points

"Q2 earnings have been rock solid. The bulk of guys that reported have reported positive earnings growth, as well as relative sales growth. Both of those numbers are much stronger than recent quarters," he said.

BofA Merrill Lynch strategists said in a note the selloff in high yield was a "fatigue of 'leaders'" and a classic warning sign for a market selloff. Strategists expect to see a 7 to 8 percent total return this year in high yield, and they see the recent pullback as more technically driven than fundamental.

The selloff in high yield has been monitored by stock traders who said it could be an early unwinding of risk that would be followed by other risk markets.

"We think the selloff now appears overdone and the fundamental case for investing in HY remains compelling: the Fed is committed to keeping rates low well into 2015, interest coverage is at record highs," the B of A Merrill Lynch strategists said. They added that strong earnings growth is also a plus and recommended buying single B-credits in the three-to-seven-year space.

The selloff was driven in part by crowded positioning in the short-duration high yield space, they said.

Antczak said there were three factors behind the selloff in high-yield, starting with prices that were very high and rich relative to other markets. Secondly, a massive amount of new issuance came to market in June that caused "indigestion," and finally outflows affected the market.

"I am completely mindful of the geopolitical factors and unpredictably of those factors," he said, but added high yield is a buying opportunity regardless. "When you factor in Putin-related headlines, it's not a positive but those other three factors weighed on the market more than people take into account."

Antczak said the fact that fundamentals actually improved during the period of selling proves that portfolio managers were responding to something more technical.

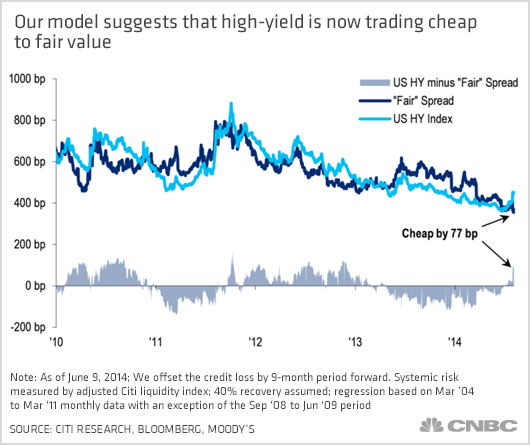

Citigroup's model shows that high-yield spreads are now 77 basis points cheap, compared with 45 basis points rich to fair value in June.

"I would rather be long than short. Ideally. You'd cherry pick and pick the names that got banged up a little too dramatically," Antczak said.

Investors also use ETFs like JNK or HYG to invest in high yield. The SPDR Barclays High Yield Bond ETF, JNK, was 4.2 percent off its June high on Aug. 1. The ETF has since recovered about 2 percent.

The iShares iBoxx High Yield Corporate Bond ETF, HYG, was 4.3 percent off its June high, and has recovered 2.2 percent.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.