"Regained momentum in the U.S.", Japan; "slowdown in China"; "possible [positive] change in momentum in the Euro area," from today's OECD Composite Leading Indicators for Jan.

There is a "positive change in momentum in the OECD area" as a whole, which excludes the BRICs, consistent with last week's JPM's Feb Global PMI: "The world economy is gaining strength. The global PMI hit a one-year high in February."

There is "below-trend growth in Brazil," "positive change in momentum in India," Russia. For a much clearer picture in charts and table, I strongly recommend the 3-page OECD CLI monthly release (each chart shows that area's growth relative to its own trend), along with the 1-page JPM Global PMIs.

ETFs are reflecting this global growth split, with bulls pointing to the continued U.S. strength in XLK tech, XLY consumer discretionary, XRT retail during the very small SPX correction last week, the first since Draghi's Dec 21 LTRO (see my Dec 22 "Draghi as Euro Santa Claus a Big Deal").

Bears pin their hopes in the recent loss of momentum and relative strength of IYT transports, IWM small caps, and stuff impacted by China's slowing growth, e.g. XME metals, XLB materials, XLI industrials.

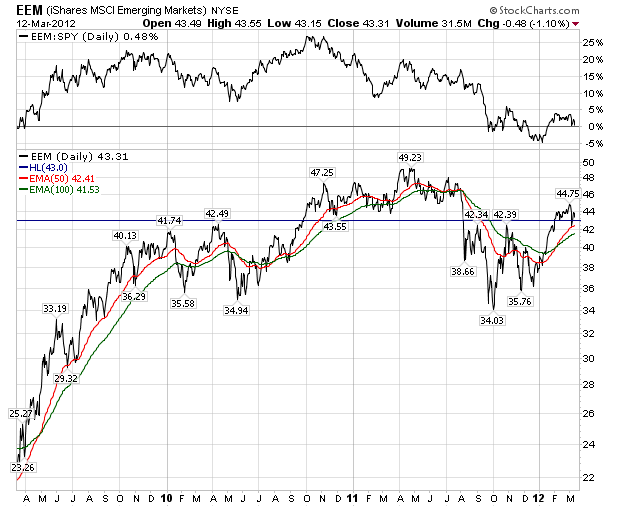

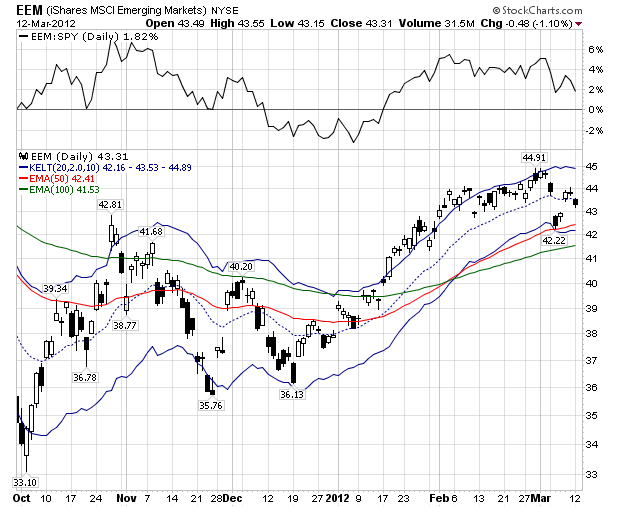

I think a clue to market direction might come from EEM emerging markets (see charts below) and BKF BRICs, which have had big ytd moves and volatile pullbacks last week.

So far this year massively easy money, most especially Draghi's two LTROs, and positive economic surprises in the U.S. have been driving the strong "risk on" global rally.

China's data releases late last week, especially its weakening exports and lower inflation, have given rise to even stronger hope for stimulus policies, including more RRR soon. Both Brazil and India central banks eased last week.

In the U.S., my impression is that 1Q GDP estimates are most recently slightly coming down from 2.3%. Continued strength in employment feeds into the ongoing debate on a new QE, with another leaked story to the WSJ last Wed, seemingly just in time to help stem the very brief market correction.

I'm watching closely whether economic surprises and GDP forecast revisions peak around here. Just as important are SPX earnings excluding very strong AAPL, which were only up 3-4% in 4Q and I believe forecast around 1% in 1Q, which the market has been ignoring in its pre-occupation with Greece.

With its second bailout deal now almost done, in Europe I'm also watching Portugal's 10-year rate, Spain's deficits, Italy's labor reforms, and April elections in France and Greece.

Also, some leading Germans have started to make noise once again, now after the fact, about the explosion in size of the balance of sheet of Draghi's ECB with its 1 trillion euro LTROs, with Draghi saying the conventional things after the ECB left rates unchanged as expected last week.

Japan has quietly put in one of the better major market performances so far in 2012, evidently mainly due to hope for an easier BOJ, which along with the FOMC meets this week, along with some hope for M&A and reforms, e.g. sales tax.

LEFT CLICK on charts to enlarge.