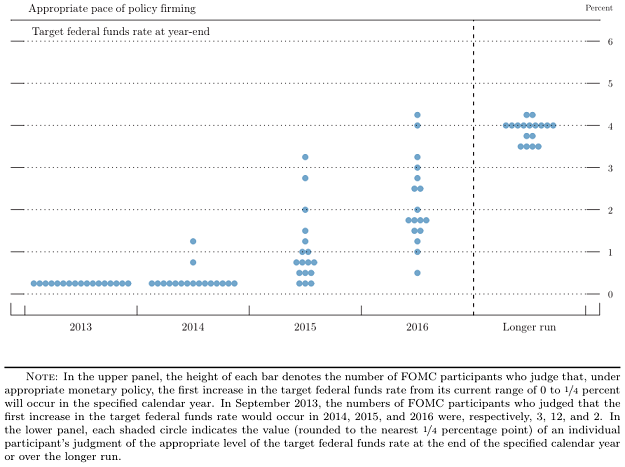

| Daily State of the Markets If the current state of the market causes you to scratch your head a bit, rest assured that you are not alone. Six days ago, the S&P 500 finished at an all-time high. Five days ago, both the S&P and the DJIA moved to all-time highs after the opening bell rang. Then for the next two and one-half days, stocks plunged due to the air coming out of the mo-mo balloons. And then for the past two days, the S&P 500 has rallied back - and is now just a smidge away from its high-water mark. So, the question for many is, which is it? Is this market poised to enter a bear market due to overvaluation and over exuberance in the Twitter's (NASDAQ: TWTR), the Amazon's (NASDAQ: AMZN) and the Yelp's (NASDAQ: YELP) of the world? Or is it time to buy the freaking dip again? The Bears Were Feeling It After being shut out of the game for a very long time, our furry friends in the bear camp appeared to be "feeling it" recently. The market's negative Nancy's are adamant that the recent action in the NASDAQ, the Russell, and the Midcaps portend bad things to come. The talk is that the very same "leaders" that had helped ramp the indices to all-time highs were now busy leading to the downside. The bears are also quick to point out that this is one of the longest bull markets in history, that margin debt is sky high, that the "Sell in May and Go Away" season is almost upon us, that earnings are limping forward, that the economy has yet to reach escape velocity, that rates have nowhere to go but up, and that mid-term election years have historically not been kind to the stock market. But, But, But... On the other side of the court though, the bulls will argue that the recent dance to the downside was simply a shining example how the market has become a playground for computers. In short, the bulls remind us that the algos giveth and then, every once in a while (especially when things get overdone), the computers taketh away. Our heroes in horns contend that the advent of algo-based trend-following via ETFs causes market moves to become exaggerated in both directions. And given that the Global X Social Media Index ETF (NASDAQ: SOCL) had fallen 20.78 percent in a month, those seeing the glass as half full suggest that the shellacking seen in the momentum names had indeed been overdone. And as such, it was time for a bounce. BTFD Again Anyone who has been paying attention over the past couple years knows that if you want to make money in stocks, you need to BTFD. So, with the sea of red ink seen in the mo-mo names and the S&P having "tested" key support at 1840 a couple times, it was a logical time for the dip buyers to re-enter the game. The point is that Tuesday's bounce wasn't exactly unexpected. But then again, the initial rebound off the low wasn't very energetic either. Up until lunchtime on Wednesday, the bounce, which some were classifying as the dead-cat variety, had been unconvincing. Volume was light, breadth was lame, and the green bars seen on the charts of the biotechs, internet and social media names were pathetic. Therefore, those traders dressed in fur felt that this time was going to be different. There was mention of this very topic around our water cooler today (well, okay, in today's world, the water cooler has been replaced with IM and Skype sessions). The thought was that rebounds off of the declines seen over the past couple years had been backed by a fair amount of oomph (and yes, oomph is a technical term in our shop). However, so far at least, this one was very lackluster. In fact, just after lunch yesterday, I opined that if the bulls didn't get something going soon, we just might the bears take control and push the S&P below 1840 before the closing bell. But then the algos found something they liked - a lot. Forget About The Darn Dots Already If you will recall, one of the concerns after Janet Yellen's first press conference as the new Fed Chair, was that the "dot plot" (the prediction of the Fed Funds rate from each Fed Governor is plotted as a dot on a chart - see below) suggested that the FOMC might be planning to raise rates sooner than had been expected.

Although Fed Chair Yellen had strongly cautioned in her press conference against reading too much into the so-called "dot plot," the bottom line is the "dots" showed that the median target for the Federal Funds rate at year-end had increased for both 2015 and 2016. And the bottom line is that this had been a lingering concern. Not a "major" concern, but it remained a potential worry for the markets. The Point Is... But when the Fed released the minutes from the March 18-19 FOMC meeting on Wednesday afternoon at 2:00 pm eastern, this concern was put to bed. In the minutes of the meeting, there was no mention of the "dots." There was no mention of raising rates sooner. And there was no mention of the now famous definition of a "considerable period" (now understood to be about 6 months). So, it appeared that maybe, just maybe, Janet Yellen and her merry band of central bankers had actually meant what they said. Go figure. Perhaps the key part of the report was the following:

In essence, this paragraph says that the economy still needs the Fed's help. So there you have it. Forget about the dots. The Fed is not going to be raising rates any time soon. The algos loved what they saw and suddenly, the vigorous bounce was "on." The question now, of course, is if it will last. Publishing Note: I have an early meeting on Friday and will not publish a morning commentary. Have a GREAT weekend! Looking for a disciplined approach to managing stock market risk on a daily basis? Check Out My "Daily Decision" System. Forget the fast money and the latest, greatest option trade. What investors need is a strategy to keep them "in" the stock market during bull markets and on the sidelines (or short) during bear markets. Turning to This Morning... Chinese Premier Li Keqiang told markets overnight that China would not respond to temporary economic volatility with stimulus but would focus on job creation in the near-term. Asian markets apparently liked what they heard while Japan finished unchanged. Across the pond, bourses are slightly higher and here in the U.S. traders are waiting on the latest jobless claims data. U.S. futures currently point to a slightly lower open on Wall Street. Pre-Game Indicators Here are the Pre-Market indicators we review each morning before the opening bell... Major Foreign Markets: Crude Oil Futures: -$0.18 to $103.42 Gold: +$17.70 at $1333.60 Dollar: higher against the yen and pound, lower vs. euro 10-Year Bond Yield: Currently trading lower at 2.669% Stock Futures Ahead of Open in U.S. (relative to fair value): Thought For The Day... What it lies in our power to do, it lies in our power not to do. -AristotlePositions in stocks mentioned: none Follow Me on Twitter: @StateDave The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors of StateoftheMarkets.com and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. One should always consult an investment professional before making any investment. Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided. The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed. The information contained in this report is provided by Ridge Publishing Co. Inc. (Ridge). One of the principals of Ridge, Mr. David Moenning, is also President and majority shareholder of Heritage Capital Management, Inc. (HCM) a Chicago-based money management firm. HCM is registered as an investment adviser. HCM also serves as a sub-advisor to other investment advisory firms. Ridge is a publisher and has not registered as an investment adviser. Neither HCM nor Ridge is registered as a broker-dealer. Employees and affiliates of HCM and Ridge may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Editors will indicate whether they or HCM has a position in stocks or other securities mentioned in any publication. The disclosures will be accurate as of the time of publication and may change thereafter without notice. Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results. |

Like Janet Said, We Can Stop Worrying About The Dots

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.