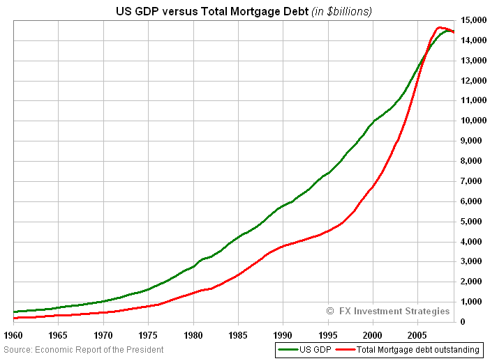

The economic report of the President is out and along with it pages upon pages of data, charts and tables. At some 450 pages I have neither the time nor the energy to read this in its entirety. However, as I was browsing through some of the data tables, I noticed two numbers that seemed too similar to ignore. US GDP is about the same as the total mortgage debt outstanding, roughly $14.4 trillion, give or take a few billion.

This ratio of US GDP versus mortgages hasn't always been so closely matched as the chart below indicates. On average, total US mortgages were below 50% of the GDP until about 1977 when the ratio started to gradually increase culminating in the year 2006, the height of the US housing market when for the first time in history US mortgage debt outranked US GDP.

I have a hard time conceptualizing how public and private sector debt could ever get this far out of hand, but the graphs essentially expresses my personal sentiment as to what is wrong with the US economy. To get back to sustainable economic growth, something's got to give. In this case, either US GDP vastly improves, or the more likely development occurs - US mortgages have to continue to delever to bring back this unique ratio to a more tolerable level and in line with historic averages.

Disclosure: no positions

US Mortgage Debt versus US GDP

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.