Predicting rain doesn't count. Building arks does.

……...Warren Buffett

All markets are driven by long term investor psychology cycles. When the cycle is positive a bull market unfolds, when negative a bear market. Bull and bear markets usually last for years. Uptrends and downtrends last for months, and are often mistaken for changes in long term trends.

For the past eight months the market has remained in a 162 point trading range with the mid-point around SPX 2054. Which was then breached on Monday July 7th when it hit 2044.

During this period some market pundits have declared: the market is now extremely overvalued, the technical pattern suggests a bull market top, equities are in a bubble, "Contagions" are all around us with Greece Debt issues & China's market is crashing.

My analysis suggests none of these claims can be confirmed. The claims that equities are in a bubble and 'now' extremely overvalued does not match basic valuations.

A bubble ? - try the 1990's when the S & P had a PE of 37, while the 10 yr was 6.5% . The earnings yield was 2.7% HALF the bond yield.

This isn't the late 1990's approaching the bubblicious top that was made in 2000 in ANY way, shape, or form.

WHY ? --- The earnings yield to day is 5% , with the 10 yr @ 2.4%

In late 2013, more than 18 months ago, the SPX reached the same PE multiple it has today: 20. During that entire 18 month period the PE multiple has ranged from 18 to 21. The reason the market is now higher is simple earnings are now higher. There has not been a multiple expansion to suggest an overvaluation.

To that end if you believed that the market was overvalued in 2013 based on these and the other flawed metrics that continue to be rolled out, well, you just missed the last 550 S & P points. I'll also remind all that the market skeptics have pounded the table with their flawed strategy for the entire duration of those 550 S & P points.

During this bull market we have only witnessed one significant correction in 2011 of 21%. Every correction since then has been less than half that value. And since mid-2012, there has not been one correction of even 10%.

There will be another correction, leg down, that will set the stage for yet higher highs. The top callers out there now will in fact be shown to be wrong again, just as they have been wrong during this entire bull run.

Like the Buffet quote says predicting rain doesn't count, and I can assure no one will be able to predict the "timing" of the next leg down.

And since building an ark does count , it goes back to a lot of the principles that we are all taught and have heard many times over.

Your "Ark" (portfolio) should be diversified, I've seen commentary from those that don't believe in widespread diversification -- they would rather choose their favorite names and forget about being diversified. That is a recipe for total disaster - and not a way to manage money and build wealth over time.

If you have participated in this bull market your ark should be strong and diversified. Those that have been bullish have harvested profits along the way, call writing and dividend collecting have shored up any issues that have taken place in non performing positions.

So going forward ANY issue that comes along, can be dealt with in a calm, decisive manner with little or no emotion. In other words forget what the naysayers and market skeptics are touting --

We see headlines like this one "Wall St lower on China fears" and that sets the tone and ramps the "Noise" out there.

It is why I continue to state ----

Until we see a break on any of the LT trends in place , calm decisive action is the call for the day. Optimism has to be the default setting when fear is running rampant in the streets during a bull market environment.

It''s at these times when market opportunities are presented, You,nor I, will know the Exact time to pick your spots in an individual name or sector during theses times of panic selling.

If you do happen to pick the exact turning point, that is great , but more often than not that will not be the case.

I reprint a passage from an investment advisor that I follow and use every time I enter a position

"Most great investments begin in discomfort. The things most people feel good about - investments where the underlying premise is widely accepted, the recent performance has been positive and the outlook is rosy - are unlikely to be available at bargain prices. Rather, bargains are usually found among things that are controversial, that people are pessimistic about, and that have been performing badly of late."

"Superior investment results can only stem from a better-than-average ability to figure out when risk-taking will lead to gain and when it will end in loss. There is no alternative."

"Unconventional behavior is the only road to superior investment results, but it isn't for everyone. In addition to superior skill, successful investing requires the ability to look wrong for a while and survive some mistakes."

Technically Speaking

The S & P 500 index had a rocky road this week, and tested the 2040 "short term" support level I have laid out for the past month. Trading down to the 2044 level on Monday then bouncing to produce a gain for the day. Tuesday's headlines on the 'issues" took the average back down to hit that support of 2044 and close the day @ 2046.

As we stand at the end of the week @ 2076 the S & P has put some "space" between the Friday close and the lows we saw @ 2044.

With the "chicken littles: running the store with quotes like ""AAPL's decline spells trouble for the nasdaq """ ( I doubt that, as I just added more) ) we surely could see another shot at testing the lows. However, my feelings at this point in time is that we may have just seen the short term lows put in at the 2044 level.

I often get questions on this topic and since there is so much fear out there, let's look at what I view as the Long Term support levels that would be meaningful.

S & P 1980 -1985. That level would cause me to sit up and take notice, and at the same time I would need to see a Dow Theory sell signal. For that to occur it would require a closing price on the Industrials below their October 16,2014 price low of 16,117 with a similar close by the Transport avg. below their respective closing price of 7,717 (10/13/14).

There is substantial room from where we are today and these levels. The secular Bull trend still rules the day---- until it doesn't, and that is the way to be positioned.

Economy

The June ISM Non Manufacturing report came in as expected @ 56.

Jobless claims rose this week to 297,000, but as I have mentioned numerous times before, the current size of the work force and total US population makes a reading below 300,000 in initial claims exceedingly strong.

The jump in claims was blamed by some analysts on oil patch cuts. While this was a valid narrative in January and February, claims in the major shale patch states are down year over year,

EARNINGS

Before we get o earnings let's start with a note on Dividends and data this year. Increases in dividends are surging +15% y/y

Per a report out of SPCapital IQ, Q1 '15, SP 500 Q1 '15 earnings growth was 11.8%, excluding Energy. Despite the dollar, winter weather, the West Coast Port Shutdown, and subdued Financial earnings, Q1 '15 earnings grew nearly 12%.

This coming week earnings season kicks in and it would be refreshing to see that data set the tone instead of the knee jerk headlines. In terms of importance, next week will be a lot more significant as 39 S&P 500 companies will be reporting, including most of the major financials BAC, BLK, C, GS, JPM, and WFC, Google (GOOGL), Intel (INTC), Johnson & Johnson (JNJ), Netflix (NFLX), Schlumberger (SLB), and UnitedHealth (UNH).

Stay Tuned

From Thomson Reuters;

Forward 4-quarter estimate: $125.63, and up from the prior week's $121.78. The quarterly bump in the forward estimate came in just as expected.

P.E ratio: 16.5(x)

PEG ratio: still negative, ex-Energy, under 2(x)

Earnings yield: 6.05%, the first time that the SP 500 earnings yield has been over 6% since late January '15.

If we continue to see earnings growth, the SP 500's valuation is still pretty reasonable.

Crude OIl

Makes the headlines once again , No need to get into the rhetoric that is coming out from every one that can spell "crude". The technical picture shows us why we are now in a corrective phase. In my view it is nothing more than that , "crude isn't telling us" anything and the cries for complete collapse of anything oil related is again overdone.

Chart from Factset

WTI has rallied from $42 to $62 , roughly a 50 % move to the upside. The commodity has now retraced that swift move after running smack into the 200 day MA. To see weakness at the first attempt to take out such a formidable resistance level is not unusual at all. The drop to the present level isn't telling us about the prospect of the world economies at all. Instead it simply could be consolidating after a large gain.

Anything is possible, we could retest the lows , but I note the that the spin that is coming out now that we will surely go back to the $40 level is coming from those that told everyone that we would surely see $30 for WTI.

With that there would be bankruptcies everywhere and the associated Texas banks and the Texas economy would then be a contagion that would have to be dealt with.

I don't make this stuff up folks I just report what the media and skeptics are writing on various financial blogs and unfortunately are using to spin the bear version on what is going on around us. I don't buy any of it.

Market Skeptics- A scorecard

Well the frustrated bears were out in mass this week, Yes it is the same crowd that rambles on about "this", " that" and some other metric that will take the market down. Of course they do surface whenever the market is weak, trotting all of the " top calling" and the " I told you the market would weaken" stories as they have for the last 500 S & P points. It was the same this week as I watched the skeptics tout their China & Greece stories and in my view their "pats on the back" will once again turn into "egg on their face"

Time for a reality check----- as it stands at the close of trading on Friday July 10, the S & P is 2.5% from an all time high .. yet they would have all believe we are in a bear market or about to enter one !!

Over the past couple of weeks I've highlighted just how hard the skeptics are working to prove their case. Lets take a look at how they are doing on the issues that will, in their minds "take the market down"

CHINA

The headlines --China's market "crash" developing into an event that will take down other global markets.

I have to give this one, a zero- In one word ----------- Absurd..

Why ? Lets look at what really has transpired shall we… As mentioned on June 27th

""While China Shares have begun their correction from their outsized parabolic move dropping 13% last week (worst week for that market in 7 years), the RUT and Nasdaq made new highs. """

An update, the Chinese market ( HSI )just crossed into "bear territory" and according to some this will be a negative issue for the U S equity market. So with this looming knife of Chinese equities over our heads here, the S & P has traded down and is off a mere 2.5% from its all time high.

This is the meltdown that they are warning us about ? Or is it what I believe ---- stocks retreating from all time highs in a consolidating phase in the same way it has played out for the last 3 years.

More importantly, lets look at some facts please. Chinese equities are one of the least correlated markets in the entire world. Perhaps a picture will define what I am referring to.

Courtesy of Bespoke Group

Can anyone please show me the correlation that everyone is now worried about? - It simply doesn't exist.

Its time to stop and apply some rationale to what is happening. The Chinese markets ran up 150% in a 9 month time frame. Our markets did NOT follow that move. The Chinese market now has given back about 35% of that move. There is nothing that surprises me when I see a market or individual stock soar in parabolic fashion to then see a similar volatile move to the downside. The Chinese market isn't signaling anything, as it clearly shows in the chart, it trades with a mind of it's own..

Our markets did NOT follow China to the upside, and they will NOT follow this downside move that is taking place.

So the "I told you so " folks with their idea that China would affect our markets simply presented more of the same wrong footed ideas that have been spilled out during this entire market run.

While the collapse in Chinese equity values may look like a cause for major concern, the facts just don't support major concern that Chinese selling will spill over into broader global indices.

Let's also take a look at the HSI ( Hang Seng) the index that the Chinese folks are trading and is now part of our daily financial headlines. The information presented shows the PE ratio of 10.2, a yield of 3.6% .

China's interest rate is 4.85% , their growth rate is ~6%

Hmmmm.. These are wild numbers aren't they -- (sarcasm intended). No doubt there has been a parabolic rise in HSI and it is in need of corrective action, (which is taking place) but perhaps some were looking and drawn to the fundamentals that this market presents.

Now this 35% drop from the 150% gain is being extrapolated to taking down their entire economy and slowing down their growth. I'm being told to believe that we should factor in the 35% drop but we should not consider the 150% gain. Sorry that doesn't compute for me.

The claim is that the average Jun (Jun stands for truth) investor has lost their proverbial "hanfu" (Chinese shirt).

Does that not happen in any individual name, sector or market where the "Jun come latelys" take the brunt of the decline ? This is no different. Those investors coming into a parabolic move late have always been left for dead, but I have a hard time believing what the market skeptics are selling.

Their extrapolating this occurrence by assuming this event has hurt the majority of the Chinese population, hence taking the entire economy down. This, in my view, is sheer speculation, and I will add the epitome of fear mongering. If one is going to spread fear on the 35% decline, then tell the entire story and factor in the 150% gain.

The latest "fears' that are being reported now is that China may slow down their US treasury purchases over this event and they may be selling U S treasuries to support their market is equally ridiculous.

Once again it is the same sources that provide us with this nonsensical approach to the markets. They have been crushed here in the U S markets and now proclaim to be experts on the Hang Seng and the Chinese economy overnight.

GREECE

Greece --- On the one hand the bears seem to admit that it really doesn't matter, but then it's said to have the possibility to spread, yes the "c" word is rolled out -- "contagion ".

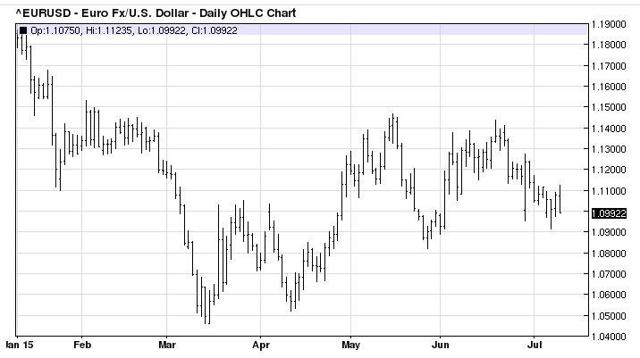

I have two "tells' here that indicate to me that there is no contagion built into this story at all. Gold is going down and the euro is not crashing. Instead,

In the 3 months leading up to this "crisis", including the recent days the Euro has Risen,

and Gold has declined in the same timeframe.

By the way, my prediction that Gold will see a triple digit print before this is all over still stands.

So I give the skeptics a 2 on this one, as they didn't really trump up this event as they usually do, but now after learning how to spell contagion, they believe Spain, Portugal, & Italy are next. Sorry, it is way too early to make that quantum leap and use it as a backdrop for your market strategy.

Individual Stock Ideas

This past week I took advantage of the overall market weakness and added two semiconductor names, NXPI & QRVO to my portfolio. Fundamental Details on both companies are readily available on this website.

In keeping with my "mission" statement, the trades are documented with date, & time stamp. I refrain from the ambiguous wording often seen of " I added this today " , I sold this for a 30% gain.

" I hold a small position in this", I bought a modest position today" all the while never posting an associated link or price.

This isn't "make believe " money, it's real, in my view the associated commentary should be "real" as well. What I often see when I walk around the internet is far from "real".

My timing could have been a little better on these new positions. The market went against these two immediately after purchase. So during the selloff I sold calls against these new adds. You can see the results posted in the 2015 Ideas playbook. The semiconductor names were hit especially hard based on news for companies that serve the PC market. As mentioned in my analysis of both QRVO and NXPI these two should not be associated with that segment, yet they to were taken down.

My outlook for their earnings and fundamentals going forward has not changed due to panic selling and recommend looking for entry points and as I will do ----"scale" into the position.

As always I will follow up on these and other ideas that are presented. Links will be provided as the situation warrants.

AAPL - Traded right down to its 200 day MA and is totally oversold @ $120

It was added to my 2015 playbook this week @ 199.98.

Fears over the demise of the Chinese consumer because their stock market decline, just created an opportunity

Conclusion

Like the Ark that Warren Buffett talks about, constructing a portfolio now or making subtle changes to your holdings, step back and look at what the market is giving you.

The fear that is out there is needed from time to time it eliminates some of the "excesses" that we see in speculative names, but at the same time allows an investor to pick up quality companies with improving fundamentals, amidst a bull market backdrop.

In addition to the stocks that I have already mentioned here, stocks like BABA & DAL that I highlighted all week in my blog, are solid names that LT accounts should be taking a look at.

If you have followed this bull market for any length of time your ark should be strong , now it's time to put some finishing touches on it.

Best of Luck to All !!