We have excellent news.

The Journal of Financial Economics published Core Earnings: New Data & Evidence, which reveals:

- Legacy fundamental datasets suffer from significant inaccuracies, omissions and biases.

- Only our “novel database” enables investors to overcome those flaws and apply reliable fundamental data in their research.

- Our proprietary measures of Core Earnings and Earnings Distortion materially improve stock picking and forecasting of profits.

Now, all investors, not just Wall Street insiders, can properly assess corporate profits after excluding the unusual gains and losses that companies bury in footnotes, which legacy earnings measures, such as I/B/E/S Street Earnings or S&P Global’s (SPGI) Operating Earnings, miss.

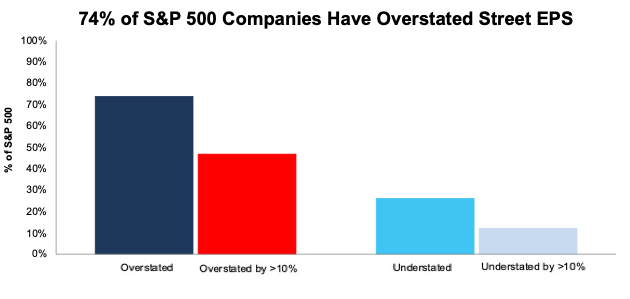

47% of the S&P 500 Firms Overstate EPS by >10%

Using our more reliable fundamental data, we find that 74% of S&P 500 companies have overstated Street Earnings per share, and 26% have understated Street Earnings per share over the trailing twelve months ended calendar 1Q21[1].

47% of S&P 500 companies have overstated EPS compared to our Core EPS by more than 10%, while 12% of S&P 500 companies have understated EPS by more than 10%. When companies overstate EPS, they do so by an average of 31%. When they understate EPS, they do so by an average of 55%.

Figure 1: Street Earnings for the S&P 500 Are Materially Misleading

Sources: New Constructs, LLC and company filings.

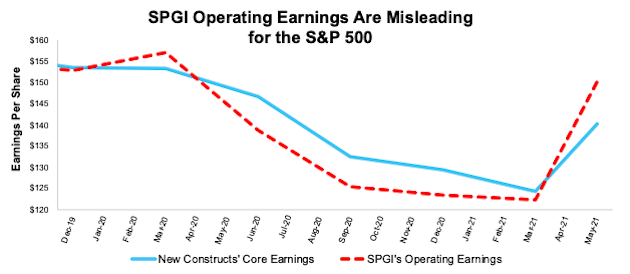

SPGI’s Operating Earnings Are Misleading, Too

Per Figure 2 (from our review of 1Q21 Core Earnings for the S&P 500), SPGI’s Operating Earnings exaggerated the drop in profitability during 2020 and are overstating the rebound in S&P 500 earnings over the last 18 months. I/B/E/S Street Earnings show a similar trend as more companies have overstated Street EPS estimates than understated Street EPS estimates.

Figure 2: Core Earnings vs. SPGI Operating Earnings: December 2019 to Present (through 5/19/21[2])

Sources: New Constructs, LLC and company filings.

More Reliable Fundamental Data

Most investors were not aware that legacy fundamental datasets suffer from significant flaws when compared to Core Earnings[3] until the publication of Core Earnings: New Data and Evidence.

The authors, professors from Harvard Business School and MIT Sloan, invested years of research into the paper. After it was rigorously reviewed by experts, The Journal of Financial Economics, a top-three peer-reviewed journal in the world, selected it for publication.

With the 100% transparency of our models, the authors could unequivocally demonstrate the differences in our data and models versus legacy firms. We eagerly share the unrivalled rigor of our research.

The paper also highlights the difficulty in collecting critical data from the footnotes and the MD&A. It underscores the unrivaled efficacy of our Robo-Analyst technology for intelligently analyzing complex financial statements and disclosures at unprecedented scale.

Harvard Business School and MIT Sloan are not the only institutions to write papers on our more reliable data and research. Find more papers here.

This article originally published on January 12, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

[1] The most recent Core Earnings and Street Earnings values are based on the latest audited financial data from calendar 1Q21 10-Qs.

[2] The earliest date that the 1Q21 10-Qs for all S&P 500 constituents were available.

[3] As proven in Core Earnings: New Data & Evidence, a paper in The Journal of Financial Economics, only Core Earnings enable investors to overcome the flaws in legacy fundamental data and research.