This post is brought to you by our PRO+ Live analysts. Click here to find out more about PRO+ »

As nearly every asset class suffers from negative year-to-date performance, there is one area of the market that has pumped out positive returns all year; cash.

With risk-assets tumbling and cash-offering the highest yield in more than a decade, short-term paper and money market funds are looking increasingly attractive to investors.

Yesterday, the Vanguard Short-Term Bond ETF (NYSEARCA:BSV) saw the biggest daily inflow in over a year.

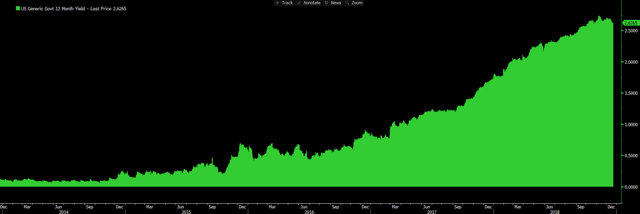

The yield on a 1-year T-bill has climbed all the way to 2.62%. As the S&P 500 yields roughly 2%, global bonds far below 1% and long-term US paper moving below 3%, investors are piling into cash.

If the Federal Reserve continues with interest rate increases, further pressuring risk assets, cash will continue to look attractive at ever higher yields.

If the Fed is able to execute a few more rate hikes as they hope, a 3% yield on cash is in the cards. That will be stiff competition for stocks.