- Technology enthusiasm is gripping the market before trading gets underway for the week.

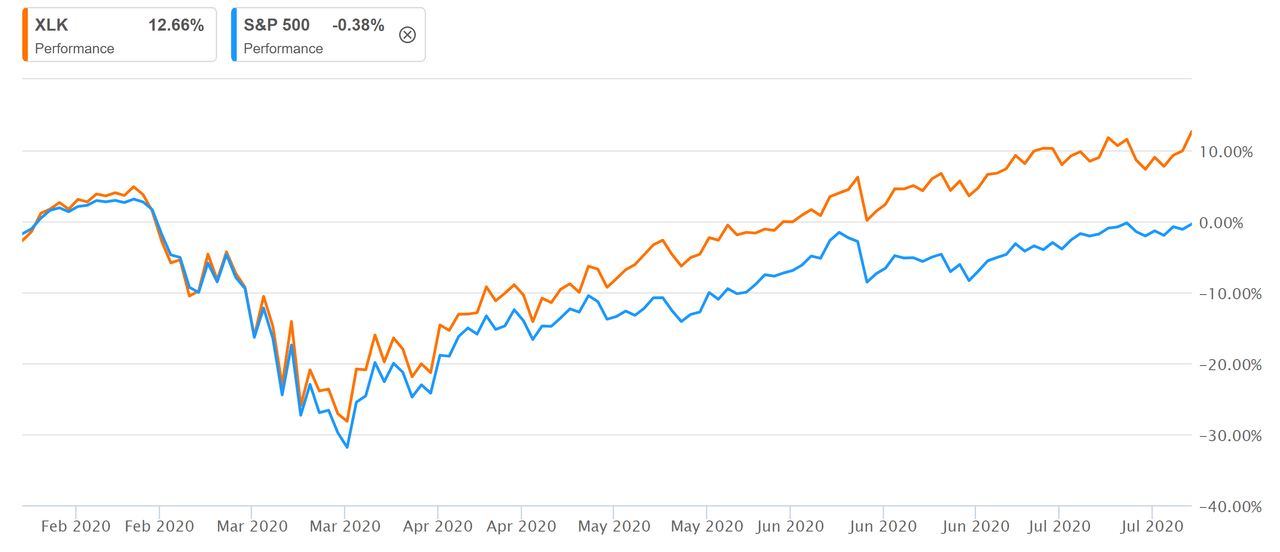

The SPDR Tech Sector ETF (XLK, +1.3%), which rose 5% last week and 5.7% in July, is on the front foot again as Microsoft (MSFT, +2.3%). Apple (AAPL +1.4%) is also higher.

Microsoft is gaining as it looks to move forward with its acquisition of TikTok, which is, along with Instagram, the essential app for the younger users. Pinterest (PINS, +3.1%) added to its huge Friday gains as Pivotal Research upped the stock to Buy from Hold, noting the “astounding” growth rate.

While megacaps are unsurprisingly rising again following last week’s earnings, other stocks are enjoying their Midas Touch as deal activity picks up.

Global Payments (GPS, +3.7%) is the top gainer in XLK premarket. It announced a new multi-year collaboration agreement with Amazon Web Services, for a cloud-based issuer processing platform to financial institutions.

ADT (ADT, +85%) is in the stratosphere after Google (GOOGL, +0.6%) took a 6.6% stake.

Tech will continue to dominate and investors are “not really in the mood” to be concerned about valuation or balance of risk, James Athey told Bloomberg.

If that attitude continues, techs and tech-adjacent sectors will continue to set the pace for broader market gains.

“At nearly 28% of the index, Tech is at its highest proportion of the S&P 500 since 2000 when the market began a three-year losing streak,” Ploutos wrote on Seeking Alpha last week.

“Some sector classification choices may actually understate tech's weight of the S&P 500. Alphabet, the parent of Google, and its $1 trillion market capitalization, now shows up in the Communications sector. The same can be said for Facebook, and its $650B market capitalization, and Netflix and its over $200B market capitalization. Together, these three companies make up another 6% of the S&P 500, and have pushed the weight of the Communications sector to its all-time high as well. Similarly, Amazon, which alone makes up 4.7% of the index, is captured in Consumer Discretionary.”

- Dig down into more market-moving events for the week in Seeking Alpha's Catalyst Watch.

- Compare Quant, Author and Wall Street ratings on the Fab 5.