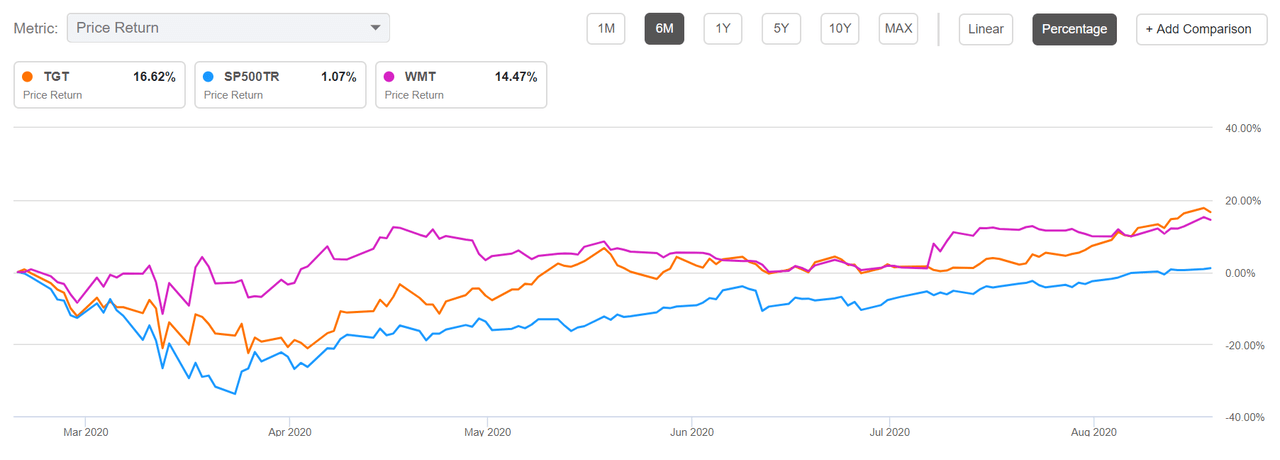

- The separation between the haves and have-nots in retail is becoming clearer as big-box stores pull away from struggling department stores. And now some differentiation between winners like Target and Walmart are emerging.

Target (TGT, +9.7%) reported stellar numbers this morning. Comparable sales skyrocketed 24.3% in Q2 to smash the consensus estimate of +8.60% and set an all-time record.

Amid lockdown measures, digital sales were the obvious beneficiary, soaring 195% year over year.

That performance was echoed by Walmart (WMT) yesterday, which reported comparable sales up 9.3% and digital sales 97% higher. But Walmart’s shares didn’t get the current reception Target is getting after Walmart noted that sales trends were normalizing as July ended, raising worries of tighter purse strings as federal government unemployment assistance started to go away.

One difference in the two reports is the mix of sales, where Target has a strength that many strategists highlight: private label.

Retail analyst Stacey Widlitz, who has Target as her top pick in the sector, told Bloomberg Target is the “one-stop shopping winner” that does “amazing in private label”.

Many smaller retailers will be overwhelmed by the increased cost of doing business, Widlitz says. That will lead customers to strong private-label players like Target.

“On the apparel front, the success of brands like Cat & Jack and the much younger A New Day, both of which are part of Target's 'billion-dollar owned brands club,' has set the foundation for strong growth in the post-pandemic era,” Beulah Meriam K wrote on Seeking Alpha last week.

“A recent report from Coresight Research shows that the U.S. apparel sector is accelerating toward a ‘record number of store closures’ and predicts potential bankruptcy risks for apparel brands and malls across America,” she says. “This puts Target in a unique position to leverage its apparel brands with its vast store presence.”

In the recent quarter, Target said apparel “moved from a 20% decline in Q1 to double-digit growth in Q2”.

In contrast, Walmart CFO Brett Briggs noted in the company’s conference call that back-to-school apparel sales were “understandably soft”.

Looking at the sector as a whole, the SPDR Retail Sector ETF (NYSEARCA:XRT) is sitting just off record highs, but not active premarket.

More broadly, the SPDR Consumer Discretionary ETF (XLY, +0.25%) is edging up, led by Target and a helping hand from Lowe’s (LOW, +1%).