- It's been a year dominated by technology stocks. And for good reason.

- Homebound consumers have turned to technology for everything from working to socializing.

- But it's shopping that may be seeing among the biggest boosts, and niche online retailers - not behemoths like Amazon (NASDAQ:AMZN) - that have seen the biggest change of fortune since the start of the year.

- Plenty of investor attention tends to focus on the biggest tech giants thanks to their eye popping numbers, meanwhile.

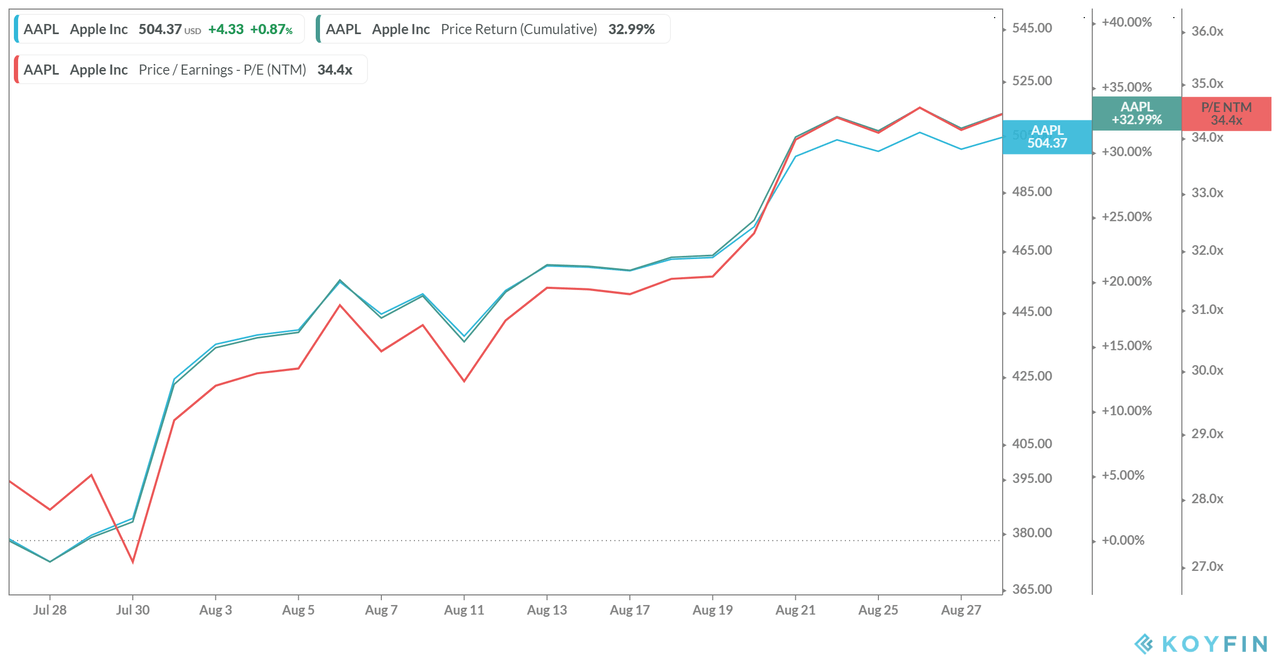

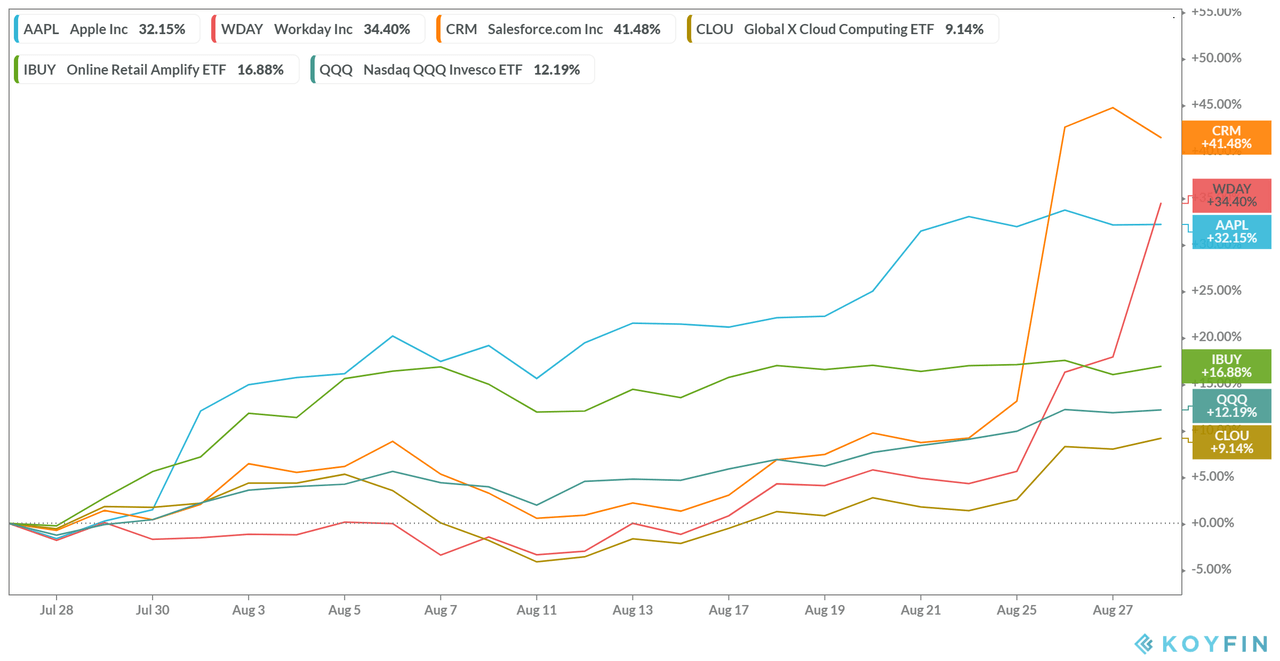

- Apple, for example, gained 35% over the last month - tacking on $530B in market capitalization - and bidding its forward earnings multiple to 34 from 28.

- And high profile software companies like Salesforce.com (NYSE:CRM) and Workday (NASDAQ:WDAY) saw their stocks surge over the week - shares are up 30% and 28% respectively - after delivering blockbuster earnings.

- The enthusiasm was reflected in the Global X Cloud Computing ETF (NASDAQ:CLOU). Both CRM and WDAY have a roughly 4% allocation to it, and CLOU ended the week up by 7%.

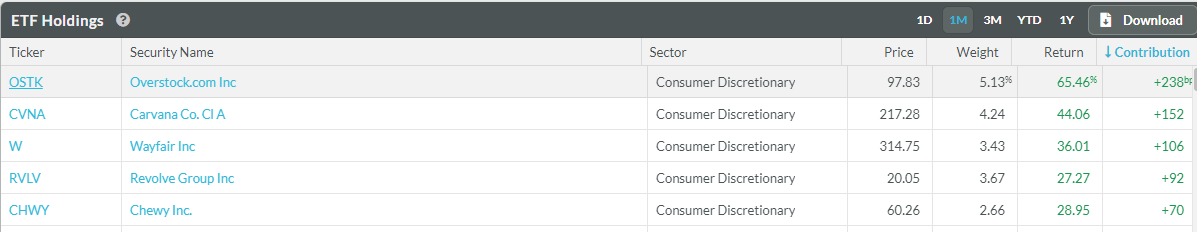

- But with less fanfare than the high profile cloud plays or AAPL, a group of specialty retailers powered the Amplify Online Retail ETF to a 17% gain over the last month. And that month caps a stellar year that puts its YTD gains at 78% - the highest of the Consumer or Technology ETFs monitored by the Seeking Alpha ETF tracker.

- Niche retailers including Overstock.com (NASDAQ:OSTK), Carvana (NYSE:CVNA), Wayfair (NYSE:W), Revolve Group (NYSE:RVLV) and Chewy Inc (NYSE:CHWY) have led the ETF's returns over the last month.

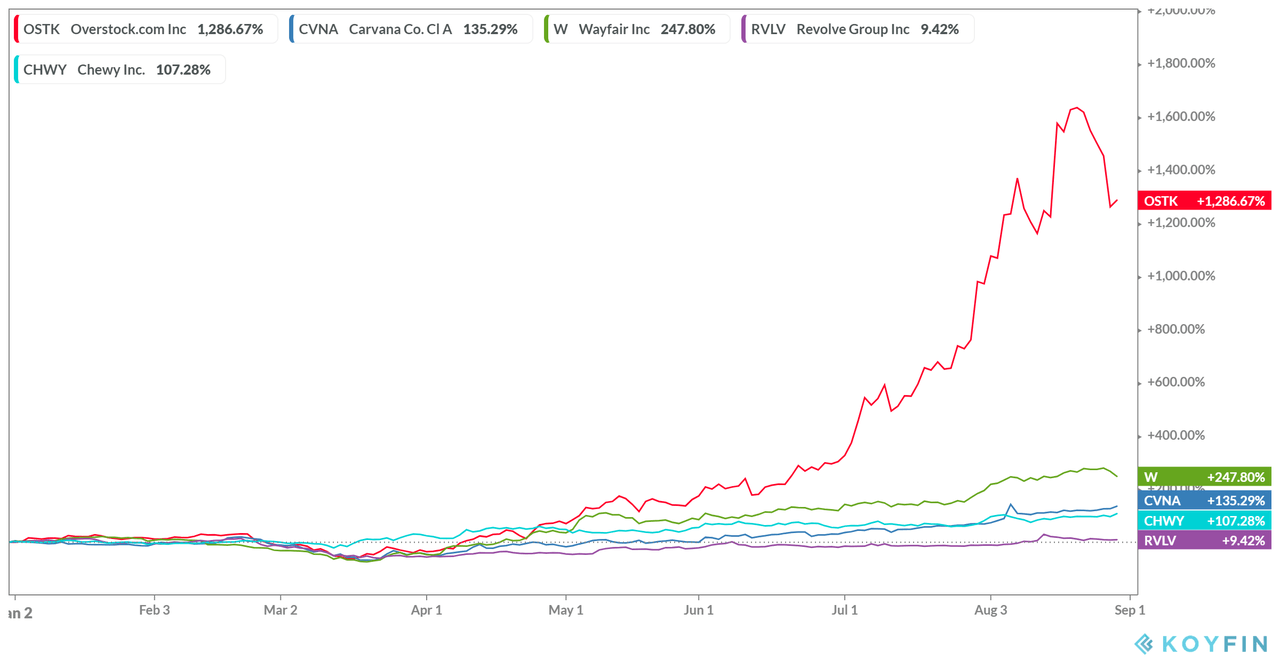

- Very strong gains by retailer OSTK - shares are up 1,297% YTD - have led the way. Some analysts have cited the stock as benefiting from the Covid-induced stay at home trends among the 'seismic forces' that could drive the stock up by another 40%.

- W, CVNA, and CHWY have all more than doubled since the start of the year.

- To be sure, valuations for the ETF as stretched. OSTK trades at 285 times forward earnings, RVLV trades at 36, and the other three companies are in the red.

- But as the Covid pandemic sprawls and tech stocks see their valuations stretched, IBUY may continue to run as investors search for focused plays on the homebound consumer.

- Thank you for being a Seeking Alpha Premium subscriber. Subscribers have exclusive access to Notable Calls, Premium Insights, and our newly launched Catalyst Watch. Taken together, readers get transparency into the boldest calls from the Street, how the market digests the latest news developments and how you can stay ahead of market moving events. For a full list of premium features, please visit the Premium Overview page here.