- Tupperware Brands (NYSE:TUP) announces further steps for improving its capital structure and refinancing Senior Notes maturing in June 2021.

- The company has entered into a commitment letter with Angelo, Gordon & Co. and JPMorgan Chase Bank, wherein the latter will provide Tupperware two term loan facilities in an aggregate principal amount of $275M.

- The proceeds will be used to redeem all of its outstanding Senior Notes of $380.2M and pay related fees and expenses.

- Assuming successful consummation of the term loan facilities and redemption of Senior Notes, TUP will not have any debt maturing until the fourth quarter of 2023.

- "Top priorities associated with the turnaround plan have been to right-size the business, improve liquidity and strengthen our balance sheet to improve our capital structure," said Sandra Harris, CFO and COO of Tupperware Brands.

- The closing of the term loan facilities and Notes redemption is expected in Q4.

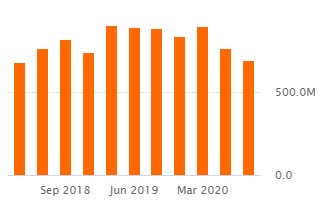

- See TUP's net debt overview in previous quarters: