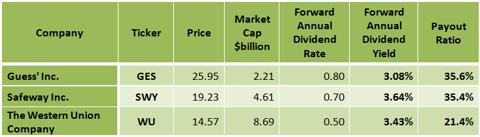

The payout ratio is the percentage of a company's earnings paid out to investors as cash dividends. The lower is the payout ratio, the more secure is the dividend because smaller dividends are easier to pay out than larger dividends.

I have searched for very profitable companies that pay rich dividends with a low payout ratio, and that have raised their payouts significantly each year. Those stocks would have to show stable financial conditions and a low P/E.

I have elaborated a screening method which shows stock candidates following these lines. Nonetheless, the screening method should only serve as a basis for further research.

The screen's formula requires all stocks to comply with all following demands:

1. The stock is included in the S&P Composite 1500 index. Description from Standard & Poor's:

An investable U.S. equity benchmark, the S&P Composite 1500 combines three leading indices, the S&P 500®, the S&P MidCap 400, and the S&P SmallCap 600 to cover approximately 90% of the U.S. market capitalization. It is designed for investors seeking to replicate the performance of the U.S. equity market or benchmark against a representative universe of tradable stocks.

2. Dividend yield is greater than 3.0%.

3. The payout ratio is less than 40%.

4. The annual rate of dividend growth over the past five years is greater than 20%.

5. Average annual earnings growth estimates for the next 5 years is greater than 8%.

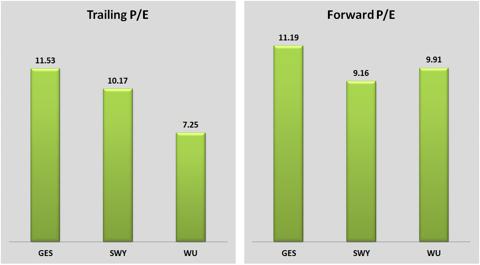

6. Trailing P/E is less than 12.

7. Forward P/E is less than 12.

After running this screen on February 05, 2013, before the market open, I discovered the following three stocks:

Guess? Inc. (GES)

Guess? Inc. designs, markets, distributes, and licenses lifestyle collections of contemporary apparel and accessories for men, women, and children that reflect the American lifestyle and European fashion sensibilities.

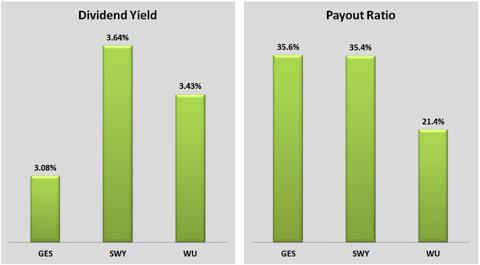

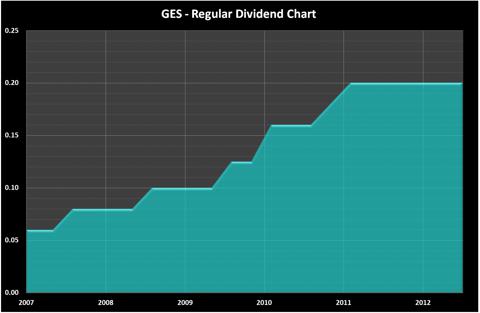

Guess? Inc. has almost no debt at all (total debt to equity is only 0.01), and it has a very low trailing P/E of 11.53 and even a lower forward P/E of 11.19. The PEG ratio is at 1.17, and the price to sales is very low at 0.85. The forward annual dividend yield is quite high at 3.08%, and the payout ratio is low at 35.6%. The annual rate of dividend growth over the past five years was very high at 20.3%.

On November 28, 2012, Guess? Inc. reported third quarter fiscal 2013 results. Guess earned $36.6 million, or 43 cents per share, for the period that ended Oct. 27. That's down from $66.3 million, or 71 cents per share, in the same quarter last year. Total revenue fell 2 percent to $628.8 million on lower royalties and sales. Analysts polled by FactSet expected 44 cents per share on revenue of $624.8 million. In the report, Paul Marciano, Chief Executive Officer, commented:

Third quarter earnings were consistent with our guidance but fell short of our operational goals, as economic pressures impacted consumer confidence in most of our markets. Our European business was stronger at the beginning of the quarter, though business softened toward the end of the period. We posted solid double digit growth in Asia. In North America, our key strategies remain relevant as we focus on driving traffic to the stores through enhanced customer engagement initiatives and elevating the brand with quality.

The compelling valuation metrics, the rich dividend and the fact that the company consistently has raised dividend payments are all factors that make GES stock quite attractive.

Data: Yahoo Finance

Chart: finviz.com

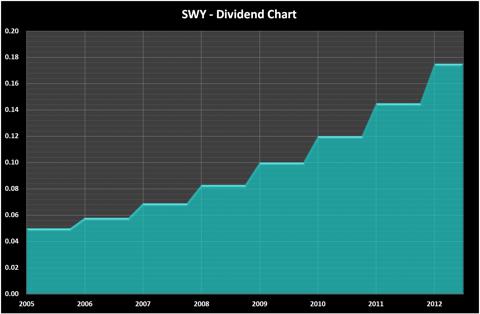

Safeway Inc. (SWY)

Safeway Inc., together with its subsidiaries, operates as a food and drug retailer in North America.

Safeway Inc has a very low trailing P/E of 10.17 and a very low forward P/E of 9.16. The PEG ratio is also very low at 0.87. The forward annual dividend yield is quite high at 3.64%, and the payout ratio is only 35.4%. The annual rate of dividend growth over the past five years was very high at 20.6%.

The SWY stock price is 4.22% above its 20-day simple moving average, 7.74% above its 50-day simple moving average and 12.34% above its 200-day simple moving average, which indicates short-term, mid-term and long-term uptrend.

Safeway will report its latest quarterly financial results on February 20. Safeway is expected to post a profit of $0.77 a share, a 14.9% rise from the company's actual earnings for the same quarter a year ago. The reported results will probably affect the stock price in the short term.

The compelling valuation metrics, the rich dividend, the strong dividend payments growth rate and the fact that the stock is in an uptrend are all factors that make SWY stock quite attractive.

Data: Yahoo Finance

Chart: finviz.com

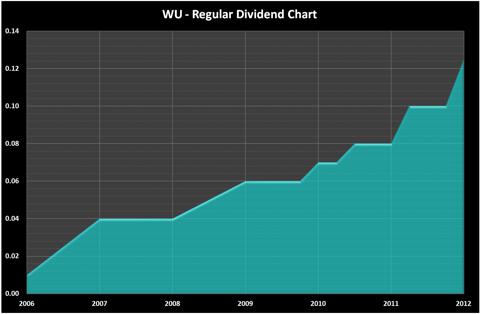

The Western Union Company (WU)

The Western Union Company provides money movement and payment services worldwide.

The Western Union Company has a very low trailing P/E of 7.25 and a very low forward P/E of 9.91. The PEG ratio is very low at 0.81, and the price to free cash flow for the trailing 12 months is also very low at 12.26. The forward annual dividend yield is quite high at 3.43%, and the payout ratio is only 21.4%. The annual rate of dividend growth over the past five years was very high at 65.6%.

Western Union will report its latest quarterly financial results on February 11. WU is expected to post a profit of $0.35 a share, a 10.3% decline from the company's actual earnings for the same quarter a year ago. The reported results will probably affect the stock price in the short term.

The compelling valuation metrics, the rich dividend and the fact that the company consistently raises dividend payments are all factors that make WU stock quite attractive.

Data: Yahoo Finance

Chart: finviz.com

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.