<< Return to page 1 - The Yo-yo Bounces Up

I do take requests and some of the charts above reflect these. If you have a particular market you’d like to see charted, email: viewermail@etfdigest.com. Nevertheless, my rule of thumb is to post those markets, that in my opinion, matter. And, as you can see by many of those posted today many markets appear in the same basic condition: oversold with periodic bounces.

MarketWatch headlines today read, “…investors step back into market.” I’d change that to say “traders” but that’s just me I guess. You have to remember where you read stuff and know what their bias is. Many depend on advertising from firms that want you to feel good so the bias is bullish.

Be prepared for the Geithner led stimulus package to be revealed Monday. They may release whatever it is before markets open for maximum impact since this government, whether Democrat or Republican, are and have been the most market manipulative in history.

Since it seems to be an “in” topic, let me describe some real life regulatory experiences I’ve had that highlight incompetence and uselessness that continues today.

Regulation Experiences: Episode 1

I left my wire house firm and established my Honololu broker/dealer in 1988. At the onset the new firm was awaiting clearance from the CFTC, NFA and State of Hawaii regulators to release our futures fund.

After the second week of opening our door for business, and still not having received regulatory clearance, three young twenty-somethings showed-up from the NFA to conduct an audit. I mentioned this to our lawyer in Chicago who laughed saying, “Well, it’s winter, you’re in Hawaii, you’re the only registered person there, they never audit firms routinely in Iowa for example, so put 2 and 2 together my friend.” Being hip to that view, I cooperated naturally.

They took my files, such as I had after such a short period, and returned sunburned three days later. They made some minor criticisms such as my written mail room procedures, order entry routine (we hadn’t even put a trade in yet) and a few other minor issues having to do with our time stamp and the like, then off they went.

What were they looking for? It seemed they had their checklist and merely were checking the boxes while relaxing at the beach. Oh, and they and others returned like clockwork every other year with the same routine.

Monday: State Regulators

Have a great weekend.

Disclaimer: Among other issues the ETF Digest maintains positions in GLD, TLT and TBT.

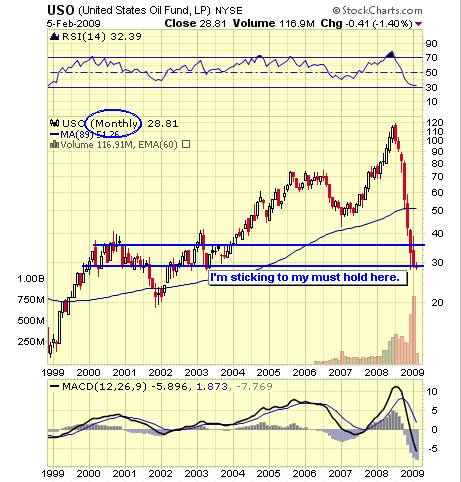

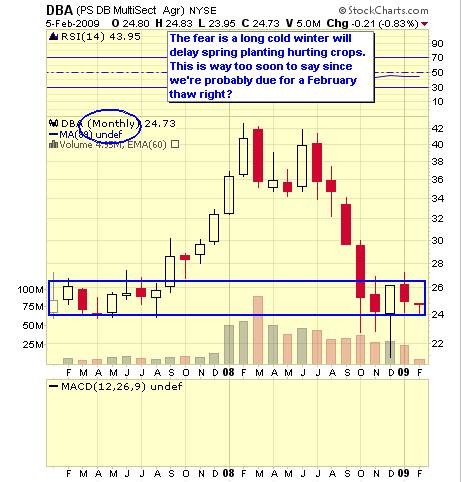

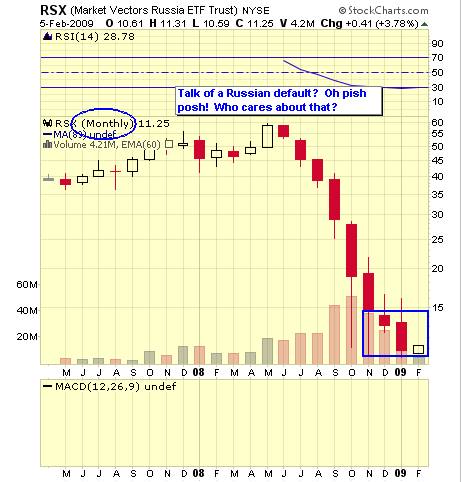

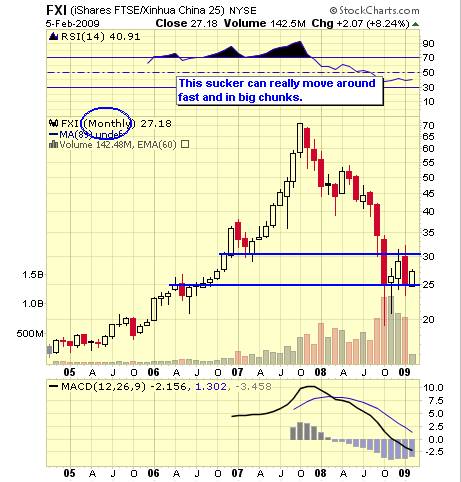

Friday Outlook: Commodities, Emerging Markets

David Fry writes a subscription newsletter focused on technical analysis of exchange-traded funds, called ETF Digest (www.etfdigest.com). Dave founded the ETF Digest in 2001 and was among the very first to see the need for a publication that provided individual investors with information and actionable advice on global ETF investing.

We particularly like the overview of financial markets that his work provides. Even if you're not a fan of chart analysis, Dave provides insight and commentary into which global markets are "working" and why.

Specializing as a market strategist and tactician, Fry focuses on evaluating, creating and implementing a variety of ETF portfolios for individual investors and financial professionals. His philosophy and approach incorporates fundamental with technical analysis in pursuit of risk management and capital preservation especially during uncertain and volatile times.

His new eBook, The Best ETFs: U.S. Equities,is now available on Amazon Kindle. Written as a cheat sheet to only the best ETFs for you or your client’s portfolios. For those that don't have a Kindle, you can purchase the pdf here: The Best ETFs: US Equities [https://gumroad.com/l/The%20Best%20ETFs]