Crocs, Inc. (NASDAQ:CROX), founded 2002, designs and manufactures those funny comfortable shoes with their patented and secret closed cell-resin material called "Crocslite." The company sold 50 million pairs in 2012, each described by the company as "innovative, lightweight, non-marking and odor-resistant." The Crocs brand, you will not be surprised to learn, has surprisingly large brand awareness for its mere 10 years of age - levels comparable to Converse and Nike (NKE).

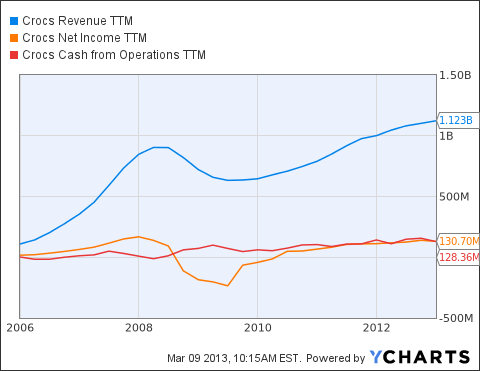

Revenue has grown at a 11% CAGR since 2008 and net income has grown at a 26% CAGR since 2008. Take a look at the operational trend of the company:

Of course, with all the revenue growth lately, cash from operations is pinched due to the large increases in working capital necessary to fuel growth:

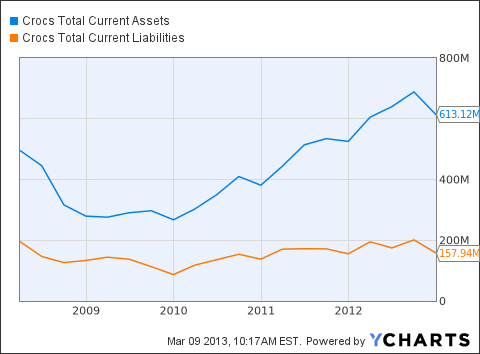

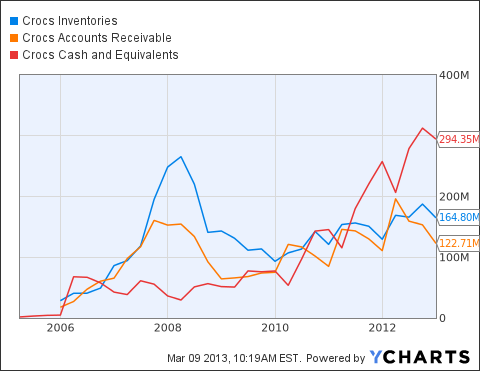

Further, if we look at some components of working capital, we see some of the interesting history of this company:

Notice the large spike in inventories in 2008 - investors bid up the shares significantly concomitant with management's over production of shoes. Notice, also, the large increase in cash to nearly $300m in late 2012, of which only about 8% is accessible without a repatriation tax (and 12% of which is potentially restricted entirely because it is in China and therefore subject to Chinese law).

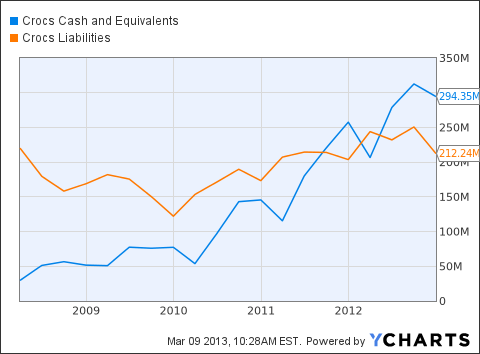

Now, I showed the working capital change overtime but this company has a very conservative capital structure, with cash and cash equivalents being greater than total liabilities alone (albeit, some of the cash is not readily accessible due to repatriation taxes):

Interesting, no? It's a potent statement about the safety of the security in terms of financial strength. It means, going forward, that there are effectively no creditors to siphon off shareholders' cash flow.

Anyways, the company is currently selling at about 9% earnings yield and a 6.3% free-cash-flow yield. The free-cash-flow yield is understated by a large degree due to increasing working capital (noted above) and growth capital expenditures. If the brand can stand the test of time, which we will talk about next, the company is fairly valued in "no-growth" mathematical terms but probably undervalued due to its balance sheet and growth prospects.

Brand

Apparently there has been a fair dose of skepticism over the brand, particularly after the large bubble of inventories at the end of 2007 and beginning of 2008. The decline in the price of Crocs shares since the pre-2008 jubilation probably left a number of people burned (indeed some of those typical and superficial lawsuits alleging "false and misleading statements by management" surfaced after the decline). The basic interpretation seems to suggest that Crocs was not diversified enough, that too much has rested on the classic Crocs style. But, of course, that old interpretation is now incorrect given the company's product line, which we are about to survey (that is, if you follow the links).

If we look at the most popular men's shoes on the Crocs website (see here) we three broad types: a sandal, a slip on, and plays off the classic Crocs style. For myself, I wouldn't be found wearing the classic style. But the former two I certainly would.

If we take a look at the most popular shoes by Crocs for women (see here) we see a much larger variety with shoes costing anywhere from $19.99 to $59.99. (Keep in mind that their ASP for 2012 was $21.55, a 7.5% increase over 2011.)

But let's not forget that kids play a major role in the future success of this company. Take a look, for instance, at the top 32 bestselling shoes on Crocs website (see here). You will notice that "kids" specifically make 37% of the designs - including 4 of the top 6 best sellers.

Anyways, the company also does boots (they also happen to be on sale) and, in my opinion, has done a good job maintaining quality and diversity. Before I go on to talk about how my aesthetic opinion is probably quite irrelevant, I would watch (video) Chief Marketing Officer, Andrew Davison, explain the changes of the Crocs brand over time.

Brand and Geography

Here is the problem with my personal and subjective analysis. In the United States, Crocs are subject to a "controversial" public opinion; at least in terms of fashion. This has led to enviable levels of brand awareness but perhaps it's exactly the ideal sort of brand awareness. For instance, it might not be cool to wear classic clog Crocs as a teenager in America. Such a situation, while mildly alarming for an investor, makes it so that we Americans are very susceptible to the "availability heuristic." That cognitive bias suggests that we use our own personal experience to evaluate the probability of something - we do this by judging the probability of events given the ease with which we can come up with examples. We make this personal evaluation (and we do it constantly) despite the obvious fact that we never have access to a satisfactory sample of experience.

In this case, we - as mostly English speaking Americans - view Crocs as many other Americans views Crocs. But perhaps this is misguided. If we look at the geographic diversification of Crocs' wholesale revenue, the United States is a large player but not the largest player:

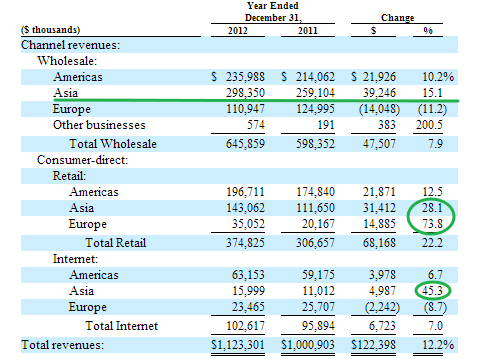

(Source: Crocs 2012 10-K, p. 28)

Or look at the growth rates in Asia versus the Americas. Notice, also, that I circled the growth rate in European retail Crocs because most of the 32 retail stores opened in Q4 were in Europe. Indeed, going forward, the company expects half of the 70 to 95 2013 retail store openings to be in Europe (with the remaining 25% in the Americas and 25% in Asia).

All this is to say that if, in America, Crocs are no longer cool, perhaps they are still cool abroad. This is the position of CEO John McCarvel holds when he stated in an August 2012 Bloomberg interview:

For Asia, we have stayed cool; we've stayed on trend - a lot more casual lifestyle, more fun, colorful products - so we have stayed more relevant to consumers in all age groups.

He contrasts this with America, where our teenage population is far too cool for Crocs. Given the new styles, we will see whether the America attitude lasts. For myself, I agree with CMO Davison, Crocs are a differentiated brand - with huge awareness - which is in the process of reinventing its image.

Valuation

First, 2012 net income was $131m - about a 9% earnings yield. The company made some statements regarding its 2013 guidance and expectations. I've quoted these below:

In the first quarter we expect revenue of $305 million to $310 million and EPS $0.32 to $0.34 per share…In summary, our 2013 outlook looks as follows. We expect revenue to grow 13% to 15% in U.S. dollars. We estimate that we will have modest gross margin expansion through some leverage on our infrastructure even with the additional SG&A related to brand investment, addition retail locations and normalize variable compensation.

Keep in mind that Q1 revenue in 2011 was about $271mm, and therefore they are projecting a 12% revenue growth year-over-year for Q1. With their additional expectation of 13% to 15% annualized revenue growth, they are anticipating more success launching fall and winter footwear.

When we look at the effects of growth in 2012, we see that operating leverage [1] at about 1. That means for every percentage increase in sales there is a corresponding increase in operating income. Therefore, if management's guidance is accurate, we can expect net income to follow revenue growth, i.e., we would be expecting an increase in net income of about 13% - or about $148m for the full year fiscal 2013.

It only takes a few years of solid growth to make this company appear undervalued. At which point it will also likely sell at higher multiples - once the old pessimism around the brand has worn off.

And seeing how far Crocs has come as a brand, when compared to their very slim selection only a few years ago, leaves me optimistic. Further, they are having much greater success in a market which will eventually be much larger than the U.S. market. Further, they have successfully increased their ASPs and they have successfully introduced products which have much higher price tags. This last point strongly suggests that people view this brand as one which is able to demand those prices. If these women's flats are a harbinger of shoes to come:

Then I think we can anticipate Crocs breaking out of its old characterization here in the sates - bearing in mind, of course, that it has never lost its cool in the (eventually) larger markets of Asia.

With CAGRs since 2008 of 11% for revenue and 26% for net income, we can expect this company to sell for greater valuations in the future if it maintains only a fraction of historical growth.

Conclusion

Crocs are becoming established and the fad period is over. Indeed, their product seems to invoke two opposite and incorrect orientations. In the first, the brand is considered undiversified and too reliant on its technology and its old styles. In the second, the brand was a niche product which was new and fresh and is now old and dead. Neither interpretation is correct. As the CEO rightly states in the most recent conference call:

One of the things that has happened having been here now eight years is that when you go through this cyclical stage of your -- like Apple, everybody wants you. You are new, you are unique, you are different and all of a sudden like Apple today, now people don't want to have the iPhone or don't want to have iPad. Everybody has it. So, I want to go to Samsung and [Clemens was on today's morning], the radio driving up, talking about how lot of people are now going to Samsung, because that's new, that's cool, that's different.

And we went through that same cyclical process. I think now we see less haters, less people who think about the brand adversely. We see a lot more neutral in the consumer space where people now would be open to advertising or promotion from us. They would be somebody who now would, maybe, think about this brand differently be it considered for new product.

He is referencing the glamor boom so typical of fads and stock market price bubbles. To borrow the CEO's term: we are still in the period when the "haters" are still hating, hence the share price.

But, following the tenants of contrarianism - and, simply, reading the financial statements which many investors wont do - this company looks primed for future growth, especially outside the United States. If it can maintain its recent growth rates for a few years, the company will be significantly undervalued, relative to the current market capitalization.

Recall, once more, that we are dealing with a globally differentiated patent protected product which is popular in growing economies and which is housed in a holding company which has more cash on hand than its total liabilities. The common stock of the holding company sells at a P/E of 10.6 and the company has issued guidance which implies at least a 13% growth rate. If 2013 comes out as expected, and if 2014 though 2018 have only moderate growth, this company is undervalued.

Please see my general securities disclaimer.

Notes:

- Operating Leverage = % change in income / % change in sales

- Market Capitalization = $1.8B; Share price = $15.68

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.