Outflows of bonds aren't just catching attention, they are setting new highs not seen since 2008. In contrast, stock buybacks are practically unchanged from the previous quarter. Read the below investor insight by TrimTabs Asset Management to review timely fund flow activity that has taken place in the marketplace.

Bond Mutual Funds and Exchange-Traded Funds Lose Staggering $43.4 Billion in June. How Will Retail Investors React as "Safe" Bond Funds Deliver Losses?

Even before Wednesday's bond market rout, fund investors were unloading bonds at a record pace. We estimate that bond mutual funds (MFs) have lost $37.0 billion in June through June 18, while bond exchange-traded funds have lost $6.4 billion. The combined outflow of $43.4 billion is the highest in any month on record, eclipsing the previous record of $41.8 billion in October 2008.

These record outflows are occurring even though the average bond fund's 3.5% loss since the start of May is relatively tame by historical standards. We would point out that many of today's bond fund holders-including those who hold target-date retirement funds that are often loaded with bonds-have never experienced a rising interest rate environment. They probably do not realize the risks in the "safe" bond investments they made in the past four years amid the biggest credit bubble the world has ever seen. How will these investors react after they see their quarter-end statements in a few weeks?

Source: TrimTabs Investment Research

Past performance is not indicative of future results.

Investors are also unloading non-U.S. equities for the first time this year. Global equity MFs and ETFs have redeemed $1.1 billion in June after taking in $84.8 billion from January through May. This month's outflow is the first since August 2012. U.S. equity MFs and ETFs have received $3.6 billion in June after taking in $68.5 billion from January through May.

Source: TrimTabs Investment Research

Past performance is not indicative of future results.

New Offerings Continue at Moderate Pace. Dealogic Reports $400 Million Set for Wednesday and $1.2 Billion Set for Thursday. Announced Corporate Buying Slumps.

The recent increase in stock market volatility seems to be putting a damper on corporate share selling. New stock offerings have been below $10 billion for five consecutive weeks, and they are likely to be below that level again the following week even though underwriters have only a few weeks to sell shares before the Fourth of July.

Underwriters did unload $5.2 billion from Friday June 14th through Tuesday June 18th, led by a $2.7 billion follow-on for Valeant Pharmaceuticals International and a $1.6 billion follow-on and convertible for Weyerhaeuser. But the flow of deals later this week should be slower. Dealogic reports that $400 million is scheduled for Wednesday and $1.2 billion is scheduled for Thursday, led by a $400 million follow-on for Brookfield Renewable Energy Partners and a $350 million follow-on for Ares Commercial Real Estate both expected Thursday. Unless some large overnights materialize, this next week's volume should not be much higher than $8 billion.

Source: TrimTabs Investment Research

Past performance is not indicative of future results.

Turning to the other side of the corporate liquidity ledger, announced corporate buying has been lackluster this week. Buybacks for Abbott Laboratories ($3.0 billion), Signet Jewelers ($350 million), and Hatteras Financial ($250 million) have been the only major transactions, and no new cash takeovers have been announced.

Source: TrimTabs Investment Research

Past performance is not indicative of future results.

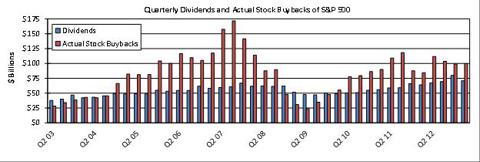

Standard & Poor's Reports Actual Stock Buybacks for S&P 500 Companies Unchanged at $1.6 Billion Daily in Q1 2013. Number of New Stock Buybacks Drops This Quarter Even as Volume Increases.

Standard & Poor's reported Wednesday June 19th that actual stock buybacks for S&P 500 companies were nearly unchanged sequentially in the first quarter. Buybacks totaled $100.0 billion ($1.6 billion daily), almost identical to the $99.2 billion ($1.6 billion daily) in Q4 2013 and up 19% from $84.3 billion ($1.3 billion daily) in Q1 2012.

Eight companies spent at least $2 billion repurchasing shares last quarter: AT&T ($5.9 billion), Exxon Mobil ($5.6 billion), Pfizer ($4.6 billion), IBM ($2.6 billion), J.P. Morgan Chase ($2.6 billion), Wal-Mart Stores ($2.2 billion), Home Depot ($2.2 billion), and Oracle ($2.1 billion).

Source: TrimTabs Investment Research

Past performance is not indicative of future results.

Although buybacks were flat last quarter, we are leaving our estimate of actual stock buybacks unchanged at $2.0 billion daily. Actual stock buybacks tend to track new stock buybacks closely, and new stock buybacks rose to $2.7 billion daily in Q1 2013 and $3.0 billion daily in Q2 2013. These levels are the highest since Q4 2007, when buybacks averaged a record $3.6 billion daily.

One trend we think is significant but overlooked is that fewer companies are rolling out share repurchases even though the volume has increased. We have counted 141 buybacks this quarter, so this quarter's figure is likely to be the lowest since at least Q1 2011. Larger firms seem more confident than smaller ones.

Source: TrimTabs Investment Research

Past performance is not indicative of future results.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Business relationship disclosure: AdvisorShares is an SEC registered RIA, which advises to actively managed exchange traded funds (Active ETFs). This article was written by Minyi Chen, CFA the portfolio manager of the AdvisorShares TrimTabs Float Shrink ETF (ticker TTFS). We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. This information should not be taken as a solicitation to buy or sell any securities, including AdvisorShares Active ETFs, this information is provided for educational purposes only.

Additional disclosure: This communication is a publication of TrimTabs Asset Management. It should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Information presented does not involve the rendering of personalized investment advice. Content should not be construed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing performance returns. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Past performance may not be indicative of future results. Therefore, no investor should assume that the future performance of any specific investment or investment strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions, may materially alter the performance of an investor's portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor's portfolio.To the extent that this content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security. AdvisorShares is a sponsor of actively managed exchange-traded funds (ETFs) and holds positions in all of its ETFs. This document should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any products mentioned.Investment in securities carries a high degree of risk which may result in investors losing all of their invested capital. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results. To learn more about the risks with actively managed ETFs visit our website AdvisorShares.com.