The share price of Broadcom Corp. (BRCM) declined substantially recently. Broadcom is in the semiconductor industry, which is leveraged to the economic cycle. In my opinion, the company is transitioning to being a value stock. It recently began paying a dividend.

Historically, over a 15-year period on a total return basis, Broadcom outperformed the S&P 500. But, more recently the company has underperformed the S&P 500 by a substantial margin. That means there is the potential that Broadcom outperforms the broader market. Buy what they hate and sell what they love.

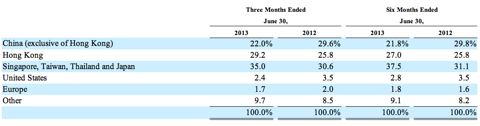

This is a company that is highly levered to the Asian economies, which is the bed of technology and is a high economic growth region. Right now, liquidity and solvency aren't an issue. But, the margins are contracting. That said, this company should benefit from the "Network Connected" trend.

Based on the valuations, if I can get shares of this one 5% or 10% lower than the current share price, I'm a buyer. That is roughly $26.50 or lower. Pretty much right in the current trading zone. I consider Broadcom an investment, which means I'm not focused on a stop-loss point. My focus is on how much of my assets to allocate to shares of Broadcom.

Risks

- The loss of a key customer or design win, a reduction in sales to any key customer, significant delay in its customers' product development plans, or its inability to attract new significant customers or secure new key design wins could seriously impact Broadcom's revenue and materially and adversely affect the results of operations.

- As Broadcom moves to smaller geometries, it has become increasingly reliant on TSMC for the manufacture of product at and below 40 nanometers. The lack of diversity of suppliers could also drive increased wafer prices, adversely affecting its results of operations, including its product gross margins.

- As of June 30, 2013, the co-founders, directors, executive officers and their respective affiliates beneficially owned 9.6% of the outstanding common stock and held 48.7% of the total voting power held by shareholders. Repurchases of shares of the Class A common stock under the share repurchase program would result in an increase in the total voting power of the co-founders, directors, executive officers and their affiliates, as well as other continuing shareholders.

- The share price has historically been volatile and may decline substantially causing investors to lose a portion or all of their investment.

Business Profile

Broadcom Corporation is a global leader and innovator in semiconductor solutions for wired and wireless communications. Broadcom products seamlessly deliver voice, video, data and multimedia connectivity in the home, office and mobile environments. Broadcom provides the industry's broadest portfolio of state-of-the-art system-on-a-chip, or SoC, and embedded software solutions.

Broadcom has three reportable segments consistent with its target markets. Its three reportable segments are: Broadband Communications [HOME], Mobile and Wireless (Hand), and Infrastructure and Networking (Infrastructure).

Its net revenue is generated principally from sales of integrated circuit products and other licensing revenue. With the Qualcomm (QCOM) agreement ending, revenue should face a 2% headwind.

With respect to the sales of integrated circuit products, it has approximately 600 products that are grouped into approximately 60 product lines. The integrated circuits marketed by each of its reportable segments are sold to one type of customer: manufacturers of wired and wireless communications equipment, which incorporate its integrated circuits into their electronic products. All of its integrated circuits are sold through a centralized sales force and common wholesale distributors.

Broadcom utilizes independent foundries and third-party subcontractors to manufacture, assemble and test all of its semiconductor products.

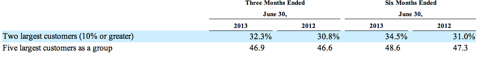

The operations are heavily leveraged to the Asian economies. Broadcom's customers and strategic relationships include the big players in the technology sector. The two largest customers account for over 30% of net revenues. The company's two largest customers are Apple (AAPL) and Samsung (OTCPK:SSNLF). In 2012, 2011 and 2010 sales to Samsung and Apple represented 17.3% and 14.6%, 10.0% and 13.1%, and 10.0% and 10.9% of Broadcom's net revenue, respectively.

Broadband Communications (Solutions for the Home) offers complete solutions for cable, xDSL, fiber, satellite and IP broadband networks to enable the connected home, including set-top-boxes and media servers, residential modems and gateways, small and residential cells and wired home networking solutions.

Mobile and Wireless (Solutions for the Hand) offers low-power, high-performance and highly integrated solutions powering the mobile and wireless ecosystem, including Wi-Fi and Bluetooth, cellular SoCs, global positioning, near field communications [NFC], Voice over IP (VoIP), and mobile power management solutions.

Infrastructure and Networking (Solutions for Infrastructure) offers highly integrated solutions for carriers, service providers, enterprises, small-to-medium businesses and data centers for network infrastructure needs, including Ethernet switches, physical layer devices [PHYS], multicore embedded processors, knowledge-based processors (KBP), switch fabric solutions, high-speed Ethernet controllers and microwave backhaul devices.

Segment Analysis

The Modems and Residential Gateways division within the Broadband Communications segment enables service providers to provide data, voice, and video services throughout the home. Demand for the Broadcom's solutions continues to grow as global service providers continue to deploy next generation broadband access technologies across DSL, cable, and fiber to deliver more bandwidth and faster speeds to consumers across the globe.

Demand for the Digital Cable, Direct Broadcast Satellite and IP Set-Top Boxes division's solutions continues to grow as global service providers are increasingly introducing new products and services in the connected home, including transcoding, digital video recording services, high definition, wired and wireless networking, and integrated tuners to enable faster channel change and more simultaneous recordings. According to the 2012 annual report, ABI research estimated 250 million set-top boxes were shipped in 2012.

The Mobile and Wireless Segment breaks down into six divisions: Wireless Local Area and Personal Area Networking; Wireless Connectivity Combination Chips; Global Positioning System; Cellular SoCs; Voice over Internet Protocol and Near Field Communications. I'm going to make the hopefully not too bold assumption that the reader knows what Wi-Fi, Bluetooth, GPS, VoIP and NFC are. I think NFC, or Near Field Communications, has a bright future in the contactless payment systems market; that use it in addition to its already everyday uses, such as remote controls, wireless mice, and bluetooth headsets.

The Infrastructure and Networking segment breaks down into three divisions: Ethernet Networking; Processors and Wireless Infrastructure and Custom Silicon Products.

The Ethernet Networking division offers five core solutions: ethernet switches; ethernet copper transceivers; ethernet controllers; automotive ethernet; and backplane and optical front-end physical layer devices.

The Processors and Wireless Infrastructure division offers four core solutions: multicore communication processors; knowledge-based processors; digital front end processors; and microwave modems and RF chip sets.

The Custom Silicon Products division offers customers a range of custom application-specific integrated circuit products that integrate customer-specific intellectual property into larger, more highly integrated solutions.

In February 2012, Broadcom completed its acquisition of NetLogic Microsystems, Inc., a provider of high-performance intelligent semiconductor solutions for next generation networks. NetLogic was incorporated into the Infrastructure and Networking segment.

In June 2013, Broadcom recorded a purchased intangible impairment charges of $501 million, primarily related to the acquisition of NetLogic and, to a lesser extent, the acquisition of Provigent, Inc.

Broadcom is highly leveraged to the network-connected devices cycles, which is an excellent strategic position.

Getting to numbers, there are four revenue generating segments. Three of the segments generate operating income; the fourth segment generates an operating loss large enough to cancel out one or two of the profitable segment's operating income. The All Other segment generates operating losses that are attributable to non-cash expenses.

Mobile and Wireless is the largest segment by revenue. The growth segments are Mobile and Wireless, and Infrastructure and Networking. That isn't surprising new evidence. What is relatively surprising is that the Infrastructure and Networking segment has the highest operating margin but, that operating margin is shrinking, which will weigh on the consolidated margin. Additionally, the Mobile and Wireless segment's margin is contracting. Operating margin pressure is bearish for valuations.

Next is the segment forecasts for fiscal 2013. I'm expecting margins to continue to contract, but Broadband Communications segment's operating margin should be roughly flat. That said, Broadband Communications revenue could grow 5% to 8%; Mobile and Wireless revenue could grow 9% to 12%; Infrastructure and Networking revenue could grow 5% to 8% and All Other revenue could decline 11% to 15%.

On a consolidated basis, I am forecasting revenue in the $8.52 billion to $8.76 billion range with operating income in the $362 million to $404 million range, and net income in the $350 million to $390 million range. The operating income and net income numbers are not adjusted for the write down.

Valuations

I am going to use several models to price the common equity shares of Broadcom. That said, the main assumption in my discounted cash flow model is that the dividend growth rate slows to 5% in 2018. The slowing of the dividend growth rate is consistent with my long-term revenue growth rate forecast.

Now that I have said that, the current share price is $27.56; my fair value estimate using a discounted cash flow model is $24.22. Consequently, Broadcom is overvalued by 13.8%.

Now, I am going to present the justified value; this one was a little tough to estimate because the company does not have a long dividend paying history. My main assumption is that the Board of Directors uses common business sense, a potentially dangerous assumption.

Based on my estimate, I come up with a justified P/E of 15. To be fair, the justified P/E could be 30 or 10 based on my model. That said, I used the same inputs that I used for the discounted cash flow as my baseline scenario. I think we are trading at an adjusted forward P/E of 17.94. So, based on this model, Broadcom is 19.6% overvalued. The fair value estimate using the justified value is $23.97.

Time to do the multiplier model estimates of fair value. Based on the unadjusted price/earnings ratio relative to its 5-year average, Broadcom's fair value is $49.88. Using the price/book ratio, the fair value is $41.34. With the price/sales ratio, the fair value is $39.16. Lastly, the price/cash flow fair value is $40.67. The average of those fair values is $42.76. Using this model, Broadcom is 54.8% undervalued.

The average of all three models gives me a fair value of $30.32. Broadcom is 9.7% undervalued. I would use about a 5% to 10% decline in the share price to accumulate shares. That way, investors would be purchasing shares closer to the fair value using the first two models presented and at a good discount to the fair value estimate. Lastly, the return on equity is higher than the cost of equity.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in BRCM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.