Introduction

Omeros (NASDAQ:OMER) is proving to be an exciting stock. I have been following it closely since a round of insider buying after OMS103 failed to meet its primary endpoint for the second time in Phase 3 trials. While the price would probably be higher if the product had unequivocally been successful, I would not have become a shareholder. It is enjoyable to own a company with several products, some of which should have near term events.

The company's current market capitalization is approximately $141M. It may be unpalatably volatile for some. There are reasons for the instability, including the fact that external financing arrangements are necessary to pay the bills. The precariousness is supported by a Phase 3 product with a submitted New Drug Application, and a pipeline containing at least two products that could be blockbusters if they can defy the odds and advance through extensive clinical study ahead.

Phosphodiesterase

Omeros is working on at least two products investigating phosphodiesterase ("PDE") enzymes. It actually has some impressively-credentialed staff that has participated in the development of Cialis, a PDE type 5 inhibitor. Those with medical, managerial, or scientific responsibilities include:

- Kenneth M. Ferguson, Ph.D., Vice President, Development and Chief Development Officer;

- Patrick W. Gray, Ph.D., Scientific Fellow;

- J. Steven Whitaker, M.D., J.D., Vice President, Clinical Development and Chief Medical Officer; and

- Albert S. Yu., M.D., Vice President, Clinical Development

The company's PDE10 inhibitor OMS824, under evaluation for treating psychiatric conditions, has gotten a strange amount of attention for a drug candidate that has not entered Phase 2 trials. In fact, an article published just over one year ago focuses on the product while in preclinical stages. The product is now relatively far advanced in light of notable competition:

- Pfizer (PFE) has a molecule that formerly was in Phase 2, PF-2545920. It appears to have been discontinued, but may now to be in new clinical studies for schizophrenia and Huntington's Disease.

- Merck (MRK) has a patent for a PDE10 inhibitor that issued in 2012.

- Privately-held EnVivo Pharmaceuticals has a Phase 1 product, EVP-6308.

- Biocrea, a privately-held German firm is also active in research and has collaborated with Pfizer. According to CEO Tom Kronbach, "Our scientific team (in our predecessor companies Biotie and elbion) has had a long collaboration with Pfizer on PDE10 inhibitors. Our PDE10 development candidate, BCA159, was conceived independent of the Pfizer collaboration and of the Pfizer molecule (MP-10 or PF-2545920). We have data that show…BCA159 is superior to MP-10 (source: emailed message)."

- Bristol-Myers Squibb (BMY) has a patent application that lists a March publication date;

- A Johnson & Johnson (JNJ) subsidiary known as Janssen-Cilag S.A. has a patent application.

There is not any indication of a candidate in development at any of the publicly-traded companies' web sites, so any products probably are not past Phase 1; if in clinical development.

OMS824 cannot be ruled out as a potential blockbuster if found effective for treating Huntington's disease or schizophrenia. Per all of the above activity, it might also render Omeros an acquisition target. In the meantime, a May 23rd Press Release announces an Orphan Drug Application, a process that has tended to require under 90 days in recent years.

However, the PDE10 inhibitor seems to have hit a snag on another front. A May 1st Press Release announces an application for FDA Fast Track status. The time for review is 60 days, so it seems that it has not been approved.

The company is also evaluating OMS527, a preclinical PDE7 inhibitor for treatment of addiction and compulsive disorders. It anticipates filing an application in Europe later this year to begin trials.

OMS721

There is another Orphan Drug Application for preclinical OMS721 as a treatment for atypical hemolytic uremic syndrome ("aHUS"). It may have encountered a problem(s). Roughly 100 days have passed since its reported filing.

The only known current treatment for aHUS is Soliris, discovered, developed, and marketed by Alexion Pharmaceuticals (ALXN). OMS721 aims to selectively inhibit mannan-binding lectin-associated serine protese-2 ("MASP-2"), and is approved for Phase 1 trials in Europe. Enrollment should have begun for in July. Notably, according to the company's CEO Gregory Demopulous, "The lectin pathway appears to play an important role across a wide range of serious disorders."

PharmacoSurgery

This aspect of the corporate model is something I like about the company. Omeros has been in the medical business since at least June 1994 when it was incorporated. Some biotechnology and biopharmaceutical companies have seen their lead candidate fail, rendering them without an approved product or money, and Demopulous assuredly has witnessed them. The most advanced pipeline products belong to the PharmacoSurgery platform, which brings drugs to the site of wounds during procedures.

OMS103, intended for knee surgery procedures, seems to be hobbled in the water. Though shown effective at treating pain, it has had two failures in Phase 3. Further studies may be announced in the future.

OMS302 uses generically-available drugs in a standard irrigation fluid to keep the eye in its desired state during ophthalmological surgery. According to multiple analysts, it has high chances of approval as a new drug. Provided the Agency files the application, a response should be known within nine months.

OMS302 might not sell the same way as treatments for diseases that have unmet needs, and certainly is not entitled to the FDA's priority and rolling review processes. There may be an onus on marketing and sales efforts at regional levels, which could be expensive, if the candidate is approved. However, even if it eventually proves to struggle commercially, it should lend stability to the corporation and perhaps its share price.

Finances

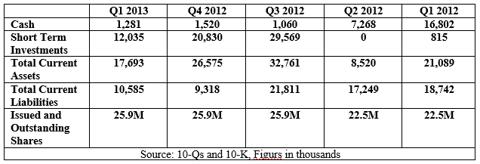

It may not be surprising that fundamentals are a difficulty for this early-stage company. Except for a share count that is now increased 32%, figures remain reasonably consistent in comparison with those from a year ago.

Since March 31, the close of Q1 2013, there has been a $16.2M registered stock placement that increases the stock outstanding by 3.9M shares. Remarkably, the price has appreciated from close to $4 pursuant to announcement of the transaction. For the foreseeable future, further dilution is a probable means to raise needed capital. There is also the chance of a new partnership(s).

Getting Paid To Be A Shareholder

Everything described thus far results in a volatile situation. In part because the stock can gyrate so much, options are expensive. The stock currently trades at around $5.55. A $6 call that expires in September can be written for around $40, or maybe higher. There is a chance of earning [ $40 / $555 = ] 7.2% on a $555 trade, or investment, without consideration of commissions. In the improbable scenario that things are unchanged for the remainder of the year, the same gains could be made every month and a half or so. Two other considerations are that, if the stock price somehow goes to $0, everything would be lost except the money for writing calls; and if the share price rises above $6, perhaps due to approval of an Orphan Drug Application, profits would be limited and assignment fees may be incurred (Just2Trade charges $20).

Here is a graphic showing the changing implied volatility ("IV"), pertinent to options and colored orange; and historical volatility, relevant to the stock price and colored blue. IV has been fairly consistent while shares have fluctuated considerably.

Conclusion

This stock is not for the risk-averse. The company does not make any money, is unlikely to anytime soon, and does not have a lot of cash to get by. For those who like Omeros and what it is trying to accomplish, some things may balance out. If so, owning shares in multiples of 100 can result in relatively high income, particularly when measured as a percentage.

Disclosure: I am long OMER. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.