Eastman Chemical is a global supplier of raw materials including chemicals, plastics, and fibers. In the first nine months of 2009, 56% of sales were produced in the U.S. and Canada; 21% in the Asia Pacific; 16% in Europe, the Middle East and Africa; and 7% in Latin America.

The Coatings, Adhesives, Specialty Polymers, and Inks segment accounted for 24% of net sales in the first nine months of 2009. Paint, coating, and ink ingredients include cellulose-based polymers; coalescents such as ester alcohol and chlorinated polyolefins; and solvents such as ester, ketone, glycol ether, and alcohol solvents. Adhesive raw materials include hydrocarbon resins, rosin resins, resin dispersions, and polymers.

The Fibers segment generated 21% of net sales. It makes acetate tow and triacetin plasticizers, which are used in cigarette filters; solution-dyed acetate yarns, which are used in apparel, home furnishings, and industrial fabrics; and acetyl chemical products which are sold to other acetate fiber producers.

The Performance Chemicals and Intermediates segment produced 25% of net sales. It supplies olefinbased, acetyl-based, and performance chemicals which are used as raw materials in the agricultural chemical, automotive, beverage, pharmaceutical, medical devices, toy, imaging, and household products industries. The Performance Polymers segment was responsible for 15% of net sales. It supplies polyethylene terephthalate (PET) resins and other polymer intermediates.

PET resins are used to make containers and packaging for beverages, food, personal care products, household products, pharmaceuticals, and other products. Specialty Plastics accounted for 15% of net sales. It supplies copolyesters and cellulosic plastics. These are used in appliances, store fixtures, electronics packaging, medical devices, photographic and optical films, and liquid crystal displays.

PET resins are used to make containers and packaging for beverages, food, personal care products, household products, pharmaceuticals, and other products. Specialty Plastics accounted for 15% of net sales. It supplies copolyesters and cellulosic plastics. These are used in appliances, store fixtures, electronics packaging, medical devices, photographic and optical films, and liquid crystal displays.

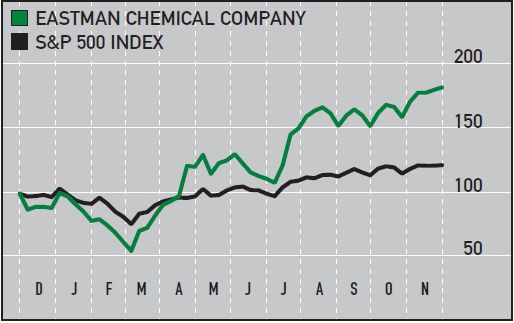

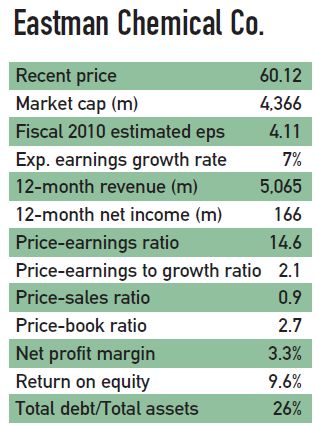

Global recessionary forces caused year-to-date net sales to fall 31% year-over-year to $3.72 billion. Weak volumes were responsible for 18 percentage points of the decline. Because prices are tied to raw material costs, tumbling prices accounted for 13 percentage points of top line decline.

But EMN has also been taking steps to shift its sales mix towards higher margin products. Like many other companies during this recession, EMN has also engaged in various cost cutting actions. And while falling raw material prices are unfavorable for the top line, they favorably impact the bottom line.

In fact, while Q3 pro forma net sales plunged 21% year-over-year to $1.34 billion, pro forma net income fell just 1% to $101 million or $1.38 per share. This was well above expectations and was attributable to the gross margin expanding 683 basis points to 24.53%. Investment risks will continue to include the health of the global economy. Also, while EMN can pass raw material cost fluctuations to customers, high volatility could negatively impact EMN’s profitability.

We are encouraged by EMN’s recent performance and near-term prospects. In fact, management recently said it expects to earn $3.50 per share in 2009. This guidance implies 99 cents in Q4 earnings per share, which was above expectations. While it remains cautious on the economy, management expects to deliver roughly 20% annualized growth in earnings per share, leading to $5-6 in earnings per share by around 2012.