Toyota (NYSE:TM) one of the largest automotive firms in the world, has had a long history of stable operational performance, especially when compared to its American peers. In the past, this stability, combined with a reputation for quality, helped the company garner strong consumer loyalty and take major market share. However, over the last few years, the company has stumbled, dealing with product recall issues, resurgent American competition, and generally slow economic growth in its key markets. These issues have led investors to overlook important trends in the business (such as its cost reduction program). Provided these trends continue, the stock is likely to be one of the best blue-chip stock plays the market has to offer.

A Quick Look at the Firm

Toyota primarily conducts business in the automotive industry. Its business segments are automotive operations, financial services operations, and all other operations. Automotive operations entail the designing, manufacturing, and sale of vehicles and related items. Financial services provide financing for the purchasing or leasing of Toyota vehicles. Toyota also conducts businesses in prefabricated housing, information technology, and communication related products. In fiscal year 2013, 92.4% of firm revenue came from automotive operations and 5.2% from financial services.

Toyota's stock price has seen major increases during the year of 2013, gaining 44%. For the most part, this was a rebound from the 2012 recall issues surrounding the Prius. Despite this rather impressive move, the stock price is still a long way from its 2007 highs despite 25% higher sales. The negative headlines and management missteps which have dominated the news flow over the last few years, have left a lingering impression on investors.

Simply a Margin Story

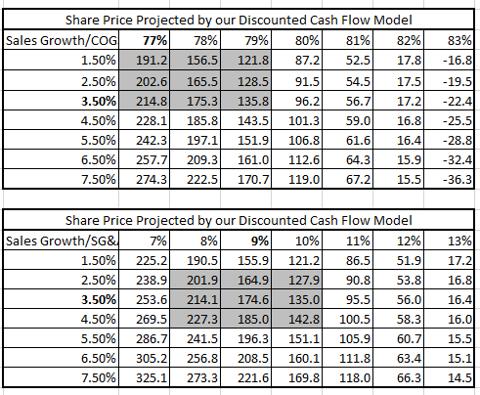

Manufacturing cars is a competitive business with thin margins. So while revenue numbers are huge, the competition hold down profits. Because of Toyota's thin margins, any movement in Toyota's cost items has a huge impact on its valuation. For every 1% decrease in cost of goods sold (COGS), the valuation of the stock can increase up to 20%. At high levels of sales growth, this effect is even more prominent. Of course, a reduction in any cost item would produce the same increase in value.

The Three-Fold Bet

Toyota has much on its side. The decrease in global steel and energy price and the weak yen support its cost reduction program and sales growth. In addition, Toyota has three levers of its own to pull. It can lower costs through shifting manufacturing locations to those with cheaper cost, by integrating its manufacturing platforms, and changing its product mix.

Manufacturing Outside Japan - Toyota invests in increasing local production in various countries, thereby taking advantage of cheap local cost factors. For example, in 2012, 75.3% of Toyota vehicles sold in North America were produced in North America, which captured the decreasing relative labor costs in the United States. This also helped meet global demand in a timely manner and reduce unnecessary currency exposure.

Streamlining Manufacturing - Toyota reports reduction in the number of platforms, the critical structure forming the base of vehicles, used in vehicle production. Management believes this will decrease the substantial expenditures required to design and develop vehicles, while achieving the scale benefits of producing larger volumes per platform. This carries the additional benefit of making shifting production easier.

Selling Higher Margin Vehicles - Toyota can increase its margins by changing its product mix. Toyota's Lexus brand name is spread throughout North America, Europe, Japan and other regions. Such luxury vehicles have higher profit margins than compacts and can therefore lower cost margins. Since the high-income group earned most of the gains during the recent economic recovery, it is likely that luxury vehicles sales will improve.

Record Margins in the Works

Toyota is already moving in this direction. The company has implemented an aggressive cost reduction program, which reduces cost in both the SG&A and COGS lines. The improvement has been hidden, however, from market participants who were simply looking at the gross margin.

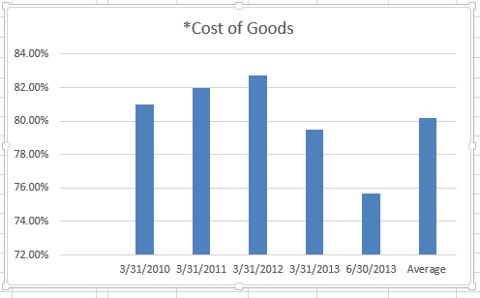

It is important to distinguish between margin improvement from cost cutting and a simple cyclical rebound. The increase in costs during a cyclical downturn can actually hide long-term decreases in cost. For instance, Toyota's management has cut 2.00% out of the SG&A line. This cost reduction has been more than offset by a large increase in COGS, driven primarily by the economic downturn and slow subsequent recovery. Toyota's COGS has yet to recover to its pre-recession levels, hiding the improvement in SG&A. Toyota's cost reduction program combined with the improvement in SG&A appears to have the company poised to deliver record margins on a sustainable basis.

*COGS is measured as percentage of revenue.

Today's market price can be justified with COGS around the five-year average of 80%, despite the fact that Toyota is working closer to the 77% margin. In the tables below, the valuation with various cost margin assumptions are evaluated. Slight decreases in cost can produce major stock price increases while holding other cost items at their recent averages. There is no doubt that Toyota's experienced executives have the abilities to reach such margins. The tables below show what happens when one line item improve.

*Approximate current stock price, margins and growth rates are highlighted. The assumptions in the table are those used to derive projections.

*Approximate current stock price, margins and growth rates are highlighted. The assumptions in the table are those used to derive projections.

Keep in mind Toyota is running SG&A closer to 9% and COGS closer 77%. This reflects a 5% improvement over the recent averages (but still below pre-recession levels). Remember, since each margin point represents a 20% gain in price, this implies a double from today's levels.

This Type of Improvement Is Not Typical

It might seem confusing as to why less than 1% of improvement in COGS is such a major factor in Toyota's stock price. A quick analysis of Toyota's financial statements gives a result: 1% is a lot.

Considering the recent financial crisis and the automobile industry's high cyclicality, Toyota has been surprisingly stable in its margins. Most components of its cost structure, measured as a percent of revenue, shows historical standard deviations of less than 1%. Only COGS has a standard deviation of 2.8%. Under this scale, a gain of 1% from cost reduction can easily be half the growth of a particular year. This is the reason cost reduction has such weight.

The Economy, Sales Growth, and Toyota

So far the story has been simple. Toyota is improving its margins. The market has not fully reacted to the implied value. Toyota is undervalued. However, it might take time for the stock market to realize this value.

As Toyota operates in the highly cyclical automobile industry, demand depends highly on market conditions, technological improvements, and social and political views. In short, if the economy booms, Toyota flies. But alas, the global market has its own dilemma to face.

Toyota's primary markets for its automobiles are Japan, North America, Europe and Asia. In fiscal year 2013, 35.9% of firm revenue came from Japan, 28.0% from North America, 9.1% from Europe, and 18.4% from Asia. The current Japanese economy, as well as the U.S. Economy, is gradually recovering. European sovereign debt crisis and the cooling economic growth in emerging countries bring poorer prospects for business. Together this paints a mixed picture for economic conditions for Toyota. Fortunately, as seen from the tables above, sales growth has much less impact on the stock price than costs. In fact, our scenarios only assume a 3.5% compound annual growth over our 10 yr time horizon (this is below the CAGR of 25% mentioned earlier).

Additionally, Toyota has one of the best balance sheets in the auto space. The company has no net debt, and still carries a AAA rating. Should the economy take a turn for the worse, they are clearly in a strong position to weather the storm.

Conclusion

In conclusion, Toyota's story is that of controlling margins. Even a minor decrease in cost can result in a significant increase in valuation. Firm executives have strong incentives to reduce cost, and the battle has already begun. Yet market prices seem to not reflect the full value created from reducing costs. Current business trends combined with the management's recent efforts positions the stock for a significant move higher. Minor margin improvements with minimal sales growth justify significantly higher prices.

Appendix

All data used is collected through Form 20-F of Toyota as given by EDGAR. The Hanke-Guttridge discounted cash flow model, a modified form of the free cash flow to the firm model, is used. Historical averages are used for margin assumptions, with the following two exceptions: change of working capital is set to zero from -0.1% to reflect the fact that working capital is not a sustainable source of cash; capital expenditure is lowered by 0.5% to reflect the significant downtrend in capital expenditure. The Excel spreadsheet used to produce the results is provided online.

Disclosure: I am long TM.

Business relationship disclosure: Blue Jay Research is a team of financial industry professionals and students. This article was written by Ryan Guttridge, CFA and W. Allen Cheng. Ryan is a Fellow at the Johns Hopkins Institute for Applied Economics, Global Health and Study of Business Enterprise and Allen is a graduate student at Johns Hopkins. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.