The Nutshell

Mining exploration and development companies are risky investment propositions. These companies do not generate cash flow and their success hinges on finding a mineral deposit that can be economically developed into a mine; and then monetizing this deposit.

If exploration companies are indeed successful, the gains for investors are often spectacular - multi-baggers so to speak. This article will introduce such a potential multi-bagger, by the name of Ivanhoe Mines Ltd (OTCQX:IVPAF).

The TSX-Venture Exchange has literally thousands of such exploration companies listed and we will take some time in this article to explain why this particular company stands out and deserves some consideration going into 2014. In the mean time, here are our main points in summary:

- Ivanhoe management has created a multi-bagger before, big time;

- The company has developed three potentially world class projects to an advanced state;

- Ivanhoe is cashed up and will be able to sustain its operations throughout 2014 with current funds;

- Ivanhoe has multiple options to access financing, even under current market conditions;

- The projects in the company's portfolio host a diverse mixture of metals including platinum, gold, zinc, copper and others;

- Ivanhoe has already attracted potent partners.

And now, let us be upfront about the risk profile of this investment proposition. The risks are high, very high in fact, and in a number of ways. But such are the rules for multi-bagging. Investors stand to lose the lot, or win big.

It is certainly a high-stakes playbook we are introducing here. The reason we are doing it anyway stems from the fact that we have identified this particular company as a standout among peers and have come to the conclusion that this company offers a much better chance to offer triple-digit returns than almost all of the rest of its peers.

The Company

The original Ivanhoe Mines discovered the awesome Oyu Tolgoi mine in Mongolia and sold control of the company to Rio Tinto (RIO) in several installments reaping handsome returns for investors who got out at the time of the sale. When Rio Tinto finally took control the original Ivanhoe Mines changed names to Turquoise Hill (TRQ) under which it is still trading.

Meanwhile, Ivanplats had existed very successfully all along and was listed on the TSX in October 2012 raising C$306M in the largest IPO in several years. This company changed names to Ivanhoe Mines in August 2013 marking the end of a one year hiatus after the Oyu Tolgoi sale to Rio Tinto. As a result, Ivanhoe Mines was resurrected under the combined leadership of the original Ivanhoe team strengthened by the existing Ivanplats team members. The main leader of this eclectic group of people is certainly the charismatic Robert Friedland who is acting as the Executive Chairman.

This new Ivanhoe Mines controls three development projects which are all of world class proportion. This company is the only development "junior" with over $1B in market capitalization we know of, and deservedly so considering the caliber of the project portfolio.

At the end of September the company had $107.7M in cash, plus another $101.6M in liquid assets and pre-paid expenses. On the other hand the company reported $23.1M of debt, of which $3.7M were a current liability.

The Assets

The company is developing three flagship assets of world-class dimensions. Each one will be worth in the order of billions should it be developed into a mine or sold off to a major mining house; and each project is located in a high country risk location. In the following we would like to provide a brief overview of the projects with links to more detailed information.

In addition to these three projects, the company also owns several early stage exploration projects in South Africa, the DRC and Gabon. For the sake of brevity we will refrain from discussing the potential of these properties in any detail in this article. A summary is available from the company web site here.

The Platreef Project (South Africa)

The Platreef Project includes a recently discovered underground deposit of thick, 4PE-nickel-copper mineralization, called the Flatreef Discovery, in the Northern Limb of the Bushveld Complex, approximately 280 km northeast of Johannesburg. A consortium of Japanese companies has bought into this project acquiring a 10% stake for a consideration of $290M. These strategic partners not only provided substantial exploration financing, they also open up the possibility of further project funding from Japanese sources.

Note the small difference here: Platreef is the general project with several prospective zones; and Flatreef is the most advanced section of the project. Also note that 4PE stands for the combination of platinum, palladium, rhodium and gold.

As of March 2013, Flatreef's indicated mineral resource totals 28.5M ounces of 4PE; 1.61B lbs of nickel and 794M lbs of copper at a 2g/t 4PE cut-off. The inferred resource stands at almost double the indicated resource.

Despite this enormous resource, there is still considerable exploration potential. For example, the recently announced drill result of 90m@4.51g/t 4PE plus 0.37% nickel and 0.20% copper represents bonanza material and is yet to be incorporated in a resource estimate.

By South-African standards the mineralization is relatively shallow at 800m to 1000m below the surface. The thickness and specific geometry of the deposit indicate amenability to highly mechanized large scale mining techniques. Furthermore, the relatively high platinum-to-palladium ratio indicates potential for comparatively high metallurgical recovery.

Ivanhoe has started to sink an exploration shaft in order to facilitate exploration from underground and also in order to take a bulk sample. An application for mining rights has been filed in June and measures to fulfill black empowerment requirements have been taken which will eventually reduce Ivanhoe's effective interest in the project to 77%.

The Kamoa Project (DRC)

The Kamoa project is situated in the Democratic Republic of Congo and represents one of the highest-grade and largest known undeveloped copper projects in the world. Using a 2% cut-off the indicated resource stands at 36.9B lbs @ 3.04%. Despite this huge resource the project remains open and further substantial resource expansions can be expected.

The project is situated in the very south of the DRC in the border region to Angola and Zambia. This region is a long way removed from the troubled and violent areas in the East of the country.

Ivanhoe controls 95% of this project and the DRC government owns the remaining 5% non-dilutable stake. The company has offered to sell an additional 15% interest to the DRC on commercial terms.

A preliminary economical assessment, or PEA, was published in 2013 showing a mine life of 30 years and an NPV (8%) of $4.2B assuming a copper price of $3.50/lb. Copper price sensitivity is of limited concern. A low-ball copper price assumption of $3.00/lb still yields an NPV (8%) of $2.6B and an IRR of 15.3%, and those numbers are post-taxation.

Completion of a pre-feasibility study, or PFS, is scheduled for 2014 and will most likely improve on the already impressive results of the PEA.

Infrastructure around this project is advantageous and includes access to hydro-electric power and all-year roads fit for heavy trucks. A train line connecting the nearby border town of Dilolo with the port of Lobito in neighboring Angola has just been re-opened. This train line is slated to be extended to pass near the Kamoa project and represents a key argument in favor of the Kamoa project since it improves logistics considerably.

The Kipushi Mine

De-watering of the past-producing zinc-copper Kipushi mine has just been reported to have progressed to the main working level of past mining activities. This has opened up this area 1150m below ground for exploration activities which are in the process of getting started as we are writing this article.

The company is focused on delineating a bonanza zinc deposit below and offset to the main working level that was discovered just prior to mine closure in 1993.

The project is situated in the same general border region of the DRC as the Kamoa project, and will also have access to the planned railway extension. Ivanhoe Mines acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the DRC's state-owned mining company Gecamines.

There is presently no NI 43-101 available. Historical data suggests grades of 38.6% zinc for the aforementioned Big Zinc deposit. Several recent drill intercepts include thicknesses of close to 100m @ 40-45% zinc. If confirmed in grade and anticipated size, this deposit will rank among the richest zinc ore bodies in the world.

Known mineralization around the historic working levels also indicate high copper and zinc grades in yet unknown quantities.

Commodity Mix

One of the compelling factors about this project portfolio lies in the mix of metals present at the three mines. We are especially bullish on the platinum group metals for 2014 present in the Flatreef project. Furthermore, we see a supply squeeze for zinc looming starting 2015 which, if true, should provide a boost for reopening the Kipushi mine. Copper might stagnate at current levels for some time to come, but the economics of the Kamoa project are very robust even under volatile market conditions.

The diversity of products that can be produced from the three mines gives Ivanhoe a great deal of flexibility going into the future making strategic decisions.

Country Risk

In our review of country risk for precious metals mining jurisdictions we computed a very high risk exposure for the DRC and low risk for South Africa. The months since the publication of this review have brought about some shifts.

South Africa has received much negative news coverage with regards to labour issues in the mining sector. Working conditions at existing mines are indeed harsh in places, and rivaling unions have made negotiations practically impossible at times. If the Flatreef project is eventually developed into a mine these issues will affect this asset as well.

There are a few factors that might help to alleviate these issues, however. Mining at Flatreef will be highly mechanized requiring relatively little manual labour. The head count at this mine will be significantly lower than what is the norm at most other gold and platinum mines in South Africa. And workers employed at Flatreef will be relatively highly qualified in comparison. Managing such a work force should prove significantly less problematic.

The issue of Broad-Based Black Economic Empowerment, or BBBEE, has been addressed by Ivanhoe and should not provide stumbling stones on the way to mining the Flatreef deposit.

The Democratic Republic of Congo is an entirely different kettle of fish. Some regions of this country remain no-go zones due to the excessive and barbaric violence seemingly ever-present there. Ivanhoe's projects are located a long way from these regions, but security is certainly an issue.

The DRC has an unfortunate history of expropriating mines from Western mining companies. First Quantum's (OTCPK:FQVLF) Kolwezi project comes to mind, for example. But there is also the very recent success story of Randgold (GOLD) and AngloGold Ashanti (AU) pouring first gold at their jointly owned new Kibali mine ahead of schedule and on budget.

The DRC is certainly one of the most challenging jurisdictions to operate in. Ivanhoe has substantial experience with country risk stemming from its discovery and mine development in Mongolia. Moreover, the DRC government owns substantial stakes in both projects there which will hopefully help in managing this particular risk.

Overall, there is no denying that country risk exposure represents one of the greatest risk factors for investors in Ivanhoe Mines.

Valuation

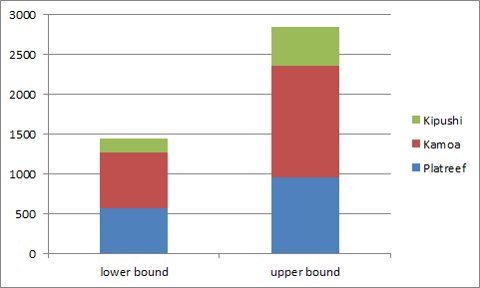

In this section we will suggest valuations for each of the three projects. Since none of the projects has had a feasibility study performed on it we would like to exercise caution and use conservative assumptions. We therefore decided to provide a valuation range for each asset.

The lower bound of our valuation range for the Flatreef project assumes a value of $20 per 4PE resource ounce and proportional values of $0.05 per lb copper and $0.10 per lb nickel. For the lower bound we decided to ignore inferred resources and only considered the indicated category. This leaves us with a value of $740M for the project, or $570M for Ivanhoe's future 77% stake.

The upper bound for the Flatreef project assumes a value of $30 per 4PE ounce in the indicated category, plus $5 per 4PE ounce in the inferred category. Nickel and copper content was scaled proportionately to arrive at a project value of $1.24B, or $954M for Ivanhoe's stake.

The Japanese consortium that bought into the Platreef project paid $290M for a 10% stake indicating a valuation of $2.9B and highlighting the highly conservative nature of our valuation.

For the Kamoa project, we referred to the 2013 PEA and used the NPV (12%) with an assumed long-term copper price of $3.50/lb as the lower bound and the NPV (10%) as our upper bound. This gives a valuation range of $740M to $1.48B for the Kamoa project, or $703M to $1.41B for Ivanhoe's stake.

The Kipushi mine is the hardest to come to grips with since there is no economic assessment or resource statement available for this asset. We therefore referred to the historic resource as a starting point. Since underground workings are available and the ore body can be readily accessed it seemed appropriate to assume a value of $0.1 per lb copper and $0.03 per lb zinc. This leaves us with a lower bound of $262M for this project, or $178M for Ivanhoe's stake.

For our upper bound, we assumed the Big Zinc discovery to live up to expectations and arrived at a project value of $720M, or a value for Ivanhoe's stake of $490M.

The diagram below illustrates our valuation range.

Considering market capitalization, cash and debt, we estimated the enterprise value to $874M. Depending on which bound of the valuation range one subscribes to, we note that the current market valuation credits Ivanhoe mines for somewhere between 30% and 60% of its asset value.

The reason for this severe under-valuation is most certainly a combination of acknowledgment of the country risk exposure, and skepticism about the ability of Ivanhoe to monetize projects of such substantial size.

Another way of looking at these numbers would be in assuming the company fully valued for its Platreef project, and considering the two DRC projects as additional freebies for investors.

Where from here?

Ivanhoe has about another year's worth of funding available at present if the recent cash burn rate is maintained. We would assume that the company will attempt to monetize its projects in one way or another in order to generate funds to continue developing its portfolio.

Ivanhoe could look for project partners to earn a share in one of the projects, or sell one project in order to fund development at the other two. Streaming deals might also be an option, except the country risk might act as a deterrent here.

Should no deal eventuate we are quite certain that access to capital markets is still open for Ivanhoe Mines and capital could be raised through private placements, convertible notes or similar.

From company presentations we deduct that Ivanhoe would like to reach production at its projects, rather than selling the lot for a profit. The Platreef project appears to be the least risky prospect for the company to turn into an operating mine, while production at the Kipushi mine could potentially be fast-tracked.

Investment Thesis and Wrap

Ivanhoe does not take half-measures. The three projects in the portfolio are world class, the management team is among the best in the business and the potential for this company is considerable. And so are the risks associated with mining projects in the DRC, and to some extent in South Africa.

An investment in Ivanhoe Mines is first and foremost a bet on management being able to realize the obvious value of its portfolio, through beneficial deals or through bringing at least one of the projects into production.

The stakes are high here, but this management team has done it before.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.