(Editors' Note: This article covers a stock that is trading at less than $1 per share and/or has less than a $100 million market cap. Please be aware of the risks associated with these stocks.)

Introduction

In this article I'll have a closer look at Golden Queen Mining (GQMNF) which is developing its Soledad Mountain gold project in California. I will start with providing a background of the project and will play with some numbers to see how good and robust the project is when using a different price of gold. Thereafter I will discuss the risks involved with investing in Golden Queen Mining.

As the company isn't fully funded to reach commercial production I will explain how the possible financing terms might look like and if investors in Golden Queen should fear for dilution. This will result in my investment thesis at the end of this article.

As trading in shares of Golden Queen mining on the US exchanges is quite limited, I'd strongly recommend to trade in Golden Queen stock through the facilities of the Toronto Stock Exchange where the company is listed on the main board with GQM as its ticker symbol.

Executive Summary

In this article, I'll prove that Golden Queen Mining's Soledad Mountain project definitely has its merits and will likely be developed as it's a low-capex low-opex asset in a safe region.

I will explain why the share price is trading at less than half of the after-tax NPV6% of the project, as Golden Queen still needs to find sufficient funds to complete the construction works at the project in order to pour the first gold bar in the second quarter of 2015.

Long story short, Golden Queen's project shows extremely robust economics and should even be profitable at $800-900 gold. However, I am waiting to see the company sign a financing agreement before dipping my toes in the water. If an acceptable financing deal can be reached, I would be very tempted to initiate a position in Golden Queen Mining.

The Soledad Mountain project - a background

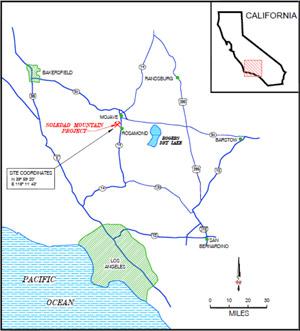

The Soledad Mountain gold-silver project is located in Kern County, southern California, approximately 65 miles north of Los Angeles. The infrastructure in that part of the state is excellent, as a paved county road leads right to the mine gates. Silver Queen Road intersects State Route 14 two miles east of the site. State Route 14 is the major highway, which connects Mojave, Rosamond and Lancaster to the greater Los Angeles area. Within a five mile radius from the Soledad Mountain project, several past producing mines can be found, such as the Cactus Gold Mine and the Tropico Mine.

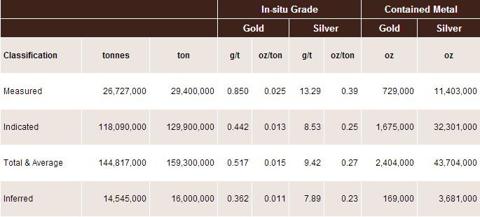

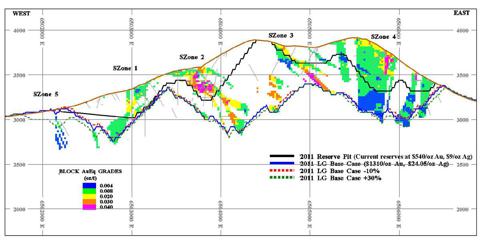

Golden Queen has completed a NI43-101 compliant resource estimate for the project which contains almost 2.6 million ounces in all categories. As almost 95% of the resources are located in the measured and indicated categories, one can be quite certain about the reliability of the resource estimate. The average grade of the project is approximately 0.5g/t. This might sound low but don't forget this is a heap leach project with a relatively simple flow sheet. According to the filed feasibility study, the mine plan is based on a reserve estimate of 66.8M tonnes at an average grade of 0.0188oz/t gold and 0.343oz/t silver resulting in reserves of 1.25M ounces of gold and almost 23 million ounces of silver of which 1.07Moz gold and almost 12Moz silver will be recovered.

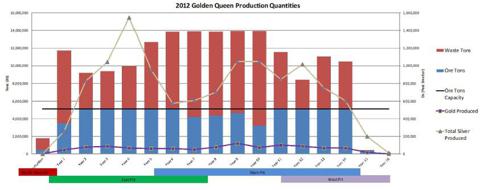

In September 2012, Golden Queen released the results of a feasibility study which outlined a production scenario with an average output of 77,000 ounces of gold per year and almost 900,000 ounces of silver. The initial capex is expected to be very low at just $119M (excluding an additional $31M in sustaining capex). As the average recovery rate is quite decent (85% for gold and 52.5% for the silver), the operating cost per ounce of gold is estimated to be low at just $490 per ounce of gold-equivalent (using a silver/gold ratio of 50). As the silver/gold ratio has increased to approximately 60:1, I will use a cash cost of $575/oz AuEq to reflect the change of the ratio.

Playing around with some numbers

In this part of the article I will update the numbers from the feasibility study a bit, and see how the current gold and silver price influences the NPV of the project. As Soledad Mountain is located in a safe first-world country I feel comfortable using a discount rate of 6%, especially because the project is fully permitted. The appropriate tax rate is 30% and the gold price I'll use in my base case scenario is $1200/oz. I will adjust the initial capex and opex for inflation and will use $125M as initial capex, $40M as sustaining capex and $600/oz AuEq as opex. I will deduct $7M per year from the operating cash flow as allowance for sustaining capital expenditures and further exploration activities.

So let's see what the after-tax NPV of the Soledad Mountain Project is.

Cash Flow per year | Corporate tax rate (30%) | after tax | Discount rate (6% per annum) | NPV6% |

-125000000 | -125000000 | |||

0 | 0% | 0 | 1,00 | 0 |

13000000 | 0% | 13000000 | 1,06 | 12264151 |

53000000 | 0% | 53000000 | 1,12 | 47169811 |

64000000 | 0% | 64000000 | 1,19 | 53735634 |

50000000 | 20% | 40000000 | 1,26 | 31683747 |

37000000 | 30% | 25900000 | 1,34 | 19353987 |

23000000 | 30% | 16100000 | 1,42 | 11349865 |

17000000 | 30% | 11900000 | 1,50 | 7914180 |

46000000 | 30% | 32200000 | 1,59 | 20202678 |

77000000 | 30% | 53900000 | 1,69 | 31903327 |

50000000 | 30% | 35000000 | 1,79 | 19543817 |

60500000 | 30% | 42350000 | 1,90 | 22309452 |

54000000 | 30% | 37800000 | 2,01 | 18785442 |

39000000 | 30% | 27300000 | 2,13 | 12799305 |

42000000 | 30% | 29400000 | 2,26 | 13003648 |

15000000 | 30% | 10500000 | 2,40 | 4381283 |

201,400,327 |

Based on my relatively conservative assumptions, the after-tax NPV6% is$201.4M. As said, this only takes the reserves into consideration. In the next table I will expand the mine life by another 7 years to see which impact this would have on the NPV. Keep in mind the average grade will be lower which will increase the cash cost per gold-equivalent ounce.

Cash Flow per year | Corporate tax rate (30%) | after tax | Discount rate (6% per annum) | NPV6% |

-125000000 | -125000000 | |||

0 | 0% | 0 | 1,00 | 0 |

13000000 | 0% | 13000000 | 1,06 | 12264151 |

53000000 | 0% | 53000000 | 1,12 | 47169811 |

64000000 | 0% | 64000000 | 1,19 | 53735634 |

50000000 | 20% | 40000000 | 1,26 | 31683747 |

37000000 | 30% | 25900000 | 1,34 | 19353987 |

23000000 | 30% | 16100000 | 1,42 | 11349865 |

17000000 | 30% | 11900000 | 1,50 | 7914180 |

46000000 | 30% | 32200000 | 1,59 | 20202678 |

77000000 | 30% | 53900000 | 1,69 | 31903327 |

50000000 | 30% | 35000000 | 1,79 | 19543817 |

60500000 | 30% | 42350000 | 1,90 | 22309452 |

54000000 | 30% | 37800000 | 2,01 | 18785442 |

39000000 | 30% | 27300000 | 2,13 | 12799305 |

42000000 | 30% | 29400000 | 2,26 | 13003648 |

15000000 | 30% | 10500000 | 2,40 | 4381283 |

18000000 | 30% | 12600000 | 2,54 | 4959943 |

17500000 | 30% | 12250000 | 2,69 | 4549214 |

17500000 | 30% | 12250000 | 2,85 | 4291711 |

17500000 | 30% | 12250000 | 3,03 | 4048784 |

17500000 | 30% | 12250000 | 3,21 | 3819608 |

17500000 | 30% | 12250000 | 3,40 | 3603404 |

17500000 | 30% | 12250000 | 3,60 | 3399437 |

230,072,429 |

As you can see, the impact of a longer mine life is only marginal, as the after-tax NPV6% would increase by 'just' $20M.

If I would take an average of both NPV's based on a 50/50 ratio, my after-tax NPV6% is $216M.

So why is my NPV lower than the $517M number given by the company?

First of all, I used a discount rate of 6% whereas Golden Queen used a base case discount rate of 5%. On top of that, my numbers are based on a gold price of $1200/oz, whereas GQM used a three year average trailing price for its calculations (which is $1438/oz for gold and $27.65/oz for silver). These are the only two reasons which explain the discrepancy in the Net Present Value.

On top of that, a minor factor which also contributes to the difference is my conservative approach to inflate the initial capex and opex. As such, I believe my calculations are extremely conservative and as the outcome still is quite good, the Soledad Mountain project seems to be very robust.

What are the risks involved with an investment in Golden Queen Mining?

First of all, you obviously have the gold price risk. I proved in the previous paragraph that the project very likely has an after-tax NPV6% of in excess of $200M, and would even be profitable at $1000 gold. However, should the gold price enter the triple digit territory, the mine would still be profitable but most of the cash flow would be used to repay the initial capital expenditures. As the average cash cost per gold-equivalent ounce during the entire mine life is estimated to be $600/oz and the AISC very likely just $700/oz AuEq, the Soledad Mountain should be able to weather any storm.

A second usual risk in mining projects is the geopolitical risk. However, as the project is located in the USA (which still is a first world country) and is fully permitted, I don't think we should overestimate the geopolitical risks. That's exactly the reason why I feel comfortable using discount rate of just 6% instead of 8% or higher.

A third risk, and in my opinion the most important risk in this story, is the financing risk. Even though a feasibility study was completed and all permits have been received, Golden Queen Mining has been unable to secure financing for the project. Construction has already started and is funded by the proceeds of a $10M private placement last year and a $10M bridge loan. However, I think it's imperative for Golden Queen Mining to secure financing within the next few months to get the project ready for production by Q2 2015 as I'm convinced showing the market that everything is in place to start production might cause a re-rating of the share price.

Why hasn't the company lined up financing yet, and how might the financing terms look like?

There's no apparent reason why Golden Queen wasn't able to secure financing yet, but as the project seems to be robust, I think we should see a definitive financing agreement shortly.

The rule of thumb to finance mining projects is a ratio of 1/3 equity and 2/3 debt. It would obviously a huge blow to the existing shareholders if Golden Queen would decide to raise the $40M it needs for the initial capex by issuing new shares, as that would dilute the current shareholders by approximately 50%.

Fortunately, the Soledad Mountain project should also produce a substantial amount of silver (almost 12 million ounces based on the reserves). As such, it's extremely likely that Golden Queen could attract the interest of a silver streaming company such as Silver Wheaton (SLW). By selling 25% of the annual silver production under a streaming agreement, Golden Queen could easily raise $45-50M and avoid a huge dilution of the common shares.

But selling a silver stream will obviously have an impact on the cash cost per gold-equivalent ounce. I estimate a 25% silver stream would increase the cost per AuEq ounce by approximately $50-60/oz. The next table will show the impact of a silver stream sale on the after-tax NPV6% of the project with the extended mine life.

Cash Flow per year | Corporate tax rate (30%) | after tax | Discount rate (6% per annum) | NPV6% |

-125000000 | -125000000 | |||

0 | 0% | 0 | 1,00 | 0 |

12000000 | 0% | 12000000 | 1,06 | 11320755 |

49500000 | 0% | 49500000 | 1,12 | 44054824 |

59500000 | 0% | 59500000 | 1,19 | 49957347 |

44000000 | 10% | 39600000 | 1,26 | 31366909 |

33500000 | 30% | 23450000 | 1,34 | 17523204 |

18500000 | 30% | 12950000 | 1,42 | 9129239 |

14750000 | 30% | 10325000 | 1,50 | 6866715 |

41500000 | 30% | 29050000 | 1,59 | 18226329 |

72750000 | 30% | 50925000 | 1,69 | 30142429 |

47000000 | 30% | 32900000 | 1,79 | 18371188 |

56250000 | 30% | 39375000 | 1,90 | 20742259 |

51000000 | 30% | 35700000 | 2,01 | 17741806 |

36250000 | 30% | 25375000 | 2,13 | 11896790 |

41250000 | 30% | 28875000 | 2,26 | 12771440 |

14500000 | 30% | 10150000 | 2,40 | 4235240 |

17250000 | 30% | 12075000 | 2,54 | 4753279 |

17100000 | 30% | 11970000 | 2,69 | 4445232 |

17100000 | 30% | 11970000 | 2,85 | 4193615 |

17100000 | 30% | 11970000 | 3,03 | 3956241 |

17100000 | 30% | 11970000 | 3,21 | 3732303 |

17100000 | 30% | 11970000 | 3,40 | 3521040 |

17100000 | 30% | 11970000 | 3,60 | 3321736 |

207,269,921 |

As you can see, selling a silver stream wouldn't have a huge impact on the NPV of the project and might be more beneficial than issuing 50 million new shares.

Investment Thesis

Based on my calculations I dare to say that Golden Queen Mining's Soledad Mountain project seems to be extremely robust and would still be profitable when using a triple digit gold price. On top of that I did not account for a single dollar of revenue from the sale of mining waste as aggregate, which is very likely, according to the company.

That being said, I strongly believe the only thing holding the share price back is the fact that Mr. Market knows that Golden Queen still needs to secure financing to be able to fully develop the project by Q2 2015. However, there are sufficient possibilities, as I think this project should be able to attract sufficient debt. As the mine will produce a significant amount of silver, I think selling a silver stream would be the best way forward for Golden Queen to develop the project.

I made three calculations in this article, and the average value of the three results is approximately $213M which is my fair value for the project (based on conservative assumptions). If further dilution can be avoided, this would result in a price target of $2.14/share. However, as long as the company hasn't secured financing, I think a ratio of 0.6X the NPV is acceptable, resulting in a short-term price target of $1.29/share. This should increase to 0.9X NPV or $1.90 once a financing package without share dilution would be confirmed.

Golden Queen seems to be an extremely interesting company, but I prefer to wait until the project financing has been secured.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.