One of my favorite cartoons for the paranoid is a fitting companion for the graph that follows:

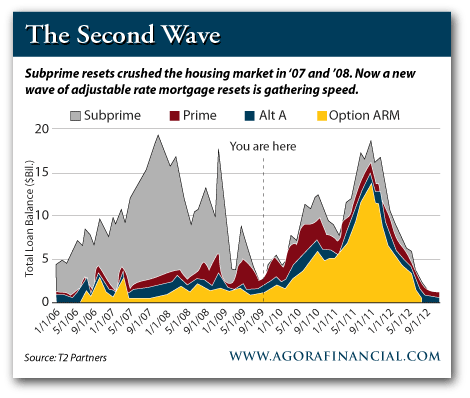

From the 5-Min. Forecast comes a recasting of a familiar graphic to those following the housing market:

This does indeed look like the eye of the storm for mortgage problems, but it may not be as bad as it might look. Here are two reasons:

- The biggest part of the second wave is comprised of Option ARM mortgages, which are not necessarily of low quality.

- Interest rates remain historically low and resets may occur with little increase in payment. I have received reports from individuals who have reset to lower rates during the past year.

However, there are reasons that Option ARMs could become a problem. If rates rise and the resets are to higher payments, mortgagors may not be able to refinance into a lower rate fixed mortgage if their house is under water. The possibility of defaults (both forced and strategic) will increase if interest rates rise.

In many cases Option ARM mortgages were selected so the buyer could "reach" for the maximum possible house. Such buyers will have a higher probability of owing more on their mortgage than the house is worth on the market. This is especially true for buyers in the peak bubble years 2005-06 when the Option Arm was most popular.

The latest numbers I have seen indicate that about 23% of all mortgages are under water. For the reasons mentioned above, the percentage for Option ARMs may be higher. The graph indicates that the total value of Option ARM resets to occur over the next two years is in excess of $200 billion. If interest rates rise the potential for defaults from this category of mortgage alone could easily exceed $50 billion.

So that means that minimizing the reset problem will depend on maintaining low interest rates. Lower interest rates are most likely in a weak economy. If the economy is weak employment will continue in the doldrums and personal income will remain depressed. If incomes are depressed then the ability to meet mortgage payments is diminished.

The very things that could minimize the reset problem are the things that could push default rates higher. This is a circular dependency and the circle is definitely not virtuous.

Disclosure: No stocks mentioned.