Introduction

In this article, I'll have a closer look at Red Eagle Mining (OTC:RDEMF), which aims to develop its Santa Rosa underground mine in Colombia. I'll start with providing some background information on the project, whereafter I will use the Preliminary Economic Assessment to alter some assumed inputs to see how robust the project is using different gold prices. Thereafter, I will discuss the main risks involved with investing in Red Eagle Mining, and subsequently, how I think this project will be funded and why I think the funding risk is very low. This will result in my investment thesis at the end of this article.

Source: Technical Report

As the volume on the US Exchanges is quite low, I'd strongly recommend to trade in Red Eagle Mining through the facilities of the TSX Venture Exchange, where the company is listed with "RD" as its ticker symbol.

All images in this article were directly sourced from the company's website, corporate presentation and NI43-101-compliant technical reports.

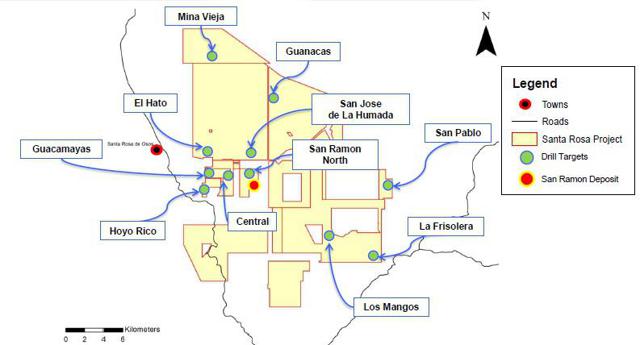

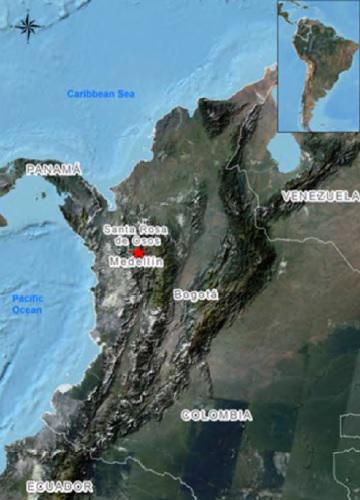

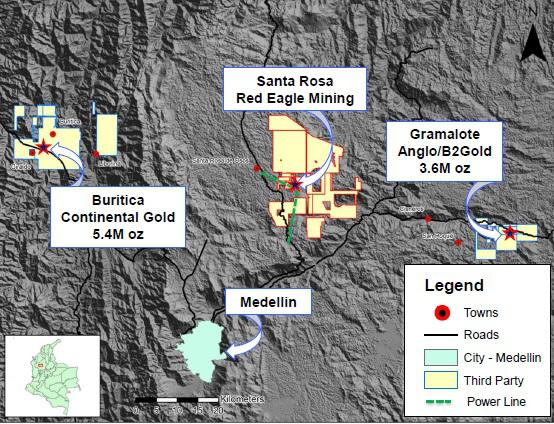

The Santa Rosa project - a background

The location of Red Eagle's Santa Rosa project is as good as it gets in Latin American countries. The project is located less than 45 miles from the town of Medellin, which is one of Colombia's largest cities. This is very advantageous, as it means there will be a labor force available to work at Santa Rosa within driving distance. Furthermore, the infrastructure is a dream, as the project is located just 5 miles from a paved highway, which is really beneficial to keep the operating expenses and initial capital expenditures down, as no major infrastructure upgrade work is needed.

Source: Company Presentation

Red Eagle completed a

Preliminary Economic Assessment (PEA) at the end of Q3 last year. The results of this PEA were better than I anticipated, as the capital expenditures ($91M) and operating costs ($540/oz) were lower than expected. This assessment only took the underground ounces at the San Ramon zone into consideration, but I'd like to emphasize there's a huge potential to expand the current resource base, as there are several high-priority drill targets within wheelbarrow-distance from the San Ramon processing facility (see next image).Source: Company Presentation

As the cash cost and capital expenditures are low, and as there's additional exploration potential on Red Eagle's tenements, I'm very confident the San Ramon zone of the Santa Rosa project will be a mine in the very near future.

Playing with some numbers - determining the viability using different assumptions

In this subtitle, I will try to determine how the NPV of the project holds up, using some more conservative assumptions. I will start with the base-case scenario using a very conservative gold price of $1150/oz, using a discount rate of 8% and a tax rate of 34%. I will use a discount of 8% on the output (as there's currently a 4.5% NSR on the project payable to other companies (of which 1.5% is not payable on the San Ramon zone) and 3.2% to the Colombian state), an initial capex of $95M, of which $7M gets repaid in year 2 of operations, and a cash cost of $600/oz (which is 10% higher than the estimated cash cost of $540/oz). I will deduct the sustaining capex in the years when it's due.

Keep in mind these calculations are my own, and are in no way official guidances from the company. The tables should be considered as back-of-the-envelope calculations, and provide merely a starting point to do your own due diligence on this company.

Cash Flow per year | Corporate tax rate (34%) | After tax | Discount rate (8% per annum) | NPV8% |

-95000000 | -95,000,000 | |||

57,500,000 | 0% | 57500000 | 1.00 | 57,500,000 |

52000000 | 0% | 52000000 | 1.08 | 48,148,148 |

26000000 | 30% | 18200000 | 1.17 | 15,603,567 |

13500000 | 34% | 8910000 | 1.26 | 7,073,045 |

8000000 | 34% | 5280000 | 1.36 | 3,880,958 |

14000000 | 34% | 9240000 | 1.47 | 6,288,589 |

16000000 | 34% | 10560000 | 1.59 | 6,654,591 |

15000000 | 34% | 9900000 | 1.71 | 5,776,555 |

34000000 | 34% | 22440000 | 1.85 | 12,123,634 |

10500000 | 34% | 6930000 | 2.00 | 3,466,725 |

71,515,812 |

So, after using a gold price of $1150/oz, the after-tax NPV8% of the project still is $71.5M, which emphasizes the San Ramon zone seems to be very viable.

Let's now see what happens should gold go to $1400/oz.

Cash Flow per year | Corporate tax rate (34%) | After tax | Discount rate (8% per annum) | NPV8% |

-95000000 | -95,000,000 | |||

79000000 | 0% | 79000000 | 1.00 | 79,000,000 |

69500000 | 18% | 56990000 | 1.08 | 52,768,519 |

40000000 | 34% | 26400000 | 1.17 | 22,633,745 |

24000000 | 34% | 15840000 | 1.26 | 12,574,303 |

16000000 | 34% | 10560000 | 1.36 | 7,761,915 |

26000000 | 34% | 17160000 | 1.47 | 11,678,808 |

26000000 | 34% | 17160000 | 1.59 | 10,813,711 |

24000000 | 34% | 15840000 | 1.71 | 9,242,488 |

45000000 | 34% | 29700000 | 1.85 | 16,045,986 |

19000000 | 34% | 12540000 | 2.00 | 6,273,122 |

133,792,596 |

So at a gold price of $1400/oz, the after-tax NPV increases to almost $134M.

In a third scenario, I will expand the mine life by another 8 years, at an average production rate of 50,000 ounces per year. I think this scenario is quite likely, as there are a lot of drill targets on the Santa Rosa project. To allow for sufficient drilling to expand the resources, I will budget for an annual drill budget of $3M per year, and an additional sustaining capex of $10M in years 9 and $12M in year 10. I will continue to use a gold price of $1400/oz.

Cash Flow per year | Corporate tax rate (34%) | After tax | Discount rate (8% per annum) | NPV8% |

-95000000 | -95000000 | |||

76000000 | 0% | 76000000 | 1.00 | 76000000 |

66500000 | 18% | 54530000 | 1.08 | 50490741 |

37000000 | 34% | 24420000 | 1.17 | 20936214 |

21000000 | 34% | 13860000 | 1.26 | 11002515 |

13000000 | 34% | 8580000 | 1.36 | 6306556 |

23000000 | 34% | 15180000 | 1.47 | 10331253 |

23000000 | 34% | 15180000 | 1.59 | 9565975 |

21000000 | 34% | 13860000 | 1.71 | 8087177 |

32000000 | 34% | 21120000 | 1.85 | 11410479 |

4000000 | 34% | 2640000 | 2.00 | 1320657 |

32000000 | 34% | 21120000 | 2.16 | 9782646 |

26000000 | 34% | 17160000 | 2.33 | 7359630 |

24000000 | 34% | 15840000 | 2.52 | 6290282 |

26000000 | 34% | 17160000 | 2.72 | 6309696 |

25000000 | 34% | 16500000 | 2.94 | 5617607 |

25000000 | 34% | 16500000 | 3.17 | 5201488 |

21000000 | 34% | 13860000 | 3.43 | 4045602 |

11000000 | 34% | 7260000 | 3.70 | 1962153 |

157,020,671 |

As you can see, even though I deduct $30M in additional exploration expenses and add $22M in sustaining capex, the after-tax NPV8% still increases to $157M. If I would now use a weight of 40% for scenario 3, and 30% for both scenarios 1 and 2, the average after-tax NPV8% for this project is approximately $125M, which I will also use as fair value for the project at this moment.

The main risks involved with an investment in Red Eagle Mining

A first risk is the geopolitical risk. Colombia obviously isn't as safe as Canada or the USA, but I'm relatively positive about the permitting and operating risks for the Santa Rosa project. As the project will be an underground mine, the permitting should be much smoother than companies which aim to develop a large open pit mine, which would leave a scarred landscape. As such, I think a discount rate of 8% for this project in Colombia is a fair assumption. The company has submitted its environmental impact assessment (EIA) to the relevant authorities, and should receive the feedback relatively fast. The entire permitting stage is expected to be completed before the end of this year.

Topography. Source: Technical Report

A second risk is the commodity price risk, and in Red Eagle's case, one should keep an eye on the gold price. However, as the cash cost per ounce is just $540 for Red Eagle's Santa Rosa project, there's a sufficient operating margin, and as I explained in an earlier subtitle, the project will remain viable as long as the gold price remains in the four-digit range. This once again emphasizes how robust the Santa Rosa project is, and every ounce of gold added to the resource estimate will have an impact on the Net Present Value of the project.

A third risk usually is the financing risk. Even though the total initial capital expenditure is actually very low, at less than $100M, Red Eagle will have to source the funds from somewhere, and in the next subtitle, I will have a look at some financing options.

How will this project be financed?

The initial capex of Santa Rosa is just $91M (of which $7M will be recovered through the recovery of Value Added Taxes), which is interestingly low and shouldn't be too difficult to find. Using the rule of thumb of 1/3 equity and 2/3 debt, Red Eagle Mining will have to secure approximately $30M in equity. This might sound like a difficult task for a small company, but I'm convinced Red Eagle has several options on the table.

A first option is to sell another NSR on the project. Red Eagle has already been successful in selling NSRs to the Liberty Metals and Mining fund, which is an investment arm of Liberty Mutual Insurance, a large Boston-based broker. The last 1% NSR sale in December of last year brought in almost $4.2M, indirectly implying a total value for the project of $420M. There's currently a 4.5% NSR on the project (3% owned by Liberty and 1.5% owned by Grupo Bullet), so there's room to sell some more NSRs. A sale of an additional 2.5% NSR should easily bring in $10M which is already 1/3 of the equity funding need.

For the remaining $20M, I'll assume a conservative point of view and will assume this will be raised through issuing new shares. As I expect the share price of Red Eagle to increase after completing the feasibility study, I'd assume the company will be able to raise $20M through issuing 50M new shares at $0.40/share. This would bring the total share count to 125M shares. As Red Eagle also will need to raise some working capital, I think the total share count will very likely be 140M. This would mean a 110% dilution for the current shareholders, but it's a necessary evil, as the dilution will be necessary to bring Santa Rosa into production.

Why I'm not worried about the future financing needs

I'm extremely confident in Red Eagle's capability of raising the necessary $90M to fund the capital expenditures. When looking at the list of main shareholders, two funds have major positions in the company. Liberty Metals and Mining ("LMM") already owns 19.9% of the company, and Appian Natural Resources owns 15.3%. I am convinced that both funds will maintain (and increase) their stakes in Red Eagle Mining. Should LMM stay at 19.99% and Appian increase its position to 19.99% as well, these two funds would take care of 32 million of the expected 64 million issued shares.

On top of that, both funds will very likely be instrumental in sourcing or providing the debt financing. As Liberty is part of an insurer, I wouldn't be surprised if it would step in and provide the $60M in debt financing, as it would be a win-win situation. By providing the debt, Liberty (A) will receive a nice interest yield on the debt it provides, (B) will win big on its share position if the project goes ahead and starts producing and (C) will start to generate cash flow through its Net Smelter Royalty. So Liberty definitely has a huge incentive to push this project forward, and a $60M debt financing could easily be carried by its balance sheet (which totals $120B).

As Appian and Liberty both are funds with a long-term investment horizon, I am very confident they will both step up the plate to get Santa Rosa financed when the feasibility study confirms the economics of the project. Thanks to the low capital expenditures and the backing of two funds with deep pockets, I'm not worried at all about how this project will be financed.

Investment thesis

Red Eagle has a highly profitable, low-cost mine, and I think the feasibility study won't bring any surprises. As the company is also backed by some funds with deep pockets, I don't expect any problems in bringing this project into production. On top of that, I firmly believe the San Ramon zone is just a first step of developing the Santa Rosa project. As you could see on the maps, there are several high-priority drill zones at the Santa Rosa project, which each could add hundreds of thousands of ounces, which would extend the mine life.

Appian Resources and Liberty Metals and Mining have a vested interest in getting San Ramon into production, and will very likely also be able to offer debt financing to Red Eagle, should it be necessary. As Liberty has already invested $12.5M to purchase a 3% NSR, it will definitely want to have cash flow sooner rather than later, as if the project won't produce, the $12.5M investment will be worthless (because the return on the purchase of an NSR are based on the production).

According to my calculations, a fair value of the project would be approximately $125M, and if Red Eagle would indeed have to issue 64M additional shares, the NPV/share would still be $0.89, based on 140M outstanding shares.

After the most recent private placement, Red Eagle will have in excess of $10M in cash, which is more than sufficient to cover its planned expenses in 2014, and I think "all systems are go" for Red Eagle. I'm convinced San Ramon will be a mine and will be generating cash flow by 2017.

Disclosure: I am long RDEMF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.