Ticker | % Owned by Institutions | Top 3 holders | % top 3 own | Discount 7/9/10 |

38.5% | 19% | -7.8% | ||

44.4% | Karpus, Lazard, RiverNorth | 26% | -6.6% | |

35.8% | 1607, Lazard, Shufro Rose | 27% | -14.2% | |

SGF | 43.2% | City of London, Lazard, 1607 | 36% | -12.4% |

APF | 56.2% | 1607, City of London, Lazard | 28% | -12.3% |

MAY | 41.8% | City of London, Lazard, 1607 | 39% | -12.5% |

26.8% | 1607, Karpus, Gramercy | 20% | -13.2% | |

51.1% | Lazard, 1607, Karpus | 42% | -11.4% |

a vote of the shareholders, unless the bylaws say that only the Board can amend them -- which is always the case. As a result, just about every resolution that comes up for a shareholder vote is merely "precatory": like little Oliver Twist, CEF shareholders must wave their empty gruel cups at the fund Directors while politely asking: "Please... may I have some more?"

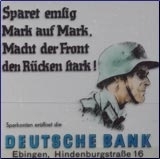

a vote of the shareholders, unless the bylaws say that only the Board can amend them -- which is always the case. As a result, just about every resolution that comes up for a shareholder vote is merely "precatory": like little Oliver Twist, CEF shareholders must wave their empty gruel cups at the fund Directors while politely asking: "Please... may I have some more?" a sufficient number of votes to be elected as a Director. Therefore... each of the four incumbents will continue to serve..." In fact, these directors lost by a margin of 43% to 57%, but they still clung to control. These four incumbents also failed the "majority of all shares" test for re-election at three other DWS/DB funds, but they continue to "hold over" there as well.

a sufficient number of votes to be elected as a Director. Therefore... each of the four incumbents will continue to serve..." In fact, these directors lost by a margin of 43% to 57%, but they still clung to control. These four incumbents also failed the "majority of all shares" test for re-election at three other DWS/DB funds, but they continue to "hold over" there as well. (H) any other derivative positions held of record or beneficially by the Shareholder and any Shareholder Associated Person and whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding has been made, the effect or intent of which is to mitigate or otherwise manage benefit, loss or risk of share price changes or to increase or decrease the voting power of, such Shareholder or any Shareholder Associated Person with respect to the Corporation’s securities; (iv) set forth, as to the Shareholder giving the notice Shareholder Notice and any Shareholder Associated Person covered by clauses (ii) or (iii) of this paragraph (2) of this Section 9.11, (A) the name and address of such Shareholder, as they appear on the Corporation’s stock ledger and current name and address, if different, and of such Shareholder Associated Person and (B) any other information relating to such Shareholder and Shareholder Associated Person, if any, that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for, as applicable, the proposal and/or for the election of directors in a contested election pursuant to Regulation 14A (or any successor provision) under the 1934 Act and the rules and regulations thereunder; and (v) set forth, to the extent known by the Shareholder giving the notice Shareholder Notice, the name and address of any other Shareholder or beneficial owner of shares of the Corporation’s stock supporting the nominee for election or reelection as a director or the proposal of other business on the date of such Shareholder’s notice... the applicable Shareholder Notice; (vi) with respect to each nominee for election or reelection as a director, be accompanied by a completed and signed questionnaire, representation and agreement required by Section 9.12 of these Bylaws; (vii) set forth any material interest of the Shareholder providing the Shareholder Notice, or any Shareholder Associated Person, in the matter proposed (other than as a Shareholder of the Corporation); and (viii) include a representation that the Shareholder or an authorized representative thereof intends to appear in person at the meeting to act on the matter(s) proposed. With respect to the nomination of an individual for election or reelection as a director pursuant to Section 9.11(a)(1)(iii), the Corporation may require the proposed nominee to furnish such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve an in independent director of the Corporation or that could be material to a reasonable Shareholder’s understanding of the independence, or lack thereof, of such nominee. If a nominee fails to provide such written information within five Business Days, the information requested may be deemed by the Board of Directors not to have been provided in accordance with this Section 9.11. (See Exhibit 3.1 Form 8-K 4/17/09)

No brains means no headache.

No brains means no headache.Do not feel singled out. While many closed end funds are advised and managed in the best interests of their stockholders, The Singapore Fund is just one of those which currently are not. It is City of London’s intention to consider placing similar resolutions on future proxy statements of other deeply discounted funds where we hold significant positions and whose Boards are similarly unresponsive to stockholder mandates to narrow those discounts.

Disclosure: Long all except MAY and EEA