The Chubb Corporation (CB), through its subsidiaries, provides property and casualty insurance to businesses and individuals. The company operates through three segments: Personal Insurance, Commercial Insurance, and Specialty Insurance. The company is member of the S&P Dividend Aristocrats index. Chubb has increased dividends for 45 years in a row. The company announced a 5.70% dividend increase in February 2010, plus a 14 million share repurchase initiative.

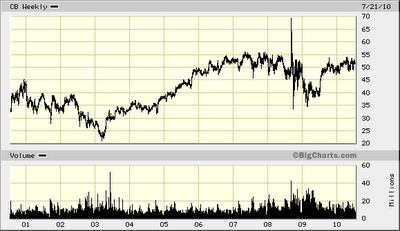

Over the past decade this dividend stock has delivered an average total return of 5.90% annually ().

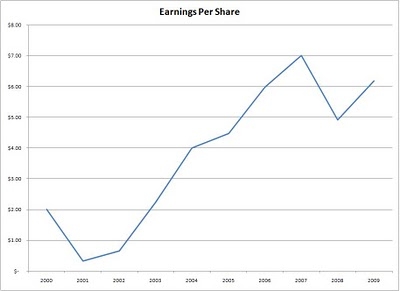

The company has managed to deliver a 13.30% average annual increase in its EPS between 2000 and 2009. Chubb is expected to earn $5.30 share in FY 2010, followed by $5.60/share in FY 2011 ().

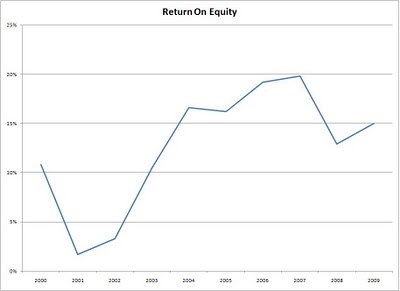

The Return on Equity () has remained around 15% for the latter part of the last decade, after falling to as low as 2% earlier. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

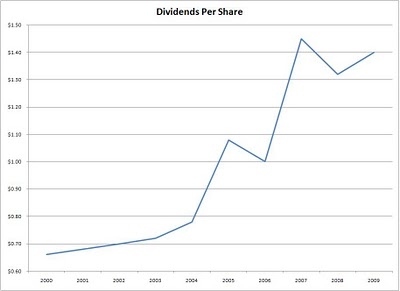

Annual dividends have increased by an average of 8.70 % annually since 2000, which is slower than the growth in EPS. The disparity is mostly due to a gradual decrease in the dividend payout ratio and the billions of dollars the insurer has spent on stock buybacks. A 9 % growth in dividends translates into the dividend payment doubling almost every eight years. If we look at historical data, going as far back as 1984, Chubb has actually managed to double its dividend payment every nine years on average ().

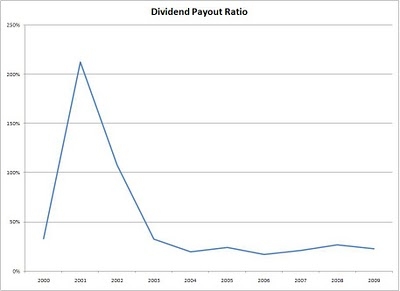

The dividend payout ratio () has been on the decline, and is still much lower than my 50% threshold. 2001 and 2002 stick as outliers, since earnings per share were lower on high underwriting combined ratios. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, Chubb is trading at 9.20 times earnings, yields 3.10% and has an adequately covered dividend payment. In comparison, rival Travelers Cos (TRV) trades at a P/E multiple of 8 and yields 2.90% , while Cincinnati Financial (CINF) trades at a P/E multiple of 9 and yields 5.90%. Berkshire Hathaway (BRK.B) is also a competitor, although it trades at a P/E of 22, and does not pay a dividend.

The company does spend a lot of its cash flow on stock buybacks, which could prove beneficial in the long run since it could provide above average dividend growth over time for the same effort. I like the company and its business model. Insurance companies like Chubb (CB) are a way for investors to fill in the need for exposure to the financial sector, after several high profile payers like Citigroup (C) and Bank of America (BAC) cut their distributions.I believe that the company is attractively valued at the moment; thus I would be looking forward to adding to my position in Chubb (CB).

Full Disclosure: Long CB