Castlight Health Inc. (CSLT) held one of the most bizarre IPO's of recent memory on 3/14/2014 selling 11,100,000 shares of B Class stock at $16/share, which was above their $13-$15 initial projected range. Goldman Sachs and Morgan Stanley were the main underwriters handing the IPO.

Although on the surface nothing about the IPO seems unusual it becomes borderline bizarre when considering that the $16 pricing gave CSLT, a company who at the time had 2013 revenues of $13 million, net losses of $62 million, and an accumulated deficit of $131.2 million, a $1.5 billion valuation. Yes, billion. Had this valuation stood the company would have been valued at over 100x revenues, a statistic that I have come to learn has become a scarlet letter for stocks destined for the pink sheets, the average return for an IPO valued at over 100x revenues at IPO over the next three years was -92.5%.

This lunacy of the IPO, remember we're still talking about the first day here, got even worse as the stock proceeded to trade as high as $41.95 (over $3 billion valuation at that point and over 300x revenues) but has since, including a bloodbath yesterday (5/7/2014) and today, come back to reality - trading at $10.50 currently.

This article will discuss the absurd unprofitability of CSLT's business, the risks and almost certain failure that faces the company going forward, their most recent quarterly results, and will present a case for being short the stock.

Who is Castlight Health Inc., what do they do, and what does the market potential look like?

CSLT, which has also gone by 4 other names in the last 6 years, operates a cloud based software platform that helps employers gain control over healthcare spending. Their platform also helps employees perform basic related tasks (finding a doctor, getting a blood test, etc.) and helps them better understand their health care benefits in general. Employees can use the CSLT platform to make decisions based on quality, price, and location of service providers rather than an at random search or using word of mouth. The platform provides search engine like results that are filtered into a list based on preferences and data points entered in by the user, such as those listed above. The search results based portion of the platform has a very Google type feel but expands on the search engine capabilities by narrowing down the results based on the particular benefits plan being offered. The platform further takes any and all data and organizes the information into easy to understand summaries that are beneficial to users (past care costs, categories of care, claims data, etc.). For instance, CSLT's software helps the employee distinguish what the household and the company have spent on health care and makes relevant suggestions on how to save on costs, like using urgent care centers instead of emergency rooms during non-traditional hours. Finally, the platform is accessible from a computer, mobile devices, and CSLT also operates a call center that serves customers. Of all the things I dislike about CSLT, this is not one of them. The software is solid, it provides clear cut benefits to both parties involved, and has multiple touch points that make using it easy.

CSLT's target market is broad but they are currently focusing on employers who have decided to self-insure. Of the $3.1 trillion in healthcare spending that will take place in 2014, and the $620 billion that will be paid by US employers, CSLT believes they directly target about $5 billion of the general market.

The US has the largest healthcare market in the world and according to the BLS, health care benefits account for roughly 8% of total employee costs and that figure is rapidly increasing. According to a 2013 survey, approximately 61% of US employees who rely on health care funded by an employer are covered by health plans by employers that have elected to self-insure (including 94% of the covered employees of U.S. employers with more than 5,000 employees), which more directly exposes employers to the volatility of health care expenses and the burdens of designing health care benefits.

A 2013 Institute of Medicine report estimates that approximately 30% of U.S. health care spending in 2009 was wasted due to factors such as inflated prices, the provision of unnecessary services and inefficient delivery of care, which I found surprising. I knew that there was a bit of this going on as hospitals and doctors have car and boat payments to make but this figure is borderline criminal. Two fundamental causes of these inefficiencies have been the absence of transparent information and the misalignment of economic incentives, which make it difficult for employees and their health care providers to make judicious health care choices. As a result, better managing health care expenses will have a direct impact on financial performance, making employers eager for solutions that can help them manage this growing problem. So, as I've stated above, there is a clear cut value-add to the platform and services that CSLT provides and there's plenty of market potential to capture, that's for sure.

CSLT believes they have the following competitive advantages that will make them the market leader for the self-insuring niche in the short term but the overall health care market in the long term:

- Company believes they have the largest comprehensive single source data base of healthcare information that is being combined with a unique ordering platform - increasing their ability to effectively deploy their value-add

- Company believes they have a better analytical engine that provides several level of benefits not found in competitive platforms - allows them to personalize recommendations for employers for specific benefits programs in which they should invest based on the health characteristics of their populations

- Company believes they are the only current solution that forces all participants in the health care dynamic to make "market based" decisions - enabling employers to take actions to optimize benefit plans, reduce inefficient outcomes and foster behavioral change.

- Company believes their independence from offering health care plans allows them to have no real or perceived conflict of interest - allows them to integrate with other key third-party data sources, programs, and applications on an open architecture basis

- Company believes they have structured their platform to closely mimic other internet based services employees are already using - increasing levels of engagement and ease of use

Of the above listed competitive advantages to me the biggest market differentiators would be their market based approach to their "search engine" feature, because the search forces the employee to have a valid reason for picking the option for treatment they picked - whether that be price, location, quality so on and so on, and their ability to integrate into a wide variety of third-party platforms. The first reason theoretically should go a long way into improving efficiency of employer sponsored programs and the second theoretically should go a long way into improving the share price at CSLT. One of these is actually happening.

CSLT's competition is essentially every company currently deriving revenues from the global healthcare market, software companies, the actual employers they are looking to serve, and anybody else with experience in coding and access to capital. Health care might be the most competitive market in the world, arguable with the finance market, and the barriers to entry to serve this particular function in the market are extremely low. Obvious competitors would be Change Healthcare, Healthsparq, Aetna (AET), UnitedHealth Group (UNH), etc. As a matter of fact, CSLT has disclosed recently that several of their customers and a few large insurers have begun investing heavily into developing platforms similar to their own, furthering the need for them to continue to innovate or become irrelevant. I think this is a significant long term risk that can't be controlled, but more on that later.

What do the financials look like and what is the growth strategy?

CSLT'S financials look like bankruptcy waiting to happen. First I'll go over the financials of the preceding three years, then we'll discuss the most recent quarter results which more or less confirm what the three year data shows.

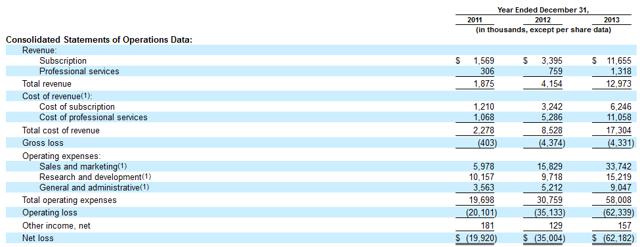

Everything about the above image is bad. Revenues in 2013 were $12.97 million on $58 million in expenses for a net loss of $62 million, unbelievable. That expense figure includes $33.74 million on sales and marketing, $15.29 million on R&D and $9.04 million on administrative costs. It really is hard to believe even staring at the data. Expenses and net losses have tripled in the last three years. The company has seen an uptick in revenues that has outpaced expenses in terms of percentage but the total volumes of the revenues make that irrelevant. This company is spending an incredible amount to generate nothing close to a profit.

As for the most recent quarter, the scenario doesn't get much better. Here are the highlights:

- Total revenue of $8.4mm

- Subscription revenue of $7.5mm

- Operating loss of $24.3 mm

- Total cash of $239.7 mm

- Net loss of $24.28 mm

CSLT expects full year revenue to be between $40-$41 million, operating loss to be between $75-$77 million, and net loss to be between $75-$77 million.

That's a $75 million loss on a 300% increase in revenues. This company currently has an unprofitable business model that has no chance of closing the net loss gap. Even if these guys can continue to add to their client base all that will do is accelerate the front end expenses which are all realized up front and accelerate the net loss. The more business they do, the more money they lose. That's their bottom line for the time being.

Now the plan at CSLT is to take on all the expenses up front, price those into the fees charged for subscriptions down the line, hope that they are in business and can maintain their clients long enough to recover initial expenses, and eventually turn a profit - assuming all other variables stay the same. What they didn't anticipate, at least I'm hoping they didn't, was taking on all the front end cost and right when they got to the point of margins turning positive (per customer) that they would become irrelevant. Margins theoretically will turn positive on a client specific basis shortly after the implementation phase is completed and remain positive perpetually. During the high growth and implementation phase, the phase that the company is in right now, the company should operate at a significant net loss. Remember, that's what has been planned for.

Meanwhile, as CSLT is expanding, its own customers, competitors, and the companies that provide the information needed for CSLT to operate its platform are all working on in-house or more competitive solutions to use as soon as possible. What CSLT has become is a place holder, a currently convenient solution to a serious problem for the market. As soon as the market can develop their own solution, they'll dump CSLT'S platform. The moment that the information providers develop their own platforms, they'll have a direct conflict of interest with doing business with CSLT going forward, which would be the end of the line at CSLT. It makes sense to do business with them now because CSLT is a monetizable outlet for otherwise non-profitable information. The moment that changes, the show stops at CSLT, a very scary realization for longs.

There really isn't a question of if this will happen in my mind, but when. The barriers to entry are incredibly low. Developing the software and paring it together with the information is the only hard part of this equation. I think that a large client of CSLT's like Wal-Mart could very easily allocate funds to a software company or themselves in an "R&D" capacity and develop a software platform to serve the functions of CSLT's. At that point it's simply outbidding for the information to run the platform, which they could do being of substantially larger size, or using the information providers' platform and outsourcing an already outsourced cost. CSLT will eventually be pushed out of the market they created because there are no real barriers to entry. It could happen at any time and in the time it does take to happen they'll be digging a larger and larger accumulated deficit hole by operating at larger and larger losses.

Why hasn't it happened already if it's so easy to do? I think that both parties that are developing platforms (insurers and current customers) are waiting to see if this platform actually serves its stated purpose (saving money) and are using CSLT as a low cost lab experiment before making the full investment. If you think the large insurance companies selling CSLT their information for their platform don't have the cash and capabilities to put together an analytics engine and an application, you're wrong. The fact that they are and have disclosed to CSLT that they are developing the actual platform shows that they want to be as close to a finished product as possible if and when they can see definitive results from implementation of CSLT's platform. For both parties it makes sense, especially the insurers. They can use this type of service as an extra value-add to sell to clients or if they can acquire enough clientele they can spin off a company in CSLT's image that would be more efficient and less dependent on outside parties. If anything, CSLT should make the market more bullish the above listed competitors.

The big underlying issue here is that doing both actions needed to run the platform that CSLT runs is not profitable or viable long term. What I mean is CSLT has to both buy the information (we've discussed the risks of that already) and run the platform as a primary driver of revenue. An insurer, for example UNH, wouldn't have to buy the information (a large portion) OR use this platform to primarily drive revenue. So they can make pricing concessions, contractual concessions, and simply offer this as a retention feature. In the same way that Google can offer the wide variety of free products they offer, for example operating a travel booking service with no markup (squeezing companies that do that primarily for revenue), and use the products as a "loss leader" to drive traffic to its main revenue source is how a UNH could and most likely will operate this service in the future.

CSLT's growth strategy in a way tries to address some of the issues discussed above and is as follows: use base of large enterprise customers to further their data gathering and analytics while leveraging their relationships for referrals, invest further into direct and indirect sales channels, further develop their existing platform, develop secondary and tertiary platforms that serve additional functions, and invest in making sure their platform can integrate with third-party application developer apps.

Clearly CSLT want to innovate (this will cost money) and they have every reason in the world to want that. I just don't see a situation where they innovate to the point that their core business can go belly up and they still come out fine. Operating under the assumption that in the near future CSLT will not be deriving revenues from their current platform, they can barely do this right now, I am not willing to bet that their innovative genius can come up with another solution that is profitable or that they can sell to a new round of investors. They literally are on the clock and on a clear path to insolvency.

My bear case isn't just built on competitors or customers developing an alternative solution. Looking at the actual economics that the CSLT model has presented, it's hard to see where the margins turn positive (net) and where the company begins to actually make money. Their sales cycle alone ranges between 3 and 24 months and their implementation cycle ranges around the same duration. That's operating in the current environment. It stands to reason that as CSLT and their customers develop a greater familiarity with the current version of the platform that they'll (and future clients) demand more specific and tailored versions for their particular needs. That will only serve to increase both sales and implementation costs, not what CSLT needs at this point.

Based on their cash on hand and expected losses for 2014, they have the funds that dilution isn't a huge concern right now, I'll give them that much at least. I still don't want anything to do with these guys based on the overall model and uncertainties that come with guessing when they will be cut off from their life blood of information and the fact that they plan such large losses on top of their large accumulated deficit.

Where's the trade?

I think the trade is to be short or to avoid at all costs. Even at today's valuation this stock is grossly overvalued. I happen to think they have a fair value of $0. Outside of their physical assets I don't think they have a single sellable item in liquidation. Nothing they have can't be developed in time by outside sources and my entire bear case is based on that. They are completely dependent on the willingness of third-parties to feed them information and that information at any time could be sold to a higher bidder or cut off from the providers. Any uptick in the stock has been met with aggressive selling, including a 15% early day pop which was sold into an eventual 11% drop in the stock today. That followed a 15% loss yesterday headed into earnings. The stock is down 75% from its 52 week highs and I don't expect it to ever see anything close to that number again. Business as usual won't cut it going forward. The model is broken, the stock is broken, and the bizarre story of CSLT will be a fun one to watch until it eventually ends. Don't buy the stock but make sure you have a clear view of the show. Good luck to all.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.