In the week following its 1Q earnings conference call QuickLogic (NASDAQ:QUIK) shares declined approximately 30%. The catalyst for this price action was the company's forecast for a drop in second-quarter revenue reflecting an inventory adjustment at the company's largest customer, Samsung. While the forecasted revenue decline for second quarter is disappointing, in our opinion the totality of the information the company presented on its conference call about its near-term and long-term growth outlook was overwhelmingly bullish.

In fact, we're fairly certain that the immediate fixation on 2Q revenue variability will prove entirely irrational as it ignores the overwhelming evidence that suggests the company is on the cusp of a very robust revenue ramp. As such we would use the recent stock price weakness to establish an aggressively outsized position in anticipation of a very strong fundamental story unfolding over the 2H'14 and 2015.

First, putting the bad news in context. As previously indicated the company forecasted - that due to an inventory correction at Samsung - its revenue for 2Q'14 will be approximately $6.5 million versus $11.2 million it booked in 1Q'14. It is important to note that QuickLogic's current business with Samsung is entirely comprised of display bridges. These are chips that, as the name suggests, bridge I/O mismatches between a tablet's applications processor and its display.

While display bridges and the design wins the company has with Samsung (Galaxy Tab 3.0 7" and Galaxy 3.0 Tab Lite) have been a good bit of business for QuickLogic over the past year, management has been clear that display bridges are not the future of the company. QuickLogic's future is sensor hubs (ArcticLink III S family) and mobile FPGAs (PolarPro 3) for smart connectivity. And on these fronts the conference call was unabashedly bullish.

While QuickLogic management is notoriously guarded about disclosing any details about its customers or its design wins, we believe the conference call shed enough light on near-term progress and opportunities that we can have a high degree of confidence in a strong 2H'14 and 2015 revenue ramp.

Likely Design Wins in Samsung Flagship Devices. By way of background, all flagship Android phones have a mobile FPGA chip in them that drives a number of functions such as LEDs, bar code transmission, and TV remote control. The market for this chip is estimated to be about $150 million this year and has historically been supplied solely by Lattice Semiconductor (LSCC).

In October 2013 QuickLogic announced the availability of its smart connectivity mobile FPGA for this market (the PolarPro 3) and provided the following update on its conference call (bolding ours):

"We continue to believe that our PolarPro 3 platform family will begin to generate production revenue during the second half of 2014. The three most common functions supported by programmable logic devices in flagship smartphones today are driving one or more LEDs, TV remote control, and barcode transmission.

We have developed proven system blocks (or PSBs) that have been fully tested in order to give our customers the assurance they can easily deploy these functions in our CSSP platforms. We introduced the first of these PSBs to drive one or more LEDs last December. And the second, for TV remote control earlier this month. We have completed the testing for our barcode transmission PSB and will issue a joint press release with our partner Mobeam next week.

A tier 1 mobile OEM has granted PolarPro 3 technical approval for use in a production design. Our goal at this OEM is to intercept a production device from an ongoing smartphone platform during the second half of 2014. At that point, we will be positioned to compete for the next major platform."

When it comes to "tier 1 mobile OEMs" the list is short. In fact there are primarily two: Apple (AAPL) and Samsung (OTCPK:SSNLF). Given QuickLogic's stated focus is on the Android ecosystem and that QuickLogic already has a strong relationship with Samsung - having qualified as a direct supplier and having secured three display bridge design wins with them - we naturally assumed that Samsung is the tier-1 mobile OEM being referenced here.

The additional reference to a partnership with Mobeam removes any shadow of a doubt as Mobeam's barcode transmission technology is currently exclusive to Samsung's flagship devices. Mobeam's website states that its technology is: "Available exclusively on the Galaxy S4, the Galaxy Note 3, and the new Galaxy S5." Therefore the goal of intercepting a production ready device with a chip that supports Mobeam can only be a reference to Samsung.

What is the production device QuickLogic is planning to intercept at Samsung? The recently released Galaxy S5 makes the most sense as the other two - the Galaxy S4 and Note 3 - have been in the market for quite some time. The opportunity for QuickLogic to get its PolarPro 3 included in the Galaxy S5 platform could come as a supplier to a second PCB design for that phone or as a supplier to a spin-off design like the rumored Galaxy S5 Premium model due out in a couple of months. And what is the "next major platform" at Samsung that QuickLogic says it is going to compete for? That could very well be the Galaxy Note 4 which is due to be released in the September/October timeframe.

While the inferences we have drawn regarding Quicklogic's role in the Galaxy S5 and Galaxy Note 4 may not prove exactly correct it is important to not lose sight of the forest for the trees: the mobile FPGA smart connectivity market in Android phones has been estimated at about $150 million this year and until now has been served entirely by Lattice Semiconductor. QuickLogic's PolarPro 3 is now production qualified at Samsung, the largest Android smartphone OEM, and it has immediate design opportunities with this chip at Samsung. This overwhelming bullish fundamental development was lost in the noise about QuickLogic's $5 million shortfall in 2Q display bridge revenue.

ArcticLink III S1 - Making Rapid In-roads into the Sensor Hub Market. The company's first generation sensor hub the S1 was released last October and the guidance provided at that time for initial revenue in 2H'14 is still operative. One of the main attributes of the company's FPGA-based sensor hub is that it provides optimal design flexibility. This flexibility can be seen in the company's three-tiered marketing/sales strategy which it fleshed out on its recent conference call.

At the high-end of the market OEM's flagship devices like Apple's iPhone and the Samsung's Galaxy Smartphones and Galaxy Notes, have sensor subsystems comprised of discrete sensors feeding data to a sensor hub (historically a micro-controller, MCU) which is running the OEM's proprietary sensor fusion algorithms.

For example, Apple uses best in class MEMS sensor vendors to provide the requisite sensors for the iPhone (motion, pressure, light, biosensors, environmental etc.) coupled with its M7 sensor hub, which is based on an MCU from NXP. The sensor hub accepts sensor data from the sensors and runs Apple's proprietary sensor fusion software/algorithms to wake the processor and execute tasks. For Apple, Samsung and other OEMs competing in the high-end of the market the software/algorithms are considered family jewels and are a huge point of differentiation in the market.

Quicklogic's S1 sensor hub is ideally suited to this segment of the market as it is far lower power than the microcontroller-based solutions that currently serve this market. The S1 has the additional advantage of being field programmable which enables OEMs to update the sensor software/algorithms on devices in the field much the way OS updates can be pushed out to devices already in the field. Microcontroller and ASIC-based sensor hubs do not support this in-field programmability.

At the lower end of the market where OEMs are interested in lowering costs and accelerated time to market and are not concerned with proprietary sensor fusion algorithms QuickLogic has created an off-the-shelf catalog solution whereby the S1 sensor hub comes loaded with Sensor Platforms, Inc. algorithm library. When it announced the S1 in October 2013, QuickLogic indicated that this tier of customer was likely to be the first to market with devices using S1-based sensor subsystems and last week confirmed that they are "engaged with numerous potential OEMs and are working on multiple smartphone and wearable designs" with initial revenue expected in 2H'14.

In the middle-tier the company has developed a hybrid approach where an OEM can use the S1 catalog solution with Sensor Platforms algorithm as a known good starting point and working with QuickLogic can customize the sensor hub with proprietary software and algorithms. At all three tiers of engagement QuickLogic's model enables OEMs to choose the best discrete sensor suppliers for their design.

The ArcticLink III S2 - A New Product Announcement that Almost No One Heard. In our minds, even more compelling than the near-term opportunity in smart connectivity and sensor hubs is the company's announcement of its second generation sensor hub, the ArcticLink III S2. To be clear, to say that management "announced" the new chip may be overstating things a bit, it was more like they "mentioned" the new chip but only to those dialed into their conference call. Other than the conference call, QuickLogic did not issue a press release about the S2 nor has it yet to include information about the S2 on its website. So, unless you were dialed in to the company's conference call chances are you do not know about it.

Our sense is that under normal circumstances the company would have waited until the chip sampled (this summer) before making a formal announcement. However, given the guidance for 2Q revenue shortfall the company decided to lift the kimono a bit so investors could get a better picture of the company's actual strategic positioning in sensor hubs.

In our opinion, the S2 could be a game-changer for QuickLogic and a disruptive entrance into the sensor hub market. The chip has taped out, is scheduled to sample this summer and will purportedly be in production by year-end.

The ArcticLink III S2, in addition to being a more advanced and powerful sensor hub, integrates into the chip the aforementioned connectivity features currently provided by a discrete mobile FPGA. To recap (again): every flagship Android smartphone includes a discrete mobile FPGA chip for smart connectivity functions. This $150 million market for discrete chips has historically been served by Lattice Semiconductor (and now by QuickLogic via its PolarPro 3).

By integrating the functions of this chip as features of the new ArcticLink III S2 sensor hub QuickLogic enables OEMs to eliminate a discrete chip from the design. This in turn lowers the bill of materials, lowers overall system power, and frees up valuable PCB space. And in the process it allows QuickLogic to capture the value of this $150 million market for itself.

In addition to having the expanded programmable logic capability, the S2 has twice the computational capacity of the S1 - meaning it can handle a greater number and more advanced sensor algorithms - and it operates at two-thirds lower power than the S1. This is a hugely important consideration to mobile OEMs as a sensor subsystem with an extremely low power requirement is critical to providing always-on and context aware applications and features.

At only 300 microWatts the first generation S1 sensor hub power profile is a small fraction (about 1/10th) of the power profile of MCU-based sensor hubs from Atmel (ATML), STMicro (STM), and NXP (NXPI) who supplies the microcontroller to Apple's M7 sensor hub. The new S2 extends this low-power advantage even further as it sips power at an incredibly low 100 microWatts, which translates into a 97% power savings over MCUs. Again, lowering the power requirements of the sensor subsystem is critical to enabling the always-on context-aware services envisioned in next generation devices.

The S2 is pin compatible with the S1 and it was developed to allow OEMs to reuse the intellectual property they develop and the investments they make around the S1 in future S2-based (and S3) designs. This should translate into the ability to get OEMs to buy in to the long-term S-family product roadmap and enable QuickLogic to develop customer stickiness.

In our view, the substantial relative power advantage that QuickLogic's S-family has over MCU-based sensor hubs coupled with the S2's integration of the connectivity features currently provided by discrete mobile FPGAs, gives QuickLogic a compelling strategic advantage in the sensor hub market.

The Competition.

Microcontrollers (MCUs). QuickLogic's primary competition in the sensor hub market is from the microcontroller (MCU) suppliers that currently serve this market. It should be noted that up until now "Always-On, Context-Aware" has been a marketing slogan and not an actual capability of a smartphone. That is, despite the uniform agreement that "always-on, context-aware" mobile devices and services is the next big trend in wireless, handsets that utilize MCU-based sensor hubs do not (cannot) actually offer always-on capabilities.

This suggests to us that the power of the sensor subsystems in these devices has not reached the threshold that makes always-on and context-aware technological realities. At a scant 3% of the power required for an MCU-based sensor hub, QuickLogic's ArcticLink III S family has the potential to be a radical game changer in this regard.

Lattice Semiconductor. As we noted several times in this article QuickLogic has designs on the $150 million mobile FPGA market currently served by Lattice. QuickLogic's product strategy is two-fold. First, it plans to compete head-to-head with Lattice for a share of this market via its PolarPro 3. Second, it intends to cannibalize this market by integrating the connectivity features directly into its S-family of sensor hubs. The functions of the discrete mobile FPGA will become features of the ArcticLink III S2.

Based on the update from Lattice's 1Q conference call, it does not appear that Lattice anticipated that their mobile FPGA chip could be cannibalized by QuickLogic, nor does it appear that it has made much of a push into sensor hubs. In response to a question about competitive dynamics, Lattice management's response strongly suggests that they considered the sensor hub and connectivity two discrete functional products: "we don't play in sensor hubs as much as people think, we are kind of a complementor to the sensor hub…what we do is add the feature rich enhancements."

It bears repeating that the ArcticLink III S2, by integrating the connectivity features into the sensor hub could be a radical disruption to both the existing micro-controller based sensor hubs and to Lattice's existing market and be a game-changer for QuickLogic.

InvenSense. In Seeking Alpha articles on InvenSense (INVN) it is common to see QuickLogic listed as a primary competitor. However, in our minds while there is likely some overlap at the low-end of the market we think the companies' products are far more complementary than competitive.

For the low-end of the smartphone market where cost and time to market are essential, QuickLogic has developed its integrated catalog solution - an S1 sensor hub pre-loaded with algorithms from Sensor Platforms, Inc. Also for the low-end of the smart phone market Invensense sells an integrated sensor solution - motion sensors (accelerometer, gyro, and magnetometer), motion sensor processor, and its proprietary algorithms in an ASIC package. In low-end designs where motion processing is the only sensor functions in the subsystem it is fair to conclude QuickLogic's catalog solution and Invensense will compete.

However, in designs that include other sensor domains such as contextual, environmental, biosensor etc. it is far more likely to be the case that an Invensense motion processing solution will be sitting next to a QuickLogic sensor hub. The Galaxy S5 is a good example of this as it includes Invensense's 6-axis motion processor (accelerometer and gyroscope) and an MCU-based sensor hub which receives and processes sensor data from the other sensors in the device: pressure sensor, heart rate monitor, step counter, etc. The proliferation of sensors throughout the entire range of devices and the attendant need for sensor fusion will continue to drive the market for discrete sensor hubs.

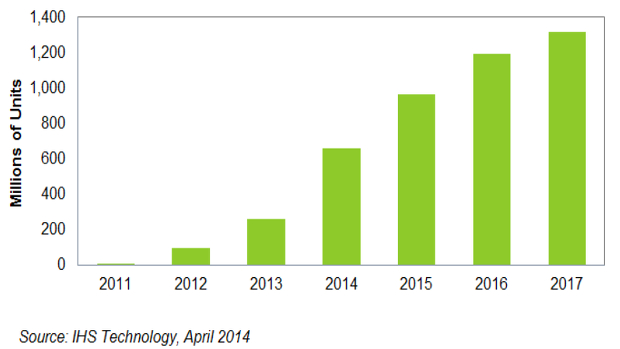

Conclusion. Nine months ago QuickLogic unveiled a product roadmap and market strategy for becoming a leading provider of sensor hubs to the mobile market, one of the fastest growing segments of semiconductors. IHS Technology forecasts that the sensor hub market is poised to double over the next three years from about 650 million units currently to 1.3 billion units in 2017. This translates into a revenue potential of several billion dollars annually.

As noted, on its earnings conference call one week ago management provided an update on its strategy to address this burgeoning multi-billion dollar market - an update that in our minds was unequivocally positive. Inexplicably this was overshadowed by news of the short-term inventory correction which prompted a 30% correction in the stock price. We think this price correction will prove short-lived.

In the very short term the prospects for QuickLogic securing designs wins for its PolarPro 3 in Samsung devices that sell 10s of millions of units quarterly could translate into a sharp inflection in new product revenue in 2H'14 and 2015.

In the mid term the opportunity to cannibalize the entire $150 million mobile FPGA market should translate into a materially higher stock price. At 4-5x EV/sales - which is fair valuation for a semiconductor business with 50-55% gross margins - this market alone would translate into a stock price for QUIK of $12-15.

In the longer term the company's strategic positioning in the rapidly growing sensor hub market should provide it a leading role in a market that, using IHS Technology estimates, is worth several billion dollars per year.

With a market capitalization of less than $200 million and with the company on the cusp of a sharp revenue inflection, QUIK shares are a compelling buy. In our opinion, in rather short order (perhaps with 3Q guidance in less than 3 months) the market will come to see QUIK in a new light and as such the shares are poised to be upwardly revalued.

Disclosure: I am long QUIK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.