Rubicon, Tenon, and ArborGen

Rubicon is based in New Zealand. Shares trade on the pink sheets (OTCPK:RUBNF) and the New Zealand Stock Exchange as RBC. The stock is highly illiquid with over 80% of the float owned by insiders and hedge funds.

Rubicon is a unique holding company with equity stakes in two separate businesses: Tenon (TNNFF) and ArborGen (ARBR). Let me start out saying that I hardly care about the Tenon asset. Tenon is leveraged to the new housing market in the U.S. and should be a beneficiary of the broader housing market going forward. Management estimates this business will print upwards of $45 million in EBITDA at mid-cycle.

ArborGen is much more interesting. Rubicon owns roughly 1/3 of ArborGen through a joint venture structure with timber giants International Paper and MeadWestVaco (MWV). Monsanto (MON) was supposedly an initial partner but backed out at the last minute. ArborGen is a bio-forestry asset with first mover status, lacking a global integrated competitor after acquiring CellFor in 2012. The company is the leading developer of biotechnology tree seedling products and is in the late stages of achieving full-scale commercialization of genetically-engineered eucalyptus seedlings, which sell at a twenty-fold premium to industry standard "open-pollinated" seedlings.

While ArborGen has an established base of customers and dominant market share in the United States for OP, MCP, and varietal seedlings, there are several near and long term catalysts that could push profitability up exponentially. ArborGen's Brazilian eucalyptus strategy has been fully operationalized and the company is set to sell five million varietals in year one (ArborGen has active product development relationships with leading forestry players for genetically-engineered eucalyptus which would sell at significantly higher ASPs relative to varietals being sold this year). Rubicon management has quantified the opportunity in Brazil at a net present value of roughly $600 million vs. RUBNF's market capitalization of ~$120 million today.

The opportunity in Brazil only scratches the surface. ArborGen is in the late stages of commercializing its genetically-engineered cold-tolerant eucalyptus seedlings in the U.S. The company has received approval to conduct trials in seven states (which have been ongoing since 2007) despite overwhelming public opposition. The government should be highly incentivized to approve full-scale commercialization of GE seedlings as global wood consumption is projected to increase substantially in coming years, and biomass alternative energy has been outlined as a key component of future energy production requirements. Disease-resistant plum and papaya seedlings are already permitted in the U.S., and yields accruing to landowners using GE seedlings can be up to 14x those derived from standard OP seedlings. It has been estimated that global deforestation alone may account for up to very substantial portion of total annual carbon emissions, and given the amount of public funds being poured into curbing emissions, allowing more trees to be grown at a much quicker pace could be viewed as a relatively straightforward (albeit somewhat simplistic) solution. The USDA recently halved the approval time for commercialization of certain biotechnologies.

Rubicon management has previously quantified the opportunity upon full adoption of just four of its biotech seedling products as a combined capitalization of $2 billion vs. RUBNF's market capitalization of ~$120 million today. When commenting on the ArborGen opportunity several years ago, Stephen Walker (head of asset management at Goldman Sachs JBWere) responded "If you could go back and buy Monsanto when it was just starting to develop genetically modified seeds, would you do it?" ArborGen has several ties to Monsanto and has succeeded in penetrating key government positions.

ArborGen is not simply a one hit wonder dependent upon USDA approval of its cold-tolerant eucalyptus seedlings. The company sold 273 million seedlings in FY2013 (+9.5% y/y) while revenues improved 14% y/y to $30 million. Going forward, ArborGen's revenues should continue outpacing volume growth due to continued adoption of MCP and varietal seedlings, which sell at substantial premiums to OP seedlings. OPs sell for a meager 5 cents per unit while MCPs and varietals ("advanced") can sell for roughly 40 to 65 cents per seedling (GE seedlings sell for $1.50 to $1.90 apiece). In 2014, ArborGen is targeting 50% growth in advanced pine seedling volumes. Advanced seedling sales as a percentage of total volumes increased over 500 basis points during 2013. In countries such as New Zealand, over 75% of ArborGen's seedling volumes are MCP or varietal compared to under 15% in the U.S.

ArborGen IPO

A public listing of ArborGen would eliminate numerous complexities attached to Rubicon's operating structure including (1) ongoing financing needs from joint venture owners, (2) lack of investor awareness and sell-side coverage, and (3) geographic and exchange rate complexities arising with foreign ownership of U.S. based assets. Accordingly, ArborGen filed offering documents for an IPO in 2010 with an offering price midpoint of $17 and implied valuation of roughly $475 million. Goldman Sachs and Citigroup were slated to underwrite the deal.

Shortly after filing, the company announced deferral of its IPO. Note this was a miserable year for IPOs with a large proportion being withdrawn or deferred. Additionally, clean-tech and biotechnology IPOs fared terribly with many trading at fractions of their initial listing price. That said, the timing may have been a bit early as the vast majority of ArborGen's revenues were being consumed by R&D while commercialization of GE eucalyptus was murky at best.

Today, ArborGen is nearing profitability (Rubicon expects run-rate profit by the end of CY2015). The business is highly diversified with established footholds in pulp and paper, wood, and bio-power end markets. More importantly it appears that USDA approval of GE eucalyptus could be on the horizon, which would magnify ArborGen's valuation by an unknown factor. The southeastern U.S. is experiencing substantial capital inflows for biomass energy and wood-pellet facilities, many of whom ArborGen has already garnered supply agreements with (I have personally reached out to several who have indicated to me that they are buying ArborGen's non-GE seedlings). Additionally the Brazilian opportunity is now on the table, and Rubicon's goal of pushing 50% growth in premium advanced seedling volumes in 2014 could be a boon for margins and accelerated profitability.

A recent address from Rubicon's chairman indicates that the ArborGen objective is clear - "to have the company independently listed on an international stock exchange… this is typically affected by way of an initial public offering of shares to new shareholders… more commonly referred to as an IPO." Hedge fund owners have pressured Rubicon in the past for a swift listing of ArborGen in an effort to unlock value. This is clearly in management's best interests as they own significant blocks of RUBNF stock.

Highly Concentrated Ownership Structure Suggests Strong Conviction in ArborGen's Story

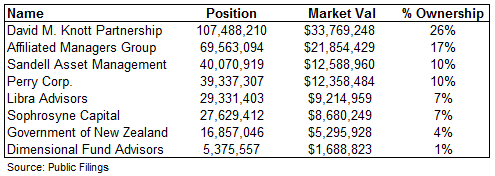

It is unclear whether Rubicon would continue to hold its ArborGen shares through a public offering, however, hedge fund owners and Rubicon insiders have held shares for many years and remain bullish on the company's prospects. If Rubicon were to offer its stake to the public at similar terms as the prior IPO, the valuation for Rubicon's stake would approach $150 million, or more than double Rubicon's market capitalization today. I personally am more intrigued in the long-term ArborGen story and would be more than happy to hold shares in the independently-listed company. Below is a summary of Rubicon's ownership structure according to various internet sources and publicly available filings:

Sandell Asset Management previously valued the entire Rubicon entity at between $1.21 and $1.65 NZD per share (3x today's share price). Edison Investment Research recently valued the entire business at $0.84 to $0.87 NZD, or more than double today's price. I personally believe that while the stock's price may accurately reflect 2014 and 2015 EBITDA expectations discounted for execution risk, the potential for either an ArborGen liquidity event or full-scale GE eucalyptus commercialization far outweighs underlying business trends for this year or the next. We have the 2010 IPO offering price range as a baseline valuation for ArborGen which suggests substantially higher intrinsic value for Rubicon shares. The real question is what kind of valuation ArborGen would command in a public offering today, and whether or not that will come attached with a green light from the USDA, giving birth to "the next Monsanto" and paving the way for exponential growth at ArborGen.

Disclosure: I am long RUBNF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.