Background

On May 28, 2014, Washington Prime Group (WPG) was spun-off from Simon Property Group (SPG). WPG operates a portfolio of 54 strip centers and 44 smaller enclosed mall properties totaling approximately 53 million square feet. Its focus is on producing stable, steady cash flows across market cycles, and its properties are occupied by anchor tenants such as Dillard's (DDS), Kohl's (KSS), Target (TGT) and Macy's (M).

WPG plans to be a retail real estate company positioned for growth. Its national portfolio, consisting of 98 properties in 23 states, represents significant scale from inception. It has a strong balance sheet with an investment grade credit rating (S&P: BBB Stable). As an independent company, it will have access to multiple sources of capital that it plans to use to fuel its growth as a developer, re-developer and acquirer of both strip centers and malls.

WPG has a market capitalization of approximately USD2.9 billion and an enterprise value of about USD4.8 billion. Its total debt outstanding is around USD1.9 billion. For more information on its business please refer to its June 2014 presentation and latest Form 10.

What we find attractive about WPG

We highlight the main points below:

- Impressive management team lead by Mark Ordan, CEO of WPG.

- Healthy ongoing relationship with SPG.

- Very stable revenues and earnings over the last five years.

- Low leverage levels.

- Sustainable dividend payout.

Mark Ordan was named CEO of WPG on February 25, 2014. He seems to have been handpicked for the job. David Simon, SPG's Chairman and CEO, stated in the press release, "We worked closely with Mark during the Mills transaction and found him to be a top-rate executive with particular expertise in creating value for an organization. I am very confident Mark has the retail real estate operating experience to lead this exciting new company." Mark Ordan inherits a well-seasoned management team with the top four executives having an average tenure of approximately 24 years at SPG. Their competence is reflected in WPG's financials as highlighted later in this section.

WPG will also benefit from continued relationships with SPG. Richard Sokolov, SPG's President and COO, will also become Chairman of the board of directors of WPG, and David Simon will also serve as a director of WPG. Post-separation, David Simon holds about a 7% stake in WPG. There is an on-going property management services contract that is automatically renewed every year. In addition, certain of WPG's support functions will be provided by SPG on a transitional basis for up to two years. This gives WPG more time to integrate the spun-out properties into its business.

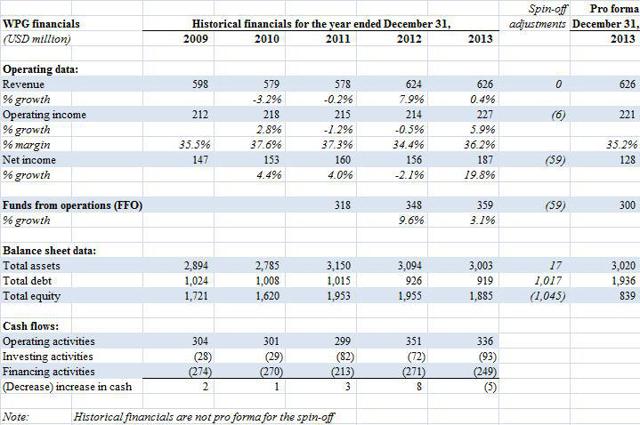

WPG has a very stable financial profile as shown in the table below. Since 2009, net income has grown from USD147 million to USD187 million, a CAGR of 6.2%. Operating cash flow has also risen over this period to USD336 million. Historically, leverage has been very low. Post-separation, WPG carries approximately USD1 billion in additional loan issues, the proceeds of which have been retained by SPG. This reduces shareholder equity by a similar amount as shown in the column labeled "spin-off adjustments" below. The additional interest expense burden of USD30.1 million and a further adjustment regarding non-controlling interests, results in 2013 net income of USD187 million falling to a pro forma amount of USD128 million. A similar adjustment to 2013 FFO, results in a pro forma FFO of USD300 million.

(Source: WPG's Form 10)

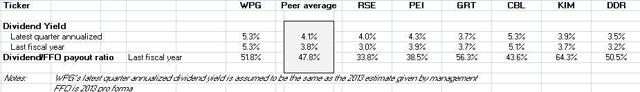

As a newly-formed company, WPG has not paid any dividends yet. However, it expects to distribute at least 100% of its REIT taxable income to its shareholders. It calculates that its 2013 annual dividend would have been greater than USD1.00 per share.

(Sources: Bloomberg, WPG's Form 10, company filings and author's estimates)

As shown in the table above, just paying USD1.00 per share would equate to a dividend yield of 5.3% in 2013. This is substantially higher than its peer average of 3.8% in 2013 and the average of the latest quarter annualized of 4.1%. WPG's dividend/FFO payout ratio is 51.8%, slightly above its peer average of 47.8%. We note, according to its cash flow statement, WPG paid SPG an amount equal to USD1.55 per share in 2013 whilst remaining net cash flow neutral. This supports our view that WPG has the ability to sustain this level of dividend payout.

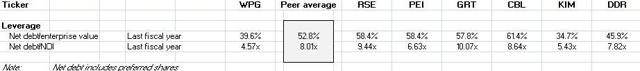

As shown in the table below, WPG's leverage is substantially lower than its peers.

(Sources: WPG's Form 10 and company filings)

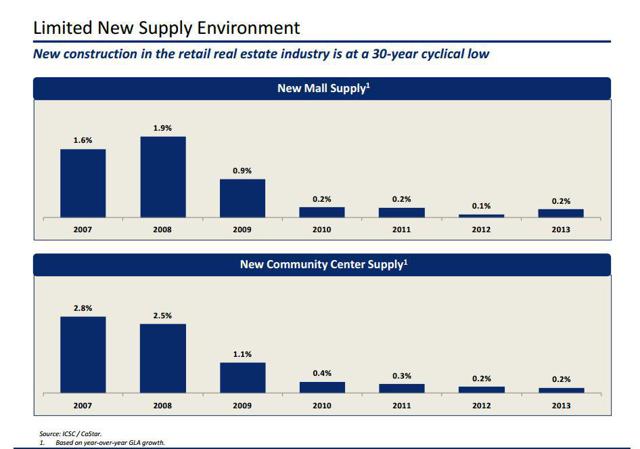

Its net debt/enterprise value is only 39.6% vs. the peer average of 52.8%. Its net debt/NOI ratio is 4.57x vs. the peer average of 8.01x. This low leverage gives WPG a competitive advantage, potentially allowing it to raise new financing at a lower cost than its competitors due to superior credit ratios. As a REIT with a required annual distribution target, its retained earnings available to fund acquisitions, development, or other capex are nominal. However, its current low leverage enables WPG to essentially fund future growth in spite of the aforementioned restriction. We calculate WPG could borrow a further USD1.5 billion before its key credit ratios, as shown above, are in line with the peer average. WPG sees plenty of opportunities to deploy this capital. For example, in the slide below WPG highlights that new construction in the retail real estate industry is at a 30-year cyclical low.

(Source: WPG's June 2014, presentation)

What's the potential upside?

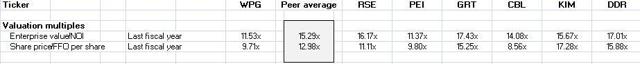

WPG trades at about a 25% discount to its peer group average.

(Sources: Bloomberg, WPG's Form 10 and company filings)

In the table above, WPG's enterprise value/NOI for the last fiscal year was 11.53x vs. the peer group average of 15.29x. Its share price/FFO per share ratio is only 9.71x vs. 12.98x for its peer group. WPG currently trades in line with PEI, which has the lowest valuation metrics. However, PEI has a much lower dividend yield of 3.9%, far higher leverage metrics and is about half WPG's size in terms of number of properties and total square feet. Given WPG's superior operating and leverage ratios, it should not be trading at the bottom end of its comparable range. We calculate that, in order to be valued in line with its peers, WPG's share price can rise to about USD25. This implies there is upside potential of approximately 33% from current levels.

What are the catalysts that will unlock value?

As a recent spin-off, we believe WPG is flying under the radar of many investors at the moment. Since its distribution date of May 28, 2014, its shares have fallen nearly 11% indicating on-going selling by SPG's shareholders who, particularly in the case of institutions, find they are holding an unwanted stock. We think the following catalysts will contribute to an upward correction in WPG's share price over the next few months:

- Easing of the temporary selling pressure mentioned before.

- WPG announcing its first quarterly results as a listed company. This should be around late July/early August if its peers are any indication of the timing.

- The announcement of its first dividend payment. We believe this will confirm WPG's capacity to maintain top line dividend payouts vs. its peers.

- WPG's core operating and valuation metrics being included in more data feeds.

- Possible key index, ETF and sector portfolio inclusions.

- Establishing a dividend history over time.

Most of the above are not a question of "if they will happen". They will happen during the normal course of business over the next few months.

What are the risks?

We highlight some of the key risks facing WPG's shareholders below:

- WPG's properties face a wide range of competition from other retail properties to other retail channels such as catalogs and e-commerce websites. This affects WPG's ability to lease space and the level of rents it can obtain.

- Sears Holding Corporation (SHLD), Macy's Inc, and J.C. Penney Co. (JCP) collectively represent about 30% of WPG's total portfolio square footage. This is a large exposure to a few clients, some of whom are struggling at present.

- WPG frequently co-invests with third parties through partnerships, joint-ventures etc. It does not have sole decision-making authority regarding 11 properties that it currently holds through joint ventures with other parties.

- WPG has yet to pay a dividend as an independent company. Shareholders should gain comfort from WPG's obligation to distribute at least 90% of its REIT taxable income. However, until a reasonable dividend history is established some investors may shy away.

Conclusion

As a recent spin-off from its much larger parent, we think WPG is currently flying under the radar of many investors. Post-separation, its shares have fallen about 11% indicating selling pressure from SPG's shareholder base who may not want to hold the spin-off distribution. We expect this will change following its first quarterly filing as an independent company. This should highlight to the wider investment community, the many positive attributes of WPG that we believe are not being fully reflected in its current valuation. We see a dividend yield easily north of 5% at these share price levels and over 30% upside potential if WPG trades in line with its peer group average.

Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings, and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in WPG over the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.