PTC Therapeutics (NASDAQ:PTCT) has a mission to "leverage our knowledge of RNA biology to bring novel therapeutics to patients affected by rare and neglected disorders." The science at PTC is focused on discovering drugs that address so-called "nonsense" genetic mutations and specifically "premature termination codon mutations." These are defects in the DNA sequence in which an amino acid code on a gene is substituted by a stop codon, which halts the sequence and prevents production of a fully functioning protein. PTC mutations are the underlying cause for 10% of all human genetic disease. About 1800 inherited human diseases are caused by nonsense mutations; no treatments are currently available so the unmet medical need is huge.

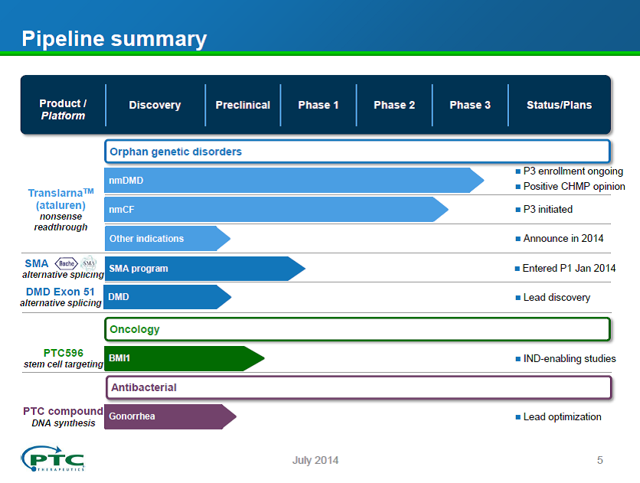

The PTCT pipeline is outlined in the slide below, which is taken from a company presentation on July 21, 2014.

Source: Company presentation July 21, 2014.

PTCT also has an early development program in spinal muscular atrophy (SMA) which is being developed in partnership with Roche. The drug candidate for SMA has been advanced through Phase 1 studies and a Phase 1B/2 proof of concept study should start in 2014 with read out in 2015. Since Phase 1 drug candidates only have a 10% probability of success, we will not include this program in our valuation of PTCT. The company is also pursuing programs in oncology and antibiotics, but these programs are still in the pre-clinical stage and again won't be included in our valuation of the company.

The focus of this article is an assessment of the medical and commercial potential of the drug candidate in Phase 3 that has a trade name of Translarna and the generic name of ataluren. This candidate is being studied for the treatment of nonsense mutation Duchenne Muscular Dystrophy (nmDMD) and Cystic Fibrosis (nmCF). The FDA has granted Subpart E designation for accelerated development, evaluation, and marketing for CF and DMD and Fast Track designation for the nonsense mutation DMD indication. As discussed in more detail below, the European Commission just gave Translarna conditional approval for DMD on August 4, 2014, a very significant and unexpected milestone for the company.

While the science that supports Translarna is not as strong as we would like to see, the clinical data for DMD and CF will likely be sufficient to obtain full marketing approval in the US and Europe in DMD and CF. Therefore, we believe PTCT is a high-risk, high-reward buying opportunity, either on the basis of the value of or as a potential takeover candidate.

Translarna - The Science

Translarna is thought to function by binding to the ribosome to enable "read-through" or "skip over" of the misplaced stop codons on the ribosome to allow a fully functional protein to be produced. While PTC and several collaborators have published many papers on the underlying science of Translarna, a few investigators have challenged the mechanism of action. The controversy was summarized by Derek Lowe in a Seeking Alpha article in Sep 2013. The most critical study was published about a year ago by a group from the University of Dundee. In carefully controlled studies, this group could find no in vitro read-through activity of Translarna even though activity was observed with a known nonsense activator, gentamicin. They concluded:

"In 2009, however, questions were raised about the initial discovery of this drug; PTC124 was shown to interfere with the assay used in its discovery in a way that might be mistaken for genuine activity. As doubts regarding PTC124's efficacy remain unresolved, here we conducted a thorough and systematic investigation of the proposed mechanism of action of PTC124 in a wide array of cell-based assays. We found no evidence of such translational read-through activity for PTC124, suggesting that its development may indeed have been a consequence of the choice of assay used in the drug discovery process.

While disagreement regarding the science underlying Translarna is troubling, PTCT and numerous independent investigators have demonstrated activity in several preclinical cell-based and animal-based disease models in multiple organs and have documented their findings in 20 publications. In addition, efficacy, although sometimes marginal, has been established in several Phase 2 and Phase 3 placebo-controlled studies in patients in both CF and DMD. It seems unlikely that the efficacy in the well-run Phase 2 and Phase 3 studies in two different indications could be a coincidence.

Translarna (ataluren) for the Treatment of Duchenne Muscular Dystrophy

Duchenne muscular dystrophy (DMD) is a progressive, and ultimately fatal, muscle wasting disease that is caused by the lack of the dystrophin protein. This protein plays a key role in preventing muscle damage during contraction and relaxation. DMD patients slowly lose muscle function, first losing their ability to walk starting at about age 7, then becoming unable to feed themselves, to ultimately being unable to breathe on their own. Most patients pass away in their 20s. The disease affects about 34,000 boys in the US and Europe, about 13% due to nonsense mutation. Several companies are working on therapies for DMD, including Sarepta and Prosena, but these companies are pursuing exon-skipping strategies that address a different subset of patients from Translarna.

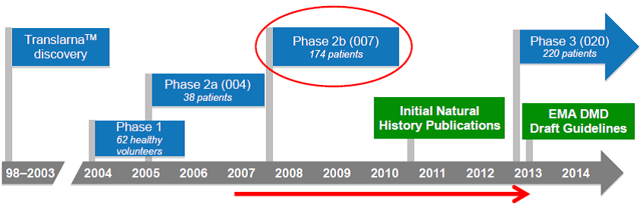

The 15-year history of the development of Translarna for DMD is outlined below.

Source: Company presentation July 21, 2014.

Importantly, in the first proof-of-concept study carried out with Translarna, a Phase 2A study in DMD, an improvement in the production of dystrophin in muscle cells was demonstrated, with 23 of the 38 patients (61%) showing a positive change in the production of dystrophin in muscle cells after 28 days of ataluren treatment. This was an important confirmation that the drug was working as expected to promote production of this muscle protein. Reductions in the concentration of creatine kinase were also observed, suggesting a decrease in muscle breakdown. This provided the confidence to move forward to a larger Phase 2B study.

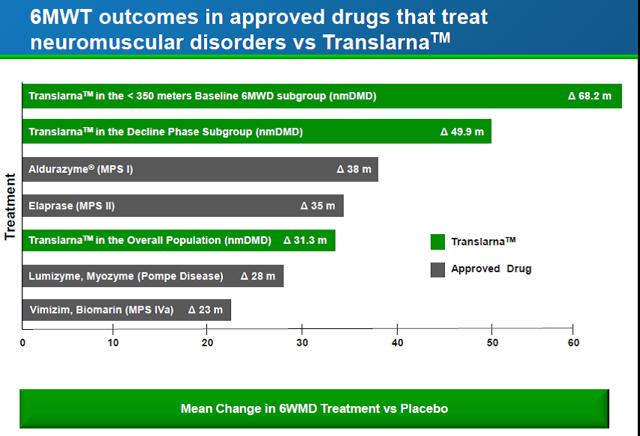

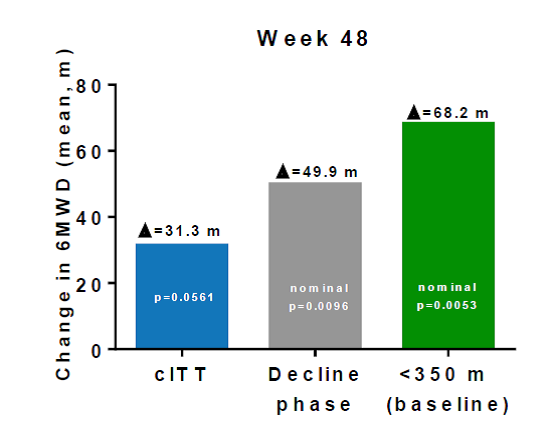

The Phase 2B clinical trial in 174 patients was completed in 2010. The primary endpoint in this study was the distance covered in a 6-minute walk, a well-validated and oft-used study for neuromuscular diseases. After 48 weeks of treatment, patients taking Translarna could walk 31 meters further than patients on placebo, although this result did not quite reach statistical significance (p= 0.056). A retrospective analysis by the company suggested a number of issues with the study since the natural history of the disease was not fully understood prior to the start of the study. Specifically, the patient population varied widely, ranging in age 5 to 20 years old with baseline 6-minute walk distances ranging from 75 meters to 550 meters. Further analysis indicated that the most severe patients were helped the most by the drug, with a 50 meter difference in the "ambulatory decline phase" subgroup, and a 68-meter difference in the patients who could not walk 350 meters at the beginning of the study. This is shown graphically in the figure below. Ataluren-treated patients also showed better outcomes than patients on placebo in several secondary endpoints, including the time function test, accidental falls, step monitoring and in the amount of time they spent in the wheel chair. Each of these end-points reflect quality of life and clinical benefits for ataluren-treated patients.

Source: Company presentation July 21, 2014.

Are these differences in walking distance meaningful? The company prepared a chart to show how the Translarna treatment compares to approved drugs for other neuromuscular disorders, as presented below. Clearly, regulators have approved drugs with similar or lower effectiveness than Translarna. In addition, for comparison to drugs currently under development and not shown in the chart, eteplirsen from Sarepta showed a 59-meter difference at week 48 which stayed about the same for a 120-week period. However, the study only involved 10 patients (6 on drug and 4 placebo). For Prosena's drisapersen, the difference in the 6-minute test ranged from 10 meters to 40 meters over a number of studies. Thus, Translarna is providing similar differences in walking distance to approved drugs for other neuromuscular disorders as well as those in development by other companies for DMD.

Source: Company presentation July 21, 2014.

Unfortunately, the boost in dystrophin levels that were measured in the Phase 2A study was not replicated in the Phase 2B study, which the company suggests may have been due to the way the samples were handled. In any event, the FDA has questioned the validity of the dystrophin assay. Other companies studying drugs for DMD have also been attempting to measure dystrophin levels. Prosensa has reported low and variable amounts of dystrophin in the muscle biopsies of patients taking their drug. Sarepta appears to have developed a more robust assay and has shown a dose-dependent increase in dystrophin with their compound. In fact, Sarepta has requested accelerated FDA approval of their drug based on the increase in this protein biomarker although they have studied their drug in only a handful of patients. For PTCT, this lack of knowledge of whether their drug is increasing dystrophin levels in DMD patients is an unsettling gap. However, given the lack of confidence by the FDA in the dystrophin assay, no biopsies to measure the protein are being done in the Phase 3 studies that are underway.

The company has initiated a 48-week Phase 3 study in 220 DMD patients divided evenly between the drug treatment arm and placebo. Based on the learnings from the Phase 2B study, the company has adjusted the enrollment criteria to augment the patient population in the decline phase of walking ability. Full enrollment was expected to be achieved by mid-2014 with top-line data available in 3Q2015.

Based on the results of the Phase 2B study in DMD, PTCT filed for conditional marketing approval in Europe in October 2013 but the CHMP issued a negative opinion on the drug in Jan2014. After the company requested a re-examination and provided further details on the sub-groups as outlined above, the CHMP reversed its decision and issued a positive recommendation on May 23, 2014. On August 4, 2014 the European Commission gave conditional approval for the drug for ambulatory DMD patients age 5 and older. The conditional approval stipulates that PTC complete its Phase 3 clinical trial and submit additional safety and efficacy data from the trial. This conditional approval will be in effect for a year and must be renewed on a yearly basis until full approval is granted.

Furthermore, on July 31, 2014, FDA head Janet Woodcock issued a letter to a Duchenne muscular dystrophy patient advocacy group that committed the agency to "explore the use of all potential pathways for the approval of drugs for Duchenne muscular dystrophy, including accelerated approval, as appropriate." Potentially, PTCT could see accelerated approval of Translarna in the US before completion of the Phase 3 study. PTCT CEO Stuart Peltz has indicated the company will initiate discussions with the FDA for accelerated approval of Translarna for DMD in the US before completion of the Phase 3 study. If accelerated approval is not granted, a NDA filing based on the Phase 3 study can be expected in early 2016 with approval by 3Q2016. Full approval in the EU should occur on a similar timeline, assuming positive results from the Phase 3 study.

Translarna for the Treatment of Cystic Fibrosis (nmCF)

PTCT is also studying Translarna for the treatment of nonsense mutation cystic fibrosis (nmCF). Nonsense mutations are categorized as Class I mutations, the most severe form of CF since little or no CFTR protein is produced. Phase 2 studies established proof-of-concept via immunostaining experiments which provided evidence of ataluren-mediated increases in epithelial cell-surface CFTR. In addition, ataluren-related changes in mean nasal trans-epithelial chloride secretion were measured, with improved chloride transport of about 2.5 mvolt/cycle.

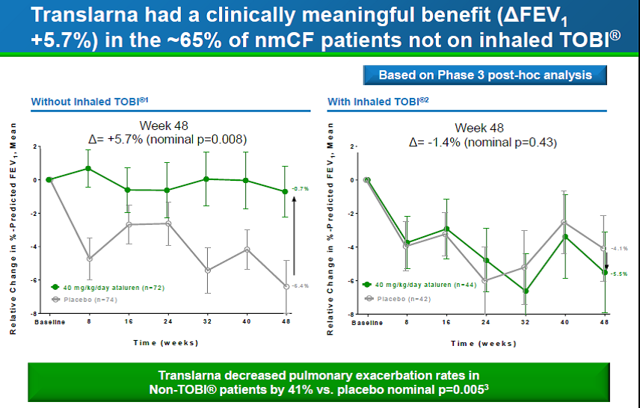

Based on the Phase 2 studies, the company carried out a 48-week Phase 3 study in 232 CF patients equally divided between placebo and drug. A 3% difference in FEV1 was observed between the ataluren and placebo group (-2.5% change on ataluren vs. -5.5% change on placebo; p=0.12) which was not statistically significant at the 48-week time point. However, a sub-group analysis of patients not taking inhaled tobramycin showed a highly statistically significant 5.7% difference in FEV1, with a mean change from baseline of -0.7% in the ataluren arm, and - 6.4% in the placebo arm (p=0.008). In addition, there were 40% fewer pulmonary exacerbations in ataluren-treated patients in this subgroup. Post-hoc in vitro testing indicated tobramycin interfered with ataluren activity, suggesting tobramycin may disrupt ataluren's mechanism of action. The difference in the sub-group is clear from the two charts below.

Source: Company presentation July 21, 2014.

As happened with the larger DMD study, the biomarkers in the CF study did not show any difference between the ataluren-treated patients and placebo, with no difference in CFTR chloride channel activity as assessed by nasal transepithelial potential difference (NPD). Again we have this worry about whether the drug is truly working as an activator of protein production.

Based on the analysis of Phase 3 sub-groups, the company has just initiated another study in nmCF patients in which treatment with aminoglycoside antibiotics will be excluded. The Phase 3 confirmatory trial is referred to as ACT CF (ataluren confirmatory trial in cystic fibrosis) and the primary endpoint is lung function as measured by relative change in percent predicted forced expiratory volume in one second, or FEV1. The study is planning to enroll 208 patients for a treatment period of 48 weeks. Based on the number of patients, a statistically significant difference in FEV should be about 4%. Given that a 5.7% difference was observed in the non-tobramycin-treated patients in the first Phase 3 study, the trial should have a good probability of success. Complete enrollment is anticipated this year, with top-line results at the end of 2015 and a filing in 1H2016.

NPV calculation for Translarna

We are basing the value of PTCT solely on the value of Translarna since the other pipeline assets are very early in development and have low POS. We are using the following assumptions for the NPV calculations:

- 4500 patients for nmDMD and 7000 for nmCF in the US and EU

- 80% of eligible patients will take the drug 5 years after full approval

- Revenue per patient: $200K per year with no price increases - similar to patient revenue VRTX is generating for Kalydeco

- Assume patent exclusivity of 7 years US and 10 years EU after full approval - Orphan drug guidelines in the US and Europe - Likely will obtain patent term extension, up to 5 years

- 70% profit margin - Very conservative; most likely >80% since market costs will be low.

- 25 % income tax

- 10% annual discount rate - perhaps low but we will factor in additional probability of success percentages as described below

NPV Calculations for Translarna

Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

% of DMD patients treated | 0 | 5 | 10 | 30 | 50 | 70 | 80 | 80 | 80 | 80 | 45 | 45 |

% of CF patients treated | 0 | 0 | 0 | 20 | 40 | 60 | 70 | 80 | 80 | 80 | 80 | 45 |

Revenue (Millions) | 0 | 45 | 90 | 580 | 1100 | 1500 | 1700 | 1800 | 1800 | 1800 | 1500 | 1000 |

Base Income based on 70% profit margin | 0 | 31 | 63 | 410 | 770 | 1050 | 1190 | 1260 | 1260 | 1260 | 1050 | 700 |

Income after 25% tax | 23 | 47 | 310 | 580 | 790 | 890 | 950 | 950 | 950 | 790 | 530 | |

10% annual discount rate applied to income | 23 | 42 | 250 | 423 | 513 | 525 | 503 | 456 | 408 | 308 | 186 | |

Total NPV $3.6B |

The total NPV assuming 100% success is $3.6B - the larger CF patient population contributes $2.2B and DMD contributes $1.4B. If we assume a 70% probability of success for DMD and 60% for CF, the risk-adjusted NPV is $2.3B. If patent term extension is gained for an additional 5 years, which is very likely given the very long development timeline, the risk adjusted NPV would increase by another $600 million. In addition, the company has indicated they will initiate proof-of-concept clinical studies in another indication this year. Assuming a POS of 25% and a patient population similar in size to DMD, the NPV would increase another $350 million. Using these conservative estimates, we arrive at a risk-adjusted estimate of $2.3-3.3 billion.

Another way to look at valuation is EPS. PTCT has 30 million outstanding shares so the discounted EPS in 2017, not corrected for probability of success, would be about $8 per share. Based on a 70% probability of success for just DMD and 0% for CF still leads to an EPS of $3.50 in 2017, a discounted forward P/E of <10.

The major problem with using risk-adjusted NPVs to value small companies is that the drugs tend to be either very successful or complete failures. So in reality a 60 or 70% risk adjustment is artificial as it will actually either be 0% or 100%. It is very possible that one indication will be approved but not the other. In any event, at a current market cap of $850 million, the market is assuming a very low probability of success for either indication.

PTCT Finances

PTCT is in good financial shape and should not need dilutive funding.

- $247 million in cash on hand

- anticipated milestone payments from the collaboration with Roche

- conditional approval in 2014 of Translarna in the EU for DMD will provide significant revenue during 2015

Potential Takeover Target?

Vertex (VRTX) is a stock I follow so I read the transcripts of their earnings report every quarter. While reading the July 29 VRTX transcript, I was struck by comments from management regarding their strategy to leverage external opportunities to build their cystic fibrosis franchise as well as expand into other rare diseases. See the quotes below from CEO Jeffrey Leiden and CFO Ian Smith:

Jeffrey M. Leiden, CEO:

"We are deeply committed to being the leader in CF therapies, and we'll maintain and build on our leadership by continuing to invest in our CF programs and by pursuing external opportunities that complement our internal efforts."

Ian Smith, CFO:

"Additionally, following the positive Phase III data for the ivacaftor/lumacaftor combination, which provided greater confidence in our future growth, we signed a credit agreement for $500 million; $300 million of which we added to our balance sheet in July, giving us now nearly $1.5 billion of cash, cash equivalents and marketable securities on our balance sheet. This additional cash strengthens our balance sheet and provides added flexibility as we work to further enhance treatment of cystic fibrosis. Specifically, we expect to utilize this financial position to support collaborations in priority programs in CF and in other areas.

In the Q&A period after the prepared remarks, Wen Shi from Bernstein, asked:

"Nonsense mutation is about 10% of the patient population. Are you thinking about some internal or external combinations to address that?"

Jeffrey M. Leiden, CEO, replied:

"Yes, I think the patients with... true nonsense mutations on both alleles obviously are not going to be helped by our current corrector therapies. And that's one of the areas where we're going to need to look outside as well for additional kinds of therapies to address those patients."

"And then on your second question on attributes of assets that might be interesting to us. Obviously, the first set of assets would be those that could complement our own internal CF assets. We certainly understand now the combination therapy is going to be the rule for most patients, particularly as we move to higher and higher levels of efficacy. And so as you might expect, we're looking very closely adding assets that could complement our internal assets in CF. Beyond that, as we've said before, we're very interested in disease -- in very serious specialty diseases where we see an opportunity to make or acquire transformational therapies. Therapies that make the same kind of difference that our CF medicines have made in CF. And so as we move forward, you can expect to see us looking at those kinds of assets."

While Vertex would like to build its CF franchise via external opportunities, only a very few such opportunities exist, at least for companies that have clinical candidates and are pursuing agents that target the basic underlying cause of the disease.

Since PTCT is pursuing the subset of CF patients that cannot be addressed with the Vertex drugs, there is a possibility Vertex would be interested in buying the company. They have $1.5 billion in cash and credit available for doing so, which is about the right amount to buy out PCTC. They have all the infrastructure in place to treat CF patients so they would not even have to add to their marketing effort. The question is whether VRTX believes in the science behind PTCT. As documented above, there are many gaps in the science in DMM and CF which make this a risky investment even though efficacy has been demonstrated in clinical studies.

Summary

The market cap of PTCT is about $850 million. With $247 million in cash on hand, the actual market value of PTCT based on its pipeline is only $600 million. Assuming a non-risk adjusted NPV for Translarna in the $3-4 billion range, the market is assuming only a 15-20% probability of success of Translarna for nmDMD and nmCF. With a conditional approval for Translarna in the EU now secured, and with the FDA indicating they are open to accelerated approval for DMD treatments, we believe the likelihood of full approval for Translarna in DMM in the US and Europe is 70%, which corresponds to an NPV of $1.0-1.3B, the latter number if patent term extension is granted. Therefore, just based on the DMD indication alone, and given the cash on hand, the company should be worth $1.25-1.5 billion or $40-50 per share. Given at least a 50% probability of success in CF, with a larger number of treatable patients than DMD, the company could see a share price at much higher levels in the next year or two as more Phase 3 data is reported.

In addition, we think a buyout is a possibility. Borrowing costs are low right now but will not remain so for much longer so M&A deals are likely to accelerate over the next few months. In the biopharma arena several small drug companies are likely to get scooped up by mid-sized companies looking to quickly build out their portfolios. Acquisition of PTCT offers an opportunity to gain access to a potential blockbuster drug at a relatively low price - a good risk/reward ratio. If Translarna fails at least the acquirer would pick up the rest of the early stage pipeline.

As outlined above, there are many risks. Most importantly, the science that underlies Translarna has a number of troubling gaps:

- Controversy over mechanism - some academic investigators have not been able to reproduce the in vitro studies on the mechanism of action.

- Unusual bell-shaped dose response curve in DMM patients - higher doses are less effective than medium dose. This corresponds to cell-based assays which also demonstrate a bell-shaped dose response curve for production of dystrophin, but nonetheless it is unusual to have to get the dose just right to see an effect clinically.

- Lack of response in CF patients in sweat chloride and nasal potential in the Phase 3 study. These two biomarkers are diagnostic in CF patients and should see changes if the drug is working as expected.

- Variable data on dystrophin production in DMD patients - unable to reproduce dystrophin production in Phase 2B study.

We believe these risks are already baked into the share price. In addition, the short interest in this company is low at 7%, suggesting hedge funds and individual investors also believe the risks are adequately represented by the current share price.

Given the acute unmet medical need in nmDMD and nmCF patients, the need for medications that can improve, or at least stabilize, the disease are desperately needed. Translarna is far from a perfect drug, but it has shown efficacy in several clinical studies. We believe PTCT and its clinical collaborators have well-defined the appropriate patient population and dosing regimens that will result in Translarna being the first treatment for children and young adults suffering from nonsense genetic diseases.

Disclosure: The author is long PTCT. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article discusses a highly speculative small biopharma company. Risks of investing are high.