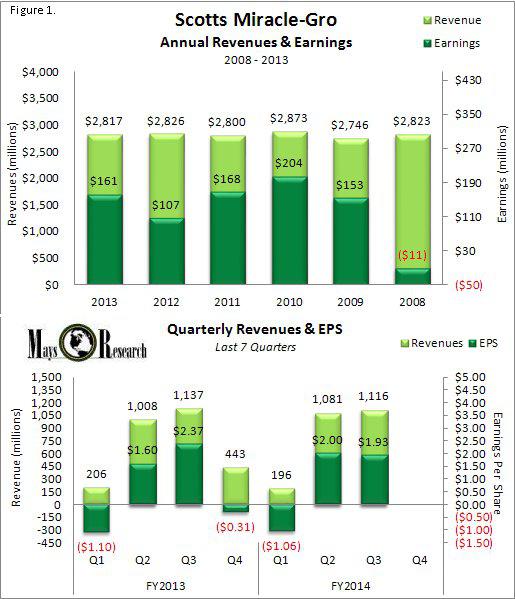

Scott's Miracle-Gro (NYSE:SMG) reported fiscal third quarter revenues of $1.16 billion, which is 2% lower than a year ago. However, through the full-year, revenues of roughly $2.4 billion are up about 2 percent. In a June piece entitled, "Can Home Depot, Lowe's, And Wal-Mart Stimulate Growth For Scotts Miracle-Gro?", I noted that annual revenues have stayed stuck in the mud at around $2.8 billion over the last several years.

Apparently in 2014 Home Depot (HD) and Lowe's (LOW) have been able to help stimulate growth as the company says revenue growth in the home center channel is in the low single digits while it estimated that even in a best case scenario, it expects a decline in the high single digits of consumer purchases in the mass retail channel. Of the company's three key customers, Wal-Mart (WMT) is the only mass-market retailer. Both the consumer and lawn care businesses in Europe have been the opposite of U.S. operations with sales up more than 10% year to date. The U.K and France are the largest markets the company serves in Europe.

According to Scott's Miracle-Gro, consumers that shop in the home center channel at stores like Home Depot and Lowe's tend to lean towards more affluence. Many shop at these stores intending to make lawn and garden purchases while the company believes that the more economically stressed consumers shopping at stores like Wal-Mart are simply opting out of the lawn and garden category. I agree with the company's assessment of the two groups of shoppers.

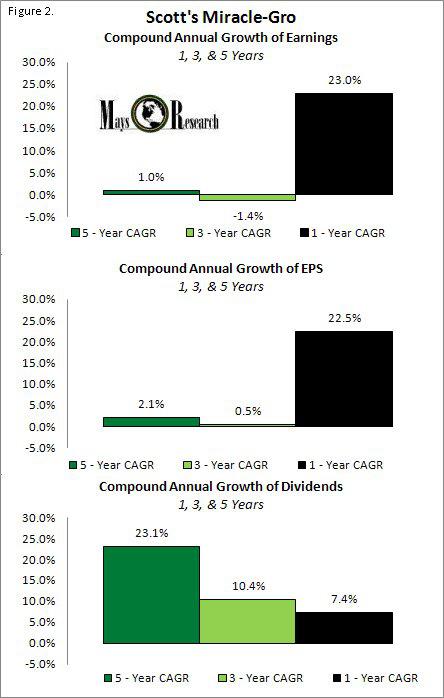

Despite the nearly non-existent revenue growth over the last several years, Scotts Miracle-Gro sees its long-term growth rate at 3% to 5%. Excluding the current fiscal year, figure 2 illustrates the company's compound annual growth rate of earnings, EPS, and dividends over the last 1, 3 and 5 years.

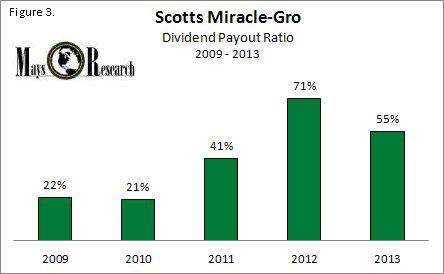

As is becoming a trend with many companies in the agricultural chemicals industry, the growth rate of dividends is faster than both earnings and EPS. Since dividend policy is largely a long-term decision that in part reflects what other growth opportunities management sees, the increases in the company's dividend payout ratio over the last five years shows some concessions with regards to long-term growth in my opinion.

A dividend yield that is now more than 3 percent does offer the stock some downside protection given that the yield on the 10-year treasury is below 2.5 percent. Additionally, the company's recent announcement of a return of $125 million to shareholders in the form of either a special dividend of roughly $2.00 per share, a share repurchase, or some combination of the two may shore up the share price even more over the short-term. The company expects to announce within a few weeks how they will structure the return of capital. However, I reaffirm my opinion that given the company's lack of growth since 2008, the stocks 42% rise in 2013 and current valuation remains unwarranted.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.