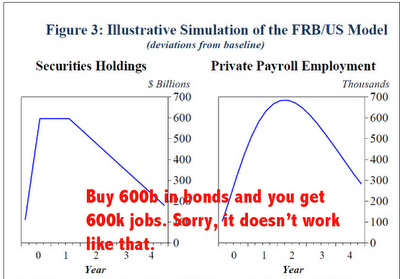

Janet Yellen (Vice-Chair FRB) gave a speech in Denver on Saturday. She did her level best at defending QE. I think she lied to us. This chart () was central to her defense of the busted policy:

Isn’t this graph nice. It shows that there is direct causality to an increase in FRB holdings and jobs creation. For every $1mm purchase of average life 5-year T-Notes that Brian Sack (NY Fed) makes, a new job is created. Magical. Actually it is just self-serving bunk. Ms. Yellen should be ashamed at using this. There is no evidence that there is a direct relationship between QE2 and an increase in employment. I hope some economists rip her apart.

I am not going to deny the relationship between low interest rates and higher economic activity. That link has been proven. For example, ZIRP can have beneficial effects. Similarly, a drop in long-term interest rates is a pro-growth force. What the folks at the Fed have done is assume that QE lowers LT rates and therefore promotes job creation. But all of the evidence confirms that QE2 has increased LT interest rates.

If Yellen wanted to be fair to the US citizens she would have prepared a different set of slides. She would have shown a graph that proved the relationship to lower (or higher) LT interest rates and economic activity (employment). If she had shown (for example) that a 1% drop in the 10-year bond DIRECTLY contributed to the creation of 600K jobs I would have accepted that. I believe that most economists would have agreed as well.

But that is not what is going on at all. LT interest rates are not falling because Mr. Sack is doing POMO buy-ins of bonds three days a week. LT interest rates are rising BECAUSE he is buying. How can that be? Is the market ignoring the laws of supply and demand? Not really.

- QE2 is ending in 4 ½ months from today. (The last month will be small amounts, totally discounted by then). There are only 87 trading days till the (functional) end of this experiment. The market is already looking beyond the corner on this one.

- QE2 is creating an opportunity for large holders of Treasuries to lighten up. There is no certainty that they will return when QE2 ends. If "they" do return, what price will “they” demand?

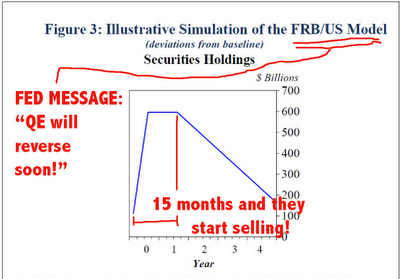

- QE has created uncertainty for investors. The Fed balance sheet is a ticking time bomb that is going to blow up on them one day. How do bond investors know this? Because the Fed has repeatedly told them so. They have said in the press and to the public through speeches like Ms. Yellen’s and even to Congress that they are 100% certain they can reverse the impacts of QE. How are they going to do this? Easy, Yellen said it (again) in her speech:

raise short-term interest rates and drain large volumes of reserves sell our holdings of MBS, agency debt, and Treasury securities

The bond market (collectively) reads these words and craps in its pants. This is the worst possible scenario for the bond market. The largest single holder of fixed rate paper in the world is going to become a massive seller at some point in the future? Lovely prospect.

Think of it differently. What would happen to our capital market if someday we got an announcement from China that they were selling their ~900b of holdings? The bond market would collapse of course. That will (hopefully) never happen. But the Fed is now bigger than China and they have said again and again that they are going to be a seller. No wonder interest rates have risen in anticipation. Who would want to own low yield, long duration paper when you are staring into a double-barreled shotgun (Fed & Treasury selling at once).

I think the stock market looks out about six months. The bond market looks out about a year. What is the message that Janet Yellen, Ben Bernanke and all the others telling the bond market? The answer to that is in the chart that Yellen used to defend QE (). Notice that she has a 600b ramp up in assets. That is followed by a run off of the portfolio less than one year after program completion. In the Fed’s own models they are assuming that QE2 unwinds starting in 2012. Just around the corner, so to speak.

There are three possible outcomes that I can see at this point:

I) QE2 will be extended and expanded. The Fed will buy an additional 600b of bonds. I give this a 5% chance at this point. The policy is disgraced. The Fed already regrets the timing of QE2. Heat from Congress will tie their hands. The economy will be muddling along and no additional “emergency measures” are justified. This is not a strong bond market scenario.

II) Before June 30 the Fed announces that it will not extend QE2. They confirm that they will hold the existing portfolio at the then current level. The proceeds of any maturities of existing holdings will be used to acquire more bonds (similar to QE-1-lite). This would immediately make a lie of all the prior statements by the Fed that QE2 was a temporary measure. That it’s affects would be removed in due course. This would be very unsettling to the bond market. The Fed would be changing the rules to suit them. No one would trust any future promises they made if they reverse course like this. This outcome is not bond friendly either.

III) Before June 30 the Fed announces that it will not extend QE2. They will say that they will take a wait and see policy. Should circumstances justify more QE they will do that. If inflation picks up they will reverse QE, raise rates and sell bonds.

I think the outcome will be #III. I see this as the worst possible outcome for the bond market. The reason? This “preferred” alternative translates into the greatest uncertainty.

Consider what the backdrop of economic news is likely to be in the future. In 2010 the (phoney) calculations that the Fed uses to measure inflation showed a YoY change of only 1%. It is impossible for this to be repeated. While inflation may not get “hot” it will be on the rise. When the monthly numbers prove that out the bond market will shudder. As the inflation numbers move back up and pass the “desired” 2% the market will worry every day, “When are they going to start selling” will be the only debate.

Here’s the bottom line Ms. Yellen. QE2 has added to uncertainly and thereby increased LT interest rates since the policy has been introduced. Increases in LT interest rates are a factor that would tend to slow job creation. Ergo QE2 will prove to be a policy that creates a drag (not a stimulus) on the economy/employment.

Man up Ms. Yellen. You folks have made a mistake. Don’t try to prove what can’t be proven. Your own graphs show the lie. Your skewed presentation is obviously flawed. You know that, the bond market knows it. When you bluff like this it just scares the bond market more.