Samson high grade strategies continued to show positive performance year to date, but experienced slight negative returns during the 3rd quarter. On a gross basis, our Short Term and Intermediate Government strategies outperformed for the year while the Core Intermediate strategy performed roughly in line with the benchmark. Our strategies seek to provide investors with the benefits of fixed income as an asset class, in separately managed accounts, with an up in quality bias, and our record reflects that objective.

The third quarter was a time of transition in the economy, Federal Reserve policy, and as a result, the structure of our portfolios. The US economy entered the period in a halting recovery, characterized by bursts of strong data, often followed by bursts of weaker data. In this jagged, saw tooth recovery, several themes emerged clearly. The US employment picture was improving, manufacturing was on the rebound, corporate profits remained healthy, and a period of austerity in public finance at the state and local level meant that public credit, as well as private credit, remained on the upswing. It also became clear that the Federal Reserve would indeed end its bond buying program, leading many market participants to believe the Fed would actually tighten interest rates, and end QE, sooner than previously expected. These themes had several consequences for our management of client portfolios.

Yield Curve Positioning

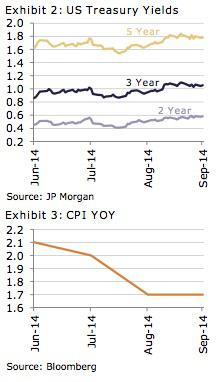

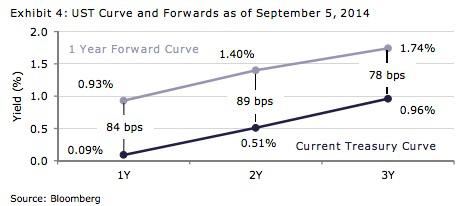

Interest rates on short to intermediate maturity bonds rose as the market begin to build in a Fed tightening. We viewed this increase in short to intermediate rates as an opportunity. The Fed has been clear that it wants inflation over 2%, but the rate of inflation has actually fallen. Our view, expressed in our recent webinar on quantitative easing, is that a Federal Funds rate increase is unlikely until the Fed meets their inflation target. As a result, we increasingly moved our portfolio structure towards a bullet with a focus on the 3-7 year maturity part of the curve. Our decision was also supported by the implied forward interest rates embedded in the Treasury curve itself.

As the chart above shows, the front end of the curve began to discount a Fed tightening that was not likely to occur, particularly as fears of deflation and economic slowdown in Europe accelerated. Our bulleted yield curve position was also supported by our statistical analysis of the Treasury slope. We believe our overweight to the 3-7 year maturity bucket should outperform barbell or laddered strategies if the curve steepens (long rates rise faster than short rates).

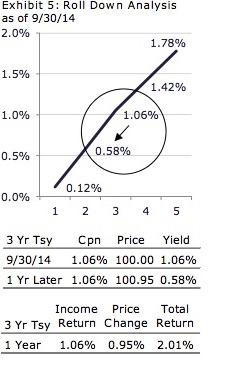

Roll-Down Opportunity Harvested

An important component of our yield curve strategy and security selection process is our evaluation of the “roll-down” opportunity in specific bonds. In this framework, we look at how the price of a bond will change as it ages, and rolls down the yield curve. For example, if rates and the slope of the yield curve are held constant, a 3-year maturity bond falls to the lower yield of a 2-year maturity bond, and the price can actually increase leading to a higher total return for the holding period than just the yield. We conduct this analysis across the yield curve. As Exhibit 5 shows, the 3-year part of the curve was particularly attractive from a roll-down perspective. This too supported our reasoning for adopting a bulleted yield curve position.

Sector Rotation

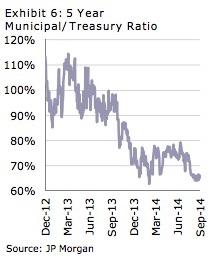

As a value oriented manager, our preference is to own sectors that are undervalued and, for several years, municipals met that criterion. During this quarter, for the first time in 4 years, we have no tax-exempt municipal exposure in our portfolios. Municipals have shown tremendous out-performance relative to Treasuries and other sectors at times. Our weightings have fluctuated over time in keeping with the changing valuations of the sector, but the recent richness of the municipal /Treasury ratio led us to exit the sector completely. Our ability to use out of benchmark municipal allocations in a meaningful measure has been additive to performance and illustrates Samson’s willingness to search across high quality bond markets to find attractive investments.

During the quarter, we rotated out of municipals into Treasuries. This was not an expression of any view that Treasuries as a sector were cheap, but rather reflected our view that 3 year bonds, in particular, were the cheapest part the yield curve. Treasuries, with low transaction costs, were the most effective, liquid way, to express that view.

Consistent with our view that the economy remained healthy, we retained our overweight to corporates relative to the benchmark. Corporates still warrant an overweight based on our market outlook and valuations. In a period of slow, but positive growth, corporates are poised to outperform agencies and Treasuries. Corporate spreads have tightened, but remain wider than historical averages – particularly when we compare today’s spreads to the averages that existed before the financial crisis. Of course, historical spreads are only one metric. Corporate balance sheets are in their best shape in years and continued easy monetary conditions support the broader economy. Our preference for large deals from a roster of diversified, blue chip companies should mitigate liquidity risk should shocks occur.

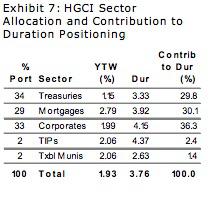

Our sector allocation and contribution to duration positioning, can be seen in Exhibit 7.

Looking Forward

With regard to the future, we are positioned for a bear steepener and rising inflation expectations. We maintain a defensive duration posture, and a bulleted yield curve position in keeping with that view. With the Fed on hold, the 3-Year part of the curve is a very secure part of the market.

In our opinion, one undervalued sector of the investment grade market is TIPS. The market is now discounting a 1.5% inflation rate over the next 5 years. If the Fed succeeds in its mission, TIPS will outperform nominal treasuries by wide margins. Investors should be careful, as many TIPS mutual funds buy long duration bonds that are subject to price risk if real rates rise; intermediate maturity TIPS may be a safer bet.

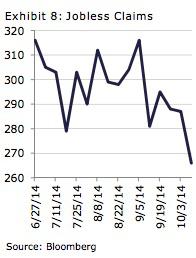

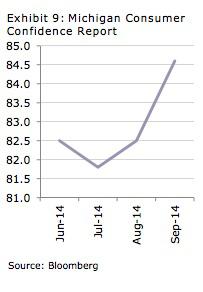

Since the end of the third quarter, the data in October has been quite encouraging. Although the retail sales data for September, released in the middle of the month, raised fears of a recession, the sharp fall in jobless claims and the jump in consumer confidence quickly corrected those views. These green shoots are fragile given the global weakness and argue for the Fed to remain easy for some time to come.

Past performance is not indicative of future results. Performance reflects the reinvestment of income and other earnings. Any benchmarks or indices shown are for illustrative purposes only, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit or other material characteristics (such as number and types of securities) that are different from HGCI, HGST, and IG. Certain information is based on third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. This information is confidential, is intended only for intended recipients and their authorized agents and may not be distributed to any other person without our prior written consent.

No representation or assurance is made that Samson Strategies will or are likely to achieve their objectives, or will make a profit or will not sustain losses. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements are now or will prove to be accurate or complete in any way. Samson does not provide tax, accounting or regulatory advice. ANY TAX STATEMENT CONTAINED HEREIN IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED BY ANY PERSON, FOR THE PURPOSE OF AVOIDING TAX PENALTIES.