Fiscal Q4 2014 In Line With Expectations

Synergy (SYRG) reported an in-line quarter. Net production averaged 5,894 boe/d, versus the 5,800-6,200 boe/d guidance. Adjusted EBITDA for the quarter was $28 million.

Synergy's report contained relatively few new operating data points, given that the guidance has been well communicated to investors and no new pads have been brought on-line since the company's most recent operating update.

With four additional large operated pads expected to be turned into sales by the end of February 2015, the market is likely increasingly focus on the production ramp-up and well performance metrics as the key drivers for the stock's price.

As a reminder, the company's production guidance for its fiscal Q1 2015 (ending 11/30/2014) is 7,500-8,500 boe/d, which equates to an impressive 27%-44% sequential growth. On the company's conference fall today, management re-iterated this guidance with "upward confidence." Production growth will accelerate further in the fiscal Q2, creating a catalyst for the stock price.

Production Will Show A Step Change In Fiscal Q2

Synergy added a third rig to its drilling program in the Niobrara in September. As a result, the company's cadence of bringing new wells on-line will accelerate in the next several months, with a particularly strong ramp-up in production expected in the second fiscal quarter of 2015 (ending 2/28/2015). The increase in production volumes during the next two quarters should help offset the decline in the operating margin due to lower price realizations (assuming no further decline in oil prices).

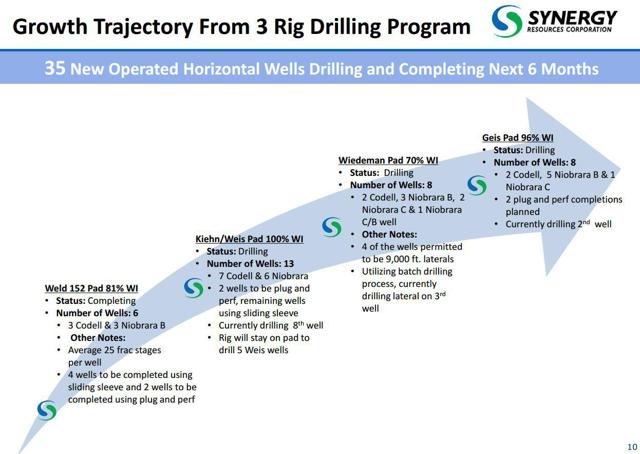

The production ramp-up over the next two quarters has good visibility. The company has a total of six operated pads, with a total of 30 horizontal wells that are already producing. Four additional large operated pads, with a total of 35 wells (31.3 net wells) and 7-8 net non-operated wells will be added by the end of the second fiscal quarter, more than doubling Synergy's horizontal well count.

- Weld 152 Pad (81% working interest): The 6 wells on the pad have been completed, and will begin initial flowback next week.

- Kiehn/Weis Pad (100% working interest): The 13 wells are expected to come on production in early 2015.

- Wiedeman Pad (70% working interest): Includes 4 standard-length laterals and 4 extended-reach 9,000-foot laterals that are expected to be on production by February 2015.

- Geis Pad (96% working interest): Currently drilling the second well of eight; the pad is expected to be turned inline in the second fiscal quarter.

- Non-operated activity may add another 7-8 net wells to Synergy's interest in the next two quarters (my estimate based on the company's comments), ~5 of which will be connected during the fiscal Q2.

The following slide from the company's presentation shows the anticipated schedule of new pad tie-ins over the next two quarters.

(Source: Synergy Resources, October 2014)

Annualizing the company's Q3 2014 Adjusted EBITDA of $28 million, the stock is currently trading at 6.8x multiple of its run-rate EBITDA. The continued rapid production growth should lead to a further contraction of this multiple (using the current stock price and no further deterioration in oil prices).

The Reserve Report

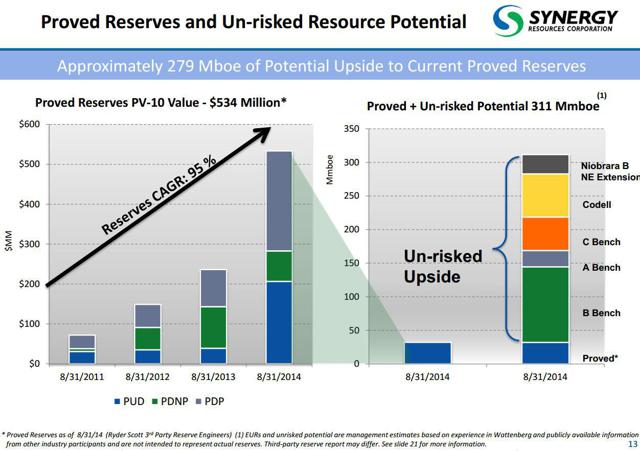

Two weeks ago, Synergy released its proved reserve evaluation (prepared by Ryder Scott) for the 2014 fiscal year ending 8/31/2014:

- Proved reserves were 32.2 MMboe, evenly split between oil and natural gas (natural gas includes the NGLs).

- The PV-10 value of the proved reserves increased to $534 million.

- Proved developed producing and behind pipe reserves accounted for 61% of the value.

The PV-10 value is perhaps the most interesting figure in the report. Using the graph from the company's updated presentation (the slide below), proved developed producing ("PDP") reserves accounted for approximately $250 million of the total proved PV-10 value at the company's year-end. Synergy's PDP reserves included over 30 operated horizontal wells that were on-line as of August 31, 2014.

By February 28, 2015, the time when Synergy will prepare its next mid-year reserve report, I estimate that the value of PDP reserves may increase to as high as $425-$500 million, using the same commodity price assumptions as those used in the calculation of the fiscal 2014 year-end value. Of note, the company's PDP reserve value is partially "protected" by oil hedges (75% of PDP production is hedged in fiscal 2015 and 60% in fiscal 2016). Adding back the value of proved developed non-producing ("PDNP") reserves, ~$75 million, the value of proved developed reserves may reach $500-$575 million by February 28, 2015, using the same commodity price assumptions. I also estimate that Synergy's net debt may increase by ~$75 million by that date, as the company's spending will exceed cash flow.

(Source: Synergy Resources, October 2014)

The PV-10 metric illustrates the leverage to potential oil price recovery that the stock offers. The company's current enterprise value is ~$870 million (which I calculate using yesterday's closing price of $11.04 per share and 79 million diluted shares outstanding). Assuming the price for crude oil recovered to the $90-$100 per barrel range (using WTI), the valuation of the company's development potential beyond February 28, 2015, implied by the current stock price, would be ~$375-$450 million. This implied valuation is very modest, in my opinion, given the company's very strong well results, large acreage position in the heart of the Niobrara/Codell play and, so far, very impressive operating track record. As a reminder, the company's Wattenberg Core acreage will likely yield well over a decade of drilling activity at the company's current three-rig pace.

Strong Well Productivity Is The Critical Value Driver

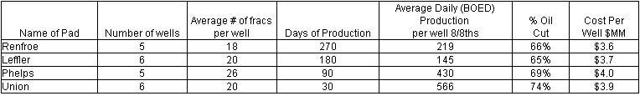

Synergy's well results to-date have been strong. The company does not provide a type curve (not enough production history), but has commented that wells on its very first operated Renfroe pad paid out 90% of their cost in 11 months. The data point is encouraging, and indicates high well-level returns and capital efficiency. While well results for the company's Leffler pad appear to be weaker than those for the Renfroe pad, well results on the Phelps and Union pads look stronger, based on early performance (please note the high oil yields for Phelps and Union pads).

(Source: Synergy Resources, August 15, 2014)

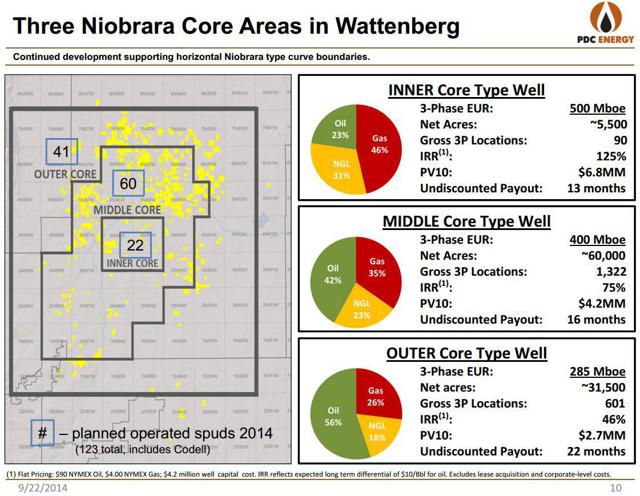

Well results by offset operators, PDC Energy in particular, provide an important cross-check with regard to Synergy's acreage quality. The following slide from PDC's presentation shows that Synergy's acreage falls mostly within areas that PDC classifies as "Middle Core," with 400 Mboe EURs and ~75% drilling returns (16-month undiscounted payout), and "Inner Core," with 500 Mboe EURs and ~125% drilling returns (13-month undiscounted payout). PDC's estimates are based on $90 Nymex oil and $4.00 Nymex gas price assumptions.

(Source: PDC Energy, September 2014)

The following illustrative calculation may be interesting. Assume PDC's "Middle Core" economics for all Synergy's future wells, with $4.2 million PV-10 per well at $90/barrel Nymex oil and $4.00/MMBtu Nymex gas, also assuming $4.2 million cost per well. "Risk" Synergy's drilling inventory, giving credit to only 750 drilling locations (a "haircut" of over 25% to the company's estimated location count). Assume further that Wattenberg Core acreage will be fully developed over a 10-year period (75 wells per year). I arrive at a full drill-out PV-10 value of such inventory of ~$2.0 billion. This illustrative estimate exceeds the company's current enterprise value by a factor of two. The estimate does not give any credit to the company's other prospects or future lease acquisition activity. Clearly, the estimate includes the big assumption that oil price realizations will recover and drilling economics are validated.

Read-Across From Noble Energy's Density Pilots

Synergy commented on yesterday's conference call that it sees no interference so far in its density pilot that includes two wells drilled on a 220-foot wellbore separation pattern. The result is a positive data point in validating the company's drilling inventory estimate for its Wattenberg Core acreage. The view is also supported by the density pilot results provided by Noble Energy (NE) on its conference call today.

Noble reported that the 23 wells on its Wells Ranch Section density pilot are "performing in line with standard spacing wells on the pad and slightly better than the Wells Ranch type curve after more than 30 days on production." Six of the wells in the pilot were developed at 16 wells per section spacing, and seventeen wells were developed on a 32 well per section spacing pattern. The downspaced wells include wells in each of the Niobrara benches.

The well density indicated by Noble is substantially higher than the density that Synergy is currently using in estimating its drilling inventory. The comparison indicates that Synergy's estimate is not overly aggressive, and suggests that some upside may exist to the ultimately recoverable reserve estimate.

In Conclusion

The sharp decline in the price of oil creates valuation uncertainty across the entire E&P sector. The concern is that the move in the commodity's price may reflect the onset of a systemic oversupply in the oil market that can only be corrected through supply destruction by a strong, and possibly prolonged, negative price signal. If such interpretation proved accurate, shale oil stocks - such as Synergy - would face a challenging macro environment that could extend over time.

I would argue, however, that it is difficult to discern at this point, with sufficient degree of confidence, whether the recent oil price correction is indeed a result of a dangerously accelerating supply growth or just a "stochastic price aberration," in part driven by demand seasonality, similar to the several corrections that we have seen with approximately once-a-year frequency over the past four years. Each of those corrections was followed by relatively quick recoveries.

For those investors who believe that the recent oil price decline is a transitory phenomenon and that oil prices are destined to recover to at least $90 per barrel in the medium term (in less than a year), Niobrara-focused operators, including Synergy, may represent an interesting group of stocks to re-evaluate, given the sharp declines they have recently experienced.

Driving Synergy's potential upside is the company's Wattenberg Core acreage that has continued to surprise in terms of strong well productivity and remarkably tight downspacing. These two factors may make the D-J Basis Niobrara/Codell one of the most economical among the North American unconventional resource plays. Synergy has a large position in this play's core. Synergy's balance sheet is strong, and funding should be sufficient to carry out the company's 2015 operating plan, even if no recovery in commodity prices materialized.

Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings, and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.