The recent plunge in the price of silver and gold has been healthy for the precious metals market. It's good for the market to chase out the weak longs and give itself time to consolidate its gains before moving to still higher prices. These sell offs (there will be more of them) are good opportunities to add to one's long positions over the coming months.

Why would someone want to buy gold now, given the recent technical damage done to the market and the advent of gold's seasonally weak [late May to August] period? Why? Because the long term fundamentals have not changed.

Stagflation is unfolding worldwide. The eurozone is experiencing much higher inflation [2.8% in April] while economic growth is trailing expectations. Greece, Ireland, and Portugal are basket cases, while Spain is holding on by a thread. And what is the ECB doing to alleviate their inflation problem ? Raising rates. The net effect being to put more pressure on the PIGS (ability to service their debt) while strengthening the Euro ---which is hurting economic growth (curtailing exports).

The U.K. is almost a basket case with inflation in the 4% area, while economic growth is barely positive. And what's the BOE doing about it? They are frozen in place. If they raise rates too soon to combat inflation they will crater the economy.

The BRICS are battling rapid inflation [India over 9%] by raising interest rates, and are not getting the results they had hoped for. In China for example, we have seen multiple interest rate increases since October, as well as a number of increases in the reserve requirements for the banks, and what is the outcome? According to Xu Biao, economist with China Merchants Bank, "risks of a worst-case scenario for the Chinese economy, namely low growth and a high inflation are on the rise".

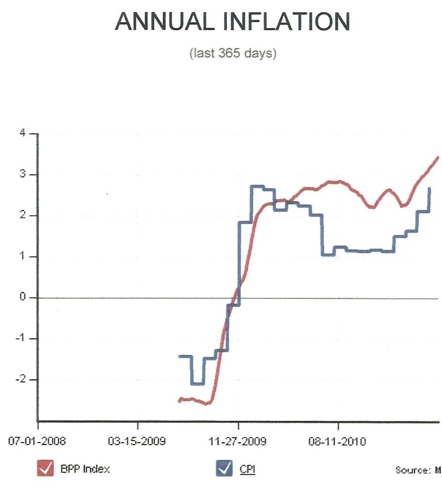

In the U.S. we have seen our GDP drop from 3.1% in the 4th Quarter of 2010 to 1.8% in the first Quarter of this year. All inflation measures are on the rise ---PPI over 5% ,import prices over 9% and the CPI is approaching 3%. If you really want to know how fast prices are rising in the U.S. take a look at the Shadow Stat's research or MIT's Billion Prices Project BPP (see chart below).

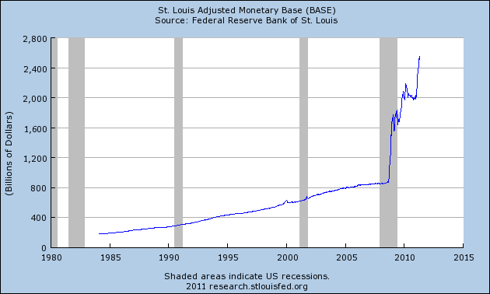

According to the St. Louis Fed numbers, the Adjusted Monetary Base is increasing at a rapid rate (see chart below).

In the first 3 months of this year alone, the monetary increase was almost 30%.

A recent PNC Bank small business survey revealed that small business managers are expecting inflation to reach around 4% in the near term and many are planning on raising their prices this year (82% plan on raising prices to offset higher input costs).

Slowing economic growth, high unemployment and rising prices are starting to develop a stranglehold on the world's major economies. Stagflation has now arrived, and it will be with us for some time to come.

Presently a number of the world's central banks are accumulating gold. Russia, India, China, Mexico, Bolivia, Sri Lanka, et al have all made recent purchases, while the developed world's central banks have discontinued their sales. Li Yining, senior economist at Peking University and member of an advisory body to the National Parliament of China, has recommended that China use gold to hedge it's almost 3 Trillion dollars of foreign exchange reserves. Gold has reclaimed its role as a monetary asset and the ultimate store of value.

In the last period of stagflation that we experienced in the 1970s, gold increased in value by almost 25 fold. Stocks and bonds had negative returns (on a real basis) for over a decade. Presently less than 1% of financial assets worldwide are in gold. Central banks, managed funds and individuals are all grossly under exposed to the price of gold. Marc Farber (Gloom,Boom and Doom) was recently speaking at an international conference of some of the world's leading money mangers when he asked everyone in the audience who had at least 5% of his / her personal assets in gold to please raise their hand. Not one did.

The gold bull market is very much intact because we are in the very early stages of a stagflationary period. Because of the high price volatility expected, you should plan to accumulate a gold position over the coming months by buying NYSEARCA:GLD periodically on price weakness. In addition to your GLD position you should also consider buying gold coins [Double Eagles,Maple Leafs etc] to diversify your gold portfolio with the actual metal. Seek out reputable dealers for your coin purchases and look to spend around a 6-7% premium over spot.

Disclosure: I am long GLD.