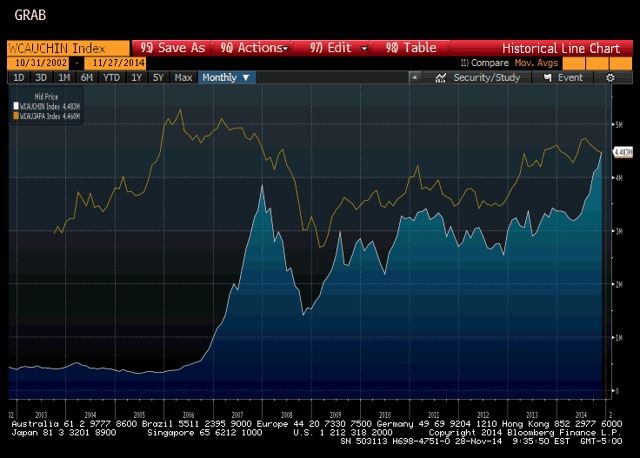

This great graphic, composed on Bloomberg, shows that China's market capitalization (white line) is now greater than Japan's (yellow line). This is the consequence of two forces.

First, the Chinese stock market has easily outperformed Japanese stocks this year, and by a wide margin. The Shanghai Composite has advanced 26.8% this year and the Shenzhen Composite is up 34.3%. In contrast, the Nikkei is up 7.2% and the Topix has gained 8.3%.

Second, market capitalization is converted into dollars to provide a basis of comparison. In some respect, the mere act confirms the special role of the dollar, despite pundits' exaggerations of the greenback's demise. The yen has depreciated by a little more than 11% year-to-date, while the Chinese yuan has fallen by about 1.40%.

Although the Hong Kong-Shanghai equity link is off to a slow start, the combination of this facility and increase in China's market capitalization to the second highest in the world, behind the US, may encourage global equity managers to boost Chinese equity exposure. There is also some speculation that MSCI (and other industry benchmarks) will add mainland shares into key indices. In this context, senior officials at the PBOC have declared that the central bank has reduced its intervention in the foreign exchange market, which seemed to have been another pre-condition for MSCI.