First my apologies for taking so long to get this posted but after the excitement of the last few days, I thought it best to wait till after Friday's close before taking stock of the post-FOMC fallout. If the only thing worse than a sore loser is sore winner, everyone should just avoid the Yinzer Analyst for the next few days as Janet Yellen came through for Team Pittsburgh in a big way and confirmed that the only thing the market need fear is change itself. Despite dissension in the ranks with a slightly more hawkish leaning at 2-1, the change in language from "considerable time" to "patient" was enough to send everyone who's lagging a benchmark and had scurried out of U.S. stocks flooding right back into them before they missed a chance to show their investors how proactive they were.

Why the rush back into U.S. equities on what was essentially a hawkish statement? From my own and non-politically sensitive point of view, the market played chicken with the Federal Reserve and won yet again. I'll give the market the benefit of the doubt that some of the move was due to the downshift in expectations for inflation and the 2016 Fed Funds rate, pushing a potential rate hike further out into the future. Given the strong economic data over the last few months, it was reasonable to drop the considerable time language and begin bracing the market for a return to the brave new world of financial risk but the recent spike in volatility and weakness in the credit markets made the Fed feel the situation was too vulnerable to risk a major sell-off at year end. If the Yellen Fed was unable to muster their courage to raise rates after the recent employment data, just what crazy gangbusters growth needs to happen before they raise it? Or, could they potentially be waiting for the global slowdown to land on our shores so they can avoid having to raise them at all?

So if you were reducing your domestic equity allocations on expectations of a tighter Fed, what's the most reasonable thing to do when you find out the Fed isn't tightening at all? That's right; you buy right back in, especially after the SPDR S&P 500 Trust ETF (SPY) made a bounce higher after pulling back and retesting the pre-announcement price after 3 P.M. Given the weak sentiment across global equities, a global rally higher was a reasonable expectation, giving Thursday a nice gap-open higher before running into the uber-excitement that is Quad-Witching Friday. Let's review a few charts to see how much damage was wrought and how it might shift our asset allocation expectations for 2015.

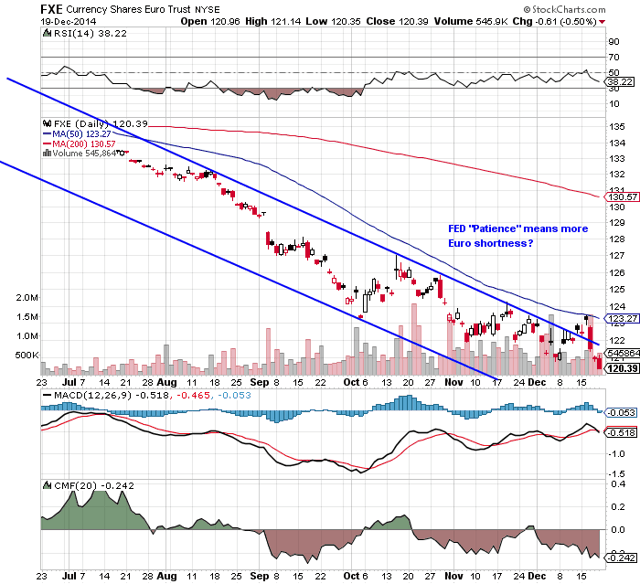

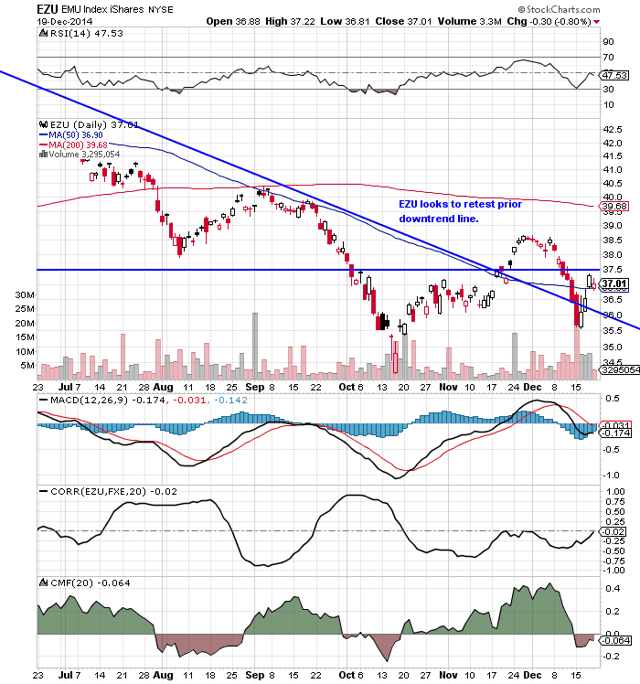

The Yinzer Analyst has been all for thinking about shifting a portion of the equity pie to Europe lately, and one of the first victims of the Fed's announcement was the CurrencyShares Euro Trust ETF (FXE) which after finally breaking through its downtrend line in the first half of the week immediately feel below it following the announcement as the hog piling resumed. The iShares MSCI EMU ETF (EZU) had also enjoyed a stronger first half of the week against SPY before giving up all that momentum following the Fed announcement. While it enjoyed a decent return, the weak volume on the daily chart leads the CMF (20) to not support the recent move despite EZU holding the 50 day moving average.

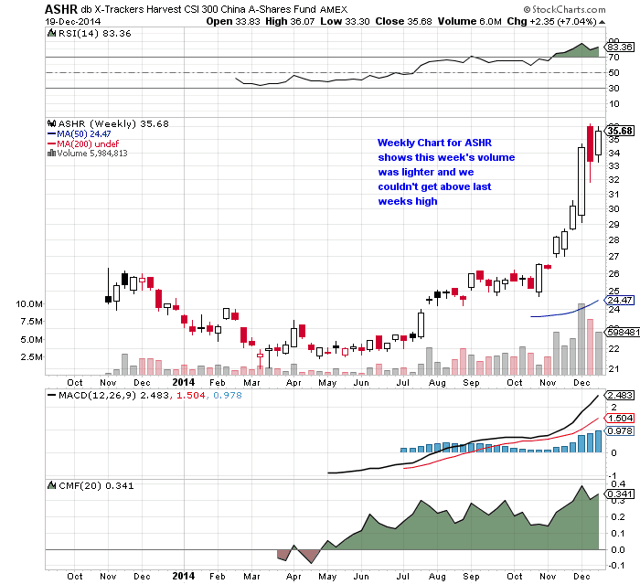

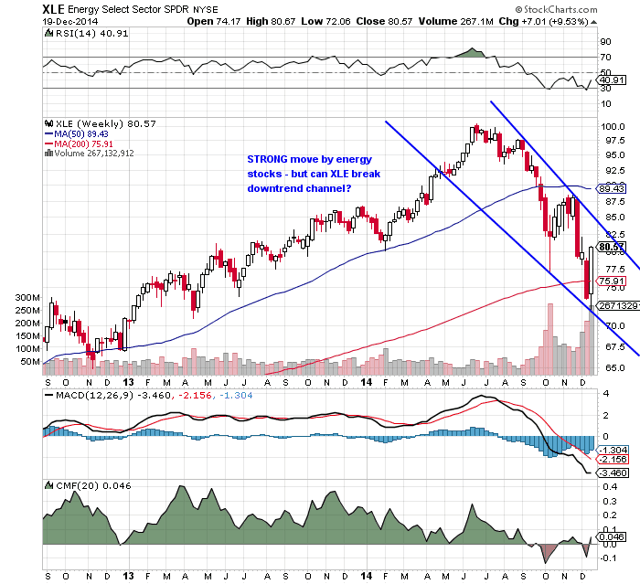

The only clear equity winner for the week besides the Chinese A-share market was the energy sector where the Energy Select Sector SPDR ETF (XLE) had a serious decoupling from either West Texas Intermediate Crude or Brent Crude and found a much strong correlation partner in broader equities. We've talked about how the energy sector was beginning to see its relative momentum versus the S&P 500 begin to bottom out and with it up over 9.5% for the week, XLE was one of only two domestic sector to continue pushing higher on Friday while the other select sector ETF's lagged with the broader market. But now it's time to put up or shut for XLE. On a daily basis, XLE is no longer oversold and about to run smack into a major gap as well as it's fifty day moving average while looking at the weekly chart, XLE is still firmly bound within a downtrend channel although there's perhaps another $4 or approximately 5% worth of room to run in.

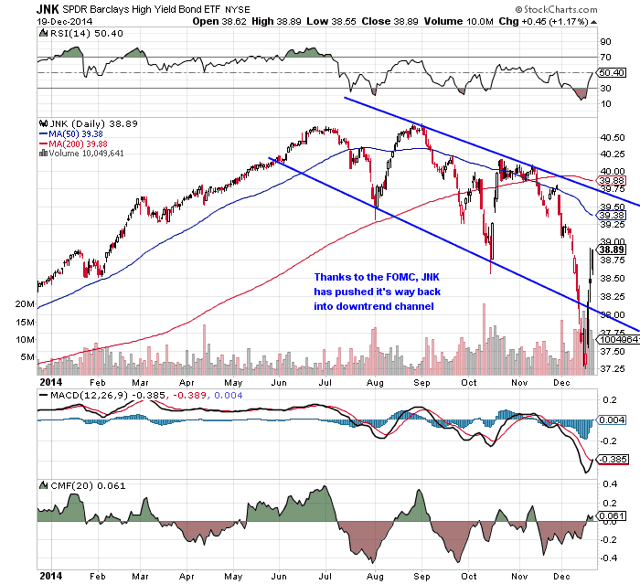

For the bond markets, the reaction was much more mixed. With the possibility of a rate hike on hold for an additional quarter or two (depending on who you read) the immediate rally in "non-investment grade" credit was hardly surprising. Both the SPDR Barclays High Yield Bond ETF (JNK) and Shares iBoxx $ High Yield Corporate Bond ETF (HYG) were trading into deeply oversold territory and due for a bounce. Sporting yield spreads in excess of 571 bps on Wednesday and back to levels not seen since late 2012 with default rates still at low levels, they offered a reasonable risk/reward tradeoff for some enterprising investors. But with this recent rally, JNK has only managed to push its way into the prior downtrend channel. Retesting the lower boundary is probably a necessary step to confirm future strength.

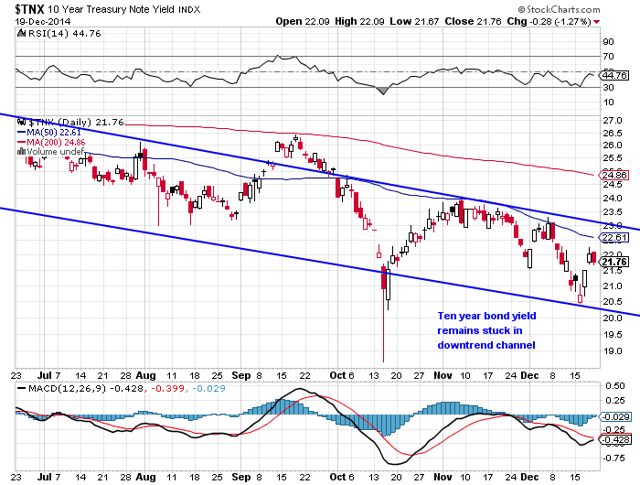

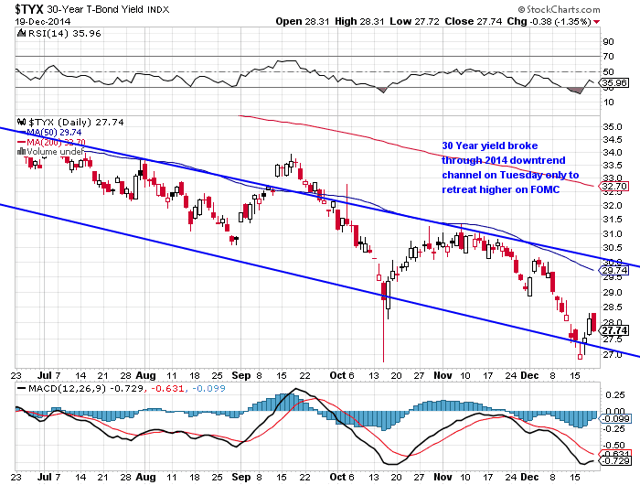

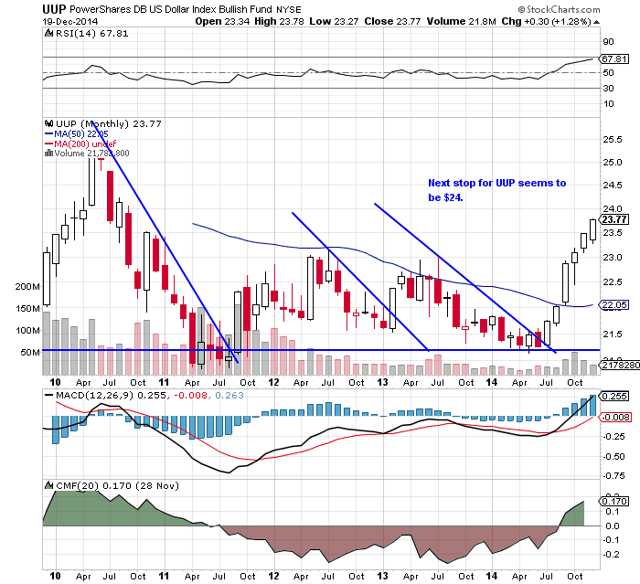

The impact on the Treasury markets was also predictable but again very short-lived. Both the ten and thirty yield Treasury yields rose but remain well-within their downtrend channels. Uncle Buck resumed gathering strength and pushing back above the recent high as the evidence of docility from the Fed was enough to keep investors focused on the easy money that could be made here versus the higher risk wagers overseas.

Time to Go All In?

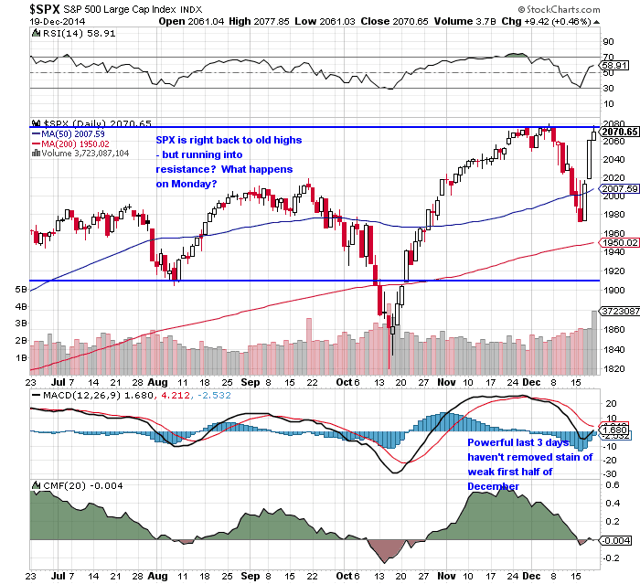

So does that mean the equity rally is due to resume on Monday as investors go all-in before the Christmas holiday. The S&P 500 could push higher yes, but the odds are in favor of us having already seen the best of the move.

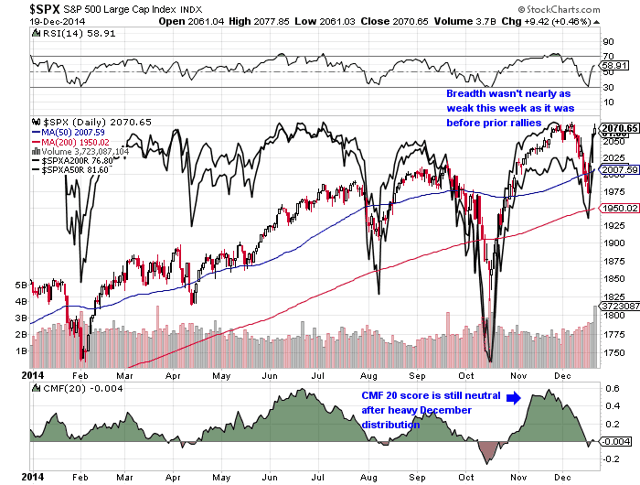

First, consider the market breadth. As you can see in the charts below, the percentage of S&P 500 stocks trading above their 50 and 200 day moving averages had dropped recently, but was nowhere near the lows of mid-October before the Bullard rally began and was still above the prior periods of weakness in August and February. But unlike those rallies, this move went much further and faster than anything else in 2014. If you had decided to take a flyer and bought at the close on Tuesday, by Friday you were up 4.96%. If you had bought the market after Bullard made his speech on October 16th, you were up 4.22% 3 days later. In fact, this was one of the best three day rallies this year. Buying at the momentum lows in early August at the close of the 7th gave you a three day return of 1.27%. Buying a similar low in early April gave you a return of 2.5% from the close of the 11th to the 16th.

Why is this significant? Because besides a certain amount of desperation being in play as a record number of managers looks to underperform their benchmark in 2014, it also means that a lot of the weak momentum has already been reversed. Looking at short-term readings over the last year, our momentum model went from the lowest decile to the top decile while longer term scores went from the lowest decile to the upper quartile. It means this move was a major one and while a slow drift higher this week on holiday volume can't be discounted, I wouldn't get overly concerned about chasing it in here as the "easy" money has been made.

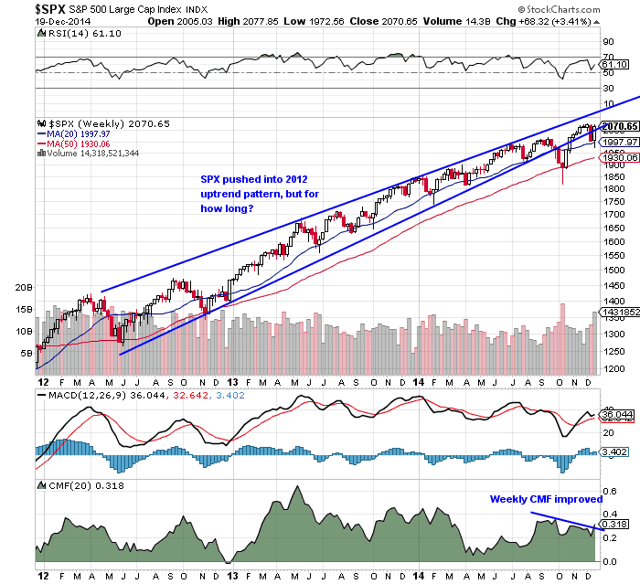

From a technical point-of-view, the S&P 500 is knocking right back on the door of the old highs but could be closing in on oversold territory while CMF 20 score fails to confirm the advance after the heavy distribution of early December. The weekly charts are more interesting; you can see the CMF 20 score improved slightly (we switched to S&P 500 from SPY due to the quad witching issues) while the rally really started after the S&P 500 hit it's 20 week moving average. The market pushed its way back into the 2012 uptrend channel, but whether it has the energy to linger there has yet to be proven.

What about those with a longer-term view? Yes, with a rate hike off the table until the next FOMC meeting in January, you could approach this as investors have been given a sort of reprieve but has anything really changed? The S&P 500 is still trading at a high valuation, the earnings outlook remain somewhat downcast for the coming year and rising rates could become a reality the next time core inflation gets above 1.5% on a y-o-y basis. While most investors will keep domestic stocks as the core of their portfolio, nothing here has made the case for going all-in on U.S. equities.