The buzz on Wall Street is that this will finally be the year that the US treasury yield creeps higher, triggering the mass exodus from the bond market. In anticipation of this long awaited event, some traders are positioning themselves for 2015 by going short the long bond as Fed accommodation ends, and we enter what they perceive as a rising rate environment. It seems like every year, there is a new doomsday prediction about the crash coming in the bond market. The deflating of the bond "bubble" is upon us they declare. But every year so far, they have been wrong, and I do not believe that 2015 will be any different for several reasons:

- US GDP Growth Remains Starkly Below Potential

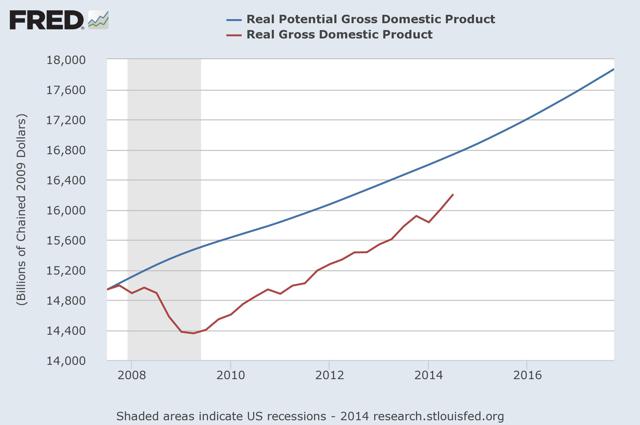

The recent rise in GDP growth for the last quarter at 5% has gotten the bond bears certain that this marks the end to the bull market in treasuries, but the realities of the US economy tell a different story. Real GDP remains far below potential, with a gap of 3.3%, indicating that inflationary pressures are still far off into the distance as the chart below illustrates.

The GDP has averaged only 2.3% for the entire 5+ years of the current recovery. Other indicators of economic health tell a similar story. Velocity remains subdued at 50+ year lows, the PSR is at 4.4% (a historically low level), the CPI and PCE remain likewise subdued below the Fed's target, and the U-6 unemployment rate remains at an elevated 11.4%. We also see that reductions in the U-3 are primarily driven not by job growth, but rather by reductions in the participation rate, which stands at 62.7%, the lowest level since 1978.

In Europe, the ECB has taken rates negative as deflation continues to roar on, and the Fed can not raise rates until inflation ticks up, which is driven by the velocity of money, which we do not have at this time. The current reading of 1.5% on M2 Velocity is the lowest reading in some 50 years. The reality is that with the current year GDP growth rate of 2.5% the output gap does not close until far past 2015. In order to achieve a rise in rates in 2015, as most bulls contend, we would need an annual GDP growth rate upwards of 5% to close the output gap, which, in my opinion, is unlikely to happen.

2. Global Deflationary Forces Rising

Inflationary pressures continue to fall globally, as deflation remains the true risk to economic growth. Recently, UK inflation came in at 1%, a 12 year low. Japan had a -6.8% GDP print in the second quarter, and the growth rate remains negative in the most recent quarter. China's GDP growth is the slowest in five years, and in the US, the GDP growth rate remains at 2.5% for 2014.

Further evidence of deflationary forces comes to us from the data in the commodities complex. If we chart commodities, we see them falling precipitously. This is deflationary not inflationary. This year alone, crude oil has fallen by over 40.98%, while Brent crude has fallen by 45.27%, gasoline has fallen 42.15%, and the Goldman Sachs Commodity Index is down 31.29%. This deflationary pressure in commodities will likely show up in headline inflation in coming readings, pushing us further down towards a deflationary spiral, which is what the Fed has been trying to fight against with QE, but they have failed to create velocity, and thus inflation in the economy.

3. The Lessons of Economic History Illustrate the Challenges of Raising Interest Rates

The Great Depression had a real effect on many Americans, and the lessons of this period of economic uncertainty have a haunting effect on central bankers. The contention that the Fed will ignore the lessons of history and raise rates before the economy is truly ready is simply impractical. The Fed does not want a repeat of 1937, and thus will likely remain lower for a longer period of time in an effort to learn from history.

4. US Treasuries Offer Value Compared to Other Sovereign Debt

If we look at Germany specifically, and study the relationship between treasuries and the German Bund we see that there is generally 1/5th of a percentage point differential. Currently, the 10-year German Bund is sitting at 0.59%, and the 30-year at 1.44%, meaning it is plausible for the 10-year Treasury bond to hit a print between 0.79% and 1% in the future. With the 10-year at 2.25%, and the 30-year at 3.00%, this seems to offer a compelling valuation compared to other sovereign debt.

5. The Supply of Treasuries Will Be Declining

In a world of growing economic and geopolitical risks, the supply of treasuries will continue to decline as US deficits decline, while the demand grows. This will be an additional catalyst to drive prices higher.

Conclusion: In a interconnected global economy, one can not realistically make the argument that we are decoupled in any way. In my opinion, the bond market is telling the real story, as is the 40+% return for the 20+ year zero coupon US Treasury bond YTD. In such an environment, long-term zero coupon US Treasury bonds are the investment of choice for those seeking a competitive store of value, and quantifiable compounding investment returns, in my opinion.

In a deflating world, US Dollar investments like Long Term Zero Coupon US Treasury Bonds are king. Given the totality of the data that I have presented here, the case is made for why I believe treasuries have legs from here. In such an extended period of global economic uncertainty and weakness, the safety of US treasuries for part of your portfolio, not only provides the most predictable way of ensuring that investors meet their investment goals, but also provides the needed offset for equity risk in a balanced portfolio. I'm sorry bond bears, but it seems 2015 could likely be yet another year to hibernate.