When you think of high-growth companies, you probably don't think of staid insurers. So the phenomenal growth at Berkshire Hathaway Inc. (BRK.A)(NYSE:BRK.B), the world's insurer of last resort, isn't something one would expect. And make no mistake: Berkshire is an insurer's insurer. When the London reinsurance market wanted rid of billions in asbestos liability inadvertently concentrated in a complicated reinsurance arrangement that became known as the London Spiral - and when CNA Financial Corp. (CNA) followed suit - only Berkshire was in a position to convincingly assume the risk. Berkshire's insurance and reinsurance businesses insure everything from business' environmental risk to the automotive liability of about one in ten drivers in the U.S.

And what is insurance? Insurance is promising protection to premium-paying customers against losses they might sustain over a policy period. To avoid going broke in the insurance business, it's necessary to promise little (relative to one's worth) and to conserve premium funds against the day each insured inevitably makes a claim for policy benefits. It's not a recipe for explosive growth, is it?

As an insurer, Berkshire is an unexciting, staid, plodding firm operated by sober value investors. Famously led by Warren Buffet, its disinterest in the unknown prevented it from deploying capital to take advantage of the tech boom. So the firm doesn't exactly look like your best bet for runaway success, does it?

And yet Berkshire's one-year chart shows this:

So, looks can be deceiving. Markets that mis-price securities through misunderstanding create opportunity. Let's look at why Berkshire is an exciting ride, despite everything.

Growth in Non-Insurance Business

As an insurer, Berkshire often made or broke its quarterly number on the presence or absence of major insured catastrophes. Consider Berkshire's 2005 results, when Katrina and Rita claims reduced operating profits at the insurer to below the level of operating profits at its non-insurance business. At this point in the company's history, performance in its insurance businesses dominated its balance sheet. Portfolio companies bought with float funds - insurance premiums Berkshire holds until it's obliged to pay insureds' claims - were an alternative to getting bank interest on its parked cash, not a major driver of results.

But Berkshire has been growing its portfolio. In 2008, non-insurance business and the insurance business had almost equal operating income. (SEC-reported net income is impacted by things like unrealized changes in the value of long-term investments, so the numbers presented below aren't the headline numbers from earnings news.) Insurance took a clear lead in operating income in 2009, but since the Burlington Northern purchase in 2010 Berkshire's non-insurance businesses have in the aggregate produced materially more operating income than Berkshire's insurance businesses.

Berkshire's profits flow form several business segments. At the end of 2012, the insurance segment provided Berkshire with $73.125 billion in "float" - premiums Berkshire can invest, interest-free, between premium receipt and claims payment. This benefit has been described in my earlier article explaining why Berkshire made a better investment than Apollo Investment Corp. (AINV). Since Berkshire keeps selling new policies, its float is stable (and growing) rather than being repaid to policyholders. In 2012, Berkshire's business did this:

Pretax Profit Segment

======= ================

$1.625B Insurance/ Underwriting Profit

$3.699B Manufacturing, Service and Retailing

$1.323B Regulated Capital-Intensive (MidAmerican)

$3.372B Regulated Capital-Intensive (Burlington Northern)

$0.848B Finance and Financial Products

=======

$10.867B

Note that this wasn't Berkshire's SEC-reportable 2012 profit; Berkshire's SEC-reportable profit includes non-operating "earnings" resulting from changes in value of certain unsold securities and derivatives, and so forth. But this gives an idea how Berkshire's insurance profits - great though they are - are not mostly from underwriting profits but from the investment of insurance proceeds (including float) in portfolio companies. Of course, insurance profits in 2012 suffered from property damage associated with Hurricane Sandy. The following year, Berkshire enjoyed a pre-tax underwriting gain exceeding $3 billion, which was dwarfed by its pre-tax earnings from railroad ($5.9 billion), utilities ($1.5 billion), and manufacturing, service and retailing ($6.7 billion) - earnings from float-leveraged investments that exceeded $14 billion. That's over 50% growth in pretax operating earnings that don't derive from insurance underwriting. The 2014 annual report hasn't been published yet, but Berkshire has been steadily acquiring high-quality businesses like Heinz, Duracell, Phillips Speciality Products, and America's largest privately-owned auto dealer Van Tuyl Group. Expect Berkshire's non-insurance businesses to continue outgrowing its underwriting profits, and fueling the company's appetite for good investments.

About The Float

Although many insurers struggle to deploy float profitably, Berkshire's huge and durable float enables it to make long-term investments with money it doesn't own. Remember how the "float" was about $73 billion in 2012? A look at the company's "owner's manual" shows how much of the company's assets are currently funded with zero-interest "debt" in the form of float and deferred taxes. Currently, it's about $135 billion. (Since management's "favorite holding period is forever", the deferred taxes on its unrealized gains in long-term investments represent cash GAAP regards as owed to the government, that Berkshire may nonetheless never have to repay. That "loan" from the government is also free cash Berkshire won't have to repay within our lifetimes.)

Performance

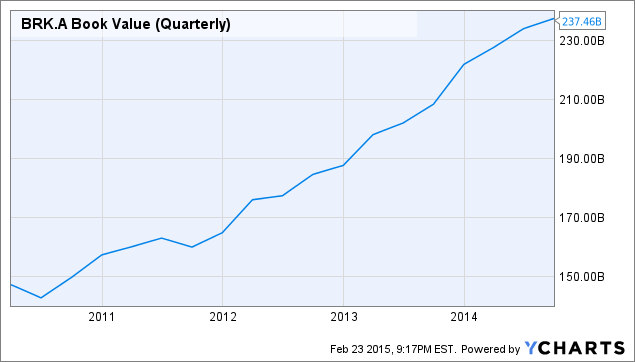

Instead of getting fixed but lackluster returns over limited periods by investing in the bond market, Berkshire can get permanent returns by investing float in profit-generating business equity. So while Berkshire's GAAP "earnings" declined in 3Q2014, Berkshire's operating profits were up 29% over the comparable year-prior quarter. With operating profits up, the "earnings" decline doesn't mean the company is losing money; the "decline" is driven by factors like GAAP including as "income" the transient fluctuations in modeled values for derivative contracts for which no market exists. Over the first quarter of 2013 - not sequentially over the prior year, but just over the quarter - Berkshire grew book value 5.5%. Of course, Berkshire doesn't do that every quarter. But it does grow book value in more quarters than not - in the absence of major financial dislocations, Berkshire has grown book value steadily:

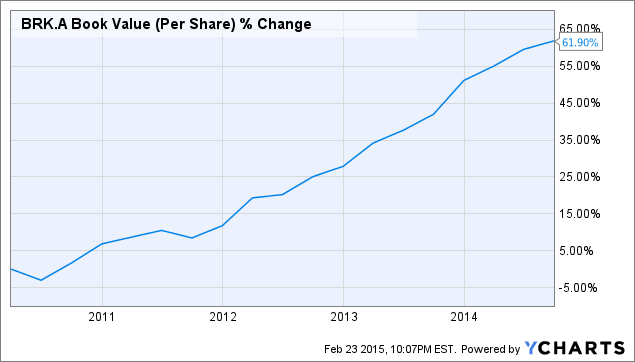

Individual investors are more interested in Berkshire's per-share metrics - after all, they're not buying Berkshire but shares of Berkshire. And Berkshire has been known to do all-stock deals that affect the denominator in per-share calculations. The per-share metrics over the last five years show double-digit average growth:

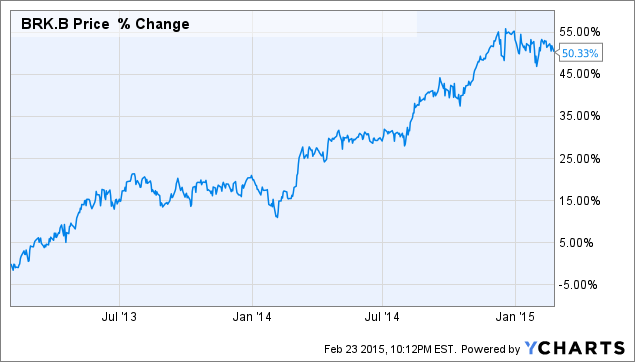

Class B shares, which first crossed the $100 mark in February of 2013 (and are more affordable to individual investors than the six-figure-apiece Class A shares), now trade around $150 a stub - about 50% growth in about two years:

Of course, one might be tempted to look at the one-year chart and its >30% growth …

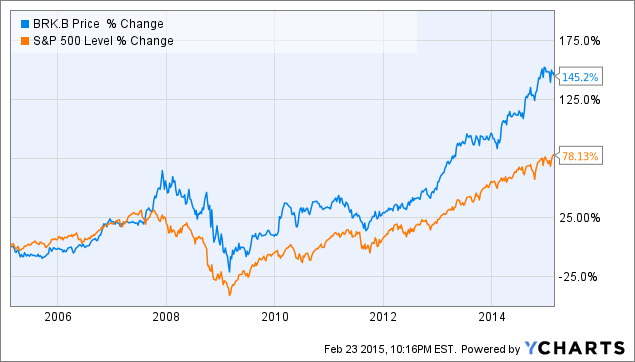

… but nobody should be buying Berkshire for a one-year result. The proof is in the pudding, and the ten-year result seems to make a strong case for Berkshire as an alternative to indexes for investors interested in growth:

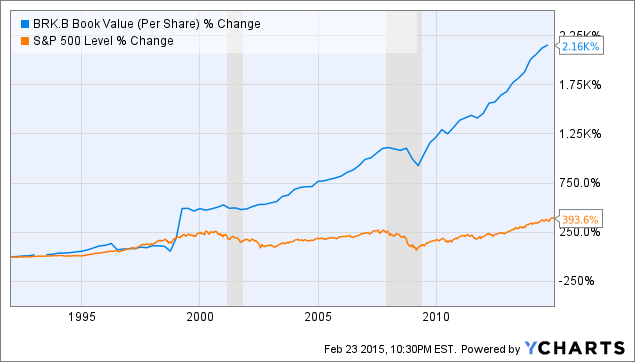

As described in Berkshire's annual reports, the company views its book value as a proxy for its intrinsic value. While Warren Buffett views the company's intrinsic value as greater than its book value, the fact that one is a proxy for the other means that measuring one provides data on the other. Over the long span of time, Berkshire's work to grow book value has paid off:

The per-share book value growth of thousands of percent - many times the return of the S&P 500 over the period - shows the fruits of a consistent, patient commitment to growing book value over the long term. Vigorous S&P-beating growth isn't something one ordinarily associates with risk-averse firms. But that's the surprise in Berkshire Hathaway: it's not risk-averse. Read any of the delightful annual reports - Berkshire has a great appetite for risk. Berkshire's just not keen on unknown risks. That, after all, is a major difference between insurance and gambling. One thing that's demonstrated by Berkshire's consistent growth in book value is that when other insurers were willing to gamble in the run-up to the crash of 2008, Berkshire still ran an insurance business.

Value

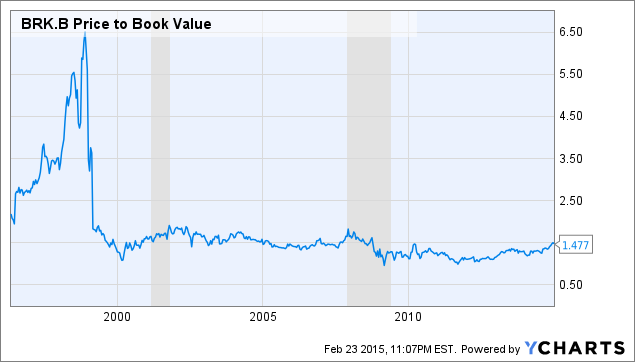

Price growth hasn't driven Berkshire's valuation into the stratosphere:

Despite the company's staid reputation, markets clearly value the company differently at different times, even as a fraction of book value. Perhaps - as suggested by the price-to-book decline during the last recession (the grey period starting in 2008 in the chart above) - onlookers were more suspicious of Berkshire's value while the rest of the financial world lay in ruins. Perhaps onlookers feared the impact of a few billion in long-term options that could not be exercised during the recession because they could be exercised, if at all, only on their maturity date years and years into the future. Whatever the reason, Berkshire currently offers a price-to-book value comparable to the valuations it's historically offered to investors. Examining the book value chart (steady growth over any long period) next to the price-to-book chart (not especially volatile, and not currently high compared to historical values) paints a powerful portrait of a company whose price rises because its value increases even as its valuation remains attractive.

Although Berkshire has been willing to repurchase shares, and has spent billions on share buybacks, it has been unwilling to repurchase shares at prices over 120% of book value and hasn't had a chance to retire shares in a few years. According to Whitney Tilson's calculation in the last half of 2014, Berkshire offers something like a 30% upside and a price floor based on its share-buyback limit: Berkshire nets over a billion in cash per month, and its buyback program has no cap.

But that upside is based on calculations of intrinsic value that are themselves based on book value. And as the chart above shows, book value is a moving target - one that historically enjoys an upward trajectory. Berkshire's large and growing operating earnings combine with its large and growing book value to offer investors a fairly secure and inflation-resistant place to park money they don't want to gamble. Although Warren Buffett famously advises investors to consider low-overhead index funds, his own money is largely invested in Berkshire Hathaway. With Buffett himself offering low-overhead management of Berkshire's enormous portfolio, why should investors pay more for less by investing elsewhere? His flat $100,000 salary doesn't scale up with Berkshire's assets or expand with profits, and he applies his ideas about executive compensation throughout Berkshire. What fund does the same, or offers the same performance? Trimming overhead is a time-honored way to improve net, and Berkshire has this down to an art in the C-suite.

Conclusion

Berkshire Hathaway combines a focus on growing long-term book value with a commitment to controlling overhead to produce outstanding returns to investors from a diversified and growing portfolio of outstanding businesses. Some, like GEICO and Heinz, are household names. Others quietly provide infrastructure support, and are calculated to grow with the demands of the broad economy. The historically modest price-to-book ratio shows Berkshire shares haven't become expensive after its +30% year or its +50% two-year period. Rather, the consistent increase in book value shows that Berkshire continues to execute on its objective to provide shareholders with increased value over time. Berkshire's focus on after-tax returns continue to lead it into tax-efficient investments like the tax-free exchanges for Duracell and Phillips Specialty Products, which the demonstrate the value in Berkshire's approach to large-scale transactions: by deferring billions in taxes "forever", Berkshire is able to keep more funds invested for shareholders even as it is required to book tax liabilities that decrease the company's nominal book value.

It's not exactly sexy, but it works. Berkshire remains a buy.