Often we hear how emerging markets are driving global growth in the absence of the developed world's contribution. Without diminishing the accomplishments of countries like China and Brazil, among others, the truth still is that these economies depend heavily on external consumption, and to exacerbate the problem, they have failed to develop their own culture of consumerism. Understandably, their advantage is cheap labor, and to elevate their populations’ economic status is virtually synonymous with killing the goose that laid the golden eggs.

A recent Bloomberg story drives the point home, and it highlights the fact that traders are betting on a 0.75% rate cut, in addition to the 0.50% decrease that took place last month:

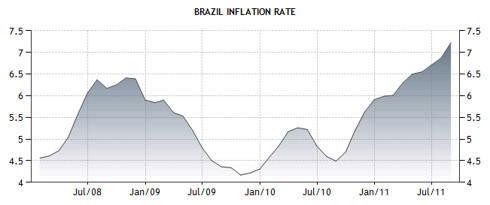

Brazil became the second country in the Group of 20 after Turkey lowered rates last month as policy makers signaled they were more concerned about the global slowdown than quickening inflation in Latin America’s biggest economy. The prospect of more cuts prompted economists in a central bank survey last week to forecast inflation will breach the 6.5 percent upper limit of the government’s target for the first time since 2003.

The severity of the situation is such that in a country with inflation running at 7.23%, the search for growth is top priority, and the resulting devaluation of the Brazilian real provides enough hope that a reversal of fortune will ensue.

The U.S. is certainly not helping the global cause, and has its own issues to deal with, but when compounded with European debt issues, and eventually China, the horizon looks very recessionary, and I take no pleasure in stating it.

“The market is pricing in the possibility of the situation in Europe worsening,” Paulo Leme, an economist at Goldman Sachs Group Inc., said in a telephone interview from Miami. “If the situation in Europe is not solved by October, you will have much deeper interest-rate cuts.”

If deeper cuts are adopted, the infamous “currency war” among emerging markets will be in full motion.

An excerpt from another Bloomberg article summarizes the mentality and short memory that the leaders of emerging economies possess (although one cannot absolve the leaders of the developed nations). Albert Ramos, a Goldman Sachs economist, is quoted:

“I’ve never seen an economy with so many macro issues that can be addressed with just one instrument,” Ramos says. “If they would cut the fiscal budget significantly, they’d let the central bank loosen monetary policy. Lula rode the wave of rising commodity prices and forgot to make the reforms needed to make it sustainable.”

By cutting government spending, Brazil could both lower taxes and reduce the cost of its $1.73 trillion debt by making more room for policy makers to cut interest rates, Ramos says. In 2008, the last year for which data are available, Brazil’s federal, state and local governments collected taxes equivalent to 35 percent of Brazil’s GDP, with half of the money spent on pensions, corporate subsidies and welfare programs and 16 percent spent on debt payments.

Sound familiar? Ah, that's government stimulus at work.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.