Once upon a time businesses borrowed long term money--if they borrowed at all--in order to fund plant, equipment and other long-lived productive assets. That kind of debt was self-liquidating in the sense that it usually generated a stream of income and cash flow that was sufficient to service and repay the debt, and to kick some earned surplus into the pot as well.

Today American businesses are borrowing like never before--but the only thing being liquidated is their own equity capital. That's because trillions of debt is being issued to fund financial engineering maneuvers such as stock buybacks, M&A and LBOs, not the acquisition of productive assets that can actually fuel future output and productivity.

So it amounts to a great financial shuffle conducted entirely within the canyons of Wall Street. Financial engineering deals invariably shrink the float of outstanding stock among the corporations visiting underwriters. Likewise, they invariably leave with the mid-section of their balance sheets bloated with fixed obligations, while the bottom tier of shareholder equity has been strip-mined and hollowed out.

At the same time, none of this vast flow of capital leaves a trace on the actual operations--such as production, marketing and payrolls-of the businesses involved. Instead, prodigious sums of debt capital are being sold to yield-hungry bond managers and homegamers via mutual funds and then recycled back into windfall gains for stock market gamblers who chase momo plays and the stock price rips that usually accompany M&A, LBO or stock buyback announcements.

Needless to say, central bank financial repression is responsible for this destructive transformation of capital market function. It has made the after-tax cost of debt tantamount to free for big cap corporations--while fueling equity market bubbles that makes stock repurchases and other short-term financial engineering maneuvers irresistible to stock option obsessed inhabitants of the C-suites.

In this context, today's WSJ saw fit to herald the $21 billion of quasi-junk bonds (BBB-) issued by Actavis PLC (ACT) to fund its $66 billion acquisition of Allergan (AGN), a company which famously supplies Botox and similar life-enhancing products. Whether this mega-merger will result in any sustainable economic efficiency gains only time will tell, but the odds are not high. The overwhelming share of today's red hot M&A deals fail to earn back the huge takeover premiums invariably paid. And, not infrequently, they are subsequently reborn as equally trumpeted corporate restructurings, spin-offs and other "value unlocking" maneuvers a few years down the road. It's Wall Street's version of "you stab 'em and we slab -em".

Yet there can be no doubt that funding the Allergan deal with $21 billion of freshly minted debt did accomplish the actual purpose of the financial engineering maneuver in question. Namely, it enabled Actavis to pay a bountiful 40% premium to the selling shareholders without diluting its own shares.

And why not? The after-tax cost of the new debt will amount to a miniscule 2.4%. Consequently, the C-suite at Actavis acquired what amounts to a quasi-free option on the spread-sheet merger synergies and economies of scale postulated for the deal by Wall Street and its in-house financial engineers.

If these projected profits do not materialize or, as in the more usual case, if they are off-set with diseconomies of scale or operational and commercial dysfunction, the carry cost of the acquired assets will be negligible until they can be disposed in a "restructuring" event. No wonder CNBC celebrates Merger Monday and gets giddy when CEOs purportedly exhibit "confidence" in the future by launching new M&A deals.

Does this imply that the overwhelming share of M&A deals in this age of central bank financial repression amount to pointless financial engineering ploys designed to goose stock prices and cash-in on stock options, while substituting for genuine organic growth strategies? Yes it does. And the systematic resource misallocations and anti-growth consequences are profound.

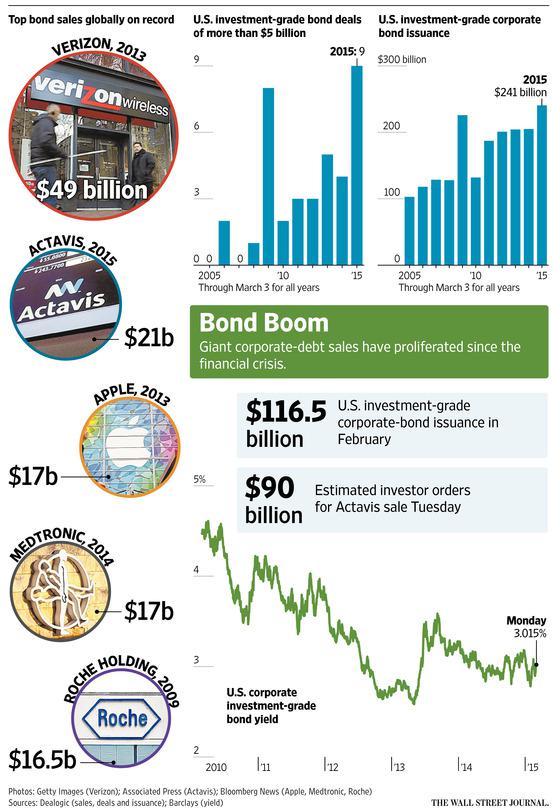

Since yesterday's Actavis deal was the second largest debt deal ever, it induced the WSJ to trot out the historical statistics. And they scream financial engineers at work.

As shown in the graphic below, the granddaddy of debt deals was last year's $49 billion Verizon (VZ) issue. This colossal obligation most definitely had nothing to do with the acquisition of plant, equipment and technology assets or even other people's second hand assets.

Instead, it amounted to an internal LBO in which the patent company bought in the stock of its own subsidiary. That's right--a cool $49 billion of holding company debt was issued to change exactly nothing at Verizon except to shower public shareholders of a second tier subsidiary with a 50% windfall against their pre-deal trading price.

It goes without saying that no one except Wall Street analysts has lately mistaken Verizon for a value-producing enterprise. It is actually a serial deal machine-- a place where corporate value goes to die.

At the end of 2007, for example, it was already well down the slippery slope with tangible net worth at negative $10 billion. Today that figure stands at nearly negative $95 billion. Destruction of $85 billion of tangible equity value in just seven years is no mean feat---even for a giant lumbering utility that has roughly 80 million quasi-captive customers to gouge.

There is no mystery to how Verizon navigated its way to the $100 billion negative (tangible) equity club. It borrowed itself silly funding "restructuring" charges and making vastly over-valued acquisitions. Thus, at the end of 2007 it had $31 billion of debt and today that metric stands at a staggering $113 billion.

What did Verizon get for the $82 billion in incremental debt that was on offer at bargain rates in the casino? It certainly wasn't any explosion of current earnings; since 2007 its EPS has only inched forward at about 3.3% per year. And it wasn't an old-style burst of investment capable of turbo-charging future profits. Its CapEx amounted to $140 billion over the last seven years, but 90% of that was needed to cover DD&A on existing assets.

Verizon and Actavis are at the top of the list, but they are merely super-sized versions of the generic syndrome. As shown below, the Fed's massive money printing spree since the September 2008 crisis has fueled a massive increase in corporate debt issuance--funds which have overwhelmingly been absorbed by non-productive financial engineering maneuvers. The five largest debt deals of all-time shown in the graphic total $104 billion, for example, but every penny went to financial engineering and tax ploys. Sitting on $180 billion of cash, Apple most surely did haul coals to Newcastle with its $17 billion debt offering last year; and the other deals were more of the same debt financed M&A.

So far this year corporate bond issues total $241 billion. That's a staggering $1.4 trillion run rate--or nearly double the run rate prior to the financial blow-off in 2008. Yet virtually all of this massive debt issuance has been cycle via financial engineering into after-burner fuel for the rocketing stock market. During the month of February alone, stock buybacks for the S&P 500 were a record $104 billion.

Is it any wonder that Wall Street threatens a hissy fit upon even a hint that the Fed's rotten regime of ZIRP might be ended after 80 months? After all, it has amounted to free money for carry trade speculators and a cattle prod driving bond fund managers into corporate debt.

But Here's the thing. This entire massive capital market deformation appears to be invisible to the paint-by-the numbers Keynesian apparatchiks who run the Fed and their fellow travelers and cheerleaders in Washington and Wall Street. And the reason for this egregious blindness is not all that mysterious.

But Here's the thing. This entire massive capital market deformation appears to be invisible to the paint-by-the numbers Keynesian apparatchiks who run the Fed and their fellow travelers and cheerleaders in Washington and Wall Street. And the reason for this egregious blindness is not all that mysterious.

These folks do not understand capitalism nor the true ingredients of wealth creation and sustainable economic prosperity. They are simply glorified econometric modelers who pay no attention to balance sheets, economic history or enterprise level economic efficiency and investment. Accordingly, all borrowed dollars are the same; they are assumed to fuel the fires of "aggregate demand", whether they are used to fund pyramids or machine tools.

Likewise, as long as the seasonally adjusted rate of spending-in this case for business CapEx--during the current quarter is measurably higher than the prior period all is well. Never mind if it is merely a upward blip in a longer trend of decay or that the "spending" components of GDP do not even capture the ingredients of true wealth production.

US household consumption spending surged during the housing and mortgage boom between 2002 and 2008, for example. Yet upwards of $3 trillion of that "spending" boom was funded with "MEW". Needless to say, mortgage equity withdrawal was not a sustainable ingredient of economic growth or main street prosperity-even if it did temporarily flatter the quarterly GDP figures.

Indeed, at least the mortgage debt explosion during the Greenspan housing bubble did confer some transient prosperity on the middle class. By contrast, the corporate bond bubble this time around has been strictly a boon to the top 10% of households, which own 85% of the stock, and especially the top 1%, which are heavily invested in the hedge funds and family offices which capture a lions share of the deal-driven windfalls in the stock market.

Here are the baleful facts. Total corporate and non-corporate business debt outstanding has been on a tear since the pre-crisis peak in later 2007. At that time, business credit outstanding totaled $11 trillion--a figure which has now ballooned to $14 trillion. So despite the propaganda about a healthy post-crisis deleveraging, its been full steam ahead with debt issuance in the business sector.

But the overwhelming share of that $3 trillion has gone into financial engineering including trillions of stock buybacks during the last six years. By contrast, business CapEx has been tepid at best, and a downright disaster in reality.

Thus, during Q4 2007 business spending on structures and plant and equipment total $1.447 trillion in constant dollars. Seven years later in Q4 2014-after massive monetary stimulus and endless Wall Street cheerleading about a rebound in CapEx, the figure was $1.496 trillion at an annual rate. If you do not have a hand calculator, that miniscule difference amounts to a 0.4% annual rate of gain. Given the dubious inflation measures embedded in the governments price deflators, the "real" rate of gain since 2007 could easily be zero or even negative.

Self-evidently, whether the seven year trend of CapEx growth is 0.4% or even lower it reflects at drastic deterioration from prior business cycles--notwithstanding the Fed's massive financial repression designed to jump start investment spending, and the incremental $3 trillion that US businesses actually borrowed during this period.

During the 7-years after the business cycle peak of 2000, for example, real spending on structures and equipment increased by nearly 2% per annum or at 4X greater rate than during the current so-called recovery. And during the 1990-1997 cycle, the rate of gain in real business CapEx was 4.3%. Stated differently, during that seven year period, real business investment spending rose by 31% compared to the tiny 3.4% gain during the equivalent cyclical period since 2007.

Once upon a time in the pre-Keynsian world, economists and practical men of finance knew something else, as well. Namely, that what counts for long-term growth and genuine prosperity is the level of the capital stock, not merely the gross rate of business investment spending in any given quarter or other short-run period.

The fact is, our Keynesian GDP accounts do not account for capital consumption or depreciation of the existing capital stock in the famous reckoning of GDP. But if new CapEx does not replace current depreciation the productive capacity of the macro-economy is falling-notwithstanding the positive number for the "I" (investment component in the GDP equation.

In fact, business sector depreciation is currently running at a $1.1 trillion annual rate for the US economy, meaning that gross spending on structures and plant and equipment barely covers the capital resources used up in current production.

Here is where the record boom in corporate debt issuance hides the true decay of productive capacity in the US business sector. During Q4 2007, real net investment after capital consumption in the US business sector was about $400 billion at an annual rate. By contrast, during Q4 2014 the comparable number was about $300 billion.

That's right. Real net investment in the US business sector is now 25% smaller than it was before the crisis; and before it was "solved" with massive money printing, false interest rates at the zero bound and the explosion of corporate borrowing that resulted therefrom.

This drastic shrinkage is something totally new under the sun, and not in a good way at all. During the 7-years after the 1990 peak, for example, real net business investment expanded by 50%.

In fact, during Bill Clinton's last year in office, the balance sheet of the Fed totaled $500 billion and real net business investment that year came in at $450 billion.

Let's see. The Eccles Building has grown its balance sheet by 9X since the turn of the century, but real net investment in the business sector has plunged by 33%!

So thanks for the corporate bond bubble, Fed. Its just one more nail in the coffin of capitalist prosperity in America.